Asset Statement Templates

Looking for a comprehensive and reliable source of information on assets? Look no further than our Asset Statement collection. This extensive collection provides you with a wealth of documents and resources related to assets, including statements, reports, and templates. Whether you need to file an IRS form, report gains and losses, or prepare a financial statement, our Asset Statement collection has you covered.

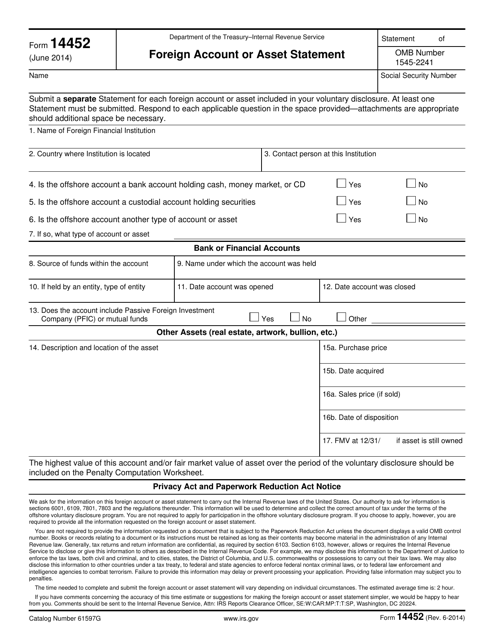

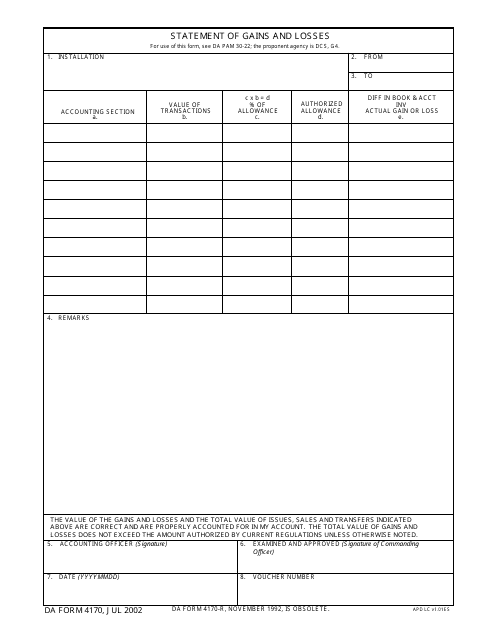

Discover the IRS Form 14452 Foreign Account or Asset Statement, designed specifically for reporting foreign accounts or assets. Additionally, explore the DA Form 4170 Statement of Gains and Losses, a valuable resource for tracking and reporting your financial gains and losses.

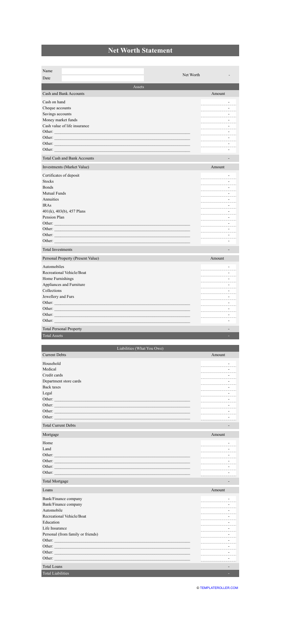

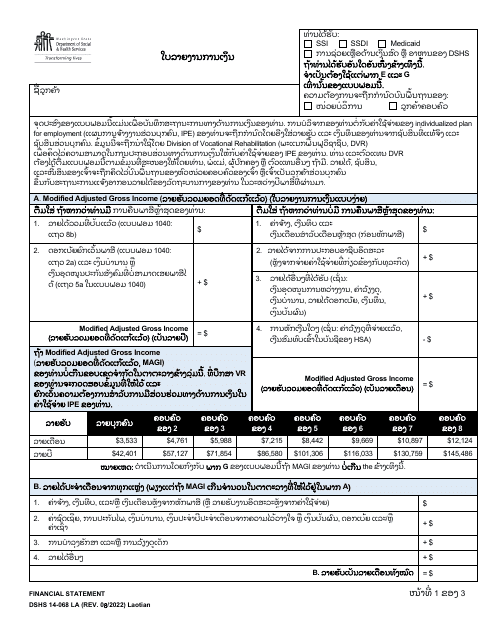

If you're in need of a Net Worth Statement template, our collection provides you with a practical and customizable template to accurately assess your financial standing. Furthermore, you can find a Financial Information Statement from Collin County, Texas, and the DSHS Form 14-068 Financial Statement from Washington (Lao) to assist you with your financial reporting needs.

With our Asset Statement collection, you can easily access and utilize a range of important documents, ensuring that your financial affairs are well-documented and compliant with relevant regulations. Don't miss out on this valuable resource for managing and reporting your assets effectively.

Documents:

11

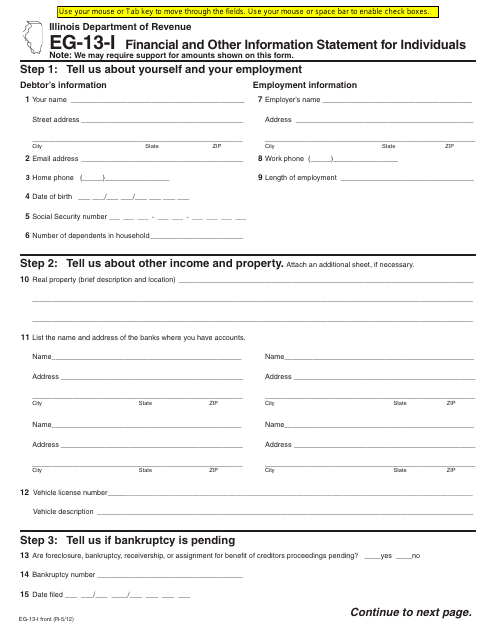

This form is used for providing financial and other information for individual residents of Illinois. It is used to gather details about the person's financial situation and other relevant information.

This form is used for documenting gains and losses in assets or property for the Department of the Army.

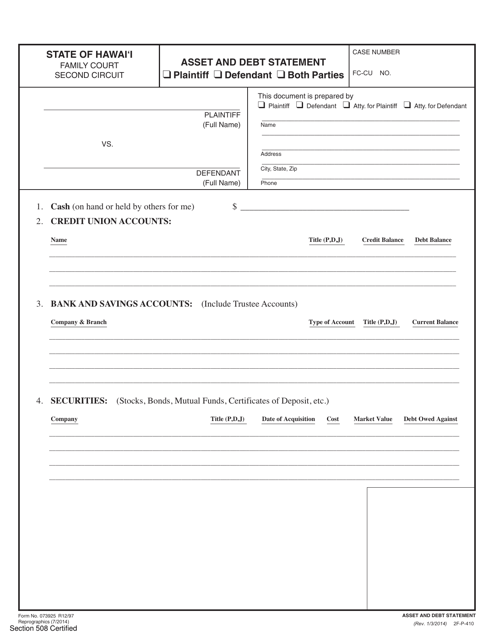

This form is used for reporting assets and debts in the state of Hawaii. It helps individuals provide a detailed account of their financial situation.

A company or individual may use this type of financial document to report their current financial worth.

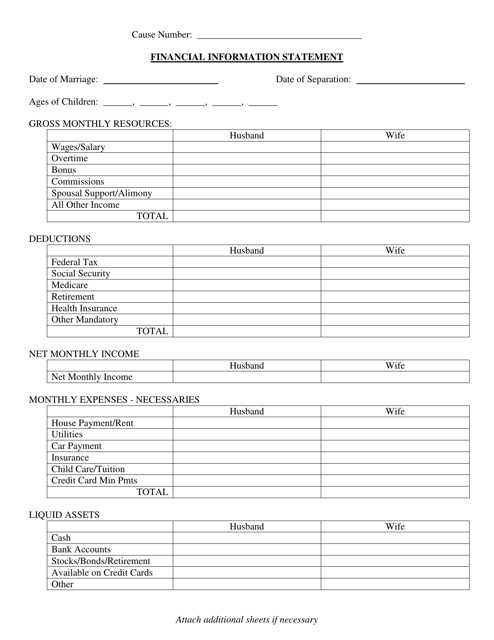

This document is used for providing financial information to Collin County, Texas. It helps assess the financial status of individuals or businesses for various purposes such as taxation, eligibility for government programs, or loan applications.

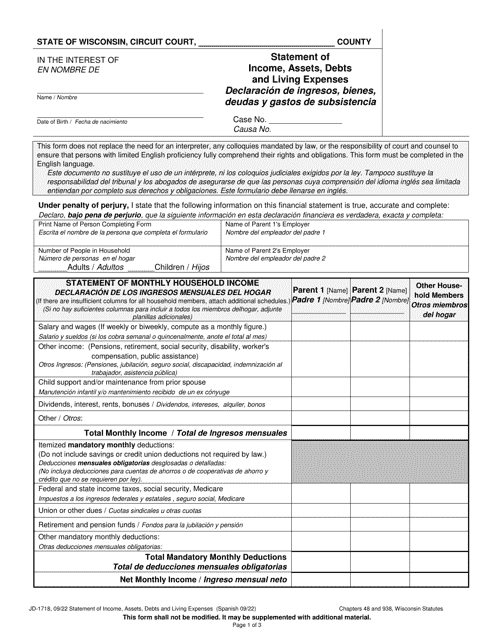

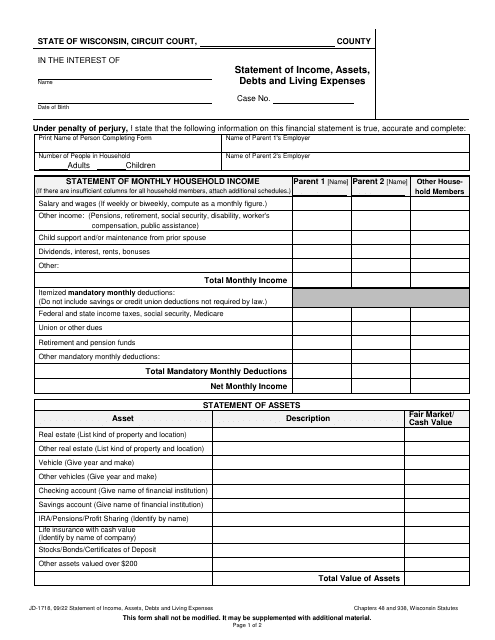

This form is used for providing a comprehensive snapshot of an individual's income, assets, debts, and living expenses in Wisconsin. It helps in assessing financial standing for various purposes such as divorce, child support, or bankruptcy.