Tax Breaks Templates

Are you looking for ways to maximize your savings on your tax payments? Look no further than our comprehensive collection of tax breaks and deductions. With various options to suit your needs, our tax breaks provide you with the opportunity to save money on expenses such as child and dependent care, rehabilitation expenses, and qualified businessincome deductions. Whether you're a resident of Virginia, California, Maine, or any other state, our tax breaks are designed to help you make the most of your tax filings. Don't miss out on potential savings - explore our collection of tax breaks today and start saving on your taxes.

Documents:

16

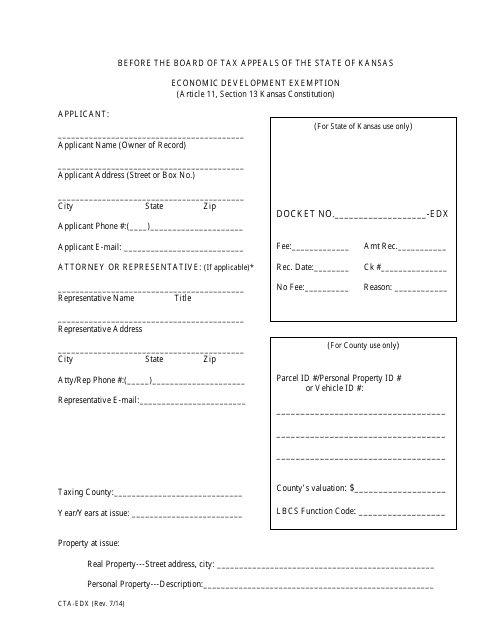

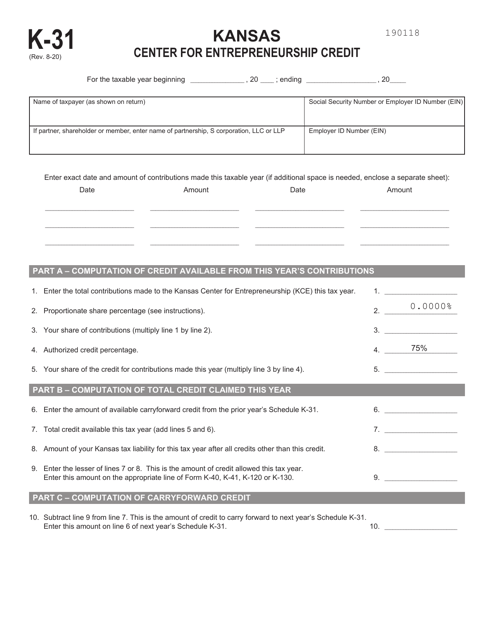

This type of document is used to apply for an economic development exemption in the state of Kansas. It allows businesses to potentially qualify for tax benefits and incentives in order to encourage job creation and investment in the local economy.

This form was developed for taxpayers who have paid someone to care for their child or another qualifying person so they could work or look for work.

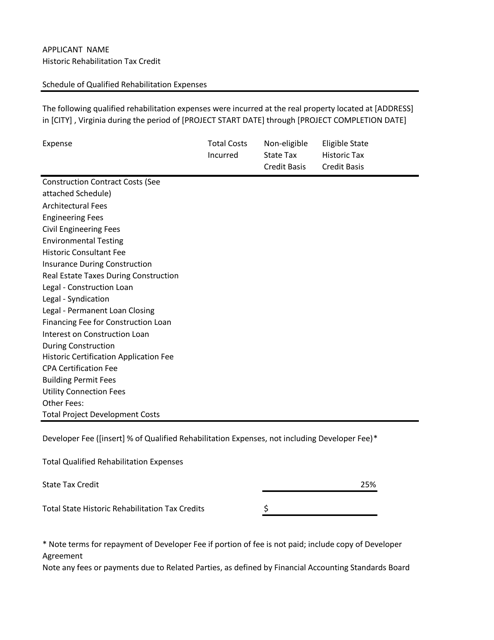

This document provides information about the schedule of qualified rehabilitation expenses in the state of Virginia. It outlines the expenses that qualify for rehabilitation tax credits in the state.

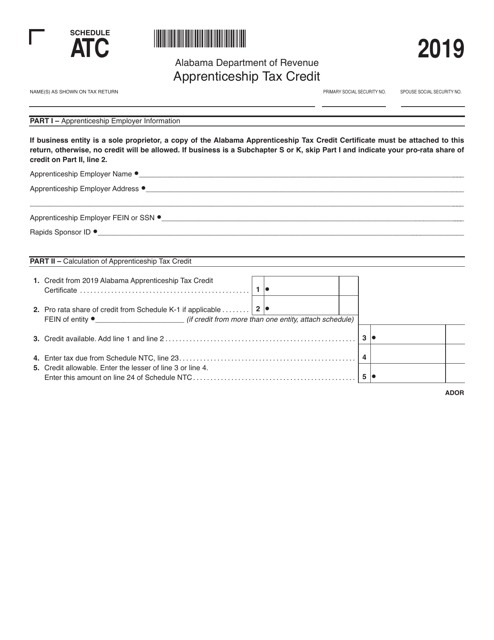

This document is a schedule for claiming the ATC Apprenticeship Tax Credit specific to the state of Alabama. It provides information on how to calculate and claim tax credits related to apprenticeship programs.

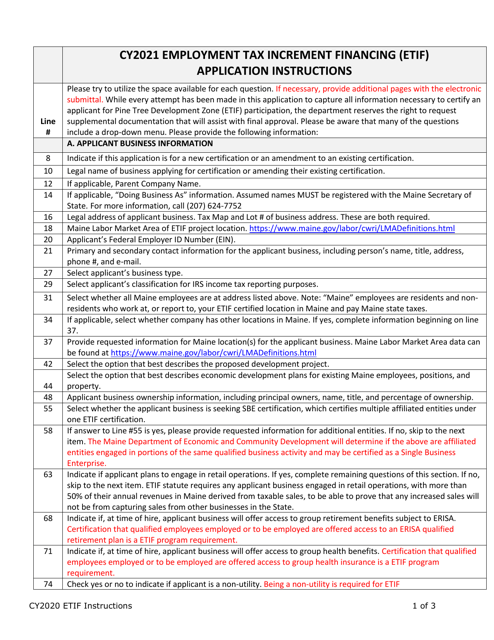

This form is used for applying for the Employment Tax Increment Financing (ETIF) Program Business Certification in Maine. It provides instructions and guidelines for businesses to complete the application process.

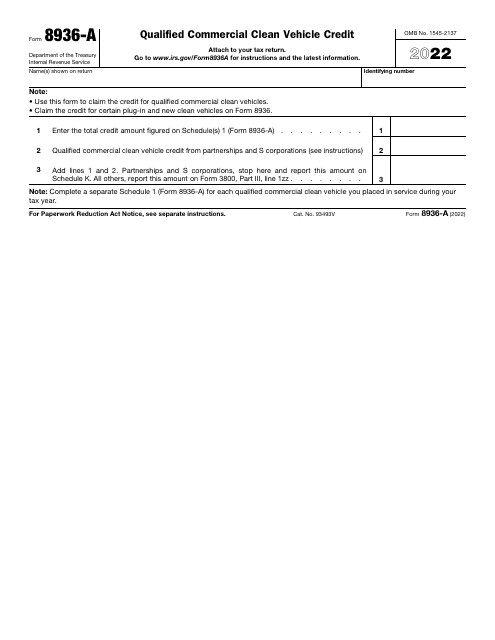

This form is used for claiming a tax credit for the purchase of a qualified commercial clean vehicle.