Tax Resources Templates

Welcome to our Tax Resources page, your one-stop destination for all your tax-related information and forms. Whether you're an individual taxpayer or a business owner, we have a wide range of resources to help you navigate the complex world of taxes.

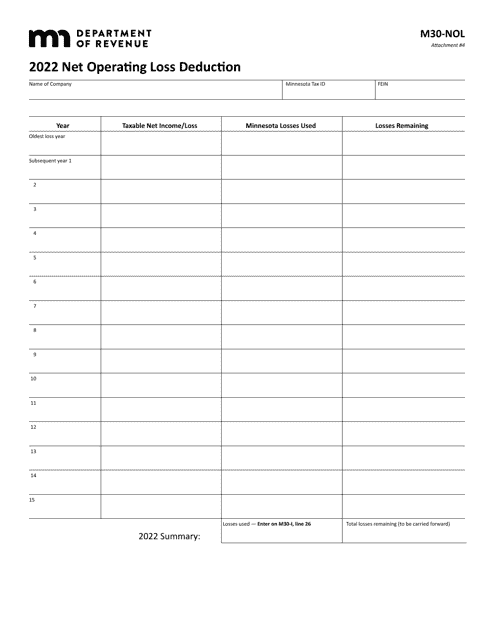

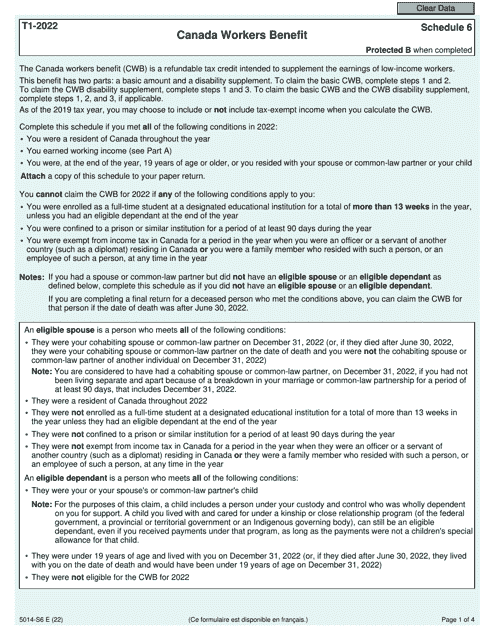

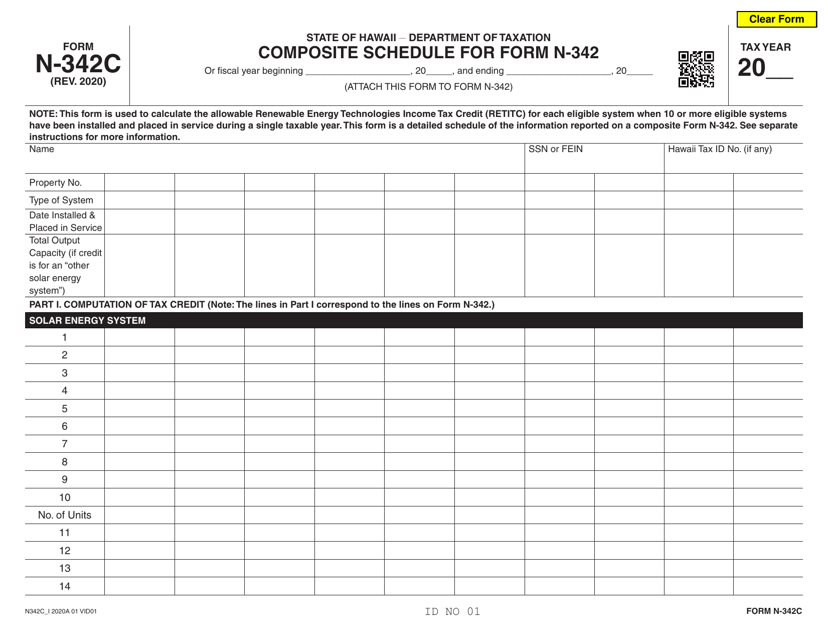

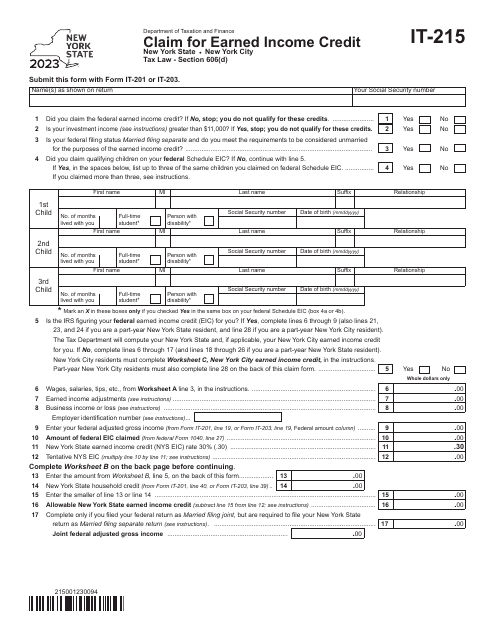

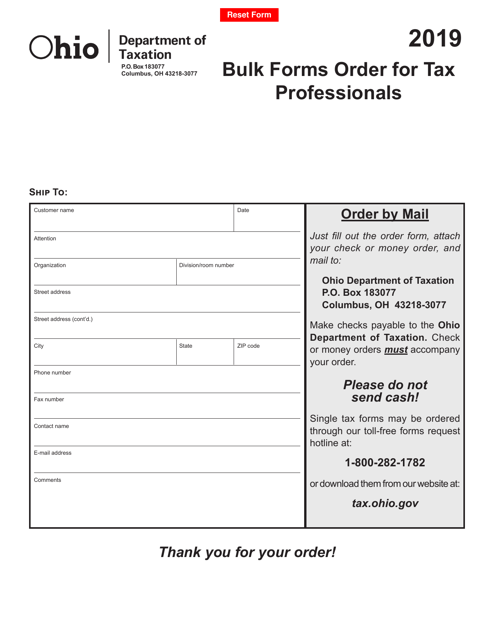

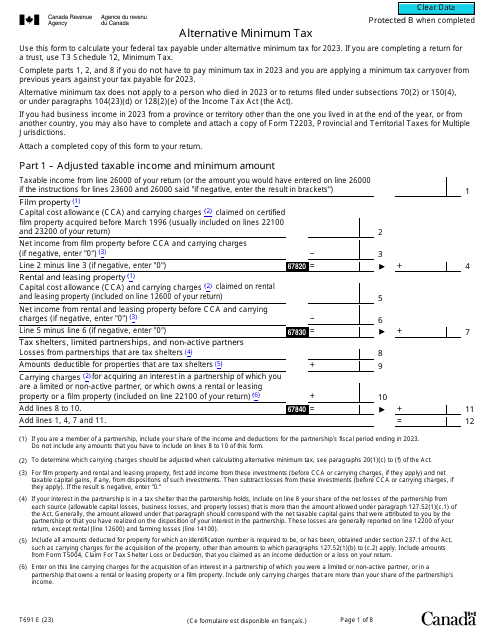

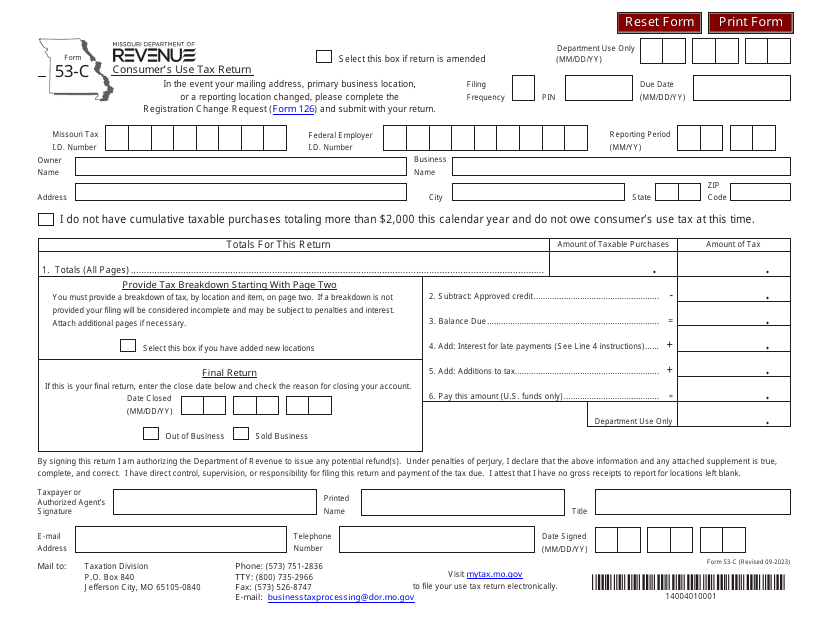

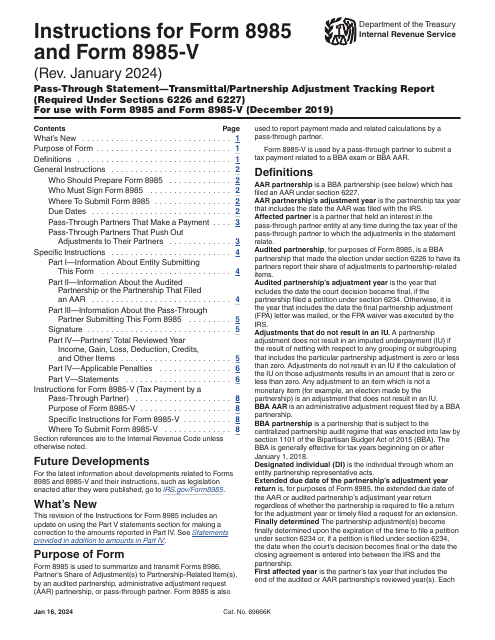

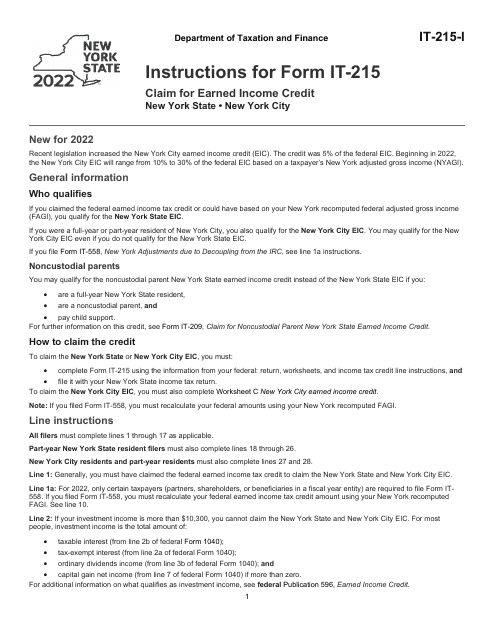

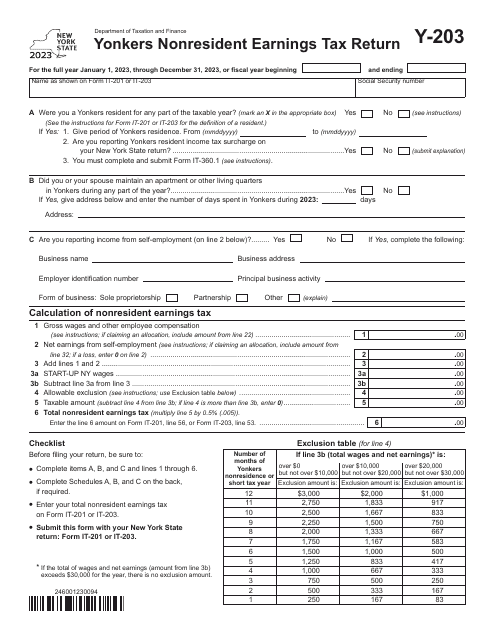

Our tax resource collection includes an extensive library of tax forms from various jurisdictions, including federal and state forms. From Form N-342C in Hawaii to Form IT-215 in New York, we have a comprehensive selection of forms that cater to different tax requirements. We also provide resources for international tax compliance, such as the Canadian Form T691 for Alternative Minimum Tax.

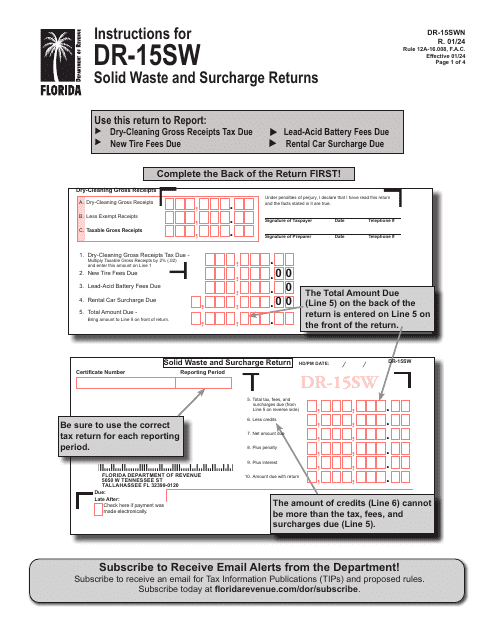

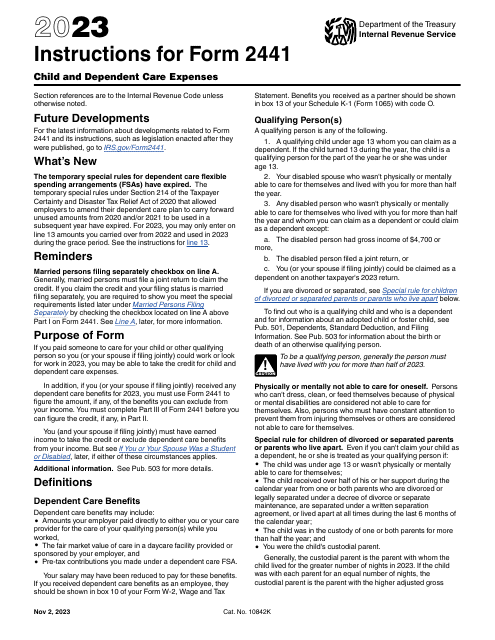

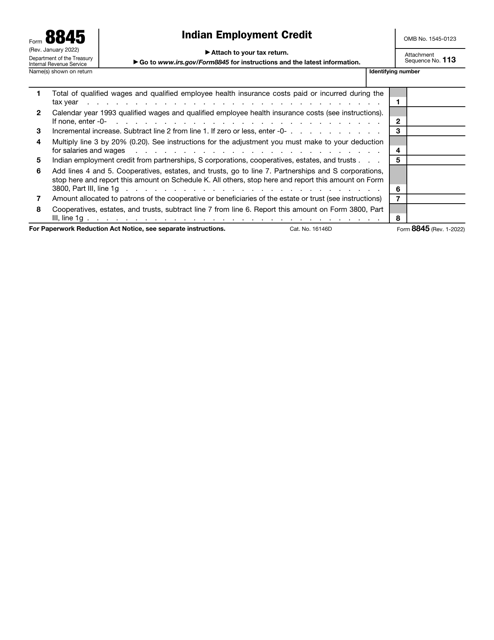

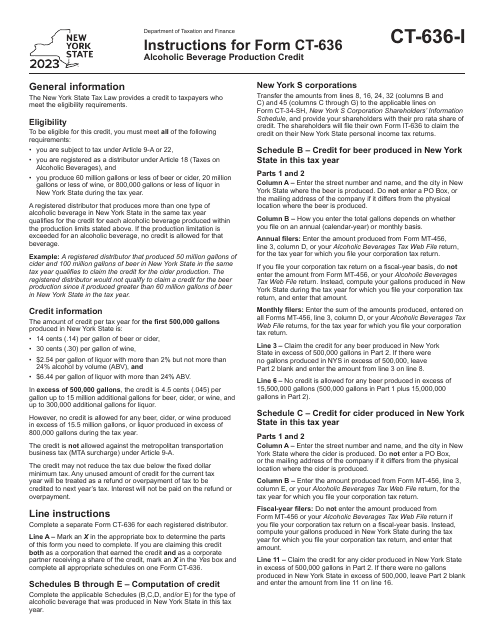

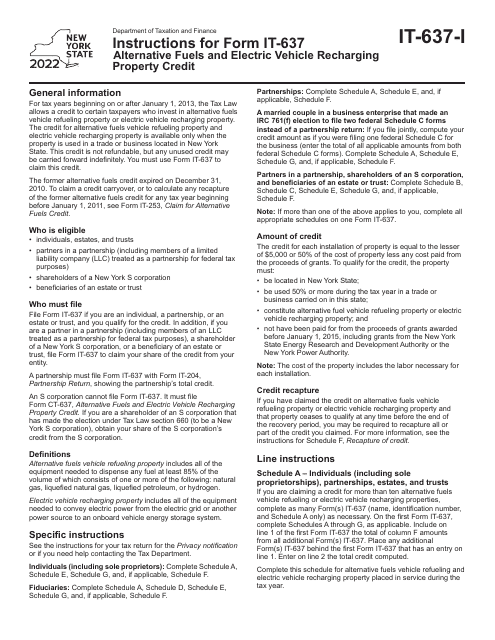

In addition to tax forms, our collection includes detailed instructions for various forms. Whether you need guidance on filling out IRS Form 8985 or Form IL-1120 Schedule J for Foreign Dividends in Illinois, our instructions will ensure you complete your forms accurately and efficiently.

As tax regulations and forms can be daunting, we understand the importance of having a reliable source for all your tax-related queries. That's why our tax resources page is designed to provide you with the necessary information and resources to help you stay compliant with tax laws and maximize your deductions.

Browse through our tax resources collection and find the forms and instructions you need for your specific tax situation. Our user-friendly interface and search function make it easy to locate the documents you need quickly. With our comprehensive library and reliable information, you can feel confident in fulfilling your tax obligations without any hassle.

Trust our Tax Resources page to be your go-to reference for all your tax-related needs. Explore our extensive collection today and take the stress out of tax season.

Documents:

57

This form is also known as the IRS itemized deductions form. It belongs to the IRS 1040 series. This document is used in order to calculate the amount of your itemized deductions.

This is a document you may use to figure out how to properly complete IRS Form 6765

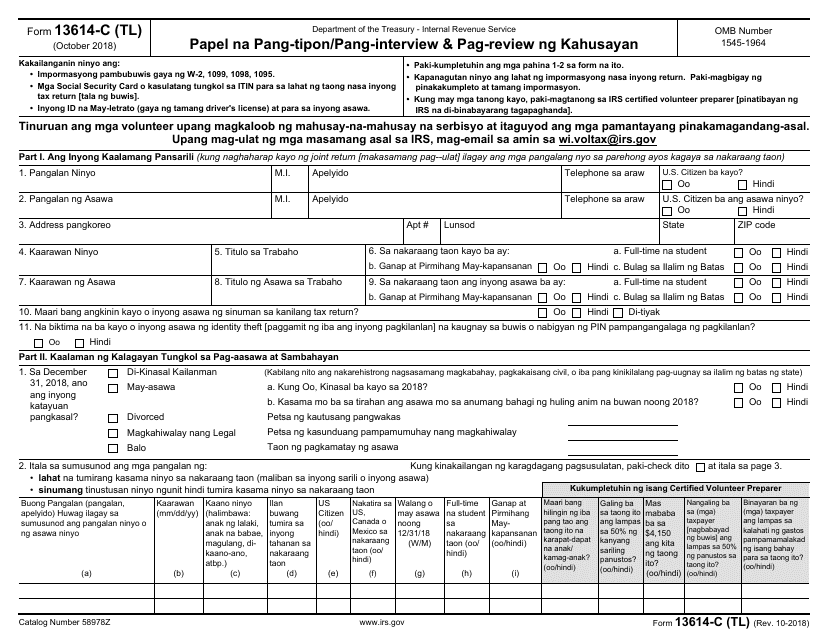

This document is for individuals who speak Tagalog and need assistance with their tax intake process. It is used to gather information about the taxpayer's financial situation for the IRS.

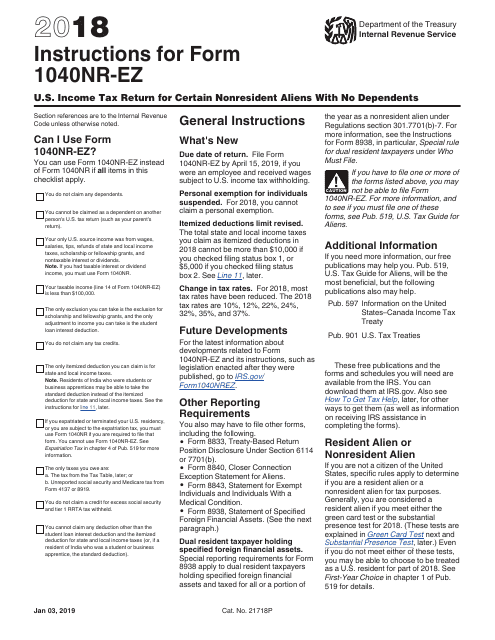

This document is for nonresident aliens with no dependents who need to file their U.S. income tax return. It provides instructions on how to complete IRS Form 1040NR-EZ.

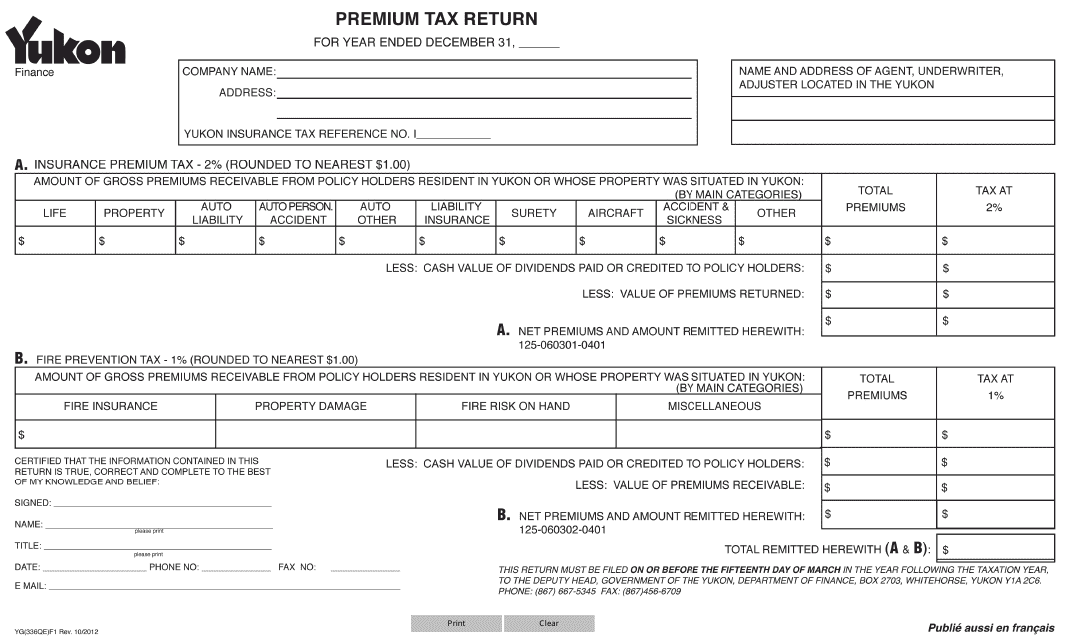

This form is used for filing premium tax returns in Yukon, Canada.

This document provides information about the Taxpayer Advocate Service, a resource available to help taxpayers with their tax-related issues and concerns.

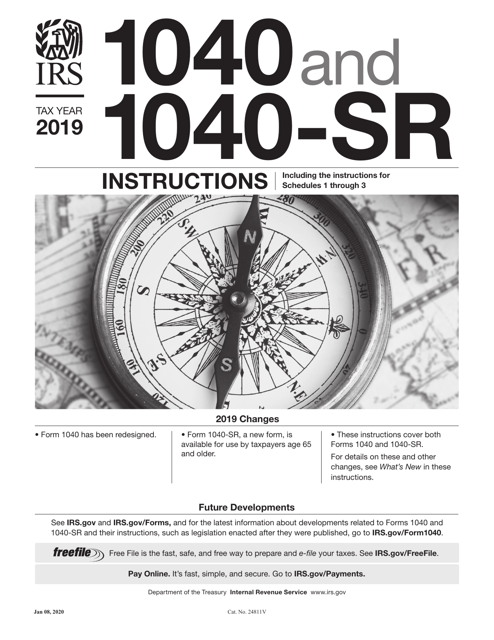

This document provides instructions for filling out IRS Form 1040 and 1040-SR. It guides you through the process of reporting your income, deductions, and credits to calculate your tax liability.

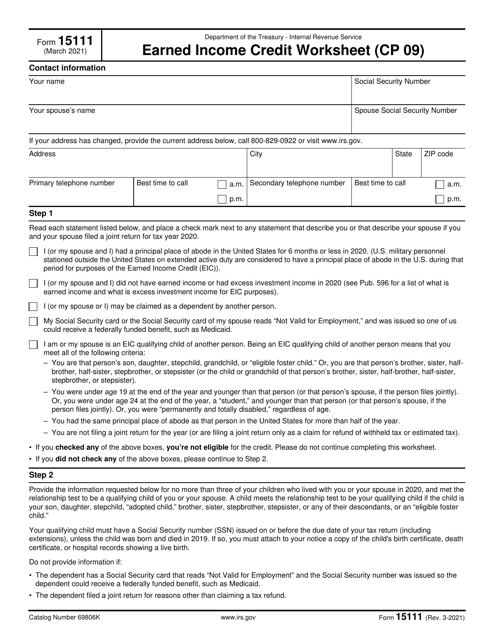

This form is used to calculate the Earned Income Credit for eligible taxpayers.

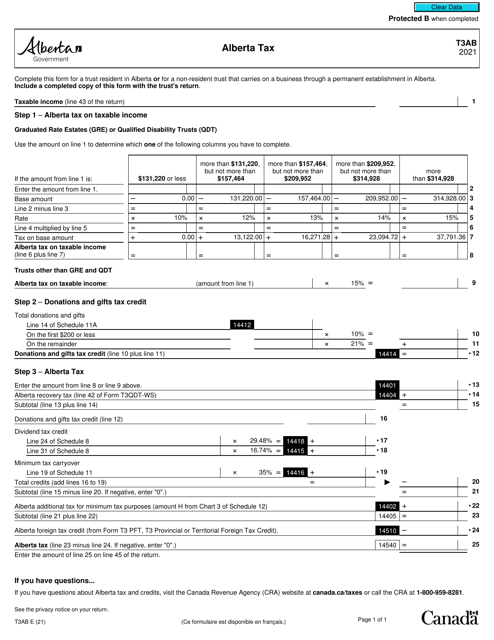

This form is used for reporting and paying Alberta taxes in Canada.