Penalty for Underpayment Templates

Are you worried about penalties for underpayment of taxes? Our penalty for underpayment documents collection provides valuable information on how to calculate and mitigate penalties related to the underpayment of estimated income taxes. Understanding your tax obligations and avoiding underpayment penalties is crucial to maintaining good financial standing.

Our penalty for underpayment documents cover various states and provide detailed instructions on how to calculate penalties based on your specific circumstances. Whether you are an individual taxpayer or a corporation, our documents can help you navigate the complex tax laws and minimize penalties.

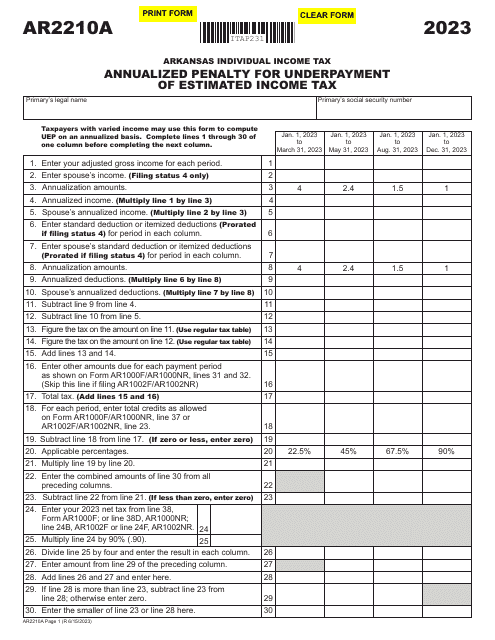

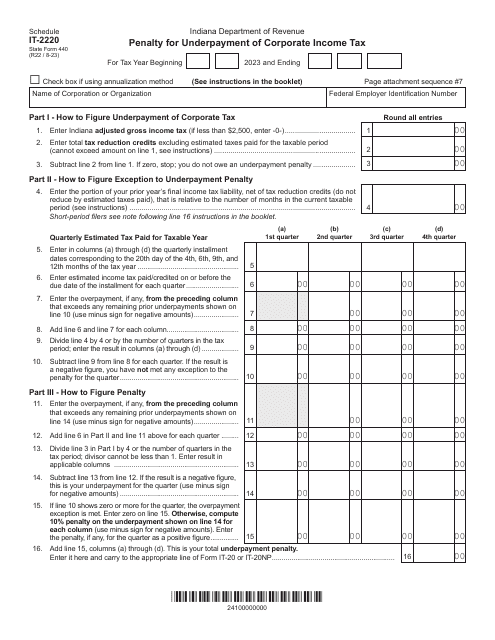

Form AR2210A in Arkansas and State Form 440 Schedule IT-2220 in Indiana are just a few examples of the documents we offer. These documents offer guidance on how to estimate your income tax liability, calculate the penalty for underpayment, and complete the necessary forms.

Don't let the fear of penalties for underpayment keep you up at night. With our penalty for underpayment documents collection, you can access the resources you need to stay compliant with tax laws and avoid unnecessary penalties. Be proactive and ensure you are up to date with your tax obligations by exploring our comprehensive collection of penalty for underpayment documents.

Note: The actual text would be longer and more detailed, but this is a condensed version for the purpose of this exercise.