Tax Receipt Templates

Tax Receipts: Ensuring Transparency and Compliance

Welcome to our comprehensive collection of tax receipt documentation. As tax season approaches, it is imperative for individuals and businesses alike to understand and comply with tax regulations. Our tax receipt resources provide the necessary guidance and templates to simplify the process, enabling you to keep accurate records of your financial transactions.

Whether you need a tax receipt template for personal use or require specific forms for a particular state or region, our collection offers a multitude of options. From the Indiana Schedule of Receipts to the North Carolina Motor Fuel Supplier Schedule of Tax-Paid Receipts, and the Wisconsin County Tax Receipt, we have you covered. We also provide a helpful Checklist for Home Based Business Tax Receipt, tailored to the requirements of the City of Greenacres, Florida.

Our aim is to provide you with the tools you need to stay organized and ensure compliance with tax regulations. With our sample tax receipt forms and templates, you can easily track your receipts and maintain accurate records. By doing so, you not only maintain transparency in your financial transactions but also prepare yourself for any tax filing inquiries or audits.

Don't let tax season catch you off guard. Utilize our tax receipt resources to streamline your record-keeping process and maximize your compliance efforts. Browse our extensive collection of tax receipt templates and forms today, and take the first step towards maintaining transparency and financial security.

Documents:

20

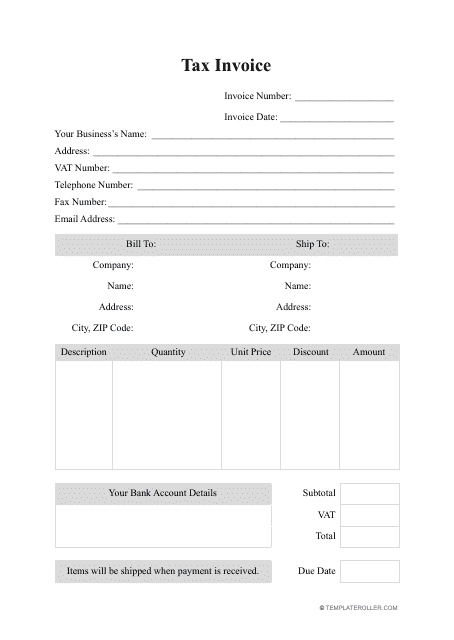

This document is a template for creating tax invoices. It provides a standardized format that businesses can use to invoice their customers for goods or services, including the necessary information for tax purposes.

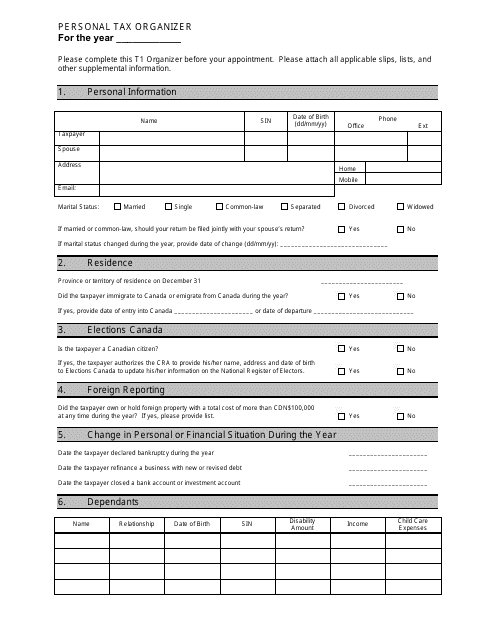

This document is a template that helps individuals organize their personal tax information for filing taxes. It provides sections to record income, expenses, deductions, and other relevant details. Using this template can help simplify the tax filing process.

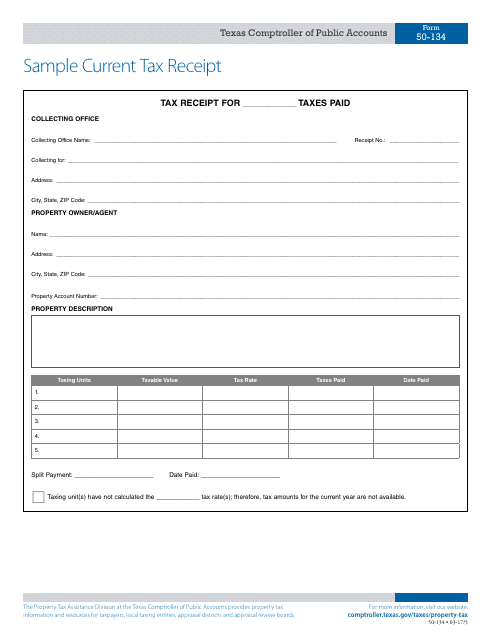

This type of document, Form 50-134, is used for providing a sample current tax receipt in the state of Texas. It showcases how a tax receipt may look like for reference purposes.

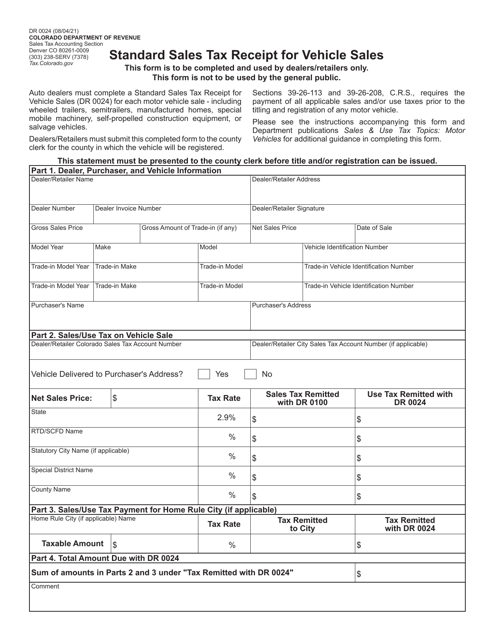

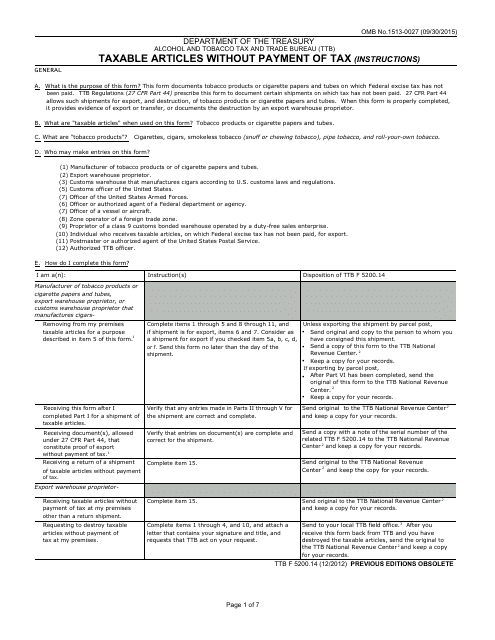

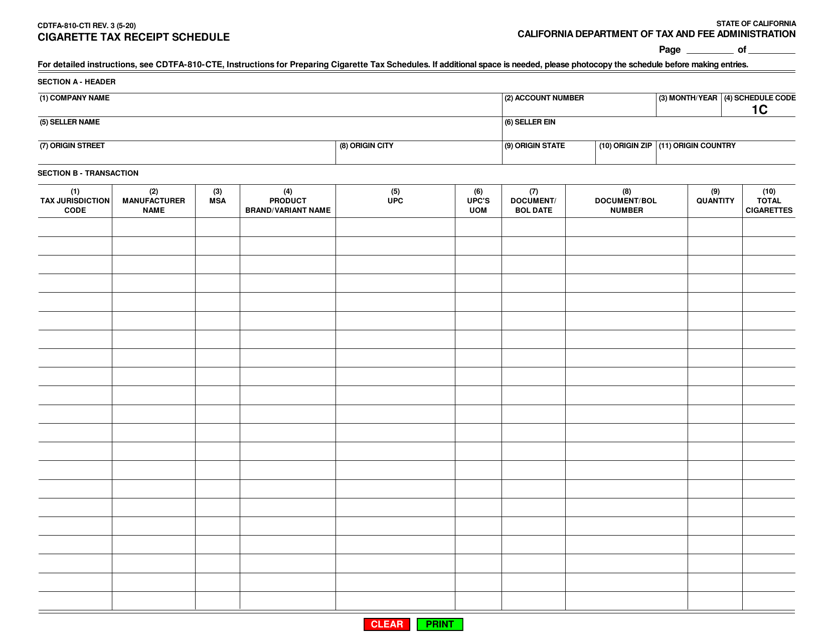

This document is used for reporting the taxable articles that are not paid for with tax.

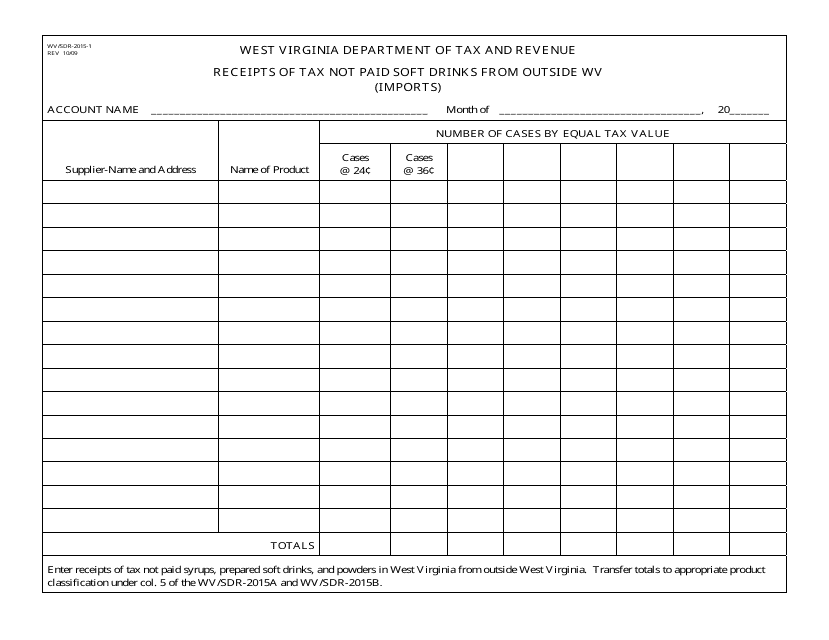

This document is for reporting the receipts of tax not paid soft drinks imported into West Virginia from outside the state.

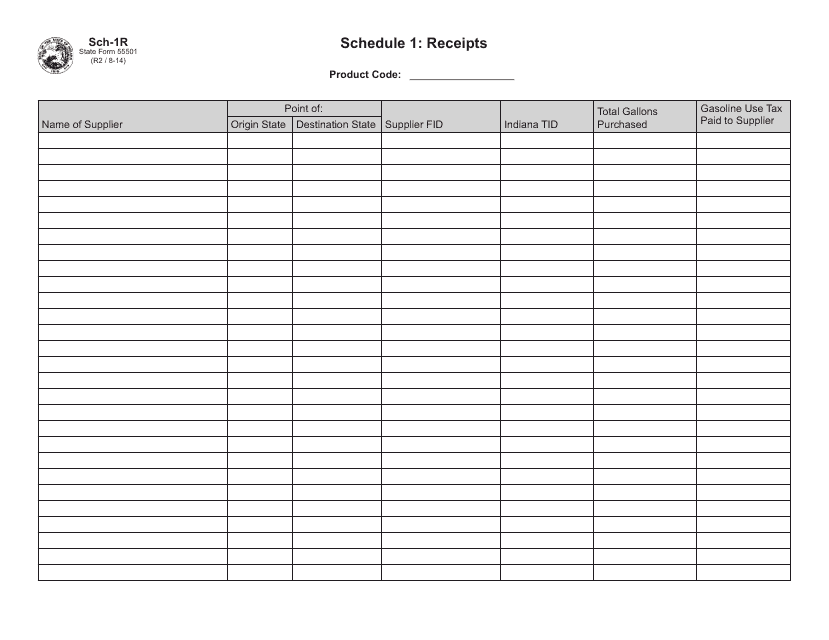

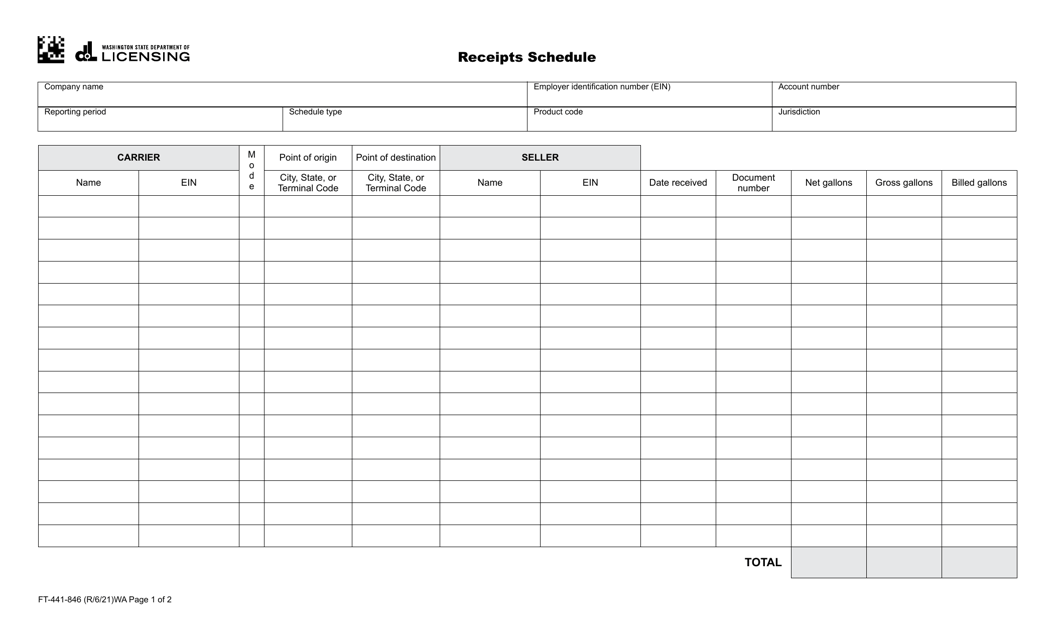

This document is used for reporting and tracking the receipts in the state of Indiana.

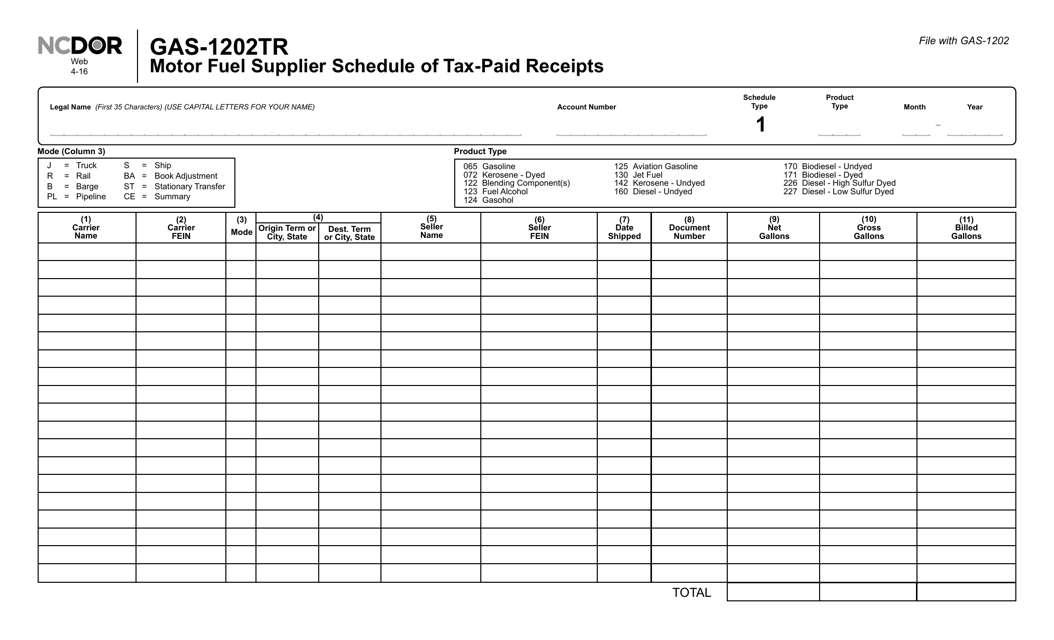

This Form is used for reporting tax-paid receipts for motor fuel suppliers in North Carolina.

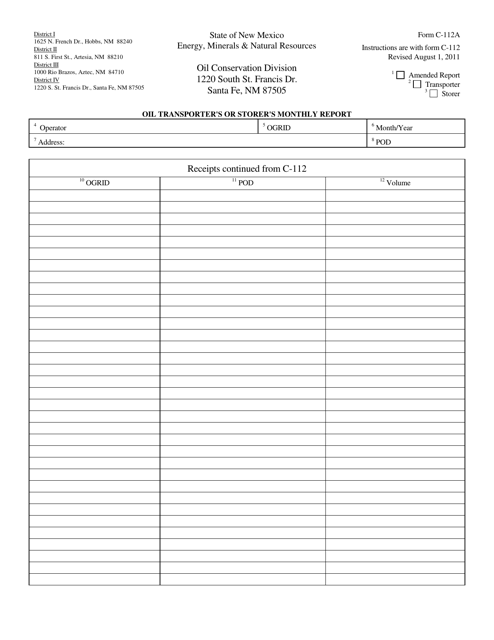

This form is used for providing a continuation of receipts information in the state of New Mexico.

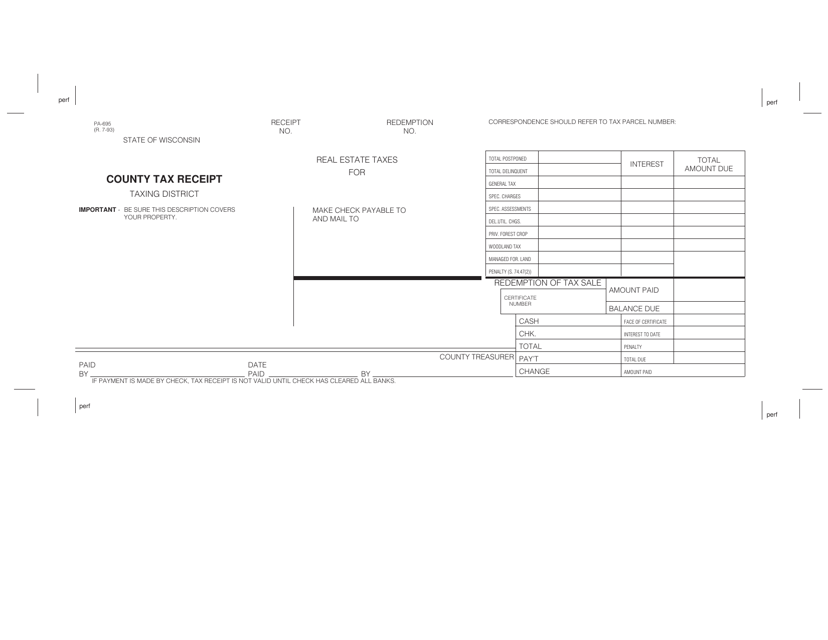

This form is used for obtaining a county tax receipt in the state of Wisconsin. It is a document that provides proof of payment for county taxes.

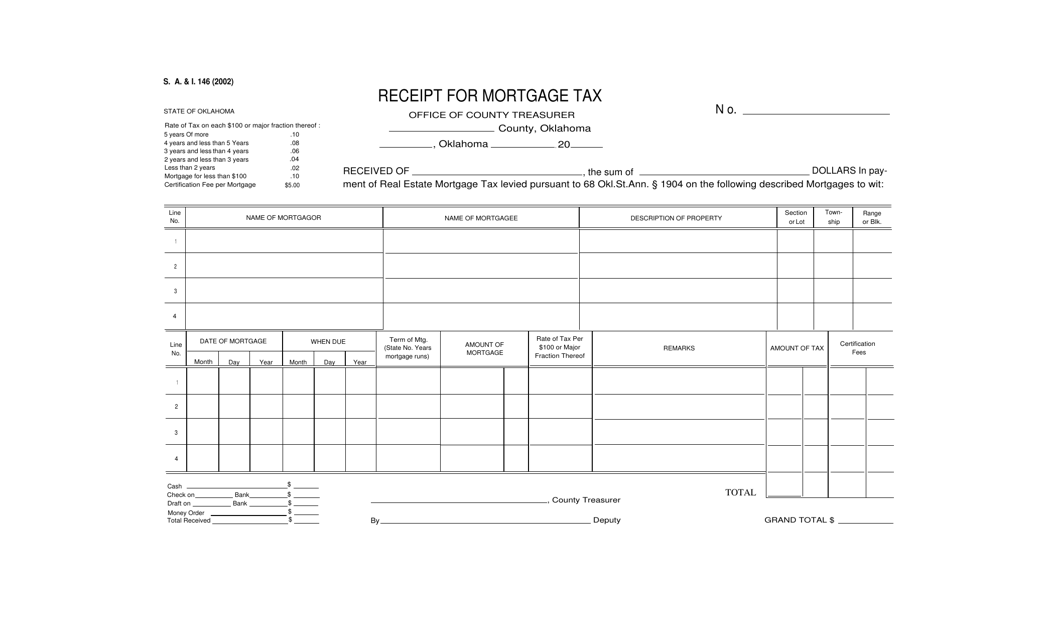

This document is a receipt for mortgage tax payment in the state of Oklahoma. It verifies that the tax has been paid for a mortgage transaction.

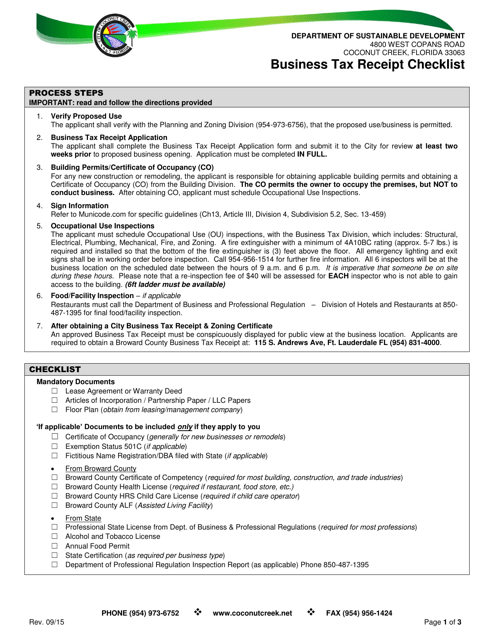

This form is used for applying for a business tax receipt in the City of Coconut Creek, Florida.

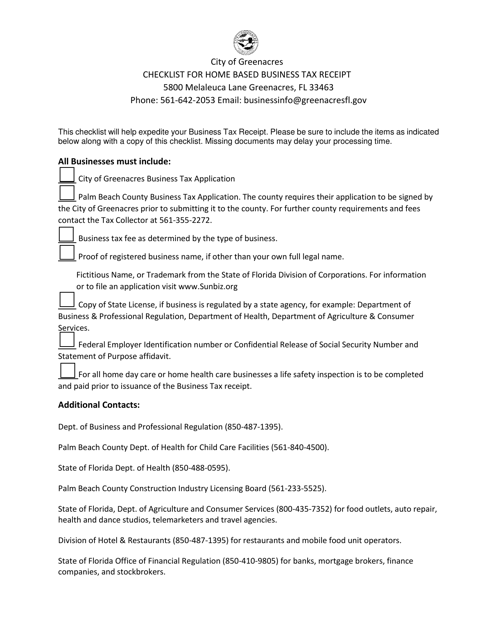

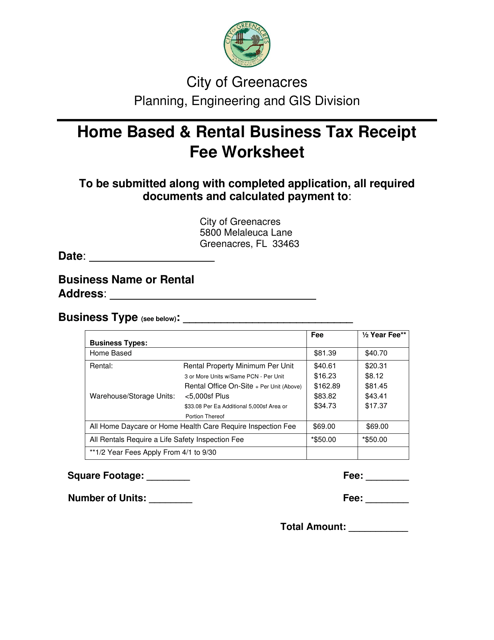

This document provides a checklist for home-based businesses in Greenacres, Florida to ensure they have all the necessary tax receipts in order. It helps individuals keep track of the required documentation for their home-based businesses.

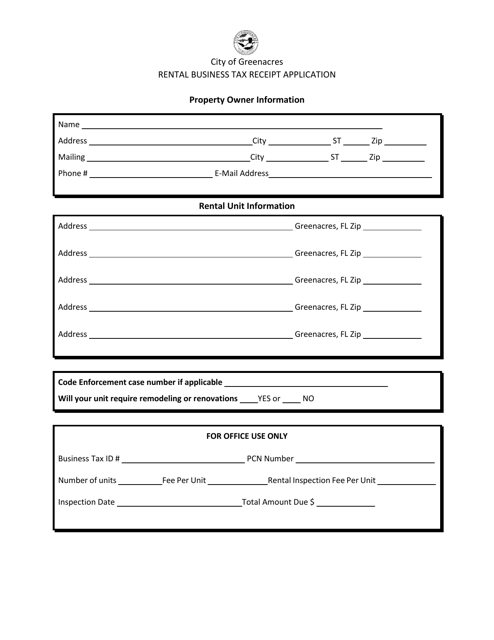

This document is an application for a rental business tax receipt in the City of Greenacres, Florida. It is used to apply for a license to operate a rental business and pay the corresponding taxes.

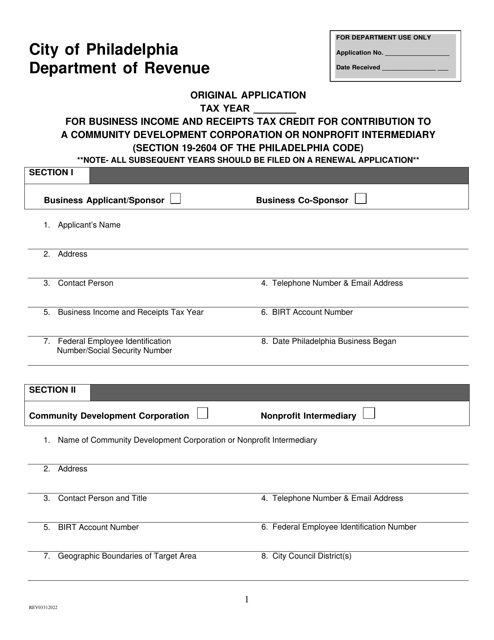

This document is used for applying for a tax credit in Philadelphia, Pennsylvania, for making a contribution to a Community Development Corporation or Nonprofit Intermediary.

This document is used for calculating the tax receipt fee for home-based and rental businesses in the City of Greenacres, Florida.

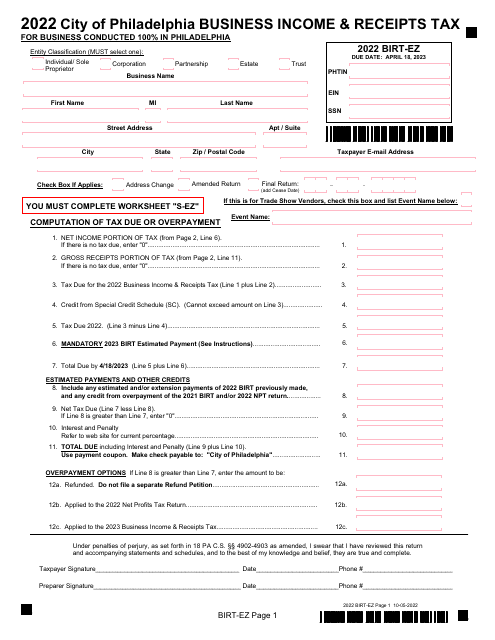

This Form is used for reporting business income and receipts tax for businesses conducted exclusively in Philadelphia, Pennsylvania.