Lease Tax Templates

Lease Tax - Ensure Compliance with Tax Regulations on Leased Assets

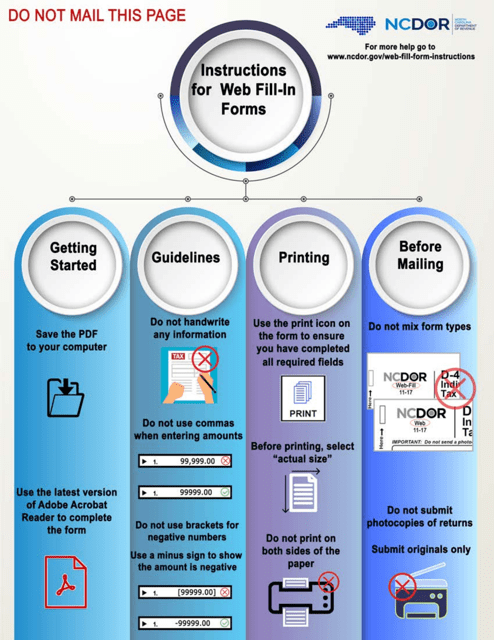

Navigating the complexities of lease taxes can be a daunting task for businesses and individuals alike. Whether you are leasing vehicles, equipment, or property, it is essential to have a firm understanding of lease tax regulations to avoid any potential penalties or issues.

Our Lease Tax document collection provides a comprehensive resource for individuals and businesses to meet their lease tax obligations. From state-specific worksheets and forms to detailed instructions on filing tax returns, this collection offers everything you need to ensure compliance with lease tax laws.

Alternate Names: Lease Taxes, Taxation for Leased Assets

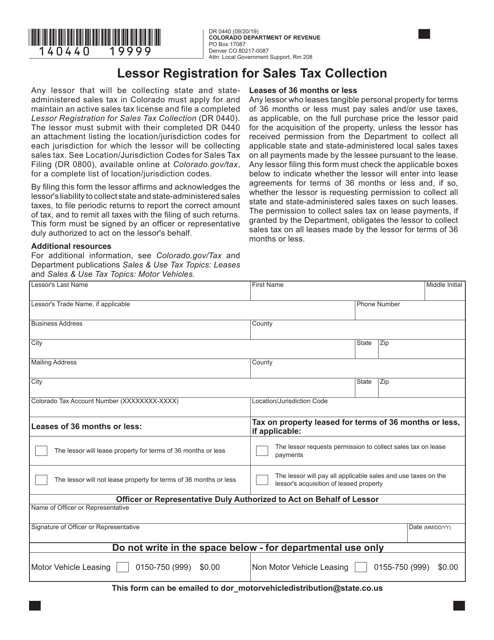

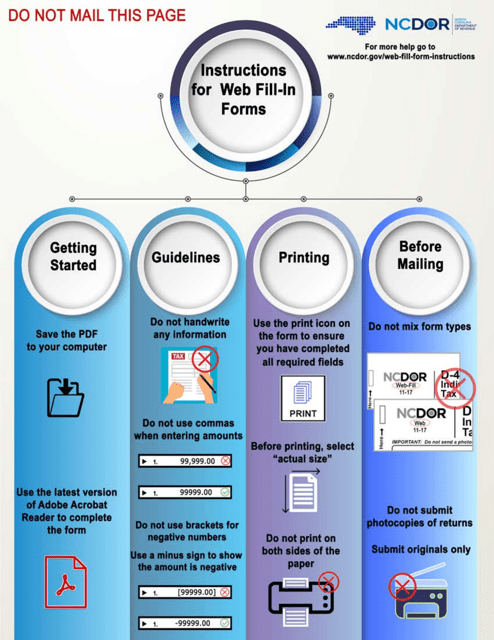

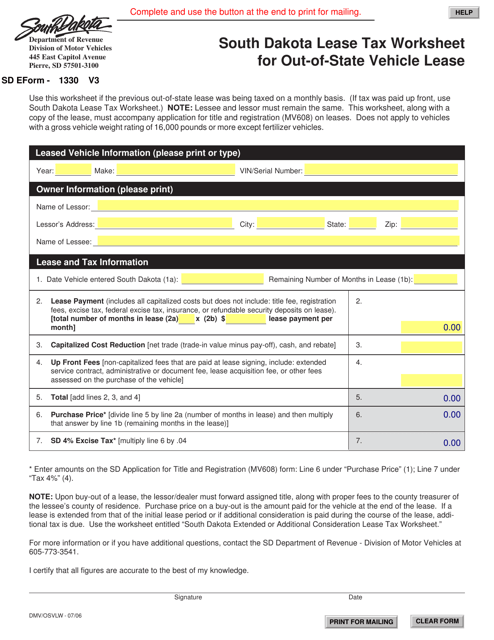

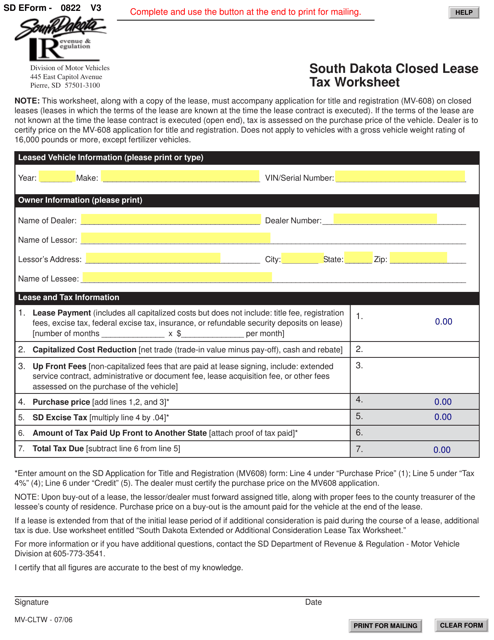

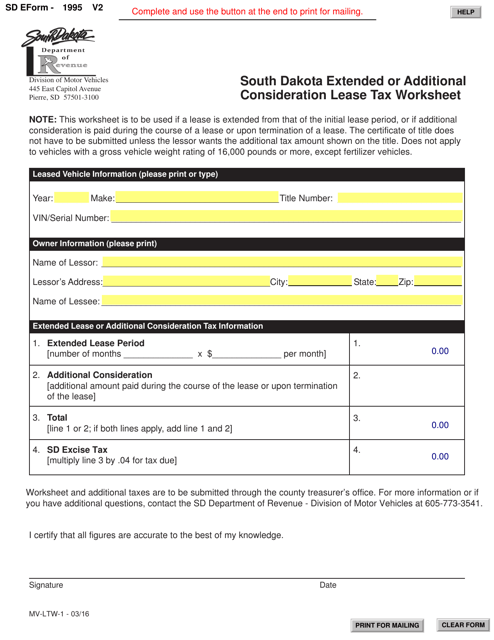

Through our collection, you can access essential documentation such as the Form DR0440 Permit to Collect Sales Tax on the Rental or Lease Basis in Colorado, SD Form 1330 South Dakota Lease Tax Worksheet for Out-of-State Vehicle Lease, SD Form 0822 (MV-CLTW) South Dakota Closed Lease Tax Worksheet, SD Form 1995 (MV-LTW-1) South Dakota Extended or Additional Consideration Lease Tax Worksheet, and Instructions for Form E-500F Motor Vehicle Lease & Subscription Tax Return in North Carolina.

Our goal is to simplify the lease tax compliance process by providing a centralized location for all the necessary documents and resources. With our easy-to-use collection, you can save time and effort in finding the appropriate forms and instructions, ensuring accurate and timely filing of your lease tax obligations.

Whether you are a business owner, tax professional, or individual leasing assets, our Lease Tax document collection is here to support you in meeting your lease tax responsibilities. Trust in our comprehensive resources and simplify your lease tax compliance today.

Documents:

9

This Form is used for calculating lease tax on out-of-state vehicle leases in South Dakota.

This document is a tax worksheet specific to South Dakota for closed lease transactions. It is used to calculate and report taxes related to the lease of a vehicle in South Dakota.

This document is used for calculating the extended or additional consideration lease tax in South Dakota.

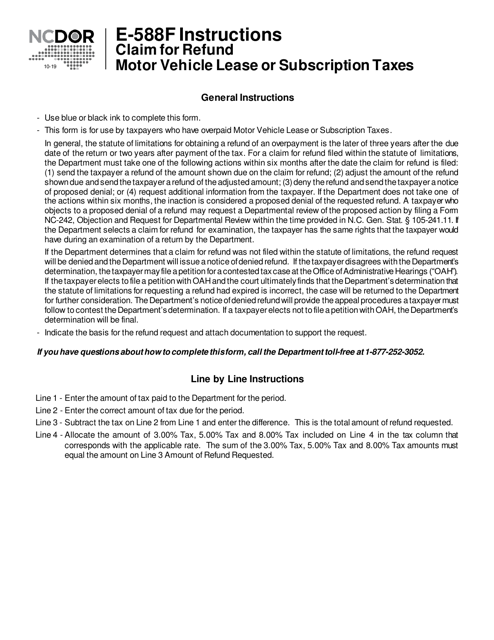

This form is used for claiming a refund of motor vehicle lease or subscription taxes in the state of North Carolina.

This Form is used for claiming a refund of motor vehicle lease or subscription taxes paid in North Carolina.

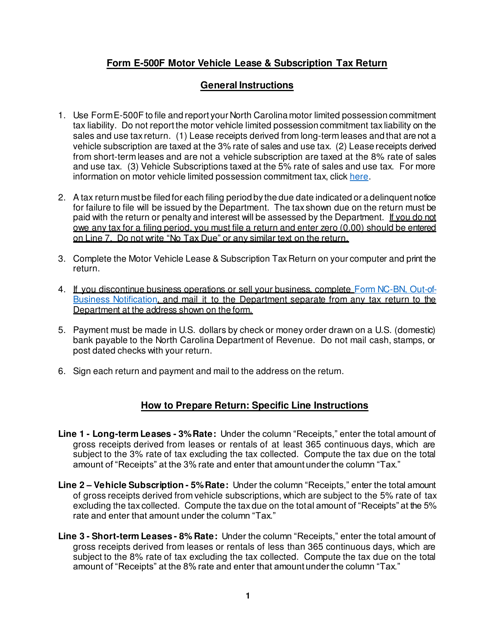

This Form is used for filing the Motor Vehicle Lease & Subscription Tax Return in North Carolina. It provides instructions on how to properly complete and submit the form.