Trust Distribution Templates

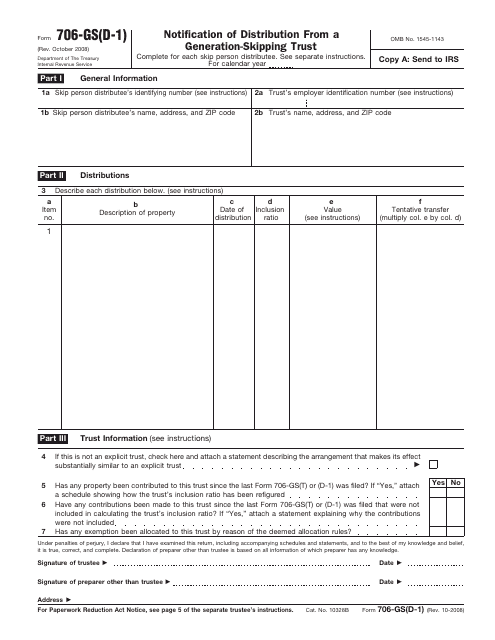

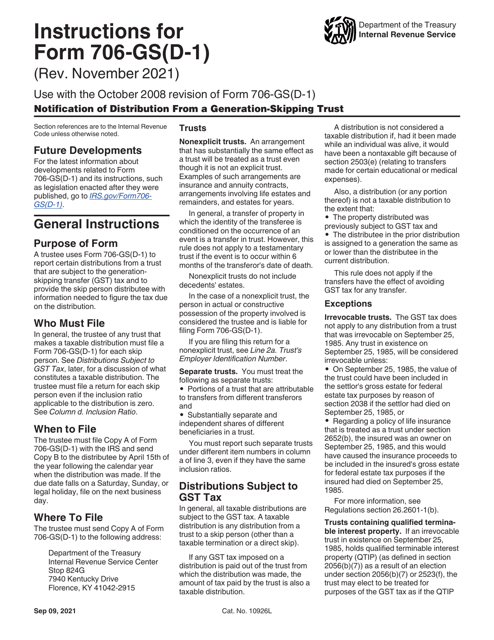

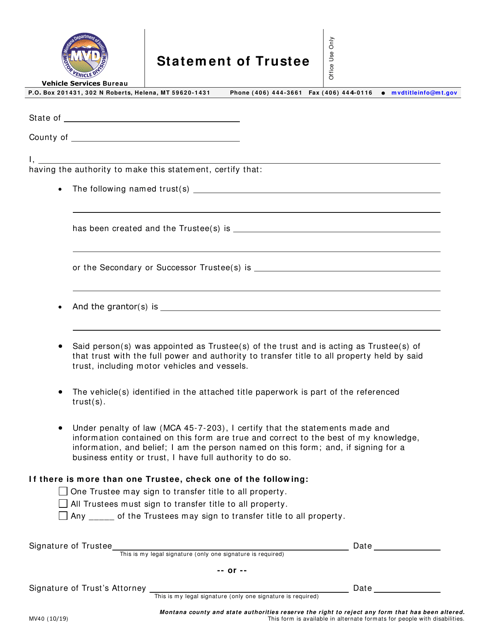

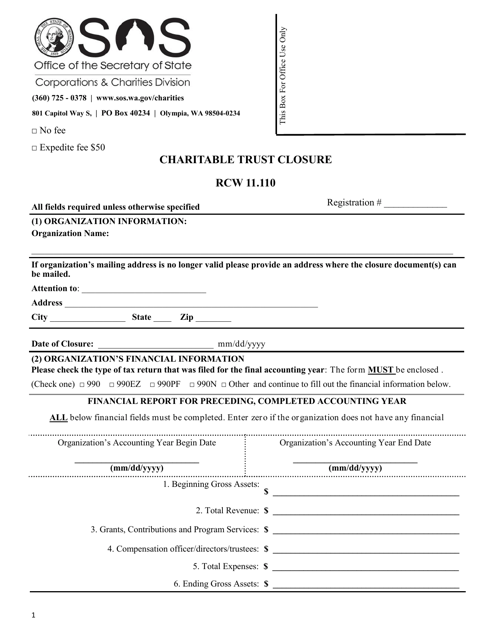

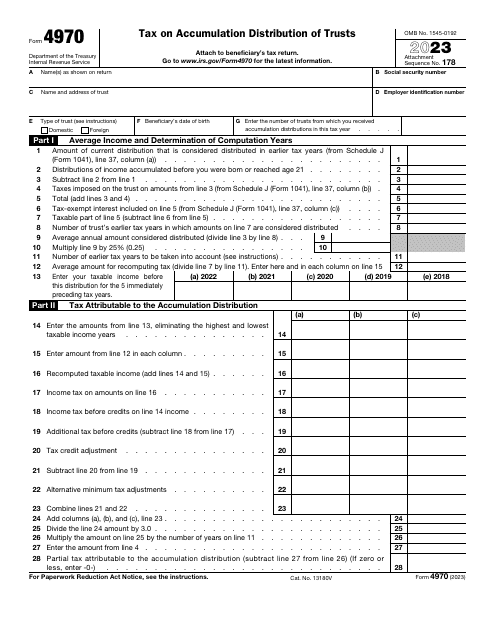

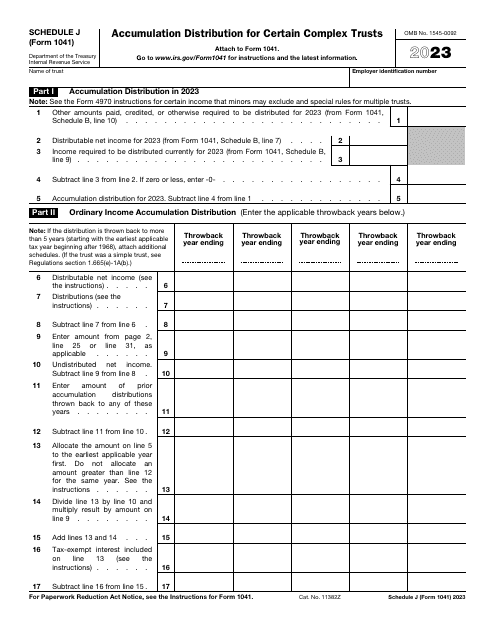

Are you looking to distribute trust assets or navigate the complexities of trust distribution? Look no further! Our trust distribution services ensure a seamless and efficient process for distributing trust assets to beneficiaries. Whether you need assistance with IRS forms such as Form 706-GS(D-1) or Form 1041 Schedule J, or require help with handling the closure of a charitable trust, our knowledgeable team is here to guide you every step of the way. With our expertise in trust distributions, you can trust us to handle the administrative tasks and ensure compliance with state and federal regulations. Choose our trust distribution services today and experience peace of mind knowing that your trust assets are being distributed in a timely and accurate manner. Discover the benefits of efficient trust distribution and let us assist you in distributing trust assets to beneficiaries.

Documents:

8

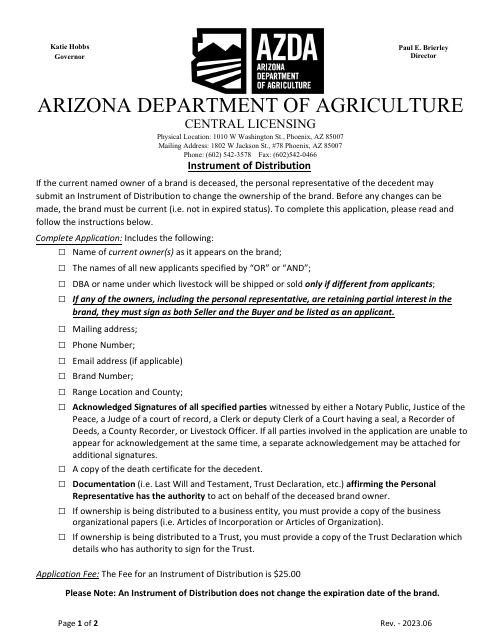

This document is for closing a charitable trust in Washington. It provides the necessary forms and instructions for properly terminating the trust.