Tax Record Keeping Templates

Tax Record Keeping: Efficiently Organize and Manage Your Tax Documents

Welcome to our comprehensive tax record keeping guide, designed to streamline your tax preparation process and ensure compliance with government regulations. Whether you're a small business owner, self-employed individual, or simply need to keep track of your personal finances, maintaining accurate and up-to-date tax records is crucial.

Our tax record keeping system provides you with the tools and resources necessary to effectively manage your tax-related documents. By implementing proper record keeping practices, you'll not only reduce the stress and hassle associated with tax season but also optimize your ability to take advantage of potential deductions and credits.

Key benefits of utilizing our tax record keeping system:

-

Stay organized: Our system enables you to keep all your tax documents in one place, making it easy to access and reference them when needed. Say goodbye to misplaced receipts or missing forms.

-

Ensure compliance: As tax regulations continue to evolve, it's important to stay updated and compliant. Our system helps you keep track of changing requirements, ensuring that you meet all necessary reporting obligations.

-

Maximize deductions: By effectively documenting your expenses, our tax record keeping system empowers you to identify and claim all eligible deductions. Don't miss out on potential tax savings.

-

Facilitate financial analysis: Maintaining accurate tax records provides valuable insights into your financial health. Our system allows you to analyze your income, expenses, and investments, helping you make informed financial decisions.

-

Seamlessly collaborate: If you have a tax professional or accountant assisting you with your taxes, our system allows for easy collaboration. Simply grant them access to your tax records, facilitating a smooth and efficient tax filing process.

Whether you're preparing for your annual tax return, managing quarterly estimated tax payments, or dealing with tax audits, our tax record keeping system is designed to simplify your life. Say goodbye to stressful tax seasons and hello to a more organized and efficient approach to tax compliance.

Start using our tax record keeping system today and experience the peace of mind that comes with organized and accurate tax documentation. Let us help you navigate the complex world of tax filings, so you can focus on what matters most to you.

Documents:

6

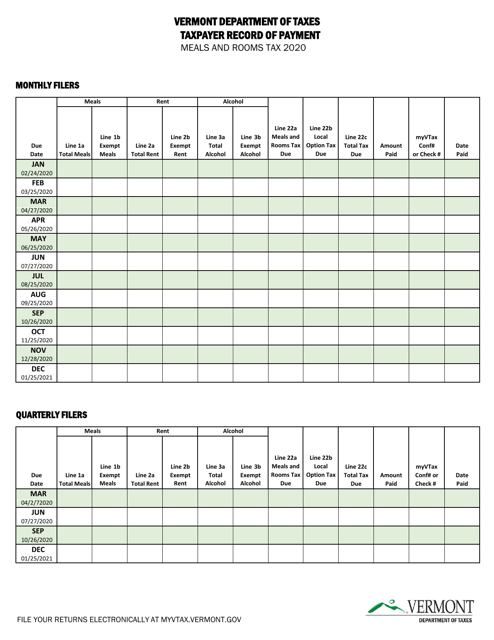

This document is used to record payments for the meals and rooms tax in the state of Vermont.

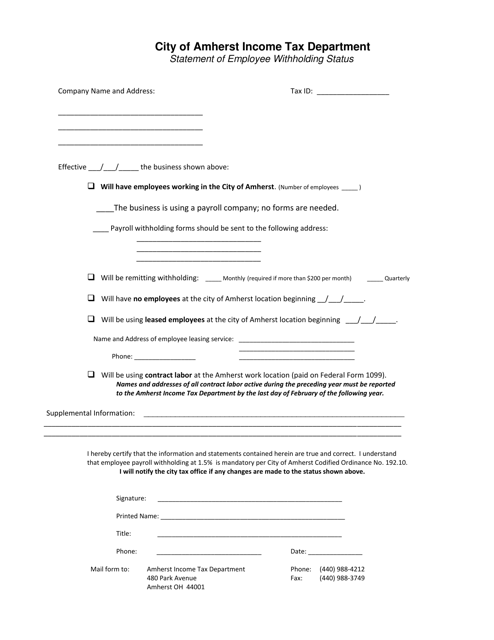

This document is for employees in the City of Amherst, Ohio to declare their withholding status for tax purposes.