Business Credit Templates

Are you a business owner looking to establish a strong credit history for your company? Look no further than our comprehensive collection of documents on business credit.

Our extensive library covers a wide range of topics related to establishing and managing credit for your business. Whether you're interested in learning about tax credits, retention programs, or relocation incentives, our documents provide valuable information and guidance.

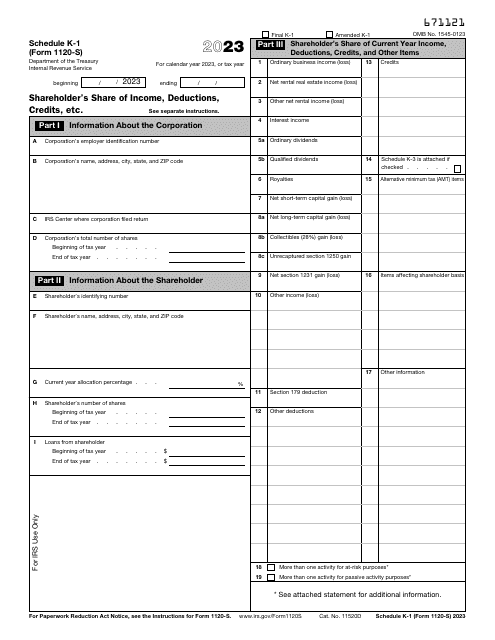

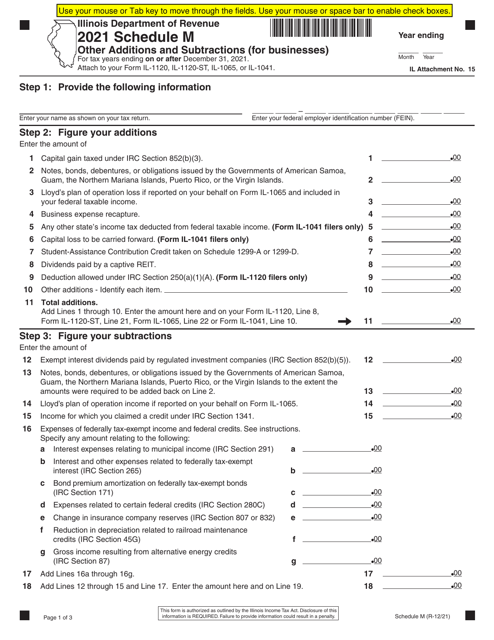

With alternate names like "credit business" and "business credits," we understand that building and maintaining your business credit is a key priority. Our documents offer detailed instructions, forms, and resources to help you navigate the complex world of business credit.

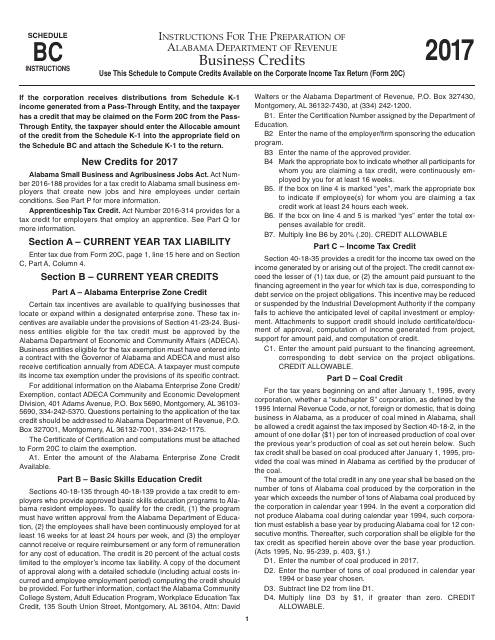

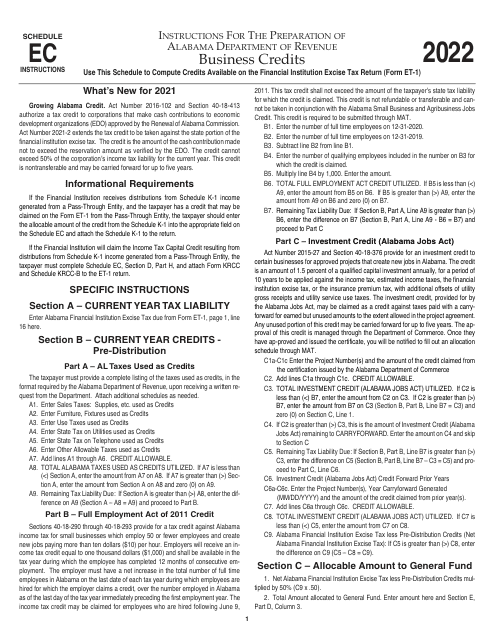

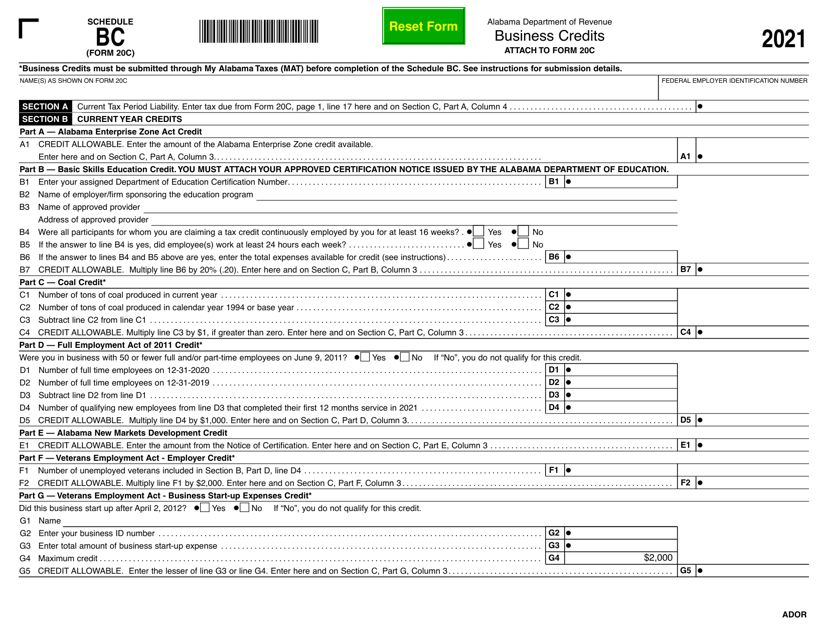

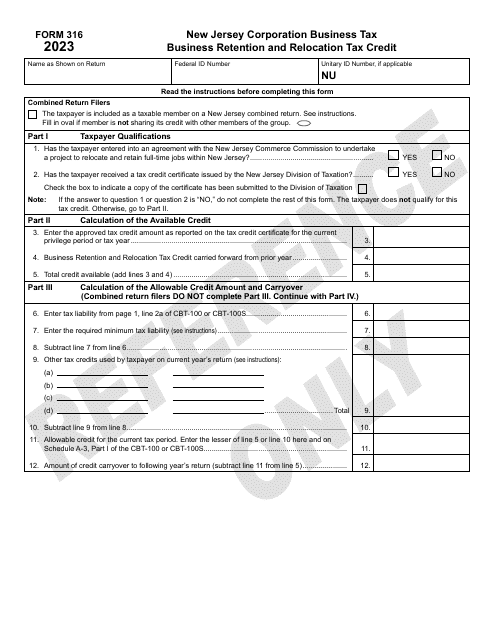

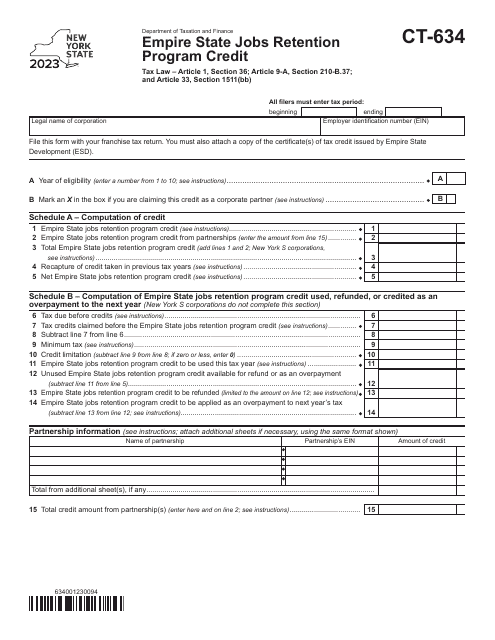

Explore our collection of documents to find instructions for forms like Form 20C Schedule BC Business Credits in Alabama or Form CT-634 Empire StateJobs Retention Program Credit in New York. These documents offer step-by-step guidance on how to take advantage of available credits and incentives.

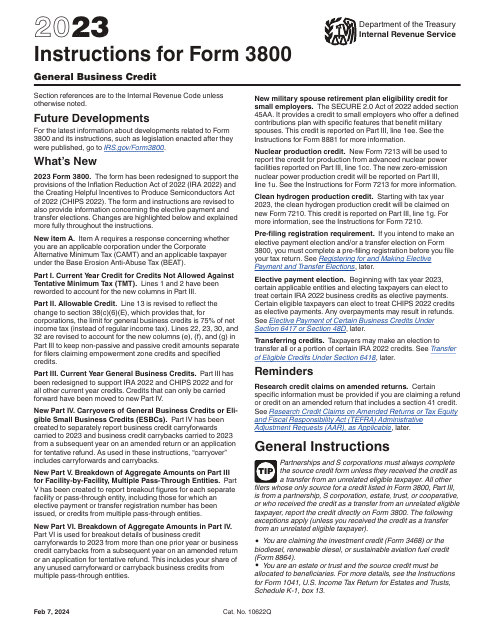

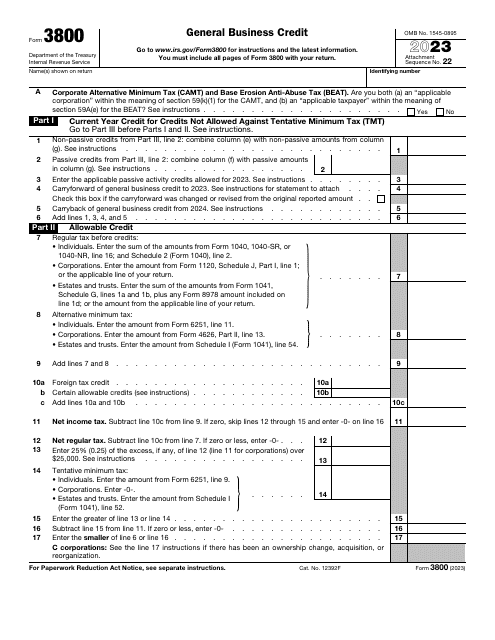

Don't miss our IRS Form 3800 General Business Credit, which provides comprehensive information on the various business credits you may be eligible for. From research credits to energy credits, this form covers it all, ensuring you don't miss out on any potential savings for your business.

Don't let the complexities of business credit hold you back. Our collection of documents provides the information and resources you need to establish and manage your business credit effectively. Start exploring our library today and take the first step towards financial success for your business.

Documents:

18

This Form is used for reporting business credits in Alabama. It provides instructions on how to fill out Schedule BC for Form 20C.

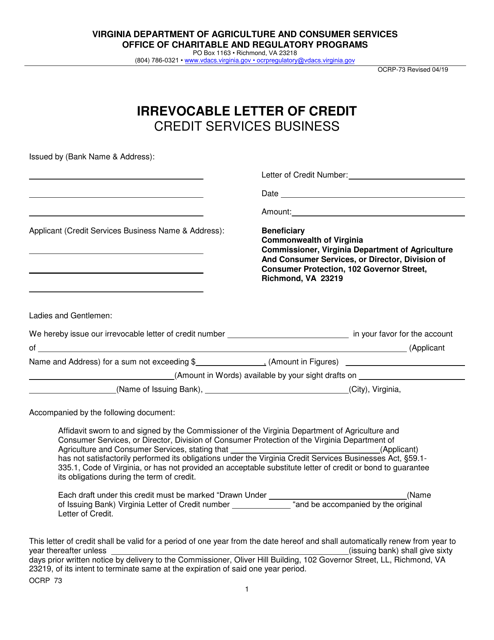

This form is used for establishing an irrevocable letter of credit for a credit services business in the state of Virginia.

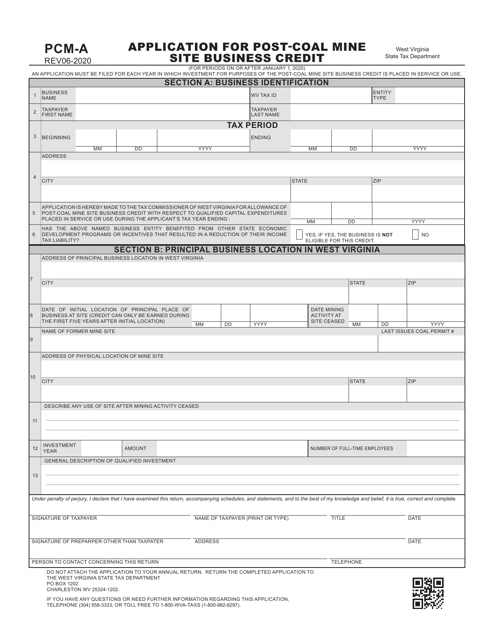

This form is used for applying for post-coal mine site business credit in West Virginia. It allows businesses to apply for financial support for projects related to reclamation and redevelopment of former coal mining sites.

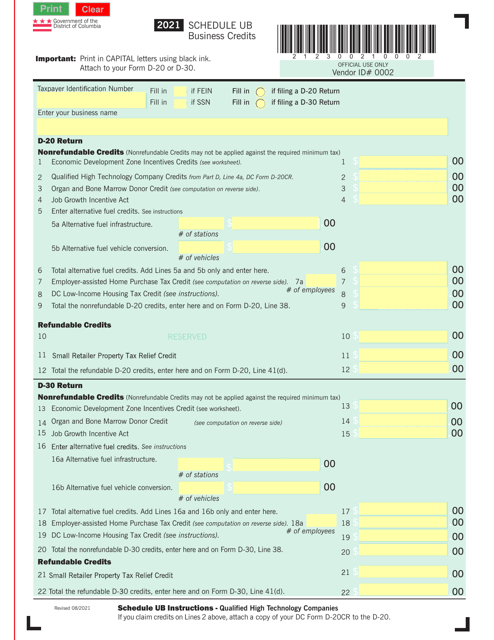

This Form is used for claiming business credits in Washington, D.C. It allows taxpayers to report and potentially reduce their tax liability by taking advantage of various business credits available in the city.