Direct Transfer Templates

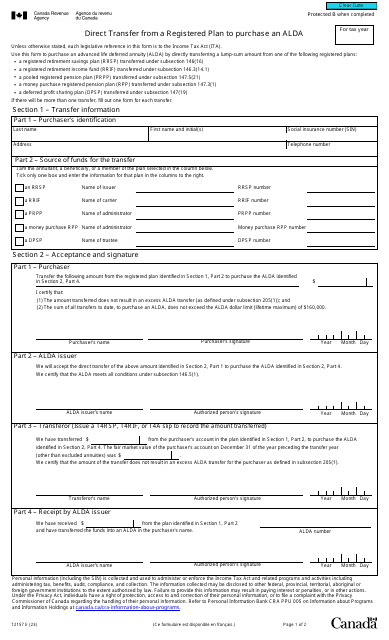

Direct transfer, also known as a direct transfer form or direct transfer under specific subsections and paragraphs, is a document used in Canada for transferring funds or assets from one registered plan to another. These direct transfers are authorized under subsections 146.3(14.1), 147.5(21), or 146(21), as well as paragraphs 146(16)(A) or 146.3(2)(E).

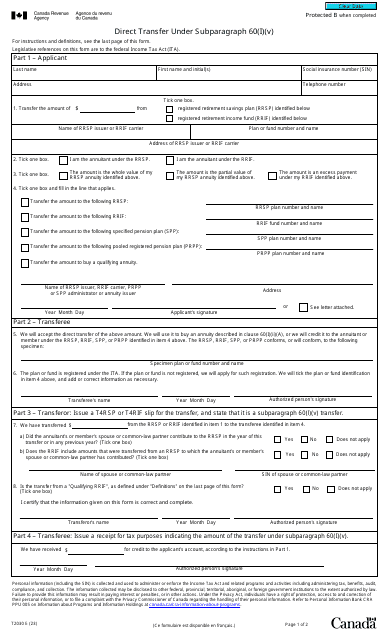

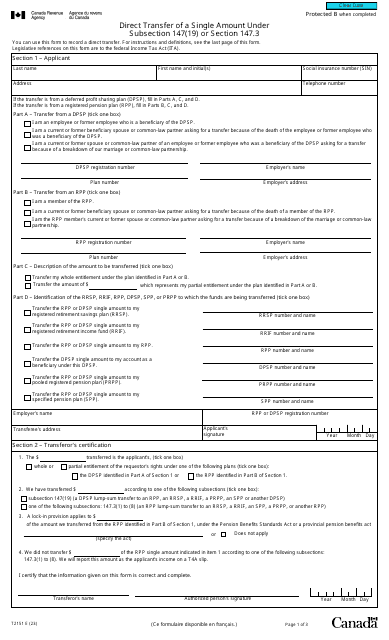

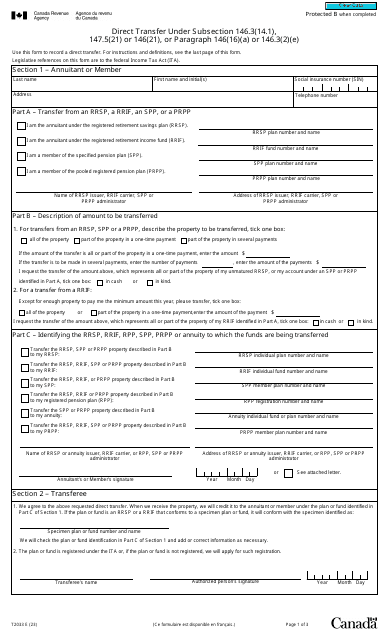

When it comes to direct transfers, the Canadian revenue agency requires specific documentation to ensure a smooth and compliant process. The most commonly used forms for direct transfers include Form T2033 and Form T2030, which cater to different subsections and subparagraphs under the Canadian Income Tax Act.

Form T2033, for example, is used to facilitate a direct transfer under subsections 146.3(14.1), 147.5(21), or 146(21), as well as paragraphs 146(16)(A) or 146.3(2)(E). On the other hand, Form T2030 is specifically used for a direct transfer under subparagraph 60(I)(V). These forms serve as crucial documentation to initiate a direct transfer, ensuring that all necessary information and details are provided.

In addition to these forms, there is also Form T2151, which is used for a direct transfer of a single amount under subsection 147(19) or Section 147.3. This form helps facilitate direct transfers in a specific scenario, ensuring compliance with the applicable sections of the Canadian Income Tax Act.

Direct transfers are an important aspect of managing registered plans in Canada, allowing individuals to move funds or assets from one plan to another without triggering taxable events. These documents and forms play a vital role in initiating and executing direct transfers, ensuring that the process is conducted in accordance with the relevant legislation.

Whether you are an individual looking to transfer funds between registered plans or a financial professional assisting clients with direct transfers, understanding the importance and requirements of these forms is essential. Proper completion of the applicable forms mentioned above will ensure a seamless direct transfer process while maintaining compliance with the Canadian tax regulations.

Please note that the details provided here are for informational purposes only. It is always recommended to consult with a qualified tax professional or seek guidance from the Canada Revenue Agency for specific advice related to direct transfers and associated documentation.

Documents:

15

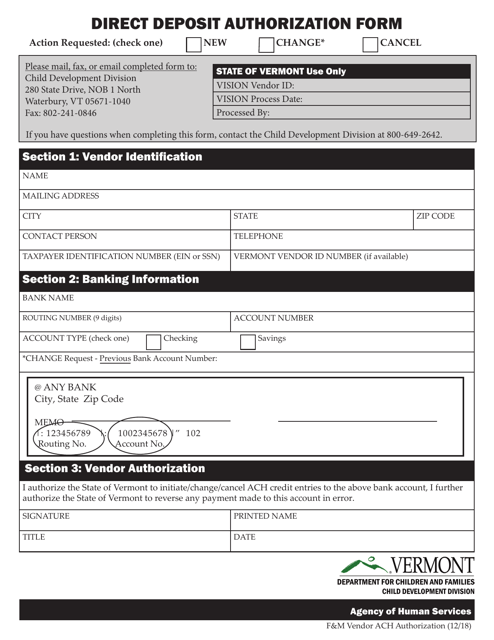

This form is used for authorizing the direct deposit of funds into a bank account for residents of Vermont.

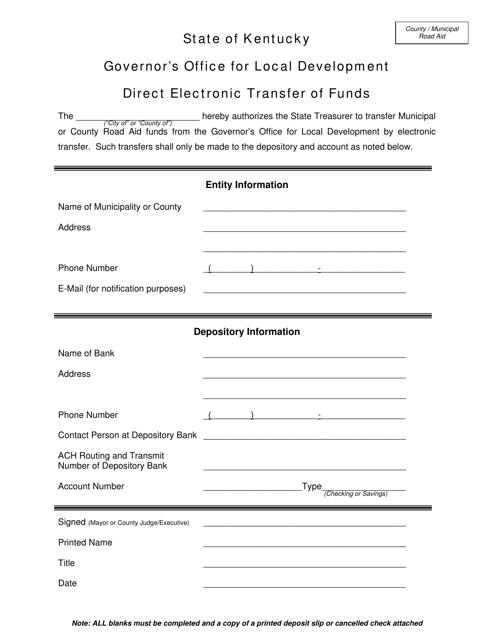

This type of document is related to the direct electronic transfer of funds in the state of Kentucky. It provides information and instructions for electronically transferring funds between individuals or businesses.