Real Property Taxes Templates

Are you a homeowner or business owner looking for information on real property taxes? Look no further! We have a comprehensive collection of documents and forms related to real property taxes, also known as real property tax forms or real property tax relief.

Real property taxes are a necessary expense for property owners, but understanding the process and available tax relief options can help reduce your tax burden. Our collection of documents provides valuable resources to help you navigate the complex world of real property taxes and make informed decisions.

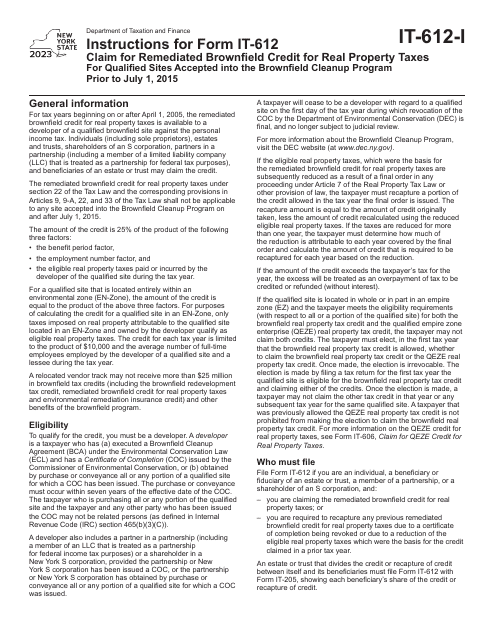

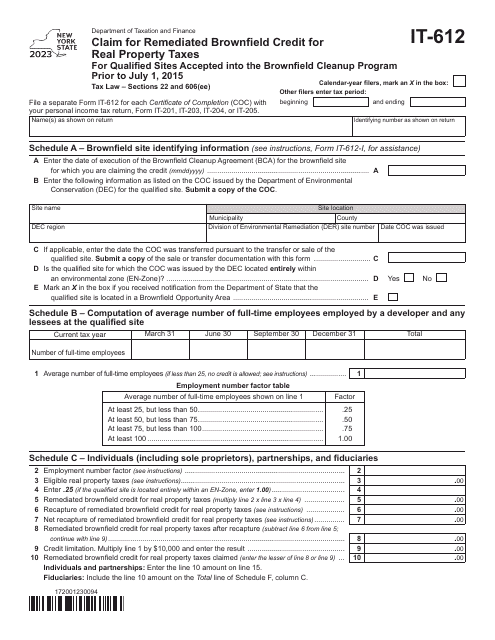

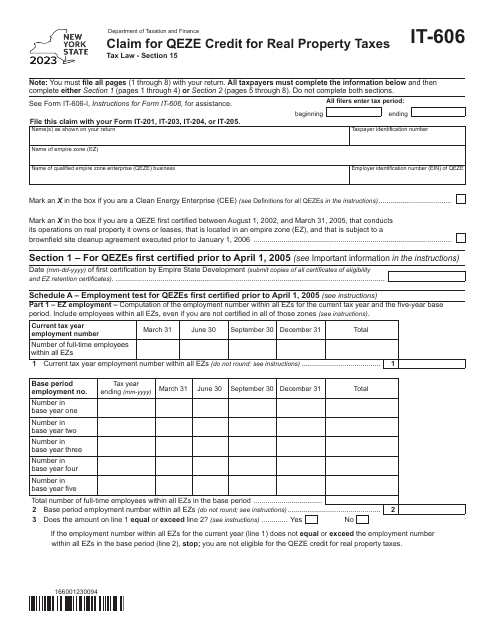

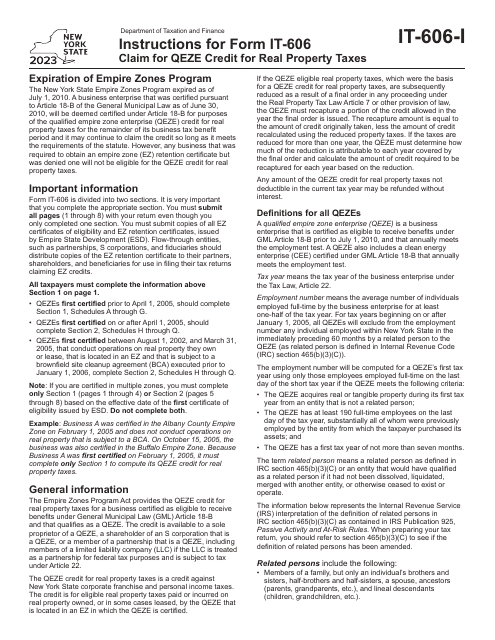

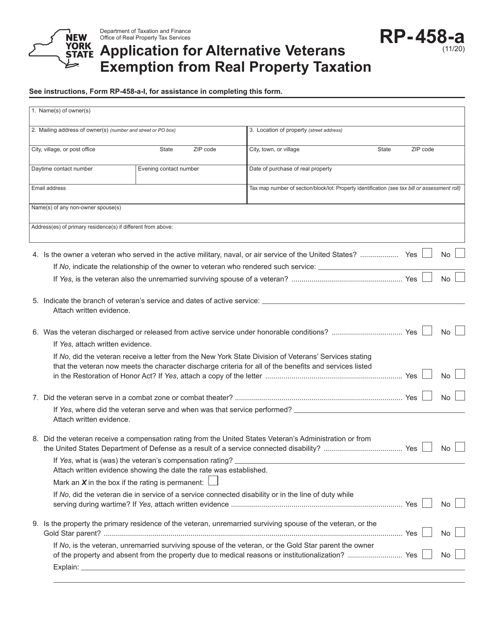

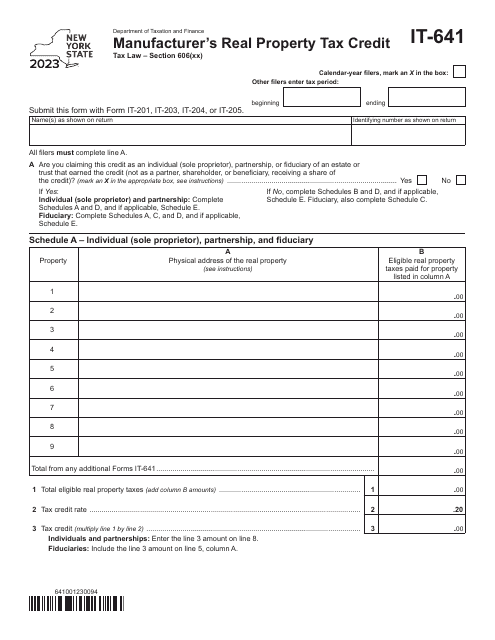

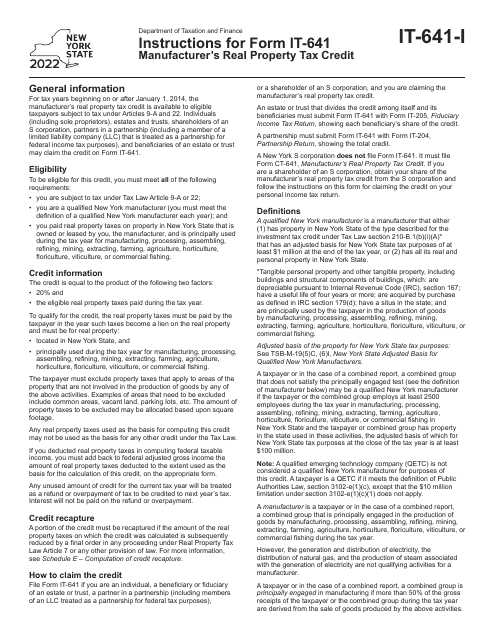

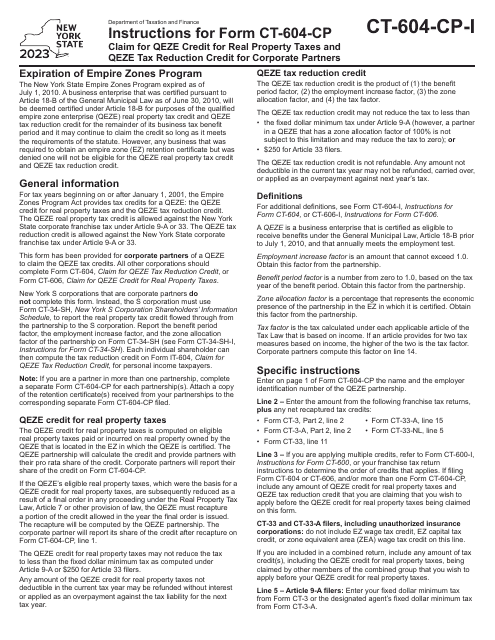

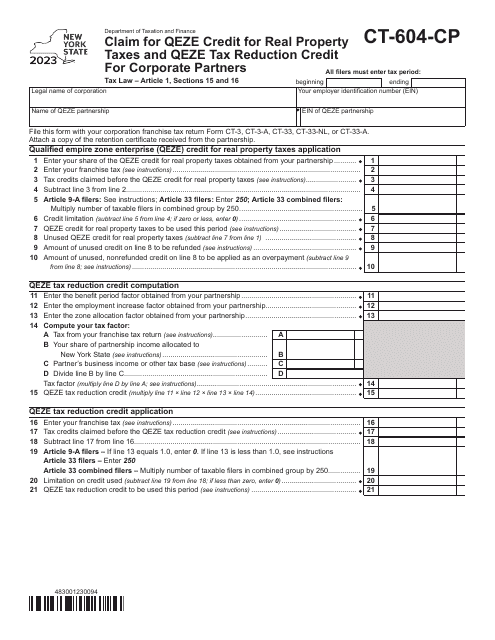

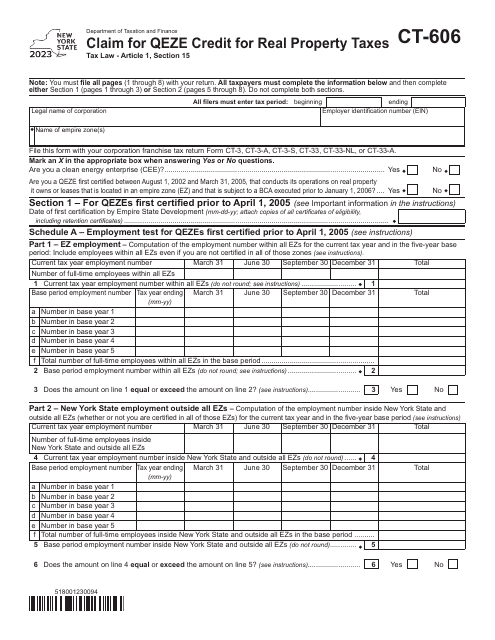

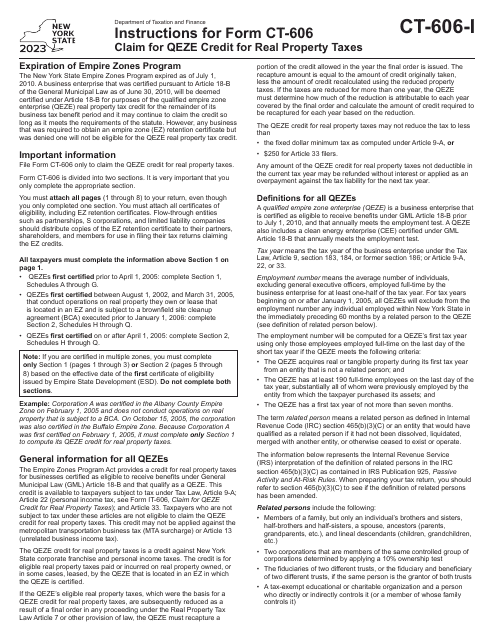

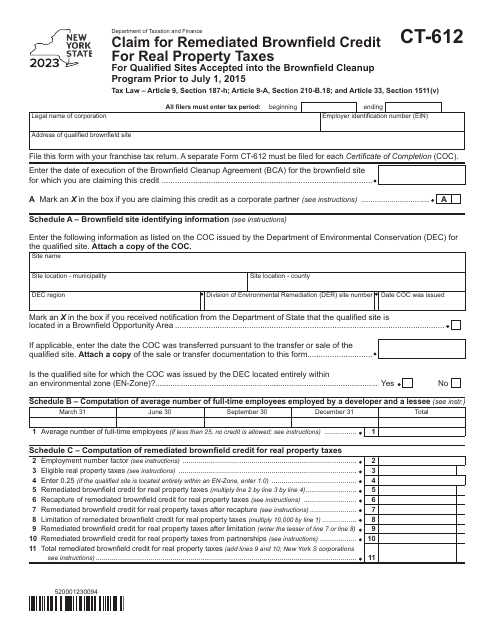

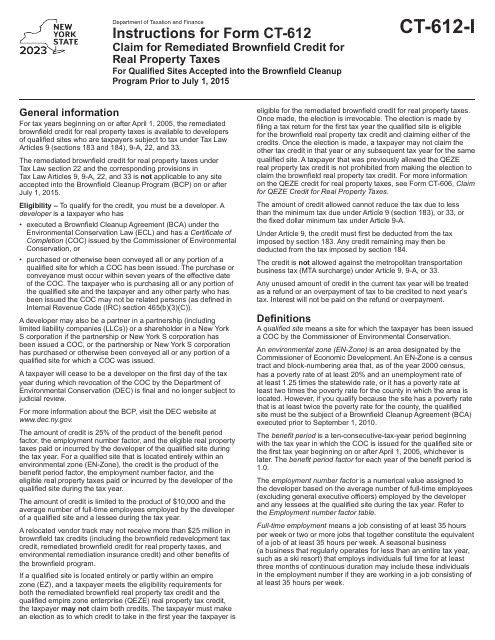

Whether you're seeking an extension of time to collect real and public utility property taxes or looking to claim a Qeze credit for real property taxes, our documents cover a wide range of topics and forms specific to various states, such as Ohio and New York. These documents include instructions, claim forms, and joint statements concerning real property tax levies.

We understand that real property taxes can be overwhelming and confusing, but with our extensive collection of documents, you'll have the information you need right at your fingertips. Stay updated on the latest tax laws, regulations, and credits related to real property taxes, ensuring you don't miss out on any potential savings.

Don't let real property taxes be a source of stress or financial burden. Explore our collection of documents today to find the information you need to navigate the world of real property taxes with confidence.

Documents:

63

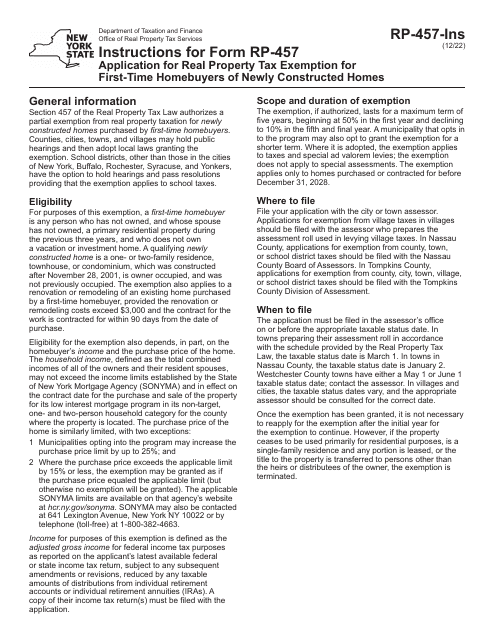

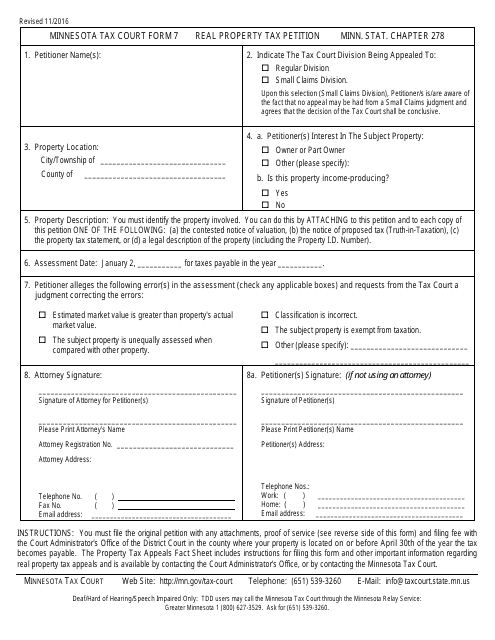

This document is used to apply for a real property tax exemption for nonprofit organizations in villages in New York. The exemption is based on the town or county assessment roll that is used for the village assessment roll.

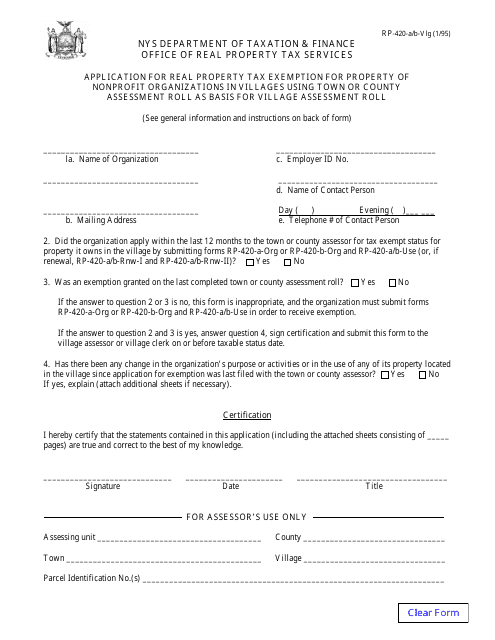

This form is used for applying for an exemption from real property taxes in New York for properties used as a residence by officiating clergy, such as a parsonage or manse.

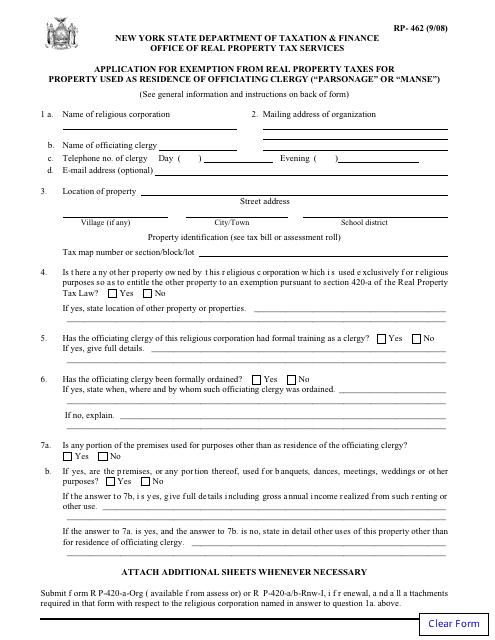

This form is used for petitioning a real property tax assessment in the state of Minnesota.

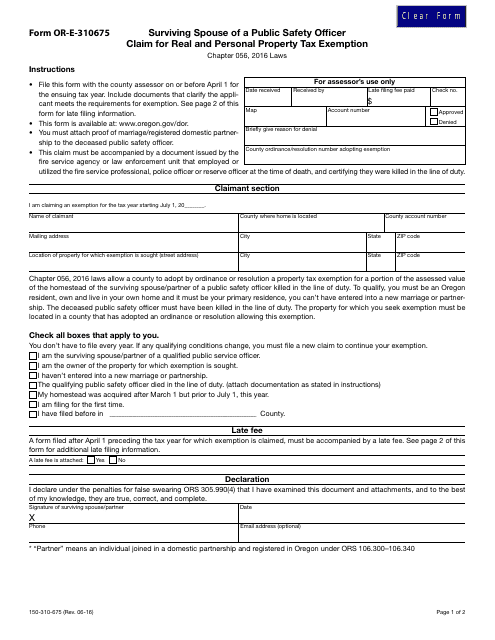

This form is used for a surviving spouse of a public safety officer to claim a real and personal property tax exemption in the state of Oregon.

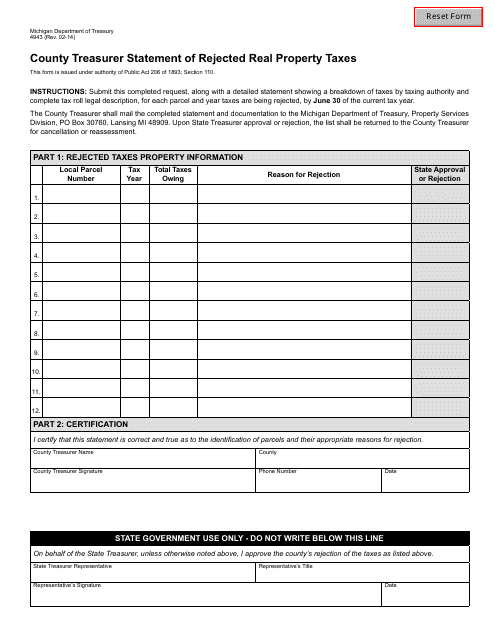

This Form is used for reporting rejected real property taxes to the County Treasurer in Michigan.

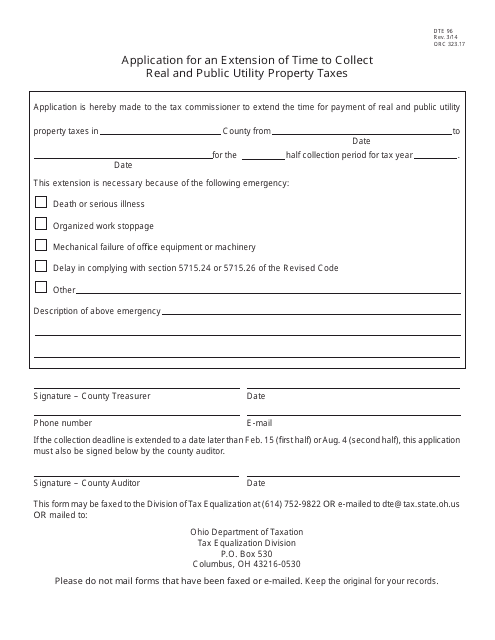

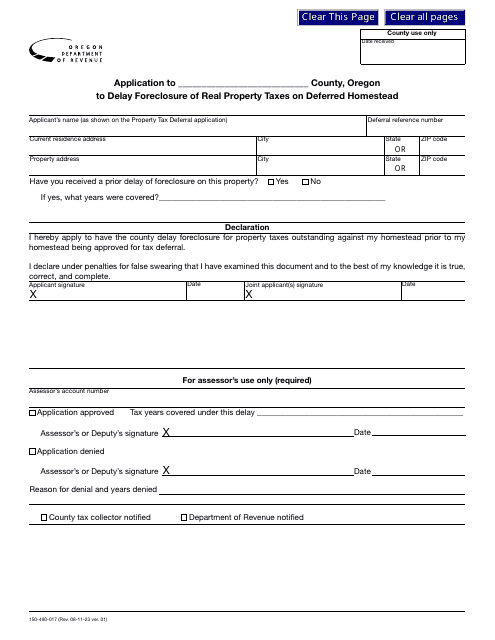

This form is used for applying for an extension of time to collect real and public utility property taxes in Ohio.

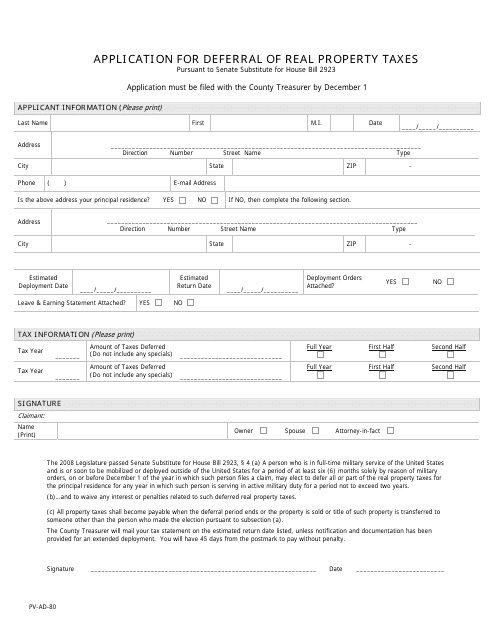

This form is used for applying to defer real property taxes in the state of Kansas. It allows eligible individuals to request a deferral of their taxes, providing financial relief for those who qualify.

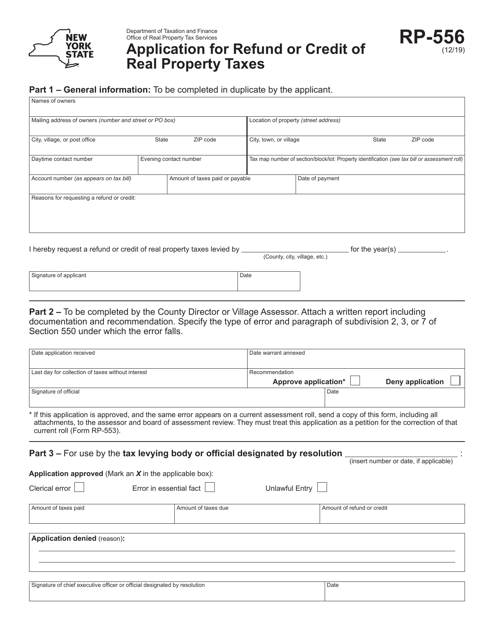

This form is used for applying for a refund or credit for the payment of real property taxes in the state of New York.

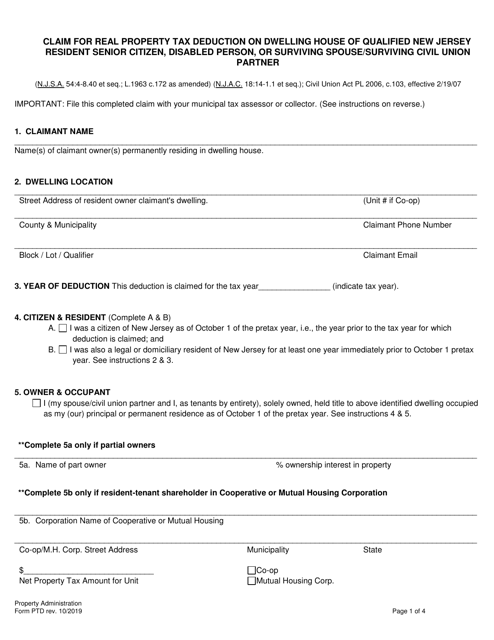

This Form is used for claiming a real property tax deduction on a dwelling house in New Jersey for qualified senior citizens, disabled persons, or surviving spouse/surviving civil union partners.

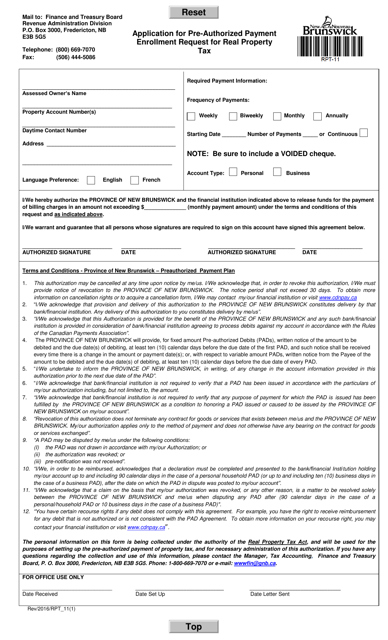

This document is used for requesting pre-authorized payment enrollment for real property tax in New Brunswick, Canada.

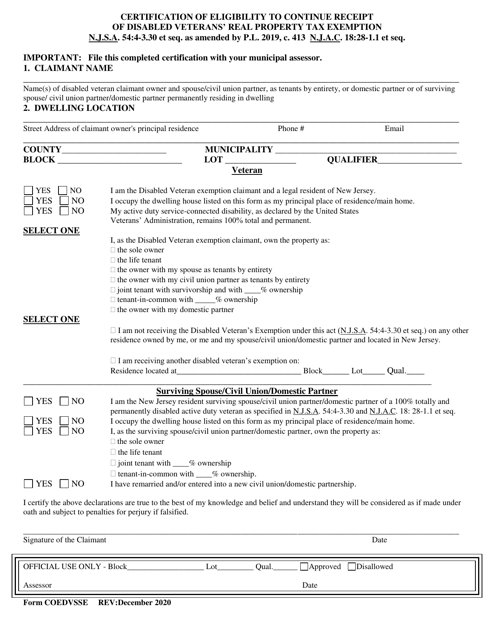

This form is used for certification of eligibility to continue receiving the Disabled Veterans' Real Property Tax Exemption in New Jersey. It allows disabled veterans to maintain their exemption and continue receiving tax benefits on their real property.

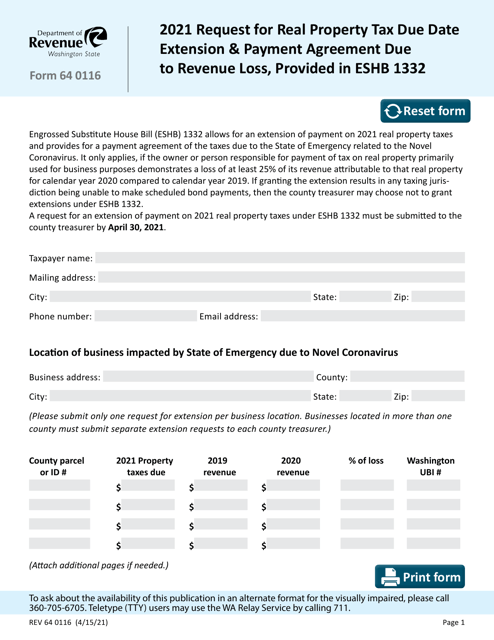

This form is used for requesting an extension of the due date for real property tax payment and entering into a payment agreement due to revenue loss, as provided in ESHB 1332 in Washington state.

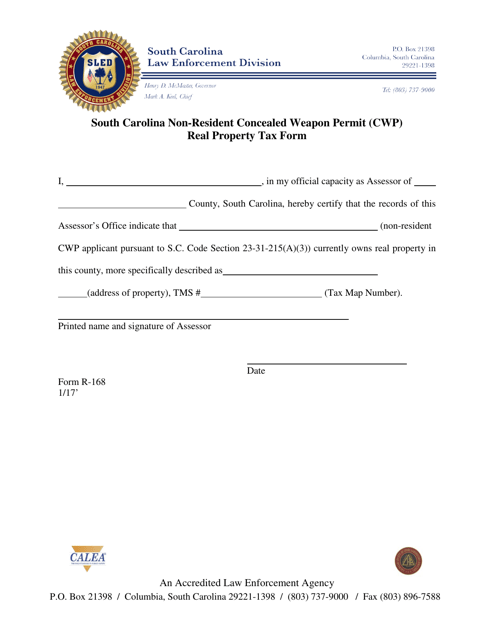

This form is used for applying for a Non-resident Concealed Weapon Permit (CWP) in South Carolina. It is specific to individuals who do not reside in South Carolina but want to obtain a concealed weapon permit in the state. The form may also require information related to real property taxes.

This Form is used for applying for a tax abatement on real property in Washington, D.C.