Star Program Templates

The Star Program, also known as the Special Tax Assessment Relief (STAR) Program, is a government initiative offered in various regions, including New York State and the Northwest Territories in Canada. This program aims to provide tax relief to eligible property owners by offering exemptions, reimbursements, or other benefits.

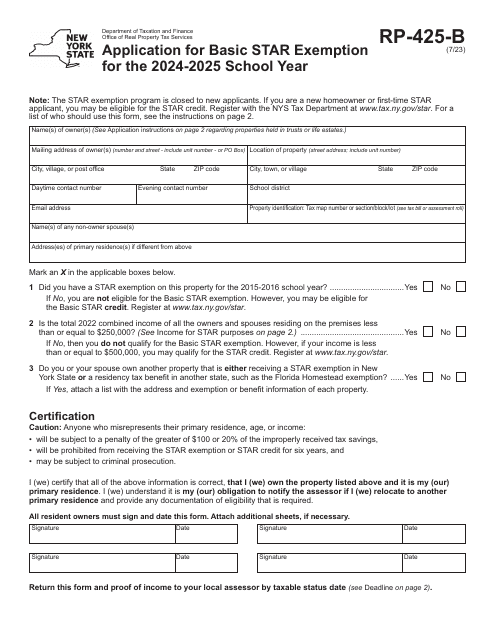

In New York, homeowners can take advantage of the Star Program by applying for the Basic Star Exemption. This exemption reduces the assessed value of a primary residence, resulting in lower property taxes. The application process, outlined in Form RP-425-B, ensures that qualified individuals can receive the financial benefits they deserve.

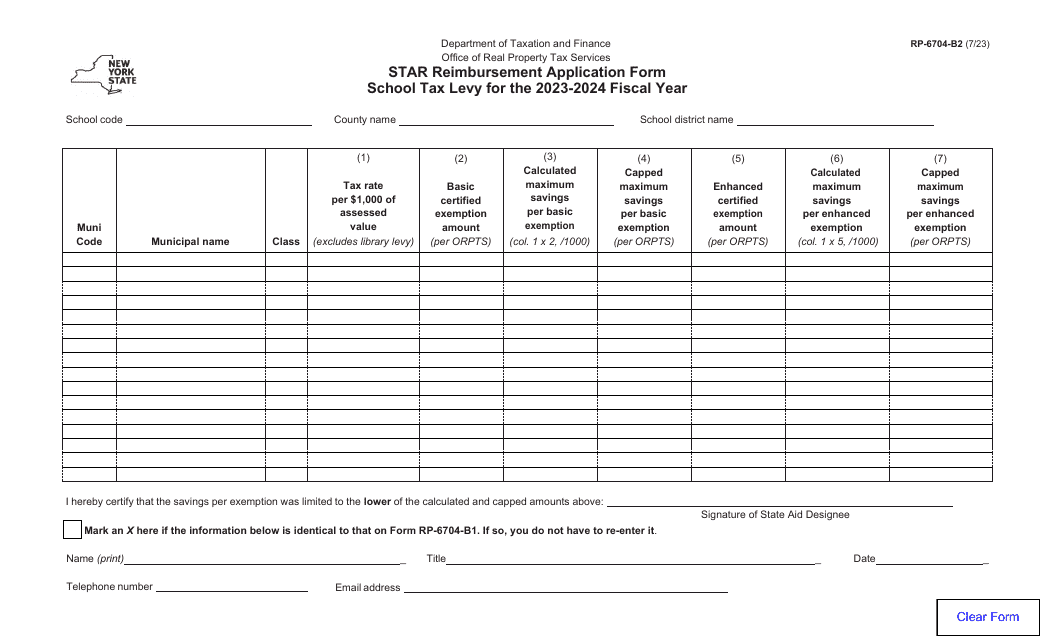

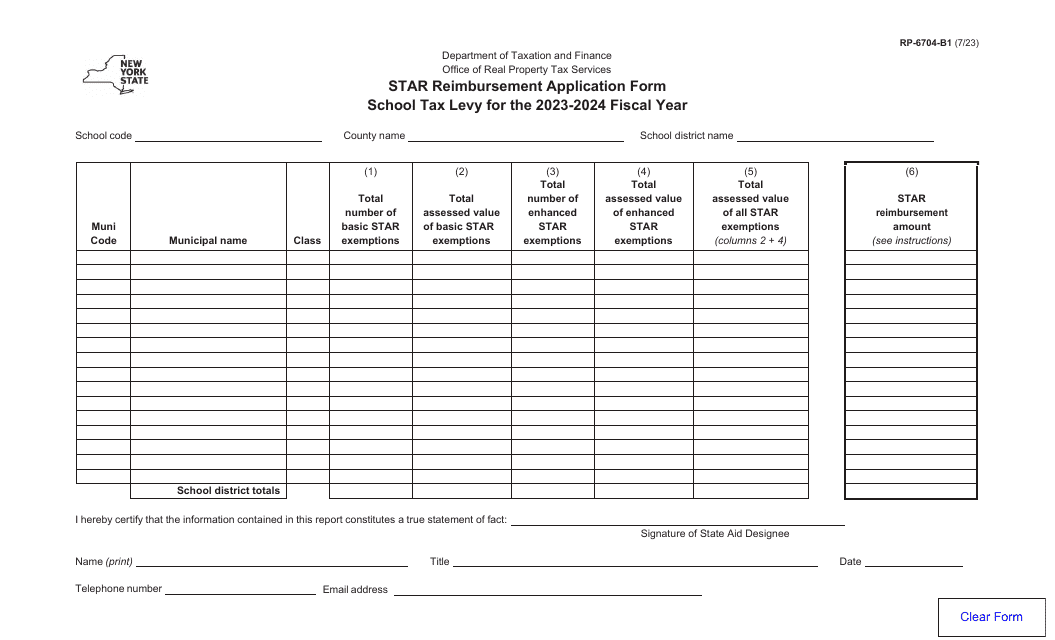

Furthermore, the Star Reimbursement Application Forms (RP-6704-B1 and RP-6704-B2) are specifically designed for homeowners in New York who have paid school taxes. These forms enable eligible homeowners to apply for reimbursements based on their school tax levy.

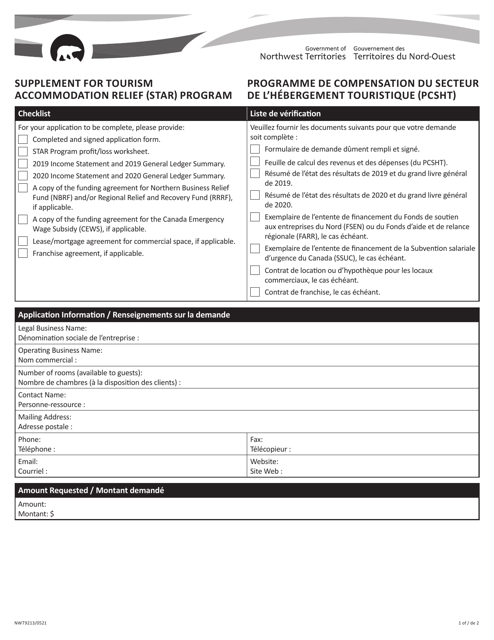

In the Northwest Territories of Canada, the Star Program is known as the Tourism Accommodation Relief (STAR) Program. This initiative provides financial relief to tourism accommodations by offering tax exemptions or reductions. Businesses in the tourism industry can fill out Form NWT9213, available in both English and French, to apply for the STAR Program.

Whether you're a homeowner in New York seeking property tax relief or a tourism accommodation provider in the Northwest Territories looking for tax benefits, the Star Program is here to support you. Explore the various application forms and take advantage of the benefits offered by this program.

Documents:

8

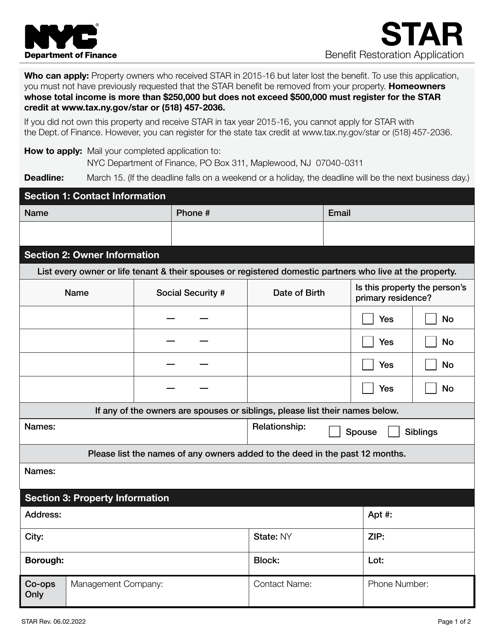

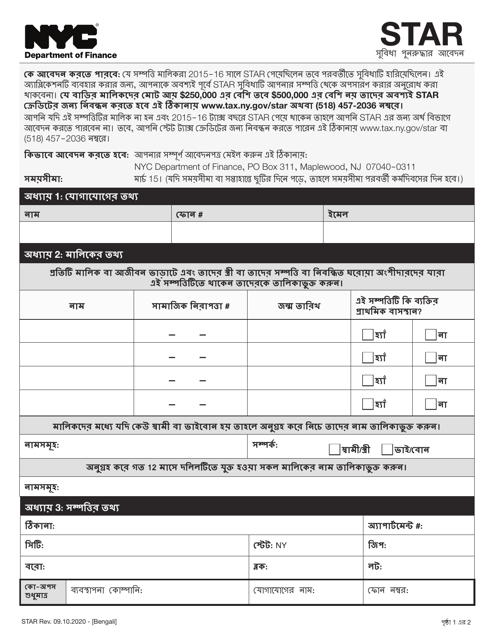

This document is for applying for the Star Benefit Restoration in New York City.

This type of document is a supplement form used for applying to the Tourism Accommodation Relief (Star) Program in the Northwest Territories, Canada. It is available in both English and French.