Personal Guarantee Templates

Are you looking for a way to safeguard your financial investments? Look no further than our comprehensive collection of personal guarantee documents. Whether you refer to it as a personal guarantee, personal guarantee form, or personal guarantees, these documents are designed to protect your interests in a variety of financial transactions.

With our diverse range of documents, you can find the perfect solution to fit your specific needs. From the Notice to Cosigner or Guarantor in Nebraska to the SBA Form 2450 504 Eligibility Checklist (Non-PCLP), our library covers a wide range of situations and jurisdictions. Whether you're a lender or a borrower, our Personal Guarantee Template and Collateral Bond and Indemnity Agreement (Partnership) can provide you with the peace of mind you deserve.

Don't let financial uncertainty leave you vulnerable. Protect your investments with our easy-to-use and legally sound personal guarantee documents. Take advantage of our extensive collection today and ensure that your financial interests are safeguarded.

Documents:

7

This document notifies a cosigner or guarantor in Nebraska of their responsibilities and obligations. It outlines the implications and consequences of not fulfilling their financial commitment.

This document is completed by a Certified Development Company (CDC) to help the Small Business Administration (SBA) to apply for a Section 504 Loan.

This document is used for establishing a bond and indemnity agreement between partners in a partnership. It ensures that each partner will be responsible for any losses or damages incurred by the partnership.

This document is used for applying for a self-bond, which allows individuals to provide their own financial security instead of a traditional surety bond.

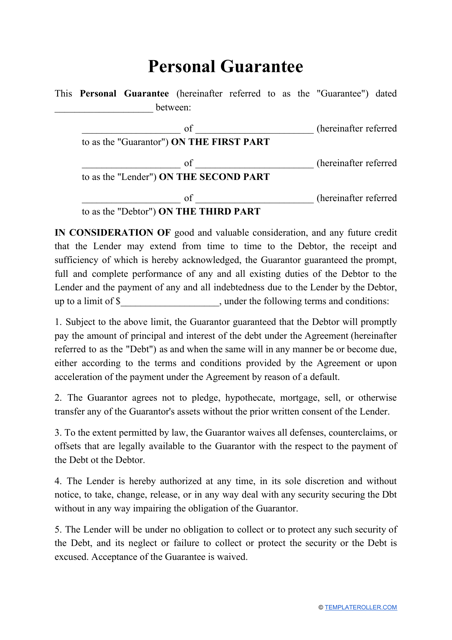

This form expresses a written promise by a guarantor to take responsibility for a debtor if they fail to pay their debt to a lender.

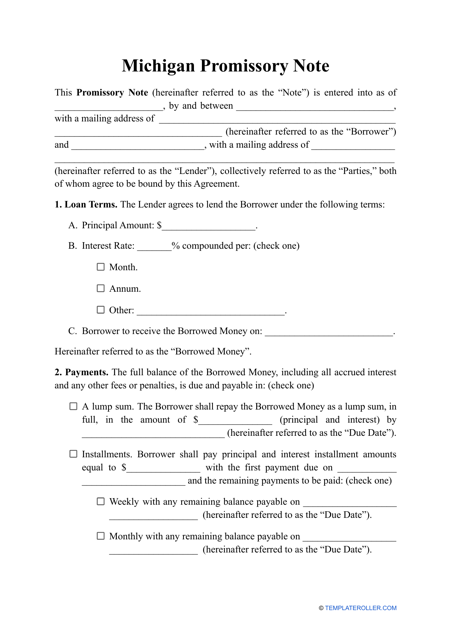

This document provides a template for a promissory note in the state of Michigan. It outlines the terms and conditions of a loan agreement between a borrower and a lender.

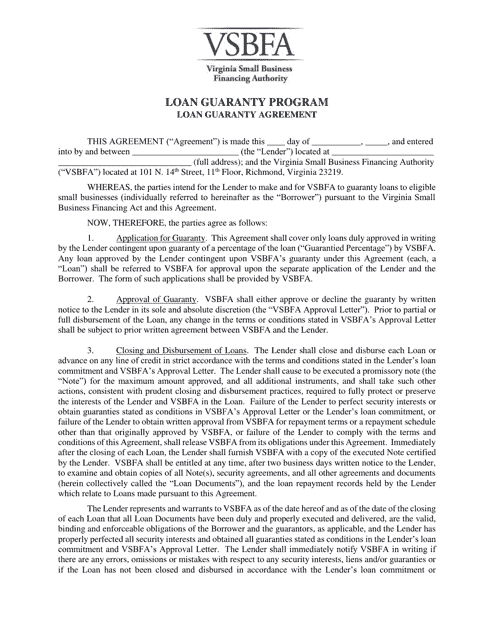

This document is used for establishing an agreement for the Loan Guaranty Program in the state of Virginia. It outlines the terms and conditions between the lender and the guarantor for the loan guarantee.