State Tax Credit Templates

Are you looking to save money on your state taxes? Look no further! Our state tax credit program offers exclusive opportunities for individuals and businesses to reduce their state tax liabilities. Whether you're a resident of New York or New Jersey, our state tax credit options cater to your specific needs.

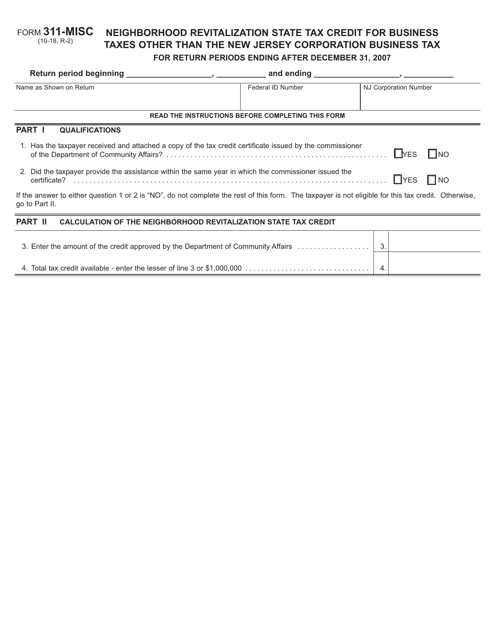

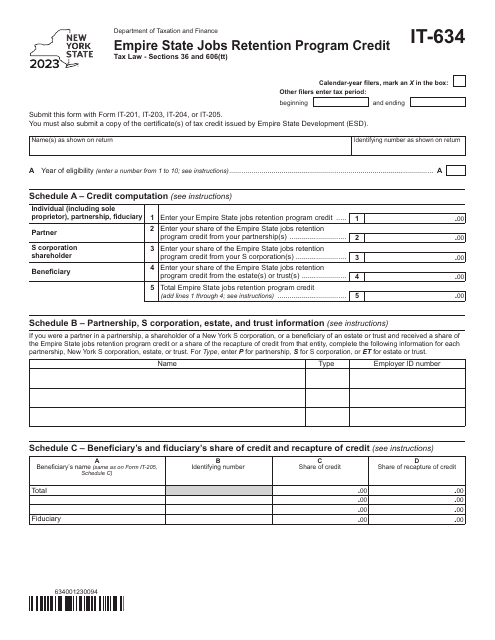

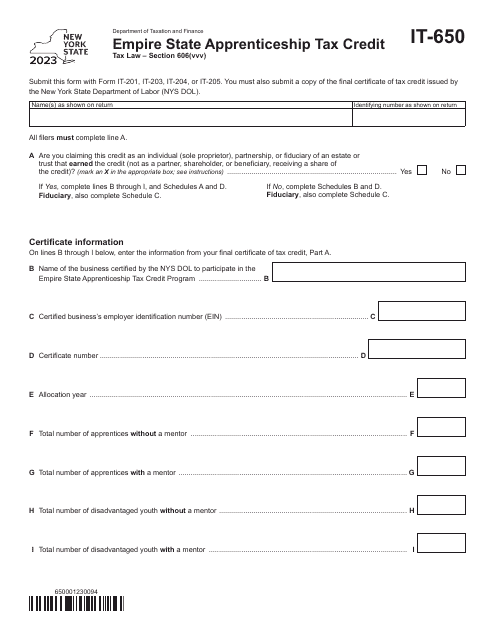

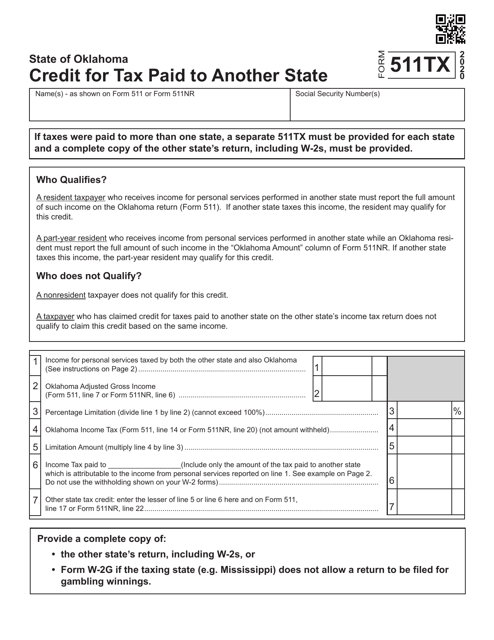

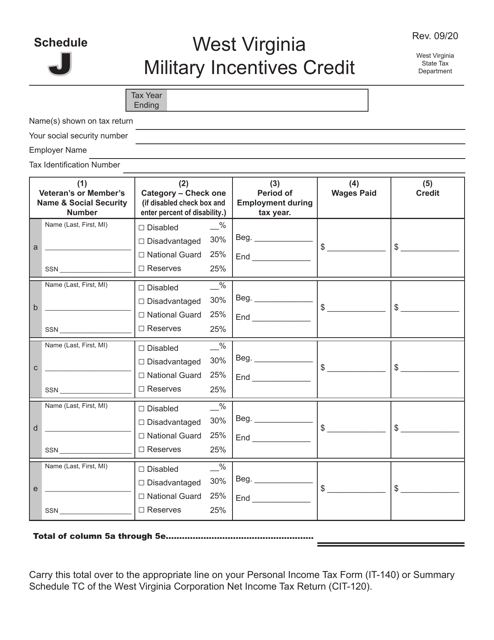

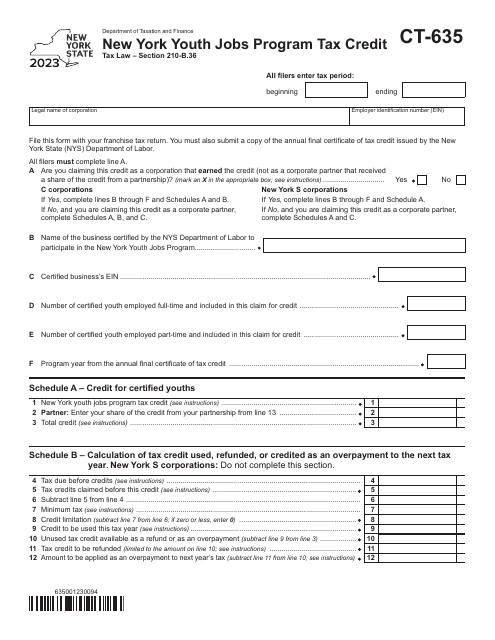

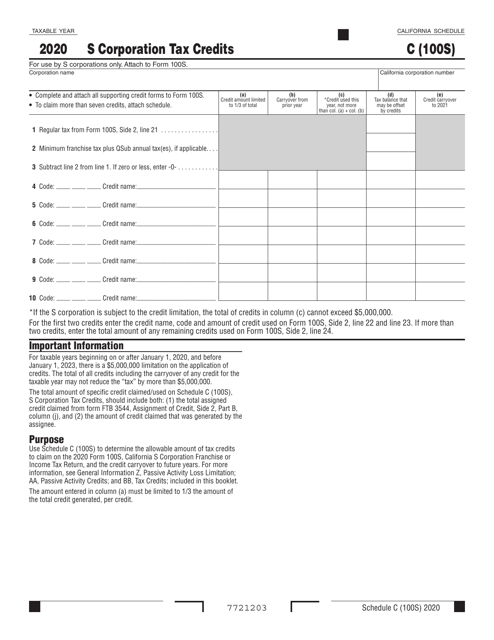

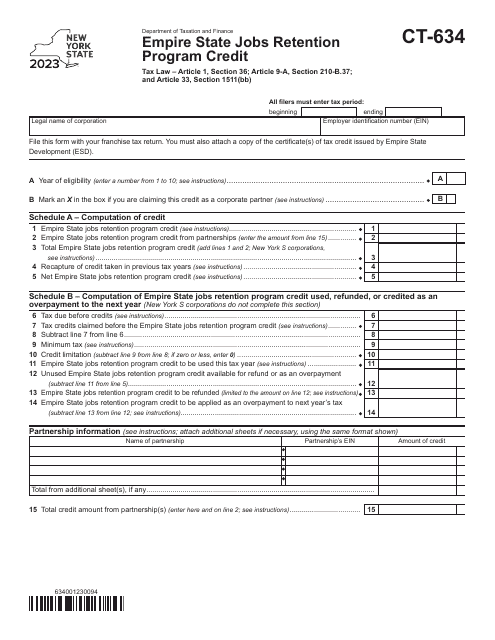

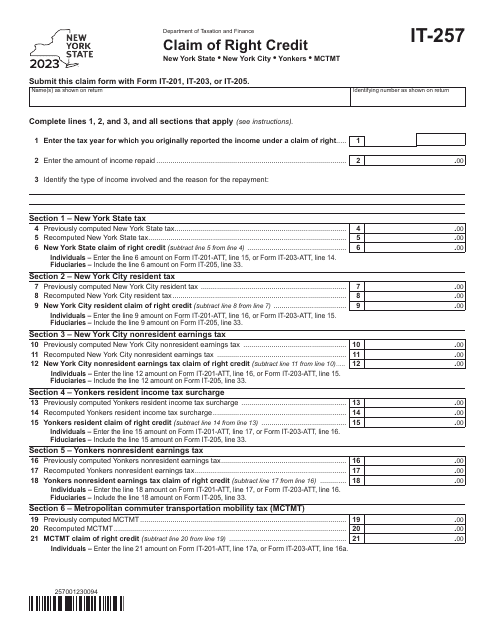

Our state tax credit program includes various forms and instructions to guide you through the process of claiming your credits. From the Empire StateJobs Retention Program Credit to the Urban Transit Hub Tax Credit, we have a comprehensive range of options available to help you maximize your savings.

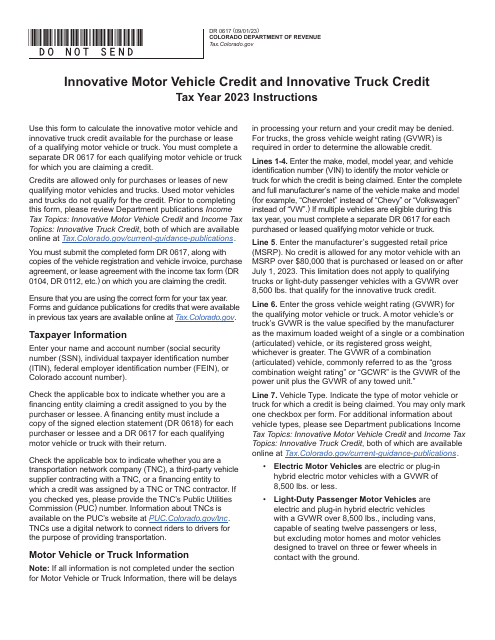

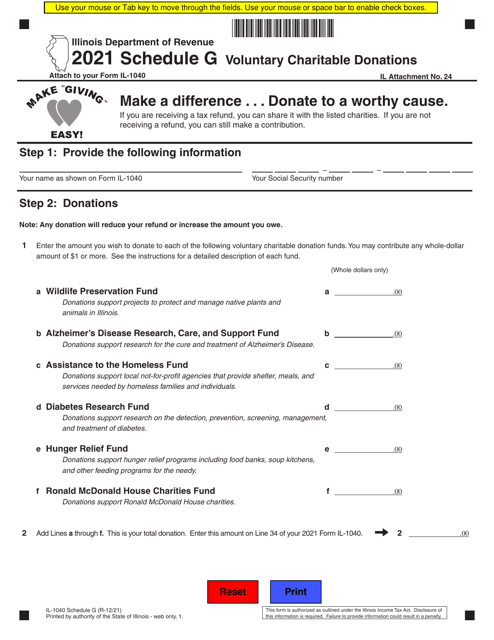

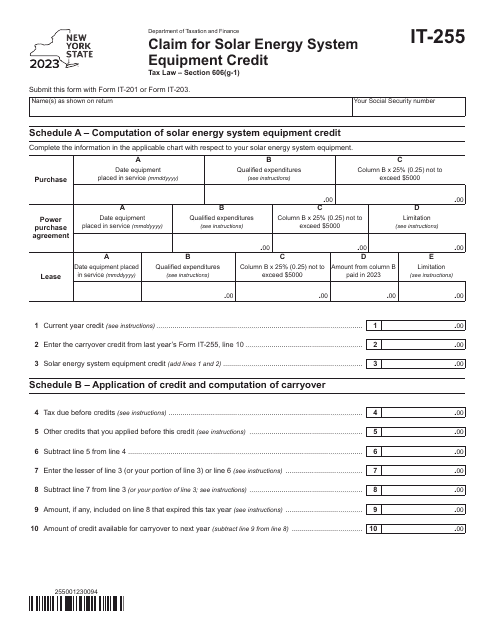

Our user-friendly forms, such as the New Jersey Amended Resident Income Tax Return and the New York Claim for Solar Energy System Equipment Credit, make it easy for you to navigate through the state tax credit process. We provide clear instructions and step-by-step guidelines, ensuring that you can complete your forms accurately and efficiently.

Don't miss out on the opportunity to take advantage of state tax credits. With our state tax credit program, you can enjoy significant savings and potentially reduce your tax liabilities. Start exploring our forms and instructions today and see how much you can save!

Documents:

36

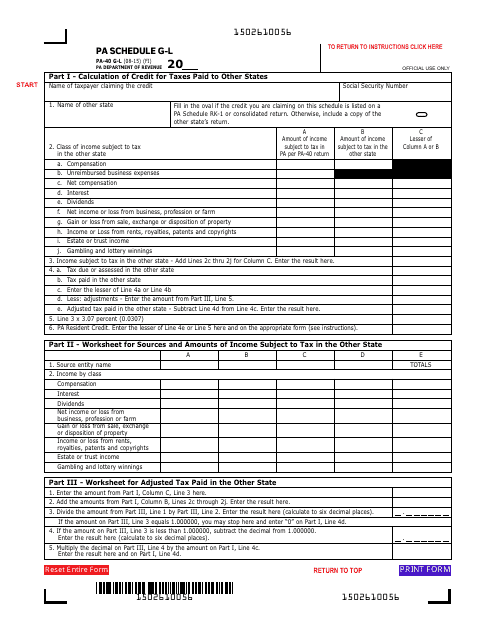

This form is used for claiming the Resident Credit for Taxes Paid in Pennsylvania for individuals filing their Pennsylvania state income tax return.

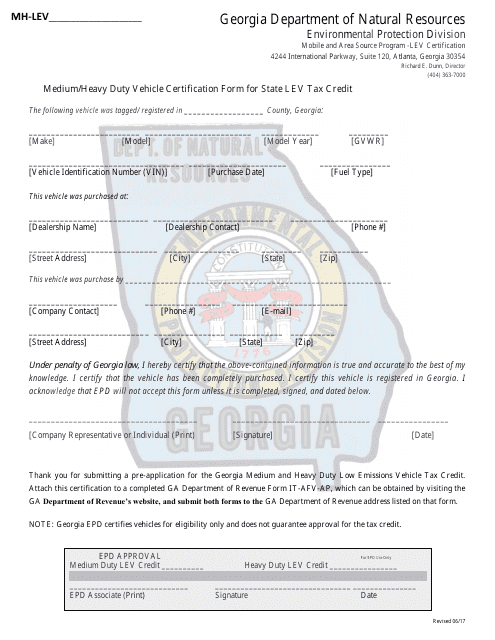

This form is used for certifying medium and heavy-duty vehicles for state-level tax credits in Georgia.

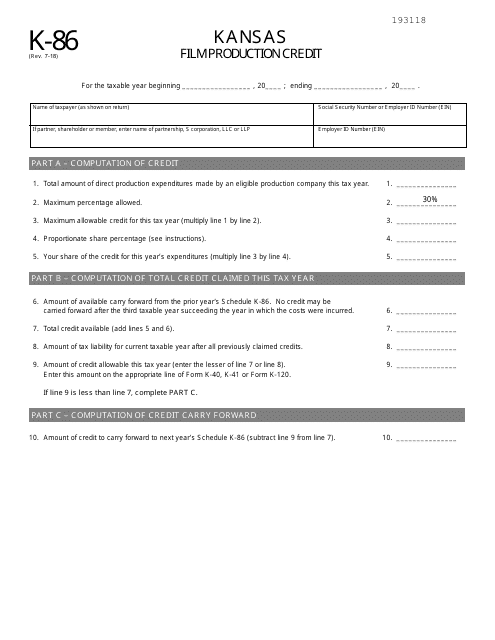

This Form is used to claim the Film Production Credit in the state of Kansas. It allows eligible film production companies to receive a tax credit for qualified production expenses incurred in Kansas.

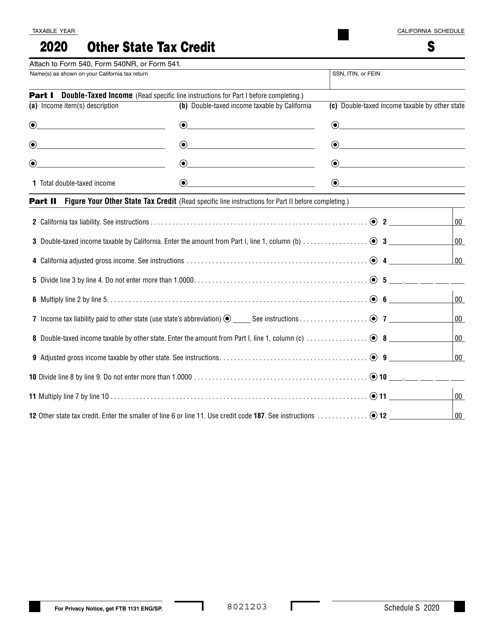

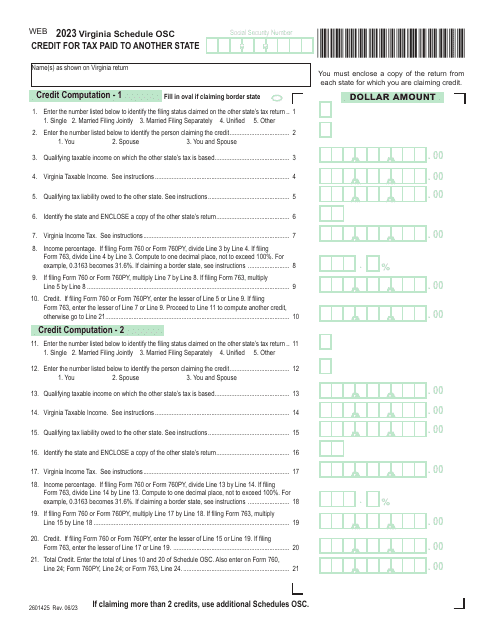

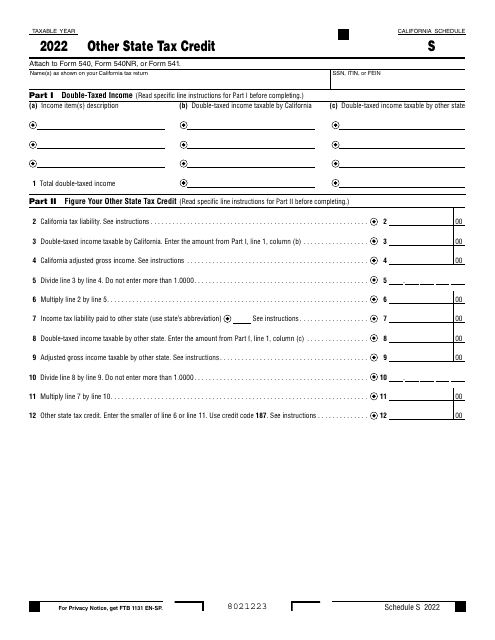

This document is used for claiming a tax credit for taxes paid to another state while being a resident of California.

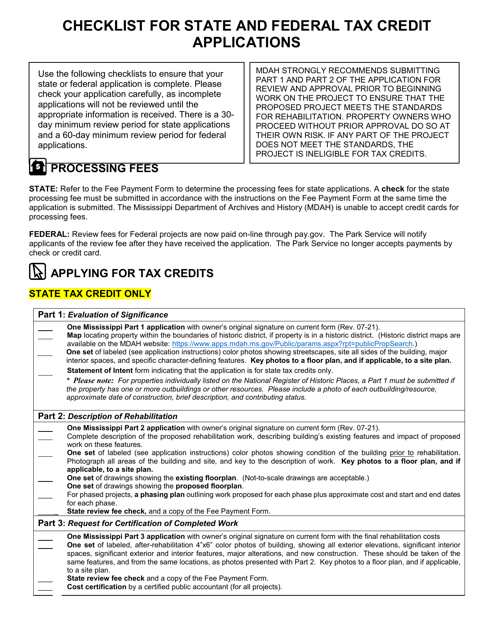

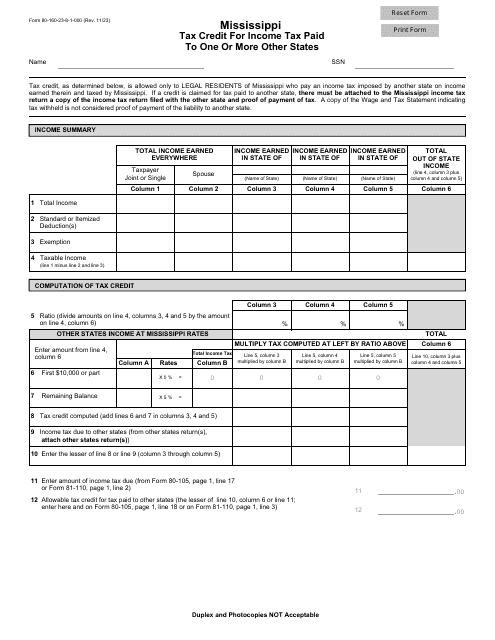

This document is a checklist for individuals in Mississippi who are applying for state and federal tax credits. It helps ensure that all necessary information and documentation are included in the application to receive tax credits.

This form is used for claiming a credit for taxes paid to other states if you are a resident of California.