Grace Period Templates

Are you aware of the grace period for various documents and financial obligations? A grace period, also commonly referred to as a waiting period, is a specific duration given before a certain action or requirement is enforced. This period allows individuals to rectify any issues or fulfill obligations without facing penalties or consequences.

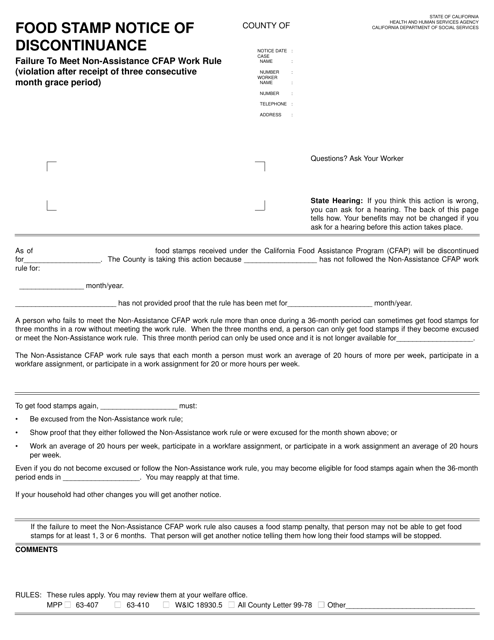

In many states, the grace period is crucial for individuals receiving benefits such as food stamps. For instance, the Form NA994 Food Stamp Notice of Discontinuance highlights a grace period of three consecutive months prior to terminating the benefits due to failure in meeting the non-assistance CFAP work requirement in California.

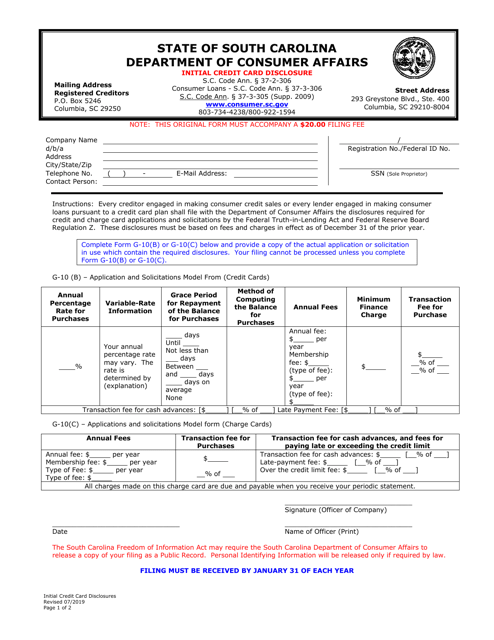

Similarly, credit card users in South Carolina are provided with an initial credit card disclosure, which typically outlines the grace period for making payments without incurring interest. This disclosure ensures that users are aware of the time window they have before interest charges are applied to their outstanding balance.

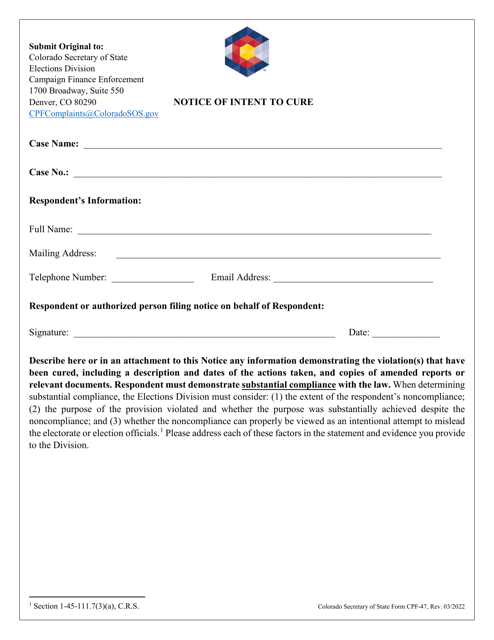

In Colorado, homeowners facing a potential foreclosure situation may receive a Form CPF-47 Notice of Intent to Cure. This notice informs them about the possibility of a grace period during which they can cure any default payments and prevent the foreclosure process from progressing.

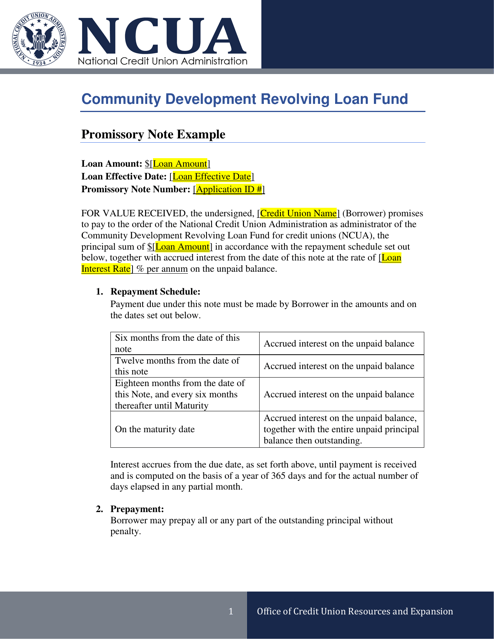

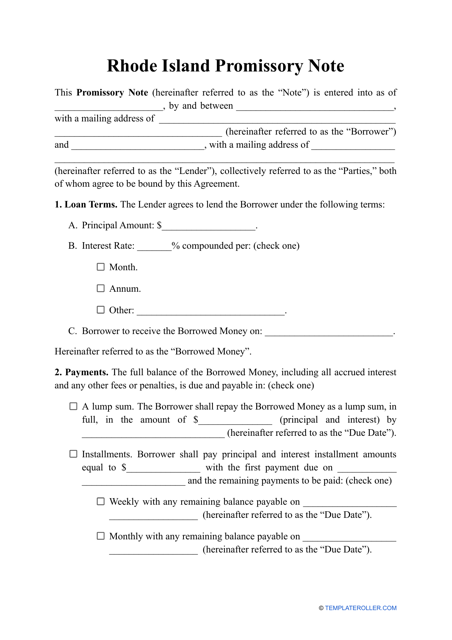

When it comes to loans and financial agreements, a loan promissory note serves as a legally-binding document, often mentioning the grace period allowed before payment is considered overdue. This grace period ensures that borrowers have a reasonable timeframe to make their payments without being penalized.

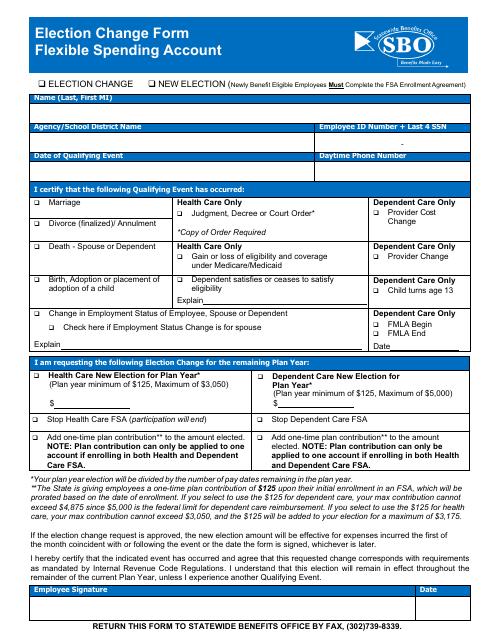

Additionally, individuals who have a flexible spending account (FSA) in Delaware can benefit from an election change form, which may include provisions for a grace period. This allows account holders to make adjustments to their FSA contributions during a designated time frame, ensuring flexibility and ease in managing their healthcare expenses.

Whether you're seeking clarity regarding food stamps, credit card payments, loan agreements, foreclosure, or FSA contributions, understanding the grace period associated with each obligation is crucial. Familiarizing yourself with the alternate names of these documents is equally important; these including terms like waiting period, notice of discontinuance, initial disclosure, notice of intent to cure, and more.

Take advantage of the grace period available to you, and make informed decisions and timely actions to avoid unnecessary penalties and repercussions.

Documents:

6

This form is used for notifying food stamp recipients in California when their benefits are being discontinued due to failure to meet the work requirement for the non-assistance CalFresh Employment and Training program.

This document provides important information about the terms and conditions of a credit card in the state of South Carolina. It covers details such as interest rates, fees, and payment requirements.

This document is a legal agreement between a lender and borrower that outlines the terms and conditions of a loan and the borrower's promise to repay the borrowed amount.

This document is a template for a promissory note in Rhode Island. It is used to outline the terms of a loan agreement between a lender and a borrower.