Tax Levy Templates

A tax levy is a legal process used by governments to collect unpaid taxes from individuals or businesses. It is an important tool in ensuring that tax revenues are effectively collected to fund public services and programs.

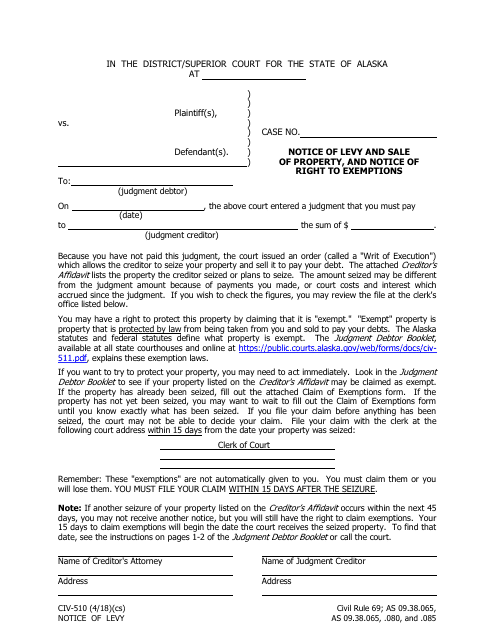

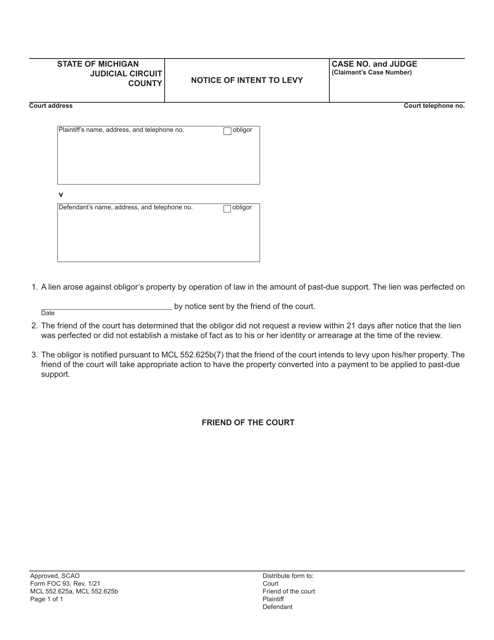

The tax levy process involves issuing a notice of levy and sale of property, informing taxpayers of their obligations and warning of the potential consequences for non-compliance. This notice also includes information about the taxpayer's rights to claim exemptions or appeal the levy.

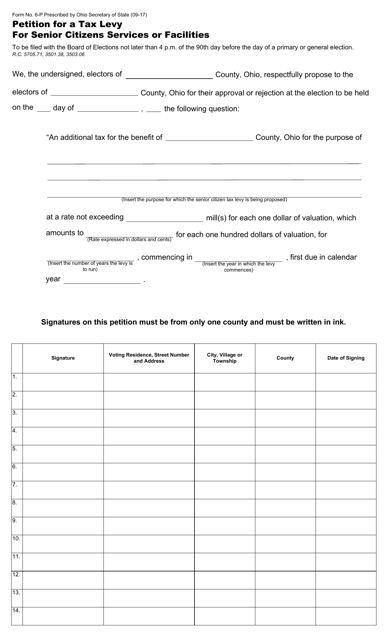

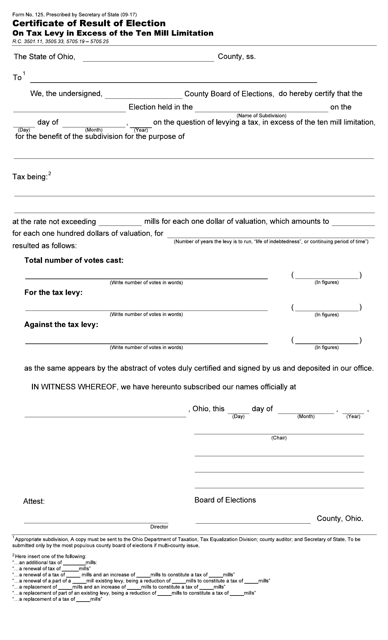

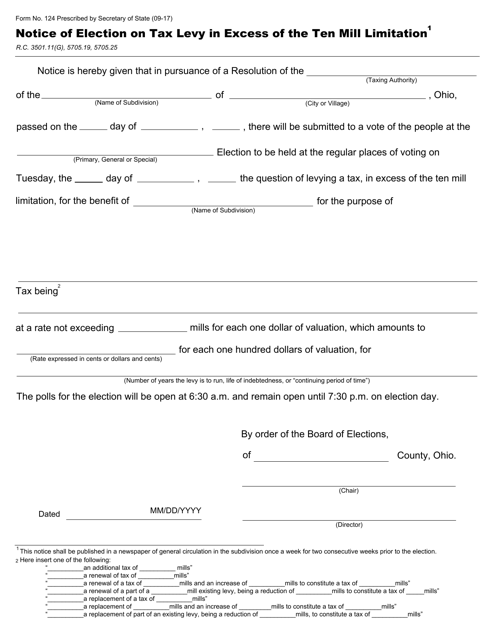

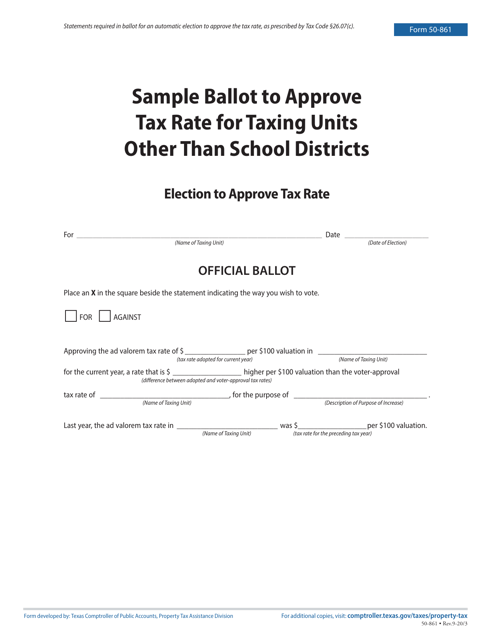

In some jurisdictions, a tax levy may require an election to be held to approve any levy in excess of a certain limit. The result of such elections is documented on a certificate, which provides transparency and accountability in the tax levy process.

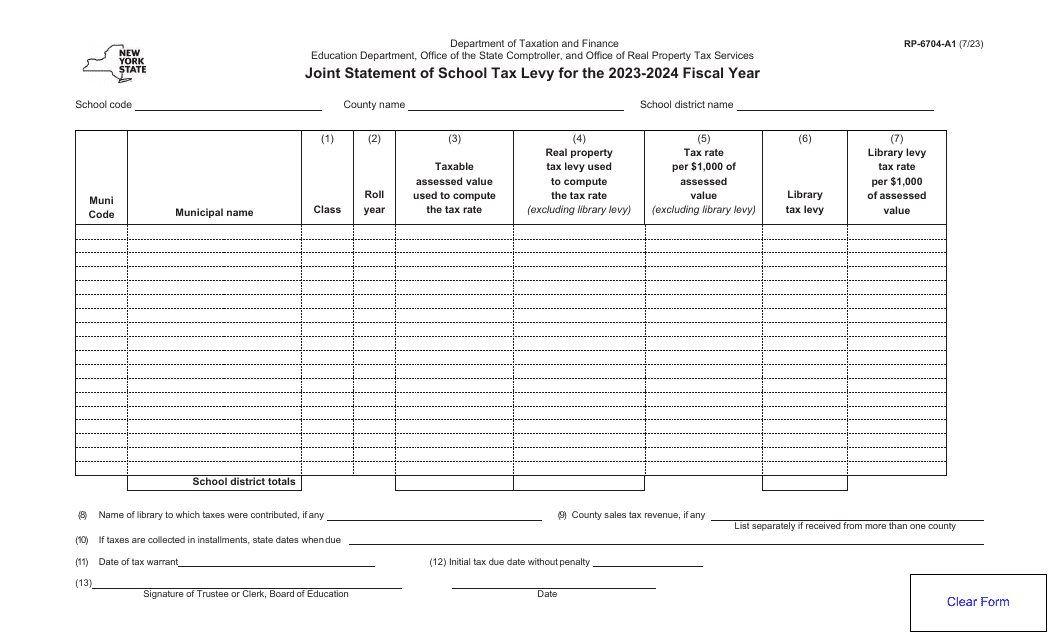

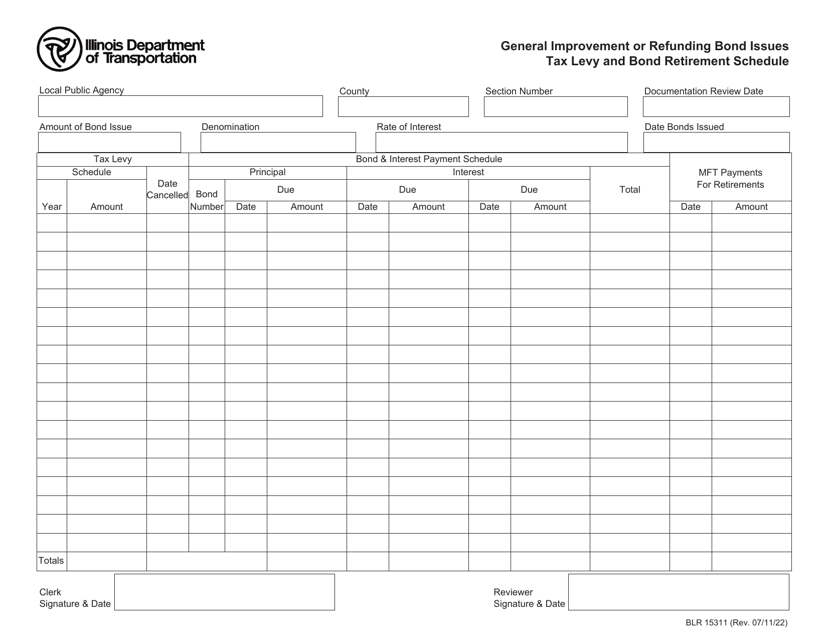

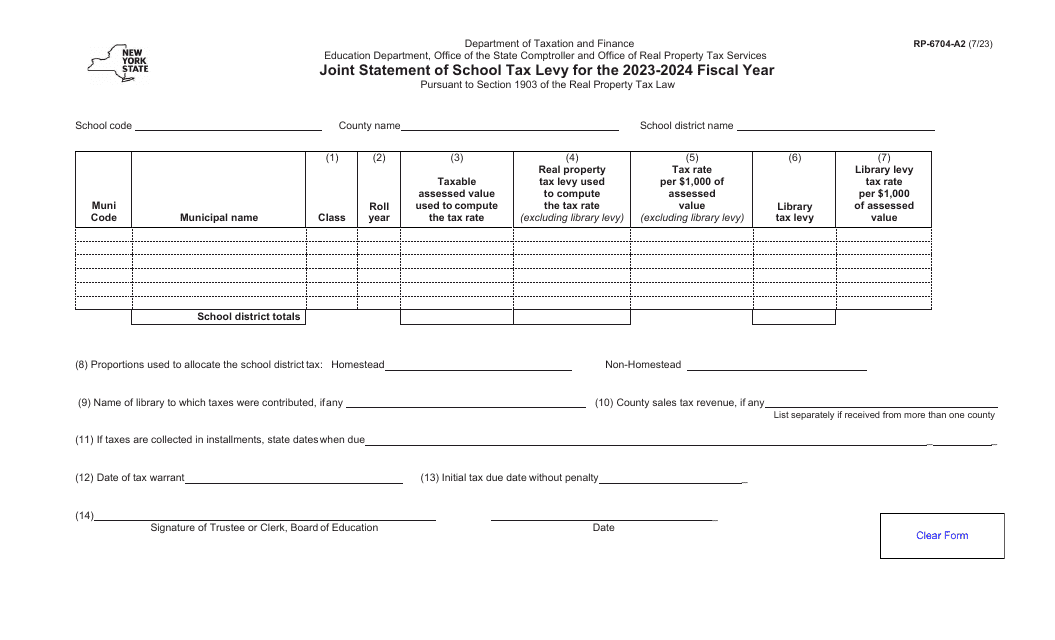

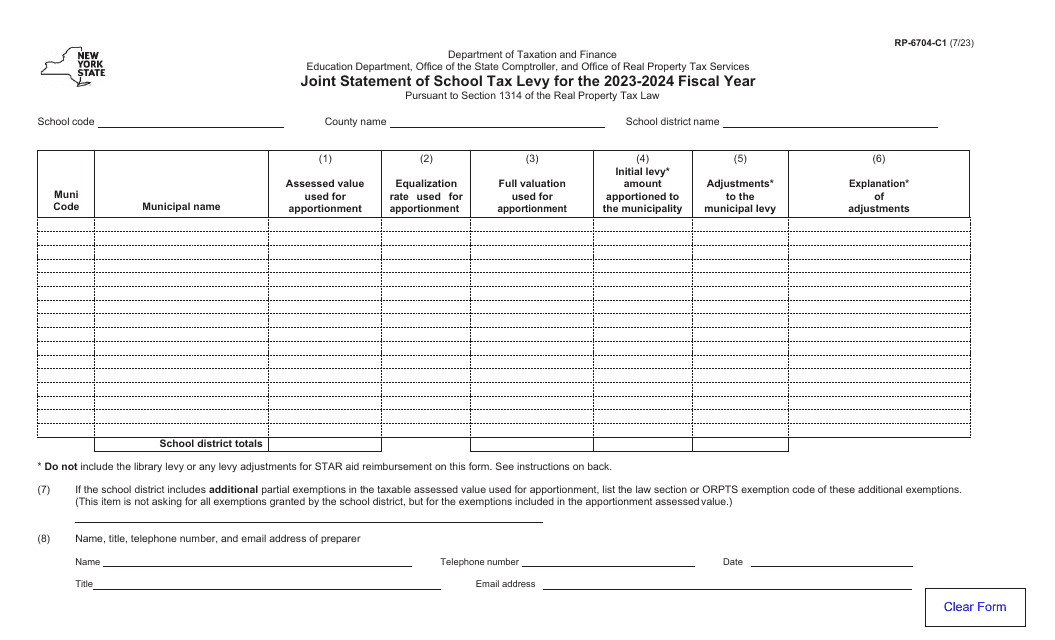

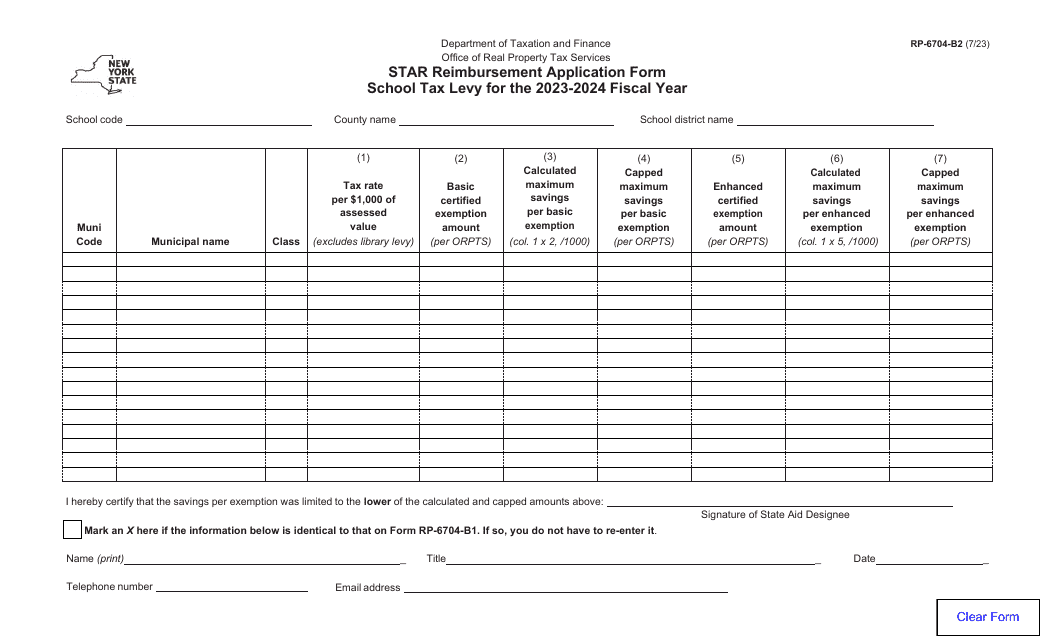

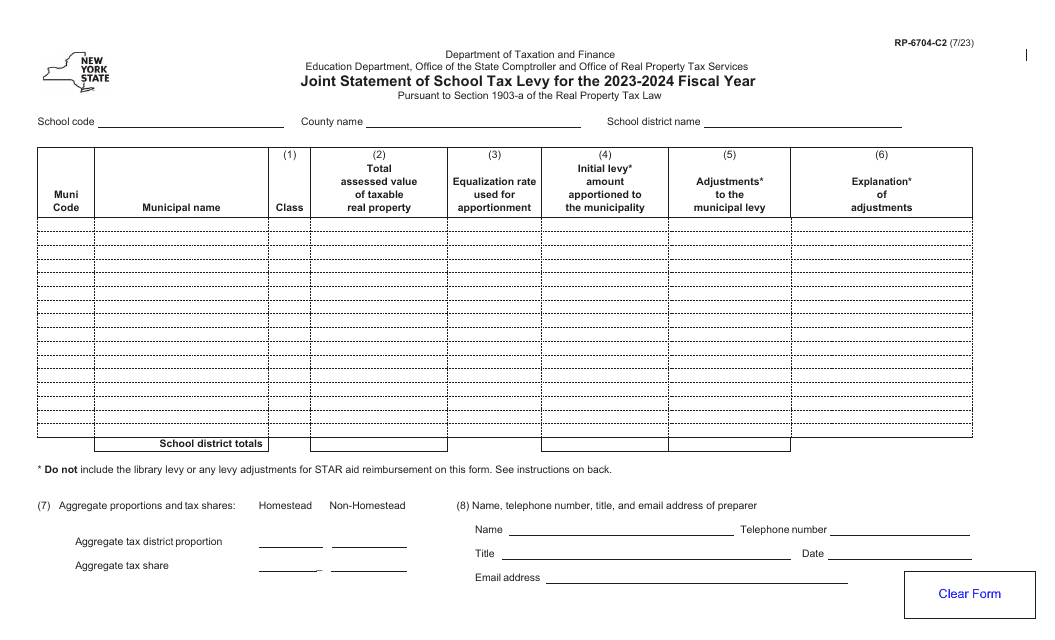

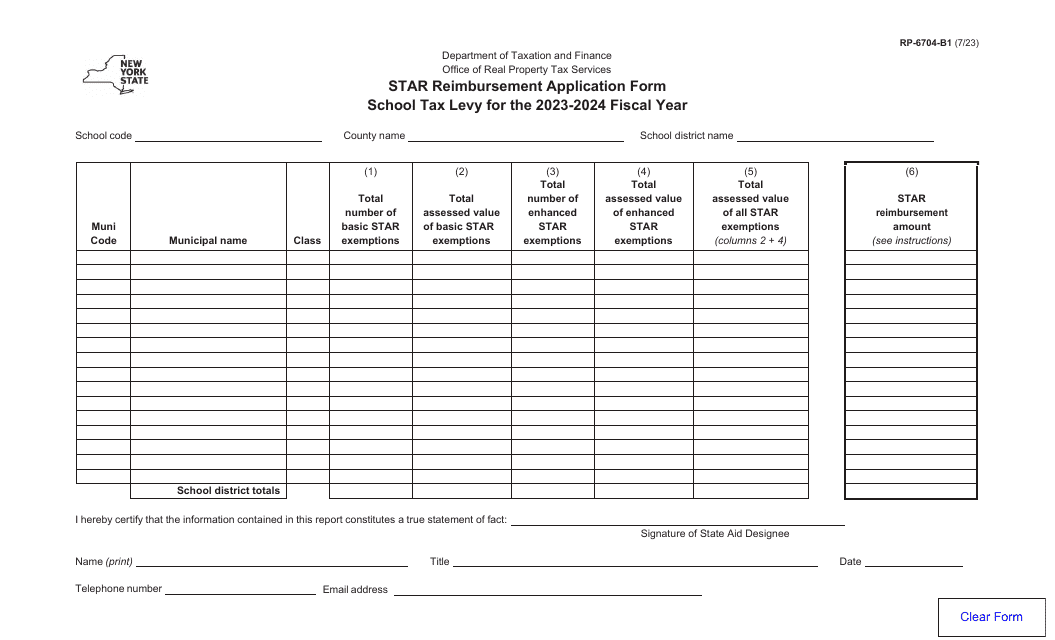

In the United States, different states may have varying requirements and procedures for implementing a tax levy. For instance, New York requires a joint statement of school tax levy, which serves as a means of collaboration and coordination between various stakeholders involved in the levy process.

When a tax levy is issued, it is important for taxpayers to carefully review the notice and respond appropriately. Failure to address a tax levy can result in serious consequences, including the seizure and sale of property to satisfy the outstanding tax debt.

If you have received a notice of tax levy or are interested in understanding your rights and obligations related to tax levies, it is advisable to consult with a tax professional or seek legal advice. They can provide guidance and assistance in navigating the complexities of the tax levy process and help ensure that you are treated fairly within the bounds of the law.

Documents:

26

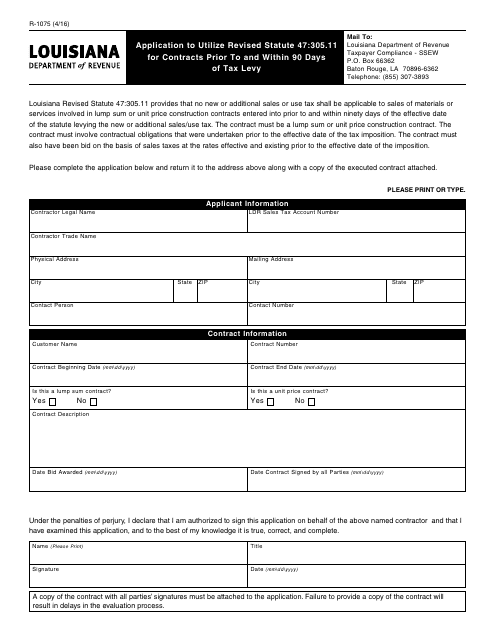

This form is used for applying to utilize Revised Statute 47:305.11 for contracts in Louisiana that are prior to and within 90 days of tax levy.

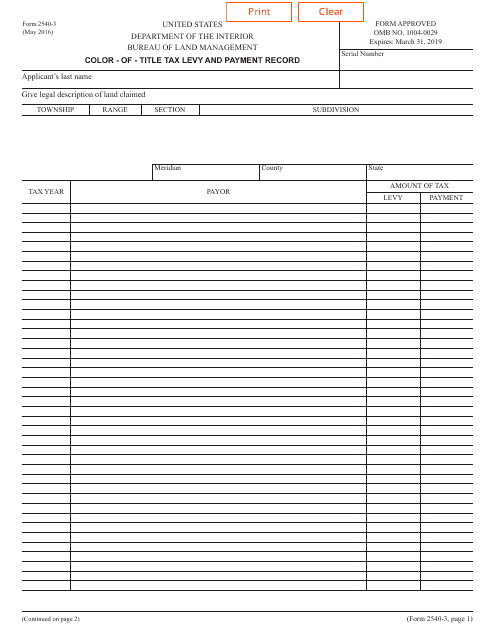

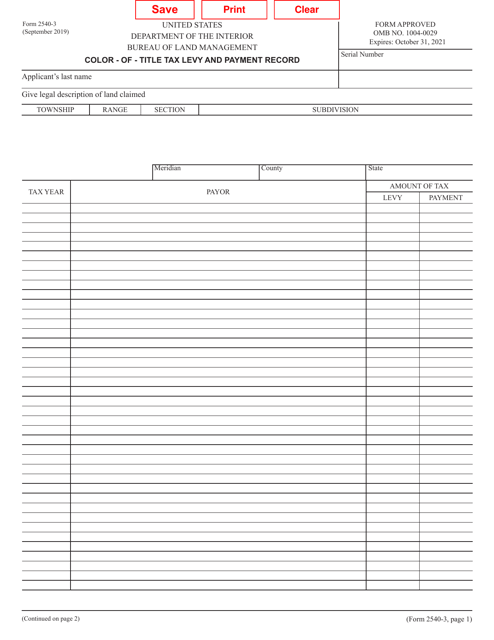

This form is used for recording and keeping track of tax levies and payments related to color-of-title properties.

This form is used for giving notice of the levy and sale of property and also informing the recipient of their right to claim exemptions in the state of Alaska.

This document is for residents in Ohio to petition for a tax levy to fund senior citizens services or facilities.

This form is used for certifying the results of a tax levy election in Ohio that exceeds the ten-mill limitation. It is used to document the outcome of the election and ensure that the levy is implemented within legal limits.

This form is used for notifying residents of Ohio about an upcoming election regarding tax levy exceeding the ten mill limitation.

This form is used for recording tax levies and payments related to color-of-title properties.

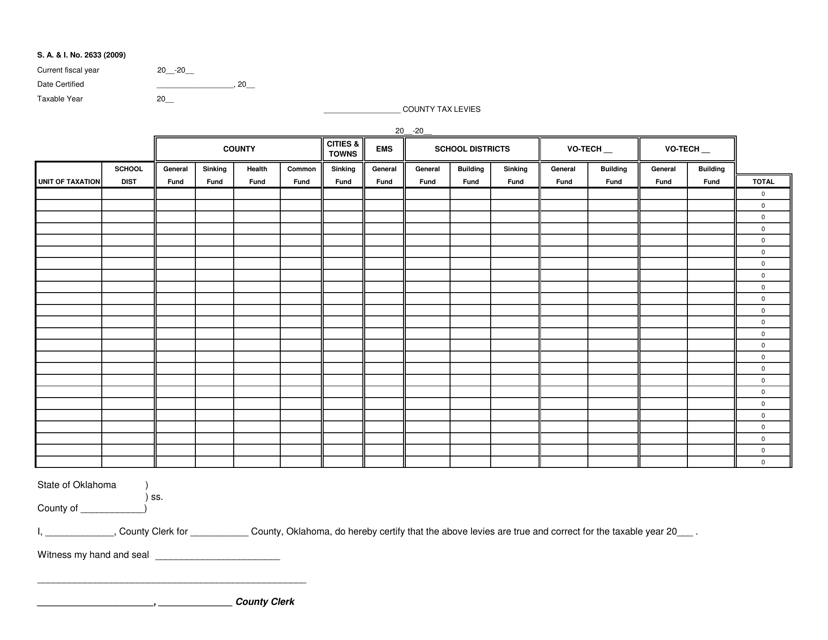

This form is used for reporting county tax levies in Oklahoma.

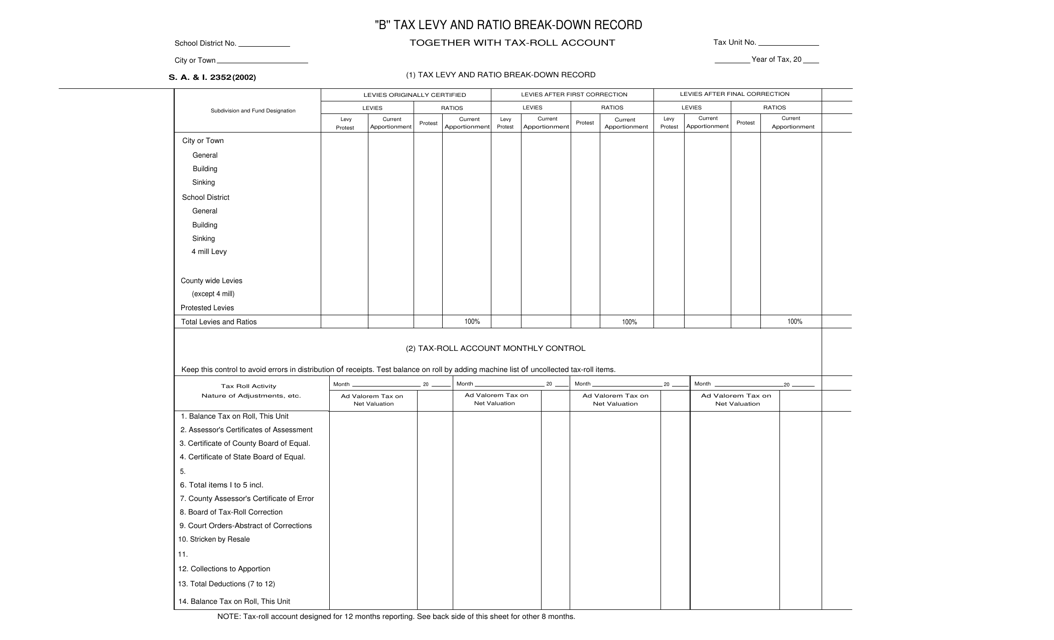

This Form is used for recording tax levies and ratio breakdowns in Oklahoma.

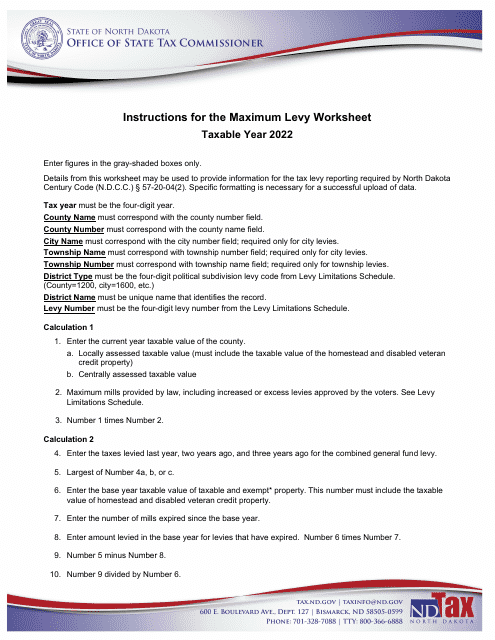

This document provides instructions for completing the Maximum Levy Worksheet in North Dakota. The worksheet helps determine the maximum amount of money that can be levied or collected for various purposes, such as taxes or funding for specific projects, within the state.