Discharge of Indebtedness Templates

Are you overwhelmed with debt? Are you struggling to meet your financial obligations? If so, you may be interested in learning about the discharge of indebtedness. Also known as debt forgiveness or cancellation of debt, this process can provide relief for individuals and businesses burdened by overwhelming financial obligations.

The discharge of indebtedness refers to the cancellation or forgiveness of a debt by a creditor. This can occur in various situations, such as when a debtor is unable to repay the debt, when a creditor agrees to settle for less than the full amount owed, or when a debt is canceled through bankruptcy proceedings. When a debt is discharged, the debtor is no longer legally obligated to repay the remaining balance.

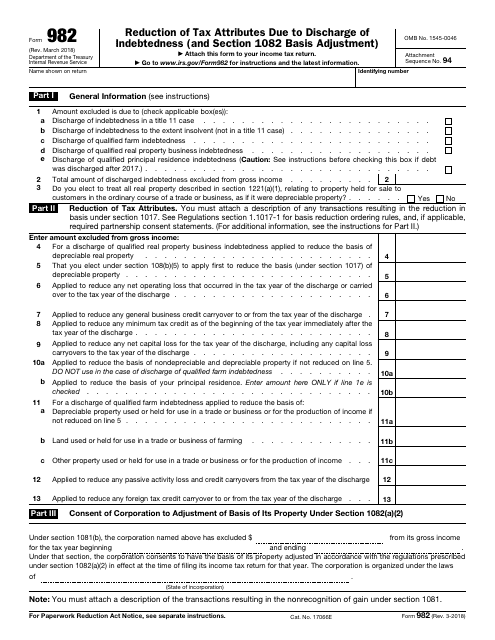

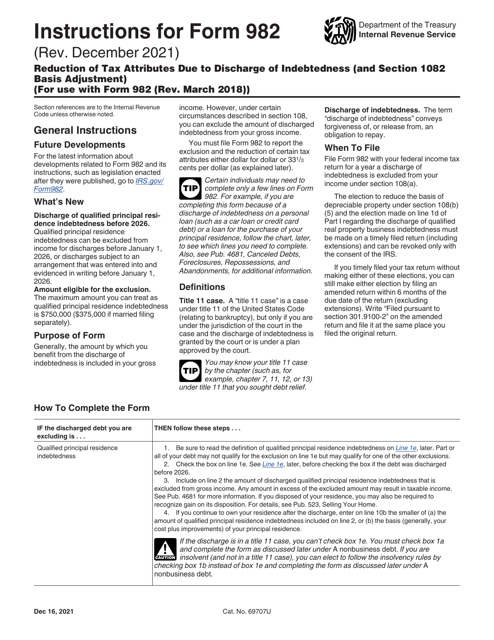

The IRS Form 982 Reduction of Tax Attributes Due to Discharge of Indebtedness (And Section 1082 Basis Adjustment) is a crucial document for individuals who have had their debts forgiven and want to claim certain tax benefits. This form allows taxpayers to exclude canceled or forgiven debt from their taxable income, reducing their overall tax liability. The Instructions for IRS Form 982 provide step-by-step guidance on how to complete the form accurately.

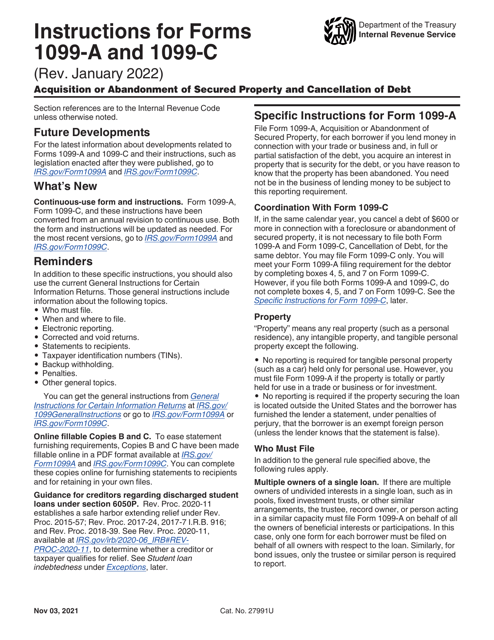

Another important document related to the discharge of indebtedness is the IRS Form 1099-A, 1099-C. This form is typically provided by the creditor to the debtor and the IRS to report the cancellation or forgiveness of a debt. The Instructions for IRS Form 1099-A, 1099-C provide detailed information on how to prepare and file these forms correctly.

Navigating the discharge of indebtedness can be complex and overwhelming without the right information and guidance. That's why it's essential to familiarize yourself with the necessary documents and instructions that apply to your situation.

Whether you're an individual seeking relief from personal debts or a business looking for debt forgiveness options, understanding the discharge of indebtedness is crucial. Explore the resources available, such as the IRS forms mentioned above and their respective instructions, to ensure you make informed decisions with regard to your finances.

Remember, seeking professional advice from a tax professional or financial advisor can also help you navigate the discharge of indebtedness process and make the most of the available options.

Documents:

6

This is a formal instrument used by taxpayers to explain to fiscal authorities why certain debts should not be taken into account as a part of their income.