Compensation Rate Templates

The Compensation Rate, also known as the Compensation Rating, is a crucial factor in determining the amount of compensation an individual is entitled to receive for various reasons such as disability, injury, or service-related incidents. It plays a significant role in different areas across the USA and Canada.

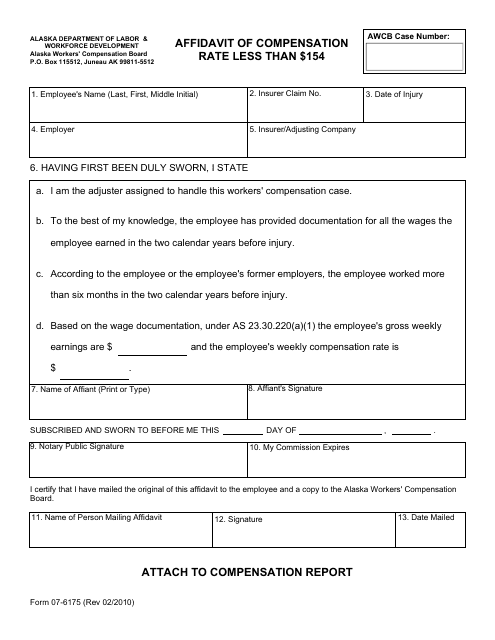

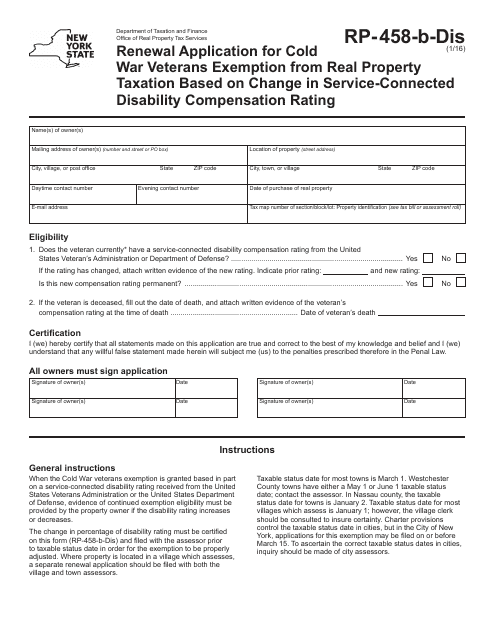

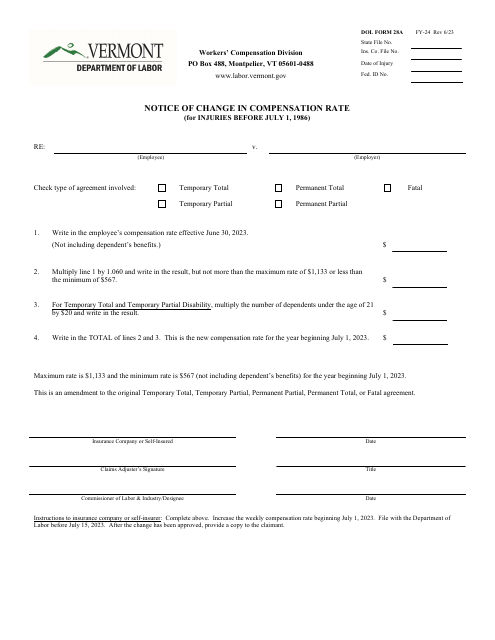

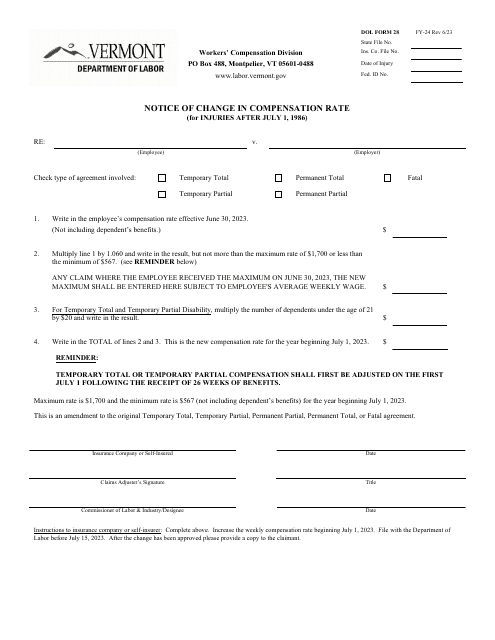

The Compensation Rate is assessed and documented through various forms and applications specific to each region. For instance, in Alaska, individuals can use Form 07-6175 Affidavit of Compensation Rate Less Than $154 to attest to their compensation rate. In New York, veterans can benefit from the Form RP-458-B-DIS Renewal Application for Cold War Veterans Exemption, which takes into account changes in the service-connected disability compensation rating when calculating real property taxation. In Vermont, the Department of Labor employs Form 28 and Form 28A for notifying individuals about changes in their compensation rate, depending on injuries sustained before or after July 1, 1986.

These documents, along with numerous others, are part of the Compensation Rate documentation collection, which ensures accuracy, transparency, and fairness in compensation calculations. Whether you require information about changes in compensation rates or need to prove your eligibility for certain benefits, understanding and utilizing these forms is crucial.

At USA, Canada and other countries document knowledge system, we provide comprehensive information, guidance, and resources related to the Compensation Rate collection. Our expert team is here to help you navigate through this complex area, ensuring you have access to the necessary documents and understanding of the processes involved.

Contact us today to learn more about the Compensation Rate documentation collection and how it applies to your specific situation. Let us assist you in securing the compensation you deserve.

Documents:

9

This Form is used for filing an affidavit to claim compensation rate less than $154 in the state of Alaska.

This Form is used for applying for the renewal of the Cold War Veterans Exemption from Real Property Taxation in New York based on a change in the service-connected disability compensation rating.