Dependent Care Credit Templates

Are you a working parent who relies on childcare to help you balance your job responsibilities? If so, you may be eligible for the Dependent Care Credit, a tax credit program designed to provide financial relief to families who incur child or dependent care expenses.

Also known as the Dependent Care Credits, this collection of documents includes forms and schedules specific to different states, such as Oregon and New York. These documents help you navigate through the process of claiming the credit and ensure that you meet all the necessary requirements.

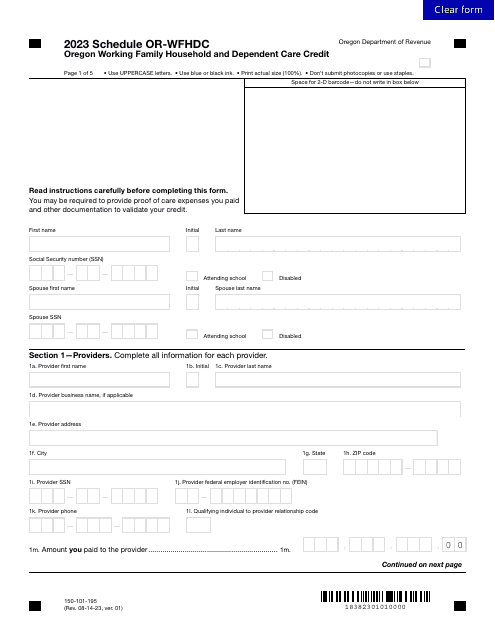

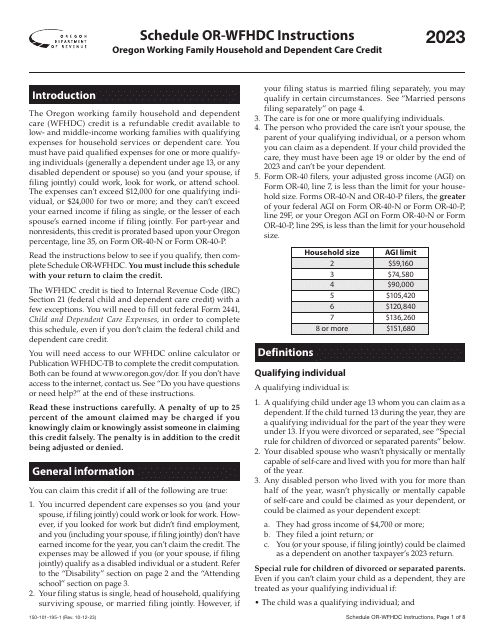

The Form 150-101-195 Schedule OR-WFHDC is one example of the documents within this group. This form is specific to Oregon and is used to calculate the Working Family Household and Dependent Care Credit for full-year, part-year, and nonresidents. By completing this form accurately, you can maximize your eligible credits and potentially receive a larger tax refund.

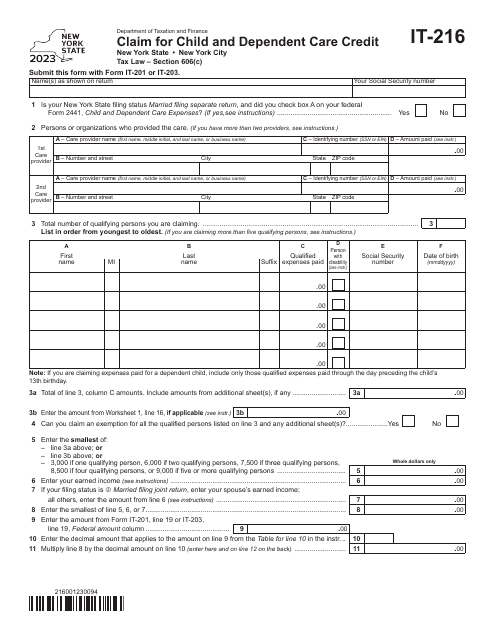

Another document within this collection is the Form IT-216 Claim for Child and Dependent Care Credit, which is specific to New York. This form allows New York residents to claim their childcare expenses and potentially reduce their tax liability.

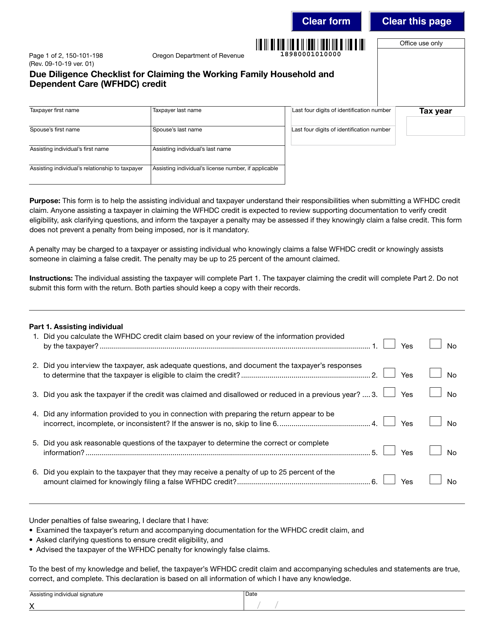

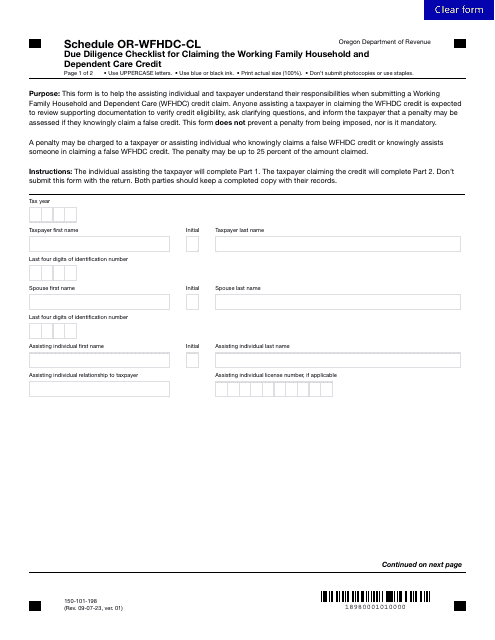

To ensure that taxpayers claim the credit correctly, the Form 150-101-198 Schedule OR-WFHDC-CL Due Diligence Checklist is also included in this group. This checklist serves as a guide to help you gather all the necessary information and documentation when claiming the Working Family Household and Dependent Care Credit. By following this checklist, you can minimize errors and ensure that your claim is accurate and complete.

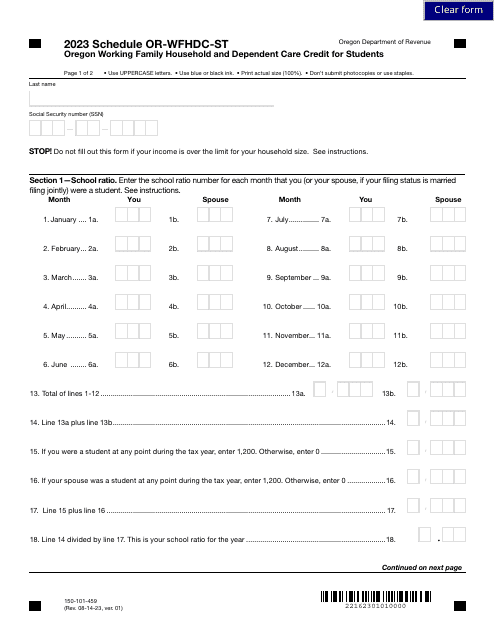

Additionally, the Form 150-101-459 Schedule OR-WFHDC-ST is another document in this collection, specifically designed for students in Oregon. This form allows students who incur childcare expenses to claim the Working Family Household and Dependent Care Credit, providing extra financial support to help them manage their educational and childcare costs.

As a working parent, taking advantage of the Dependent Care Credit can make a significant difference in your annual taxes. These forms and schedules, commonly referred to as the Dependent Care Credit, are essential resources that guide you through the process of claiming this credit, ensuring that you receive the financial relief you deserve.

Documents:

11

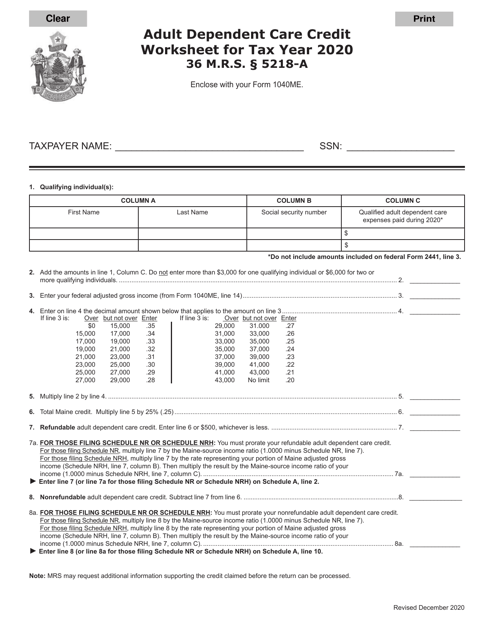

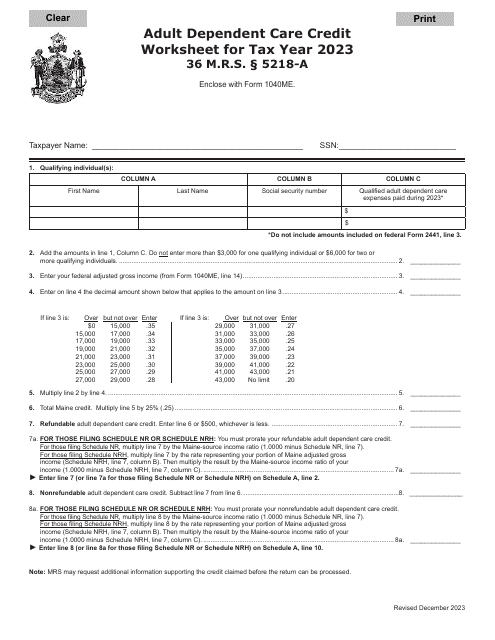

This document is used for calculating the Adult Dependent Care Credit in the state of Maine.