Petroleum Tax Templates

Are you looking for information about petroleum taxes? Look no further! In this section, we provide you with all the necessary resources and documents related to petroleum taxes. From registration updates to applications for reimbursement, we have everything covered.

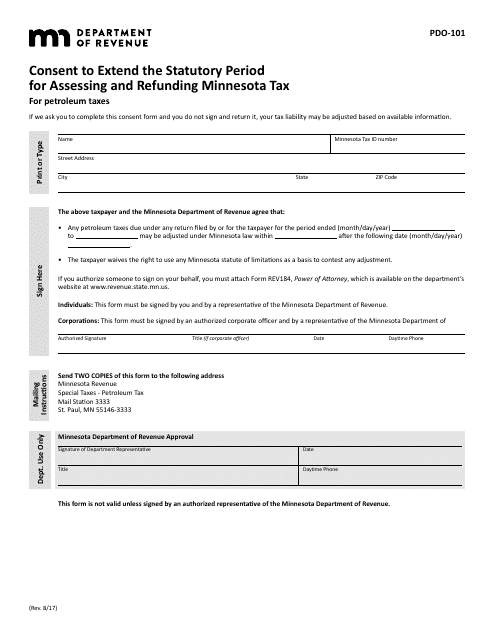

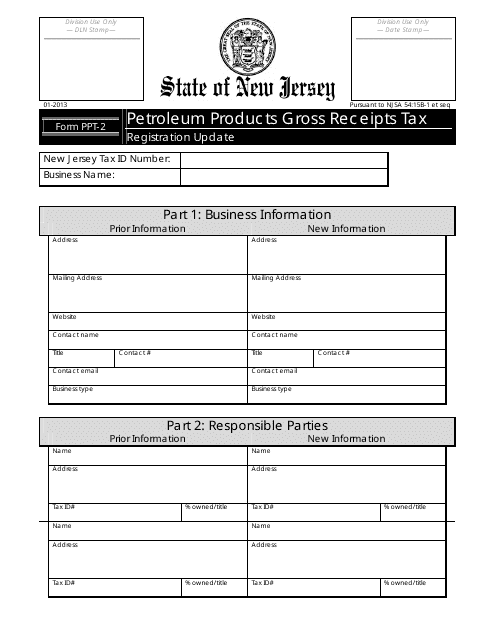

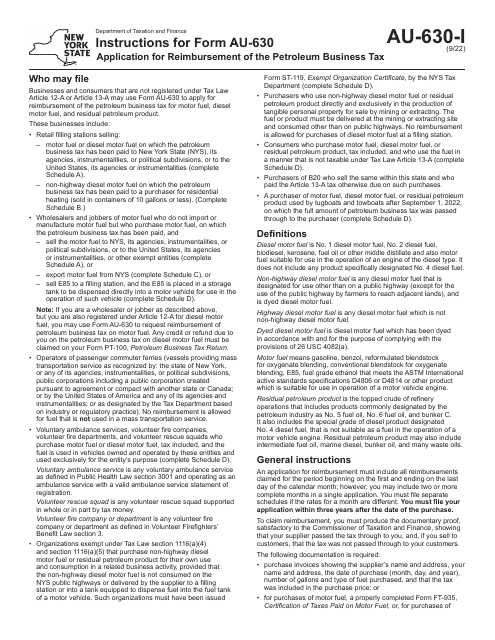

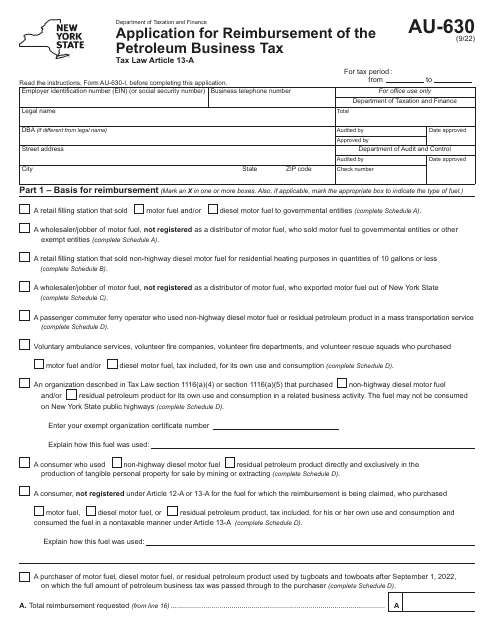

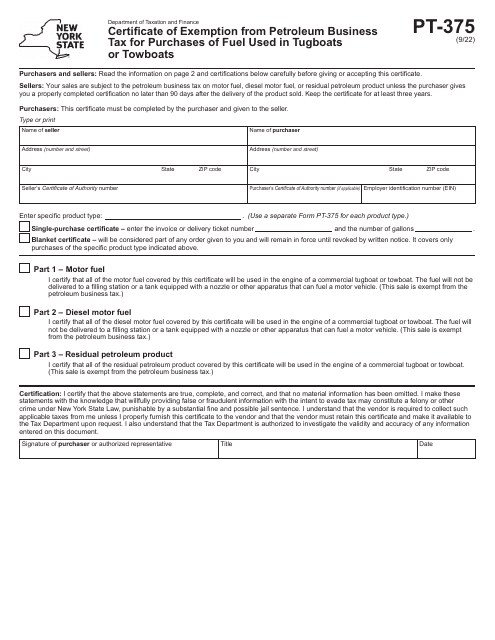

Whether you're a petroleum business owner or an individual looking for exemption certificates, you'll find what you need here. Our comprehensive collection includes forms such as PDO-101, PPT-2, AU-630, and PT-375, all of which are essential in dealing with petroleum taxes.

Stay up to date with the latest regulations and requirements by exploring our online library. We are committed to helping you navigate through the complexities of petroleum tax regulations. Access the documents you need and ensure compliance with ease.

Remember, petroleum taxes are also known as petroleum tax or petroleum taxes. Don't miss out on the information you need - start exploring our collection today!

Documents:

5

This form is used for requesting to extend the statutory period for assessing and refunding Minnesota tax for petroleum taxes in the state of Minnesota.

This form is used for updating the registration information for the Petroleum Products Gross Receipts Tax in New Jersey.

This form is used for obtaining a certificate of exemption from New York petroleum business tax for fuel purchases used in tugboats or towboats.