Business Taxation Templates

Looking to navigate the complexities of business taxation? Our extensive collection of documents on business taxation is here to help. Whether you're a small business owner or a tax professional, our resources provide valuable information on various aspects of business taxation.

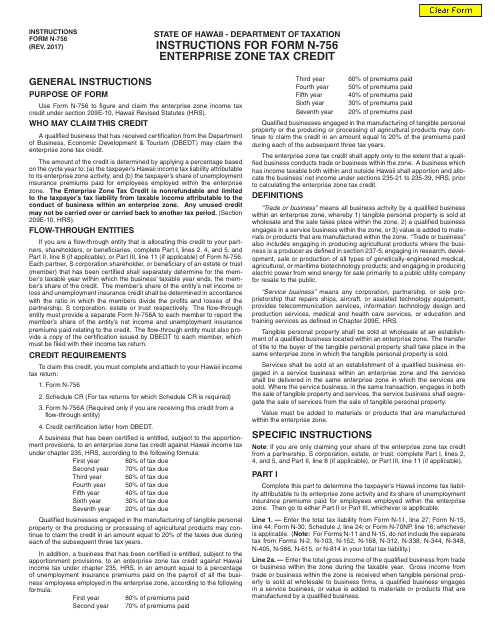

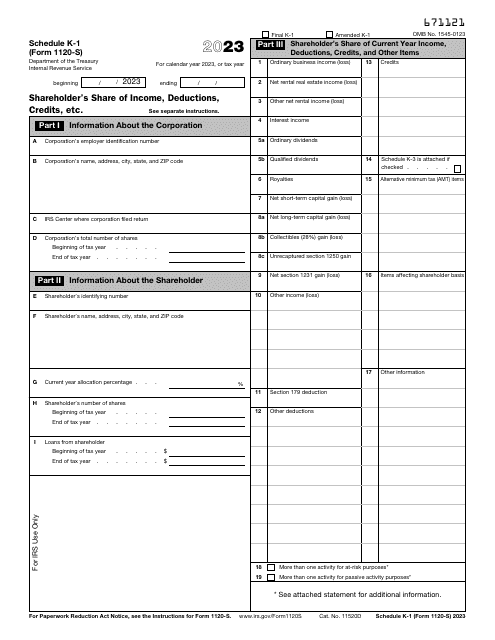

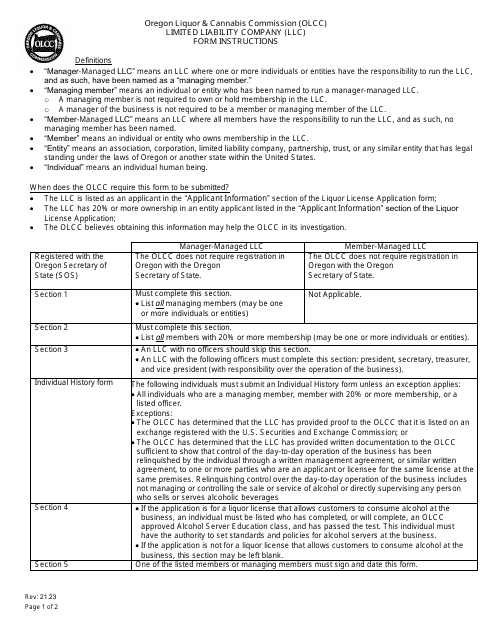

Explore instructions, forms, and questionnaires related to business taxation from different states across the United States and beyond. Our documents cover diverse topics such as enterprise zonetax credits, shareholder's share of income, deductions, credits, and more.

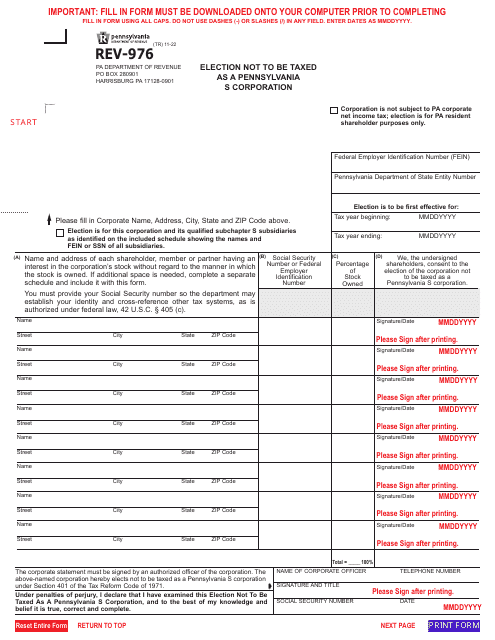

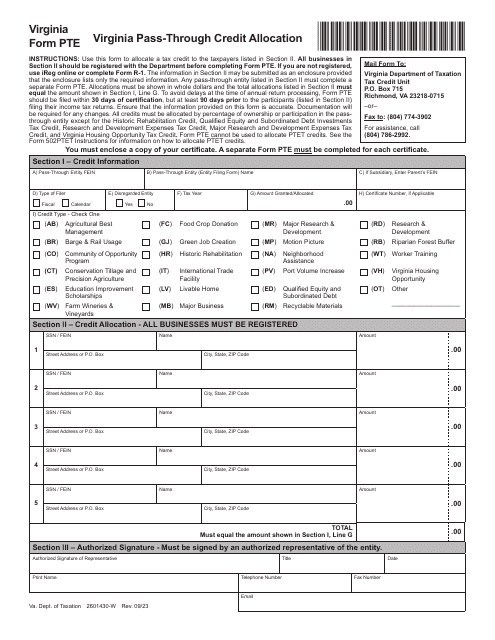

With the aim to simplify the tax filing process, our collection includes forms like Form 1120-S Schedule K-1, Form REV-976 Election Not to Be Taxed as a Pennsylvania S Corporation, and Form PTE Virginia Pass-Through Credit Allocation. These forms are designed to help businesses comply with state-specific tax regulations and maximize tax benefits.

Whether you're based in Hawaii, Oregon, Pennsylvania, Virginia, or any other state, our documents cater to the unique tax requirements of different jurisdictions. We understand that navigating business taxation can be overwhelming, which is why our comprehensive collection aims to provide the necessary guidance and support.

Stay updated with the latest changes in tax laws and regulations with our continuously updated documents. Our collection ensures that you have access to accurate and reliable information to better understand and comply with business taxation requirements.

Trust our business taxation documents to help you make informed decisions, minimize tax liability, and maximize deductions and credits. Take advantage of this invaluable resource to ensure your business stays on top of its tax obligations.

Start exploring our business taxation document collection today and take control of your business taxes with ease.

Documents:

5

This form is used for claiming the Enterprise Zone Tax Credit in Hawaii. It provides instructions on how to accurately fill out the form and submit it to the appropriate authorities.