Computation Worksheet Templates

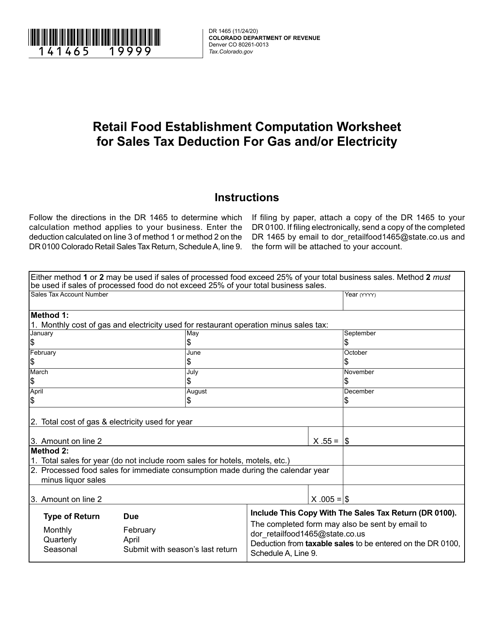

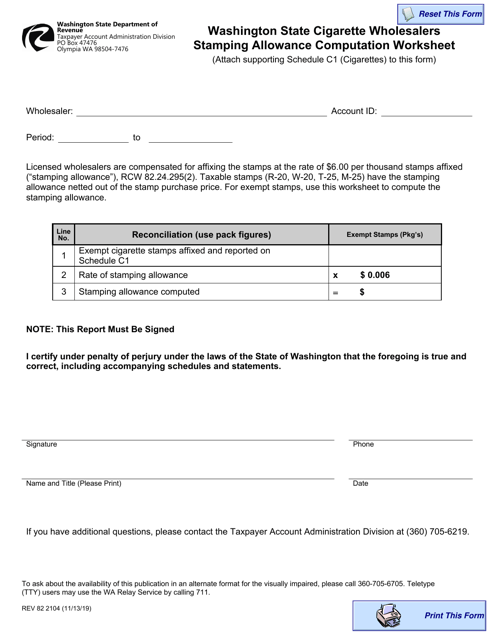

Are you looking for a computation worksheet to help with your business and financial calculations? Look no further! Our collection of computation worksheets is here to assist you in accurately determining your sales tax deduction for gas and/or electricity, franchise tax computation for reinstatement, cigarette wholesalers stamping allowance computation, child support computation for the sole residential parent or shared parenting order, and much more.

Our computation worksheets are designed to ensure that you have all the necessary information and formulas at your fingertips, making your calculations a breeze. With our user-friendly formats and clear instructions, you can confidently complete your computations with ease and accuracy.

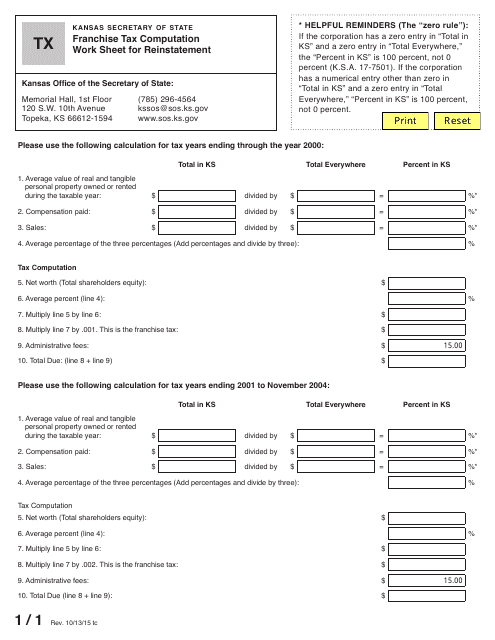

No matter which state you are in, our computation worksheets cater to specific regional requirements, such as the Colorado Retail Food Establishment Computation Worksheet for Sales Tax Deduction, the Kansas Franchise Tax Computation Work Sheet for Reinstatement, and the Washington State Cigarette Wholesalers Stamping Allowance Computation Worksheet.

Don't waste your valuable time and energy trying to figure out complex calculations manually. Let our computation worksheets simplify the process, giving you peace of mind and saving you precious resources. Explore our collection of computation worksheets now and make your financial calculations a breeze!

Documents:

10

This Form is used for calculating franchise tax for reinstatement in the state of Kansas.

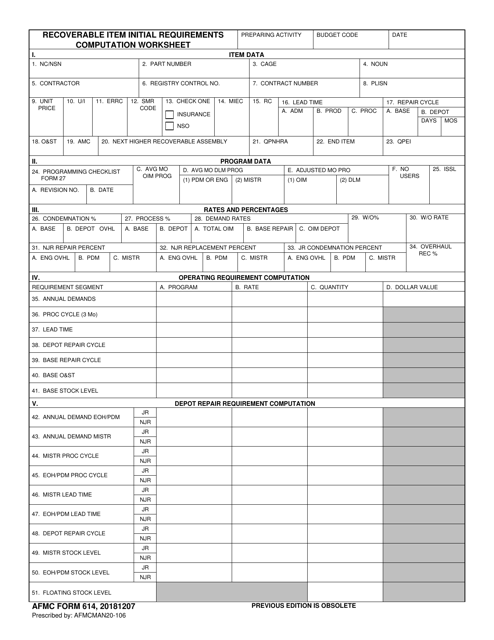

This type of document is used for calculating the initial requirements for recoverable items in the AFMC (Air Force Materiel Command).

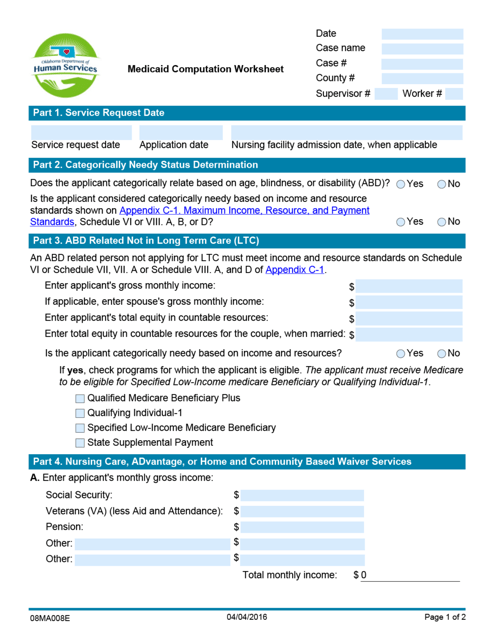

This document is a Medicaid Computation Worksheet specifically for the state of Oklahoma. It is used to calculate eligibility for Medicaid benefits.

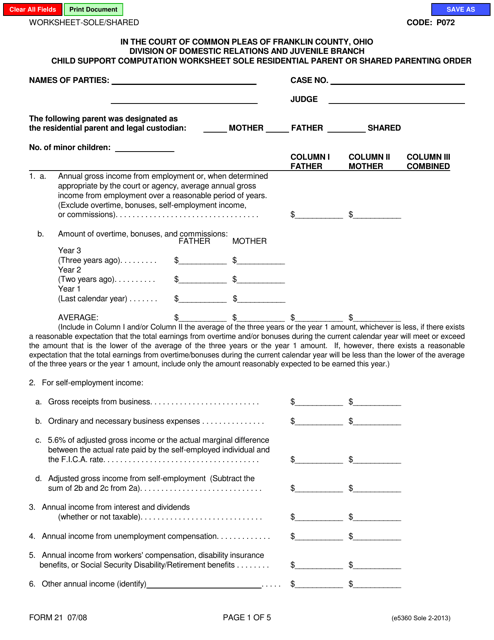

This form is used in Franklin County, Ohio to calculate child support payments. It is specifically for cases where there is a sole residential parent or a shared parenting order.

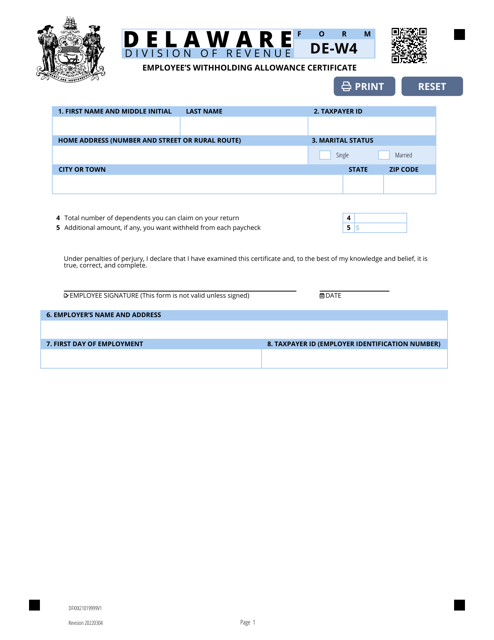

This form is used by employees in Delaware to determine their withholding allowances and calculate the correct amount of federal income tax to be withheld from their wages.

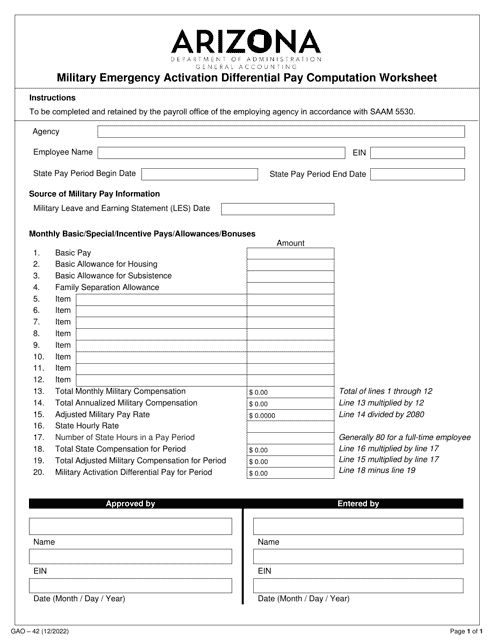

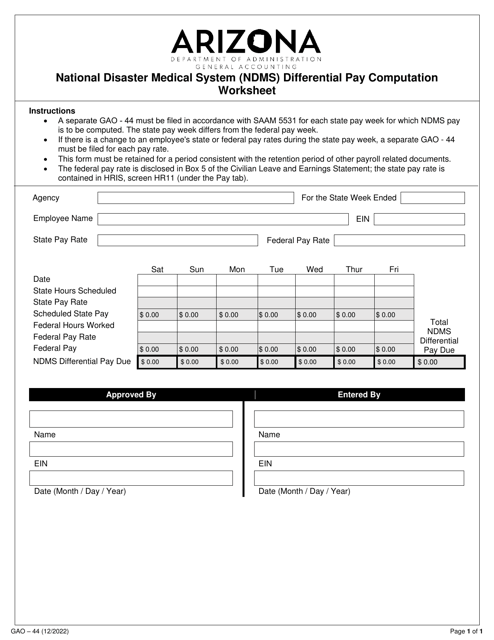

This Form is used for calculating the differential pay for military service members during emergency activations in Arizona.

Form GAO-44 National Disaster Medical System (Ndms) Differential Pay Computation Worksheet - Arizona

This type of document is used for calculating the differential pay for National Disaster Medical System (NDMS) volunteers in Arizona during a disaster.