Impuestos Federales Templates

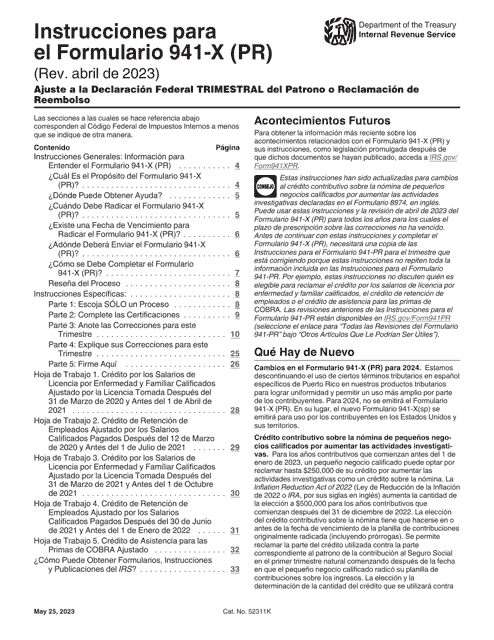

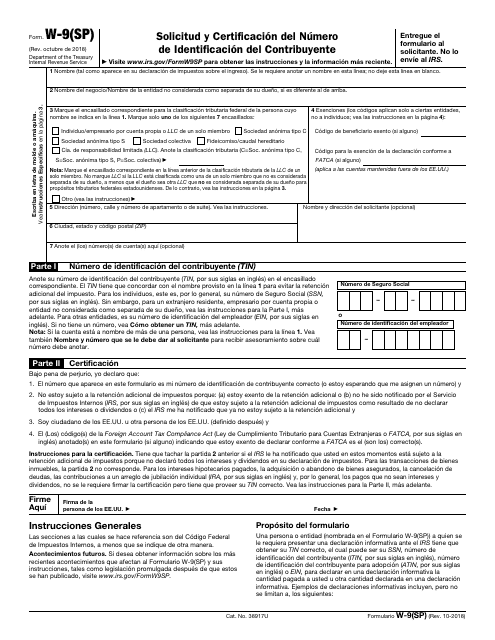

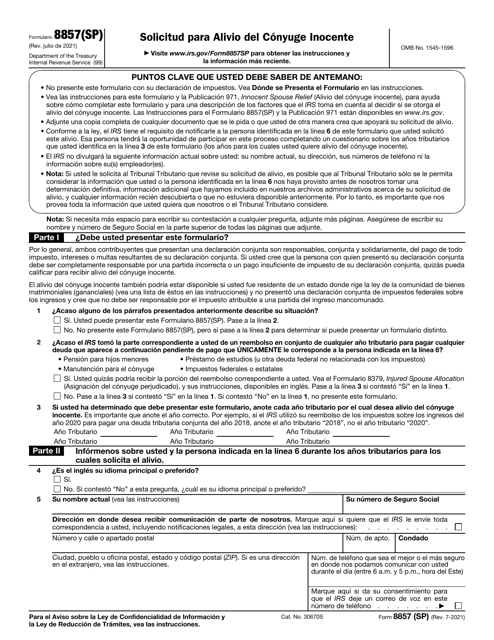

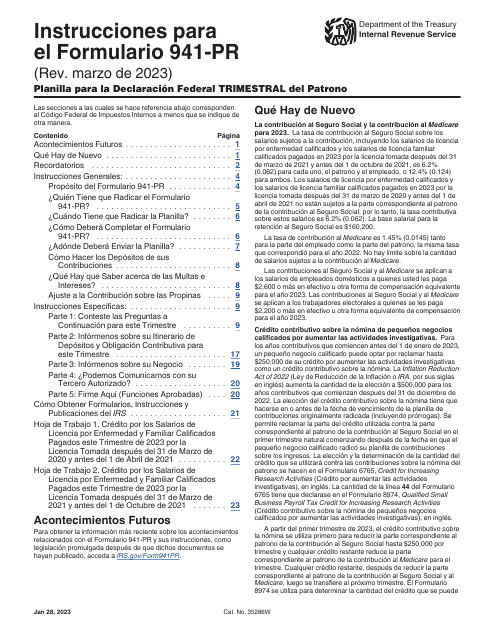

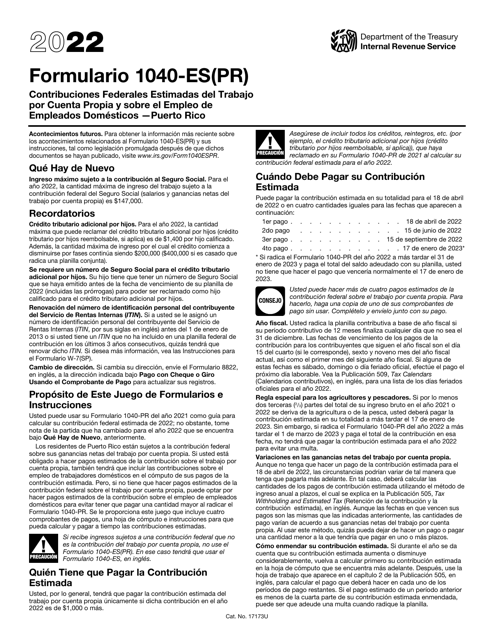

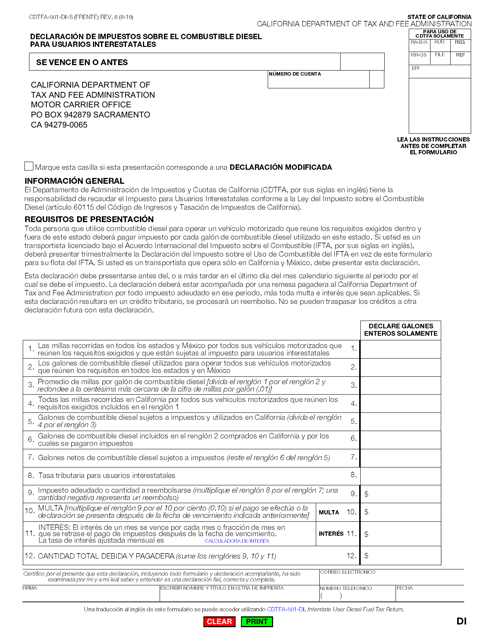

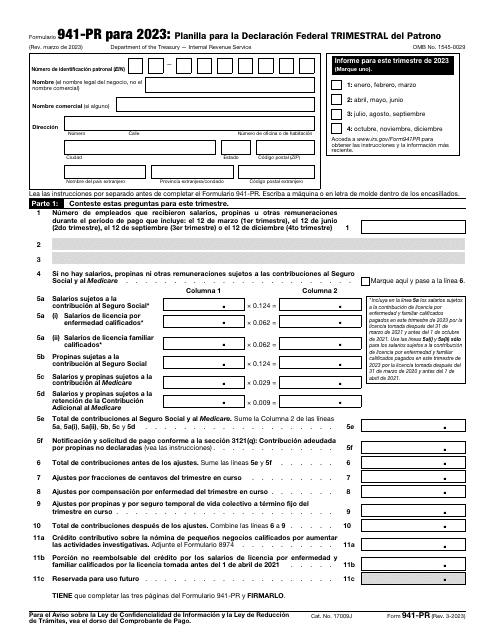

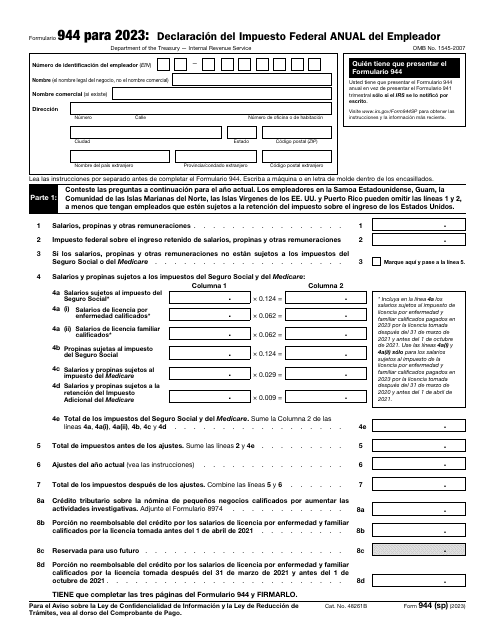

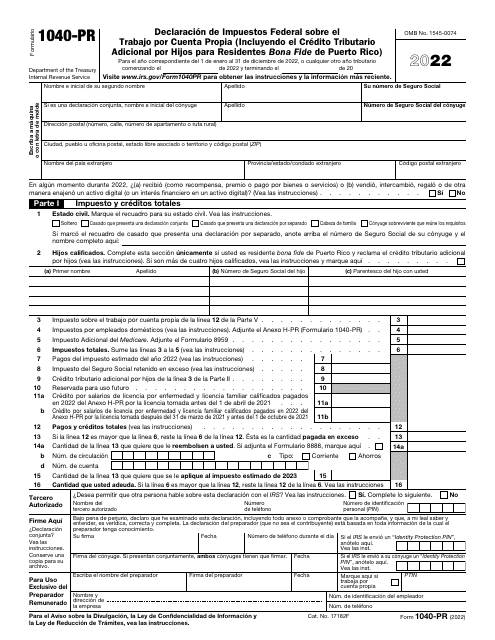

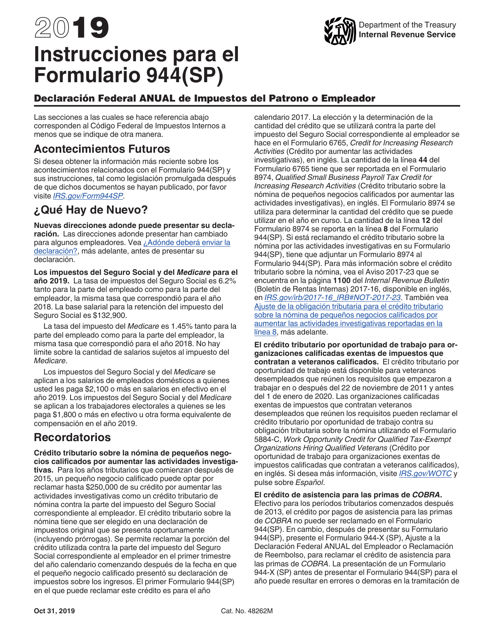

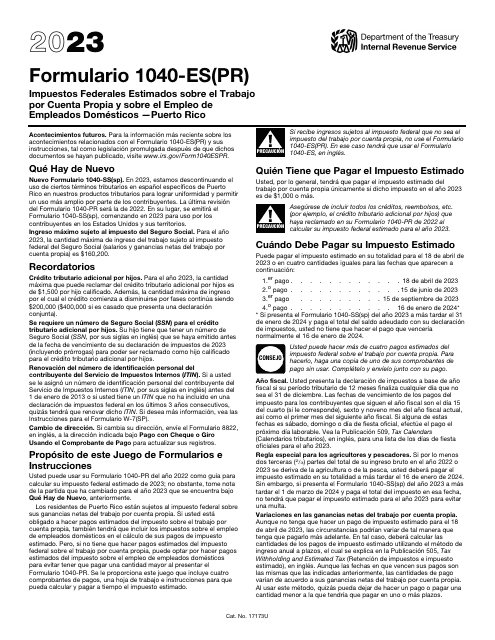

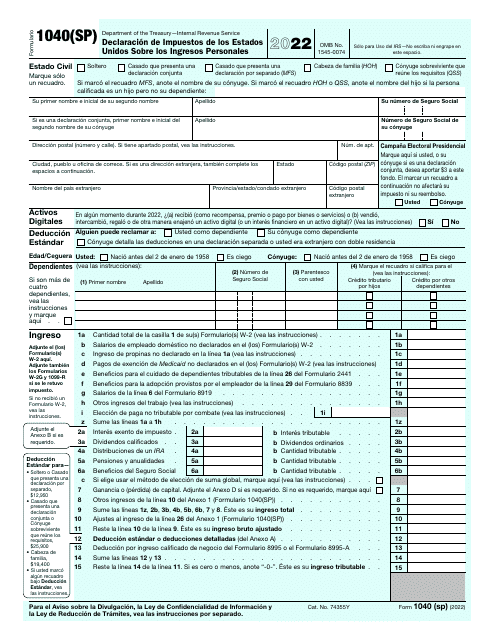

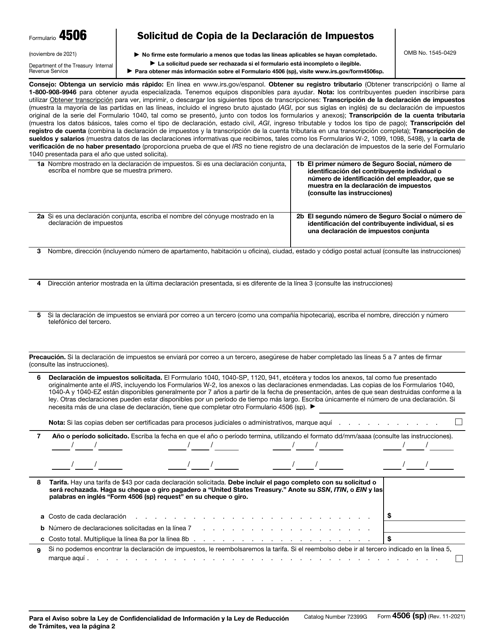

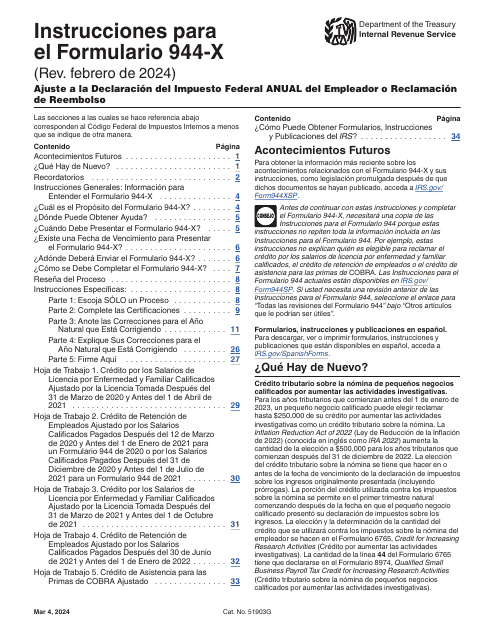

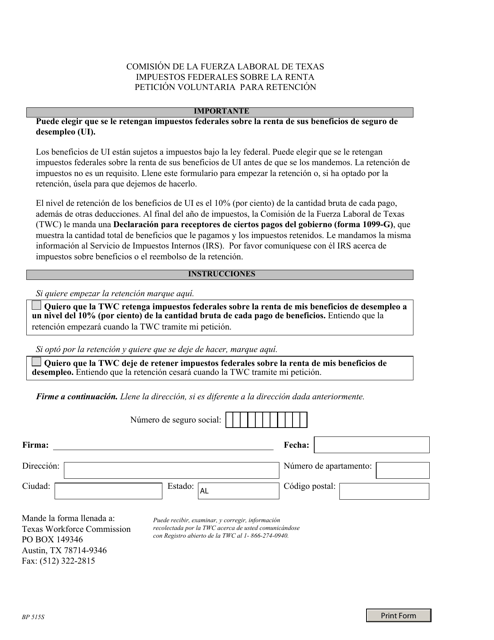

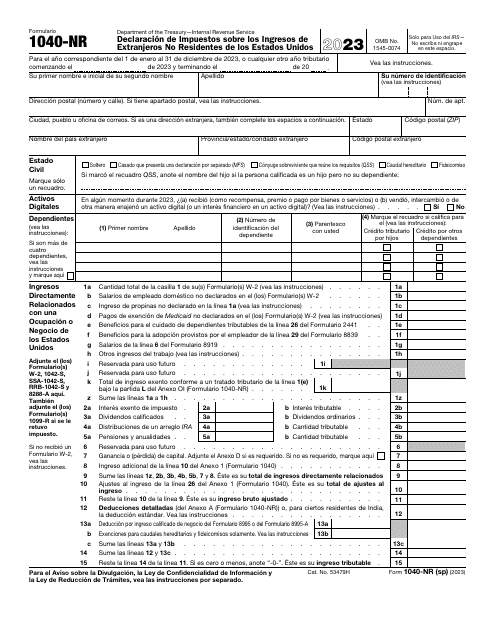

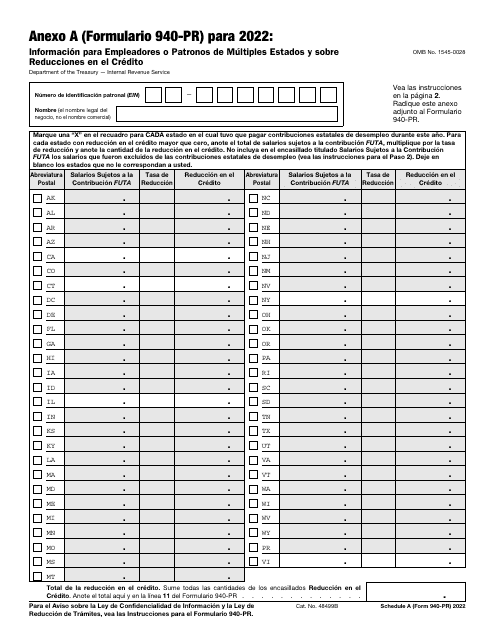

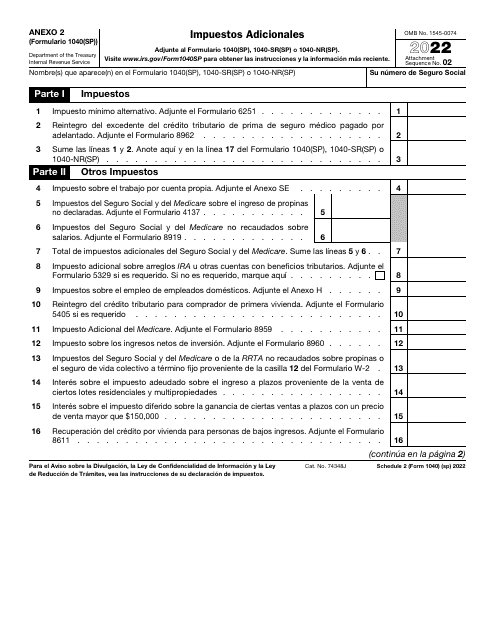

Are you looking for information about federal taxes? Discover everything you need to know about impuestos federales, the taxes collected by the government. From IRS Formulario W-9(sp) to IRS Formulario 941-PR Planilla Para La Declaracion Federal Trimestral Del Patrono (Puerto Rican Spanish), we have a range of forms and instructions available in Spanish to assist you with your tax obligations.

Whether you are an individual taxpayer or a business owner, understanding and fulfilling your federal tax requirements is essential. Our collection of impuestos federales documents provides the necessary tools and guidance to ensure compliance and minimize any administrative burdens.

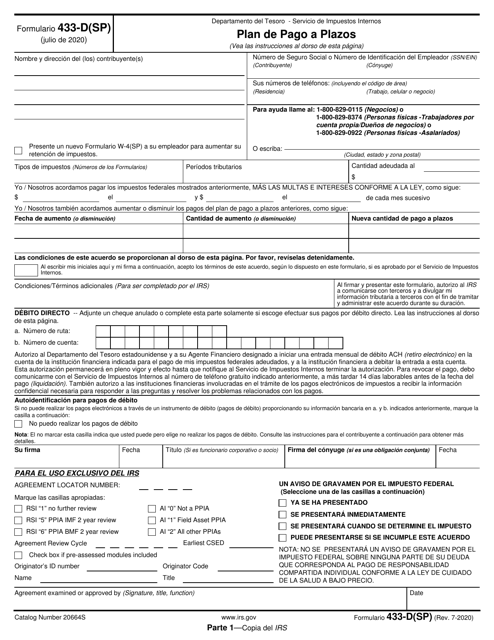

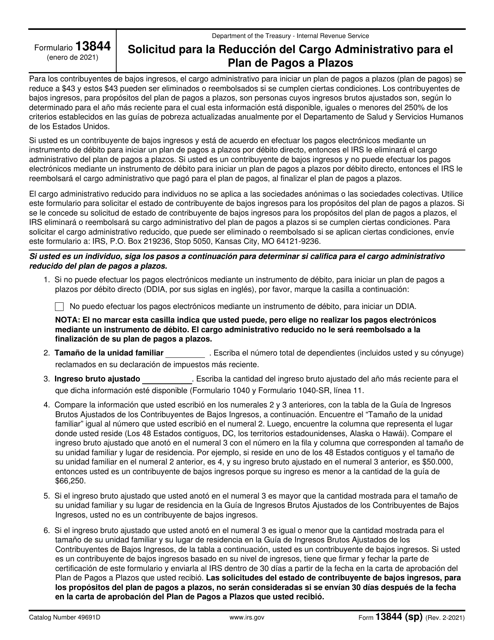

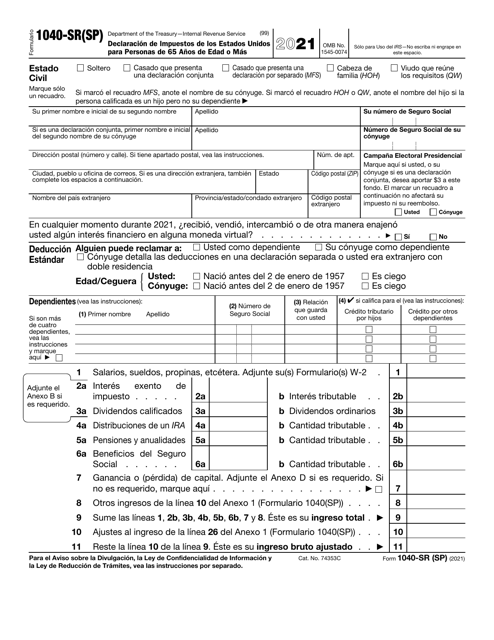

If you are a Spanish speaker, you'll find the IRS Formulario 13844(SP) Solicitud Para La Reducción Del Cargo Administrativo Para El Plan De Pagos a Plazos (Spanish) and IRS Formulario 1040-SR(SP) Declaración De Impuestos De Los Estados Unidos Para Personas De 65 Años De Edad O Más (Spanish) particularly helpful. These forms cater specifically to individuals or businesses that prefer to submit their tax returns in Spanish.

Don't let impuestos federales overwhelm you. Access our comprehensive collection of documents and forms to stay on top of your federal tax obligations. Whether you need assistance with tax identification, quarterly reporting, or reducing administrative charges, we have you covered.

Explore our impuestos federales resources today and ease the burden of tax season.

Documents:

30

This Form is used for creating a payment plan with the IRS for Spanish-speaking individuals.

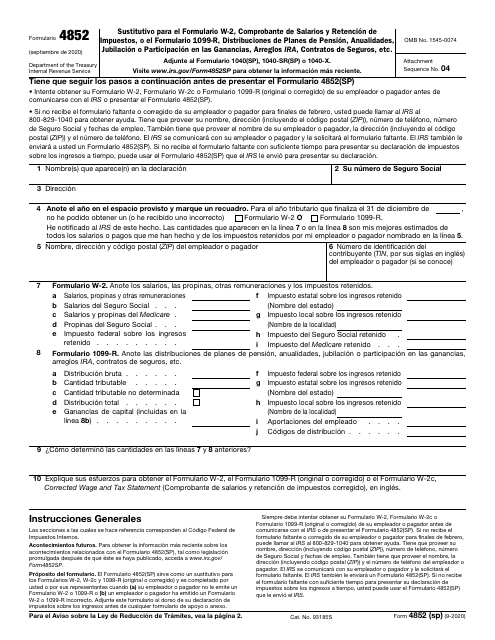

This Form is used for reporting wages and tax withholdings. It can also be used for reporting pension distributions, annuities, retirement income, IRA arrangements, insurance contracts, etc.