Tax Distribution Templates

Tax Distribution

Welcome to our webpage dedicated to tax distribution, also known as distribution tax or tax-free distributions. In this section, you can find valuable information about a variety of documents related to tax distribution, including tax forms, instructions, and regulations.

Tax distribution is an essential aspect of the tax system, ensuring that tax revenue is allocated correctly and fairly among various entities. Our collection of documents covers different types of tax distributions and provides guidance on how to comply with the related regulations.

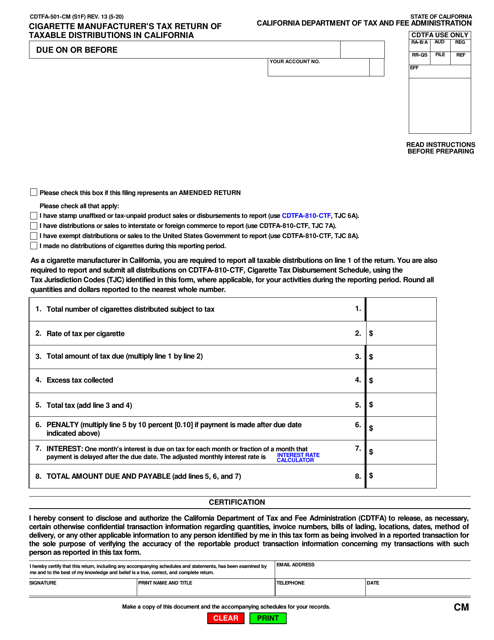

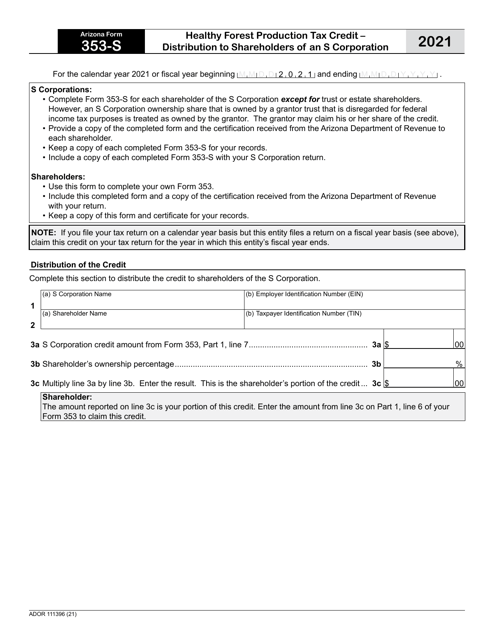

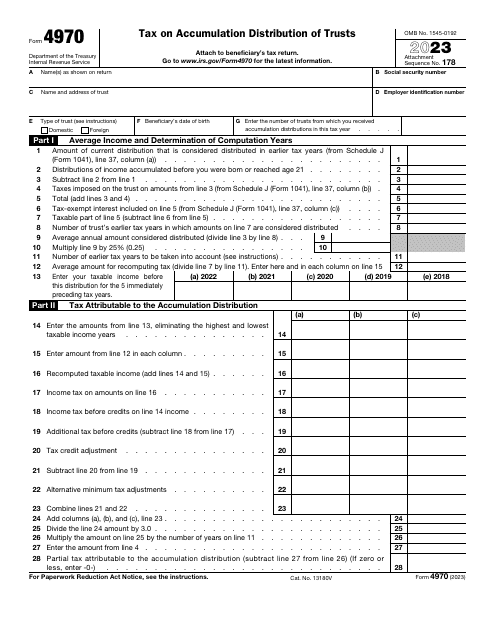

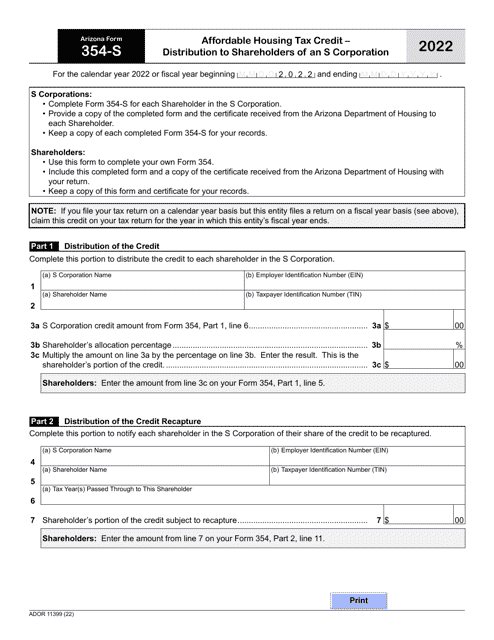

Among the documents you can find in this collection are forms like the Form CDTFA-501-CM Cigarette Manufacturer's Tax Return of Taxable Distributions in California, Arizona Form 353-S Healthy Forest ProductionTax Credit - Distribution to Shareholders of an S Corporation, and IRS Form 4970 Tax on Accumulation Distribution of Trusts. These forms are crucial for reporting and calculating tax distributions accurately.

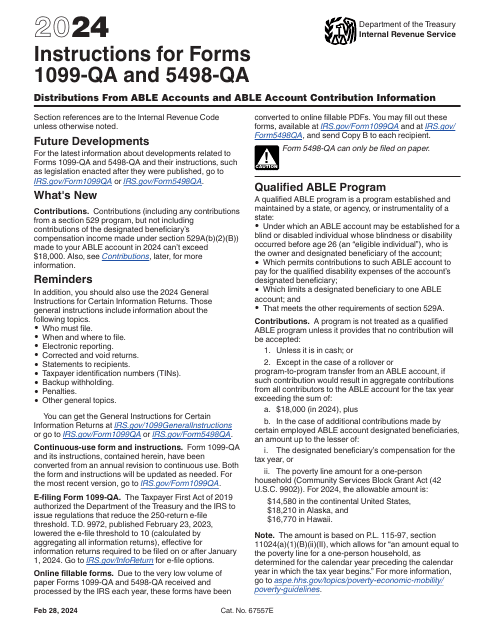

Furthermore, our webpage features instructions for IRS Form 1099-QA and 5498-QA, which provide detailed guidance on reporting qualified tuition plans and Coverdell education savings accounts. These instructions are particularly helpful for individuals and institutions handling tax-related distributions in the education sector.

Whether you are an individual taxpayer, a business owner, or a tax professional, our comprehensive collection of tax distribution documents will offer you the necessary resources to navigate this complex area of taxation. It is crucial to stay updated with the latest regulations and obligations related to tax distributions, and our webpage is here to help you achieve that.

Browse through our extensive collection of tax distribution documents and discover everything you need to know about reporting, calculating, and understanding tax distributions. Stay compliant, eliminate confusion, and maximize your understanding of tax distribution processes with our comprehensive resources.

Note: Please note that the documents in this collection may vary based on your location and specific tax requirements. Always consult with a tax advisor or refer to the official tax authorities in your jurisdiction for personalized guidance.

Documents:

5

This Form is used for claiming the Healthy Forest Production Tax Credit in Arizona as a shareholder of an S Corporation.

This form is used for distributing affordable housing tax credits to shareholders of an S Corporation in Arizona.