Mortgage Company Templates

A mortgage company plays a pivotal role in helping individuals and families achieve their dreams of homeownership. With their expert guidance and financial solutions, a mortgage company simplifies the process of securing a mortgage loan, making it more accessible and manageable for individuals seeking affordable housing options.

At Templateroller.com, we understand the significance of finding the right mortgage company to meet your specific needs. As a leading player in the industry, we offer a wide range of services and solutions that cater to first-time homebuyers, existing homeowners looking to refinance, and even real estate investors.

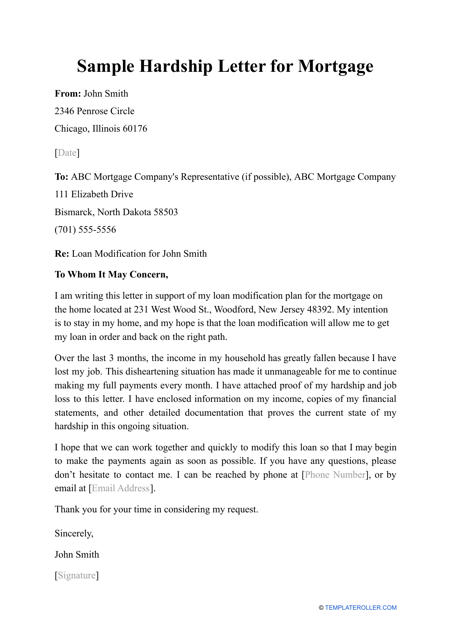

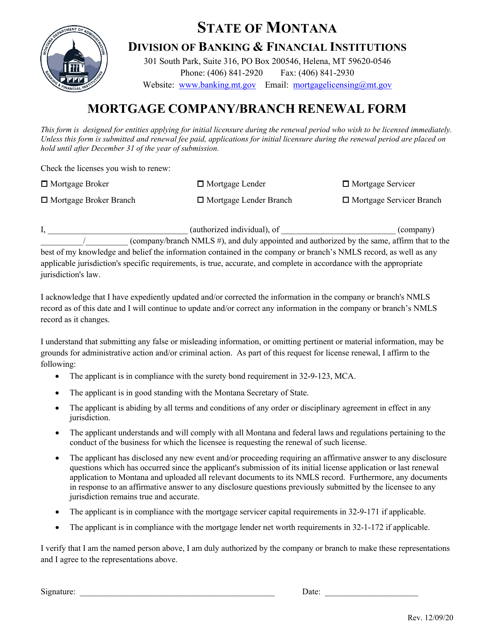

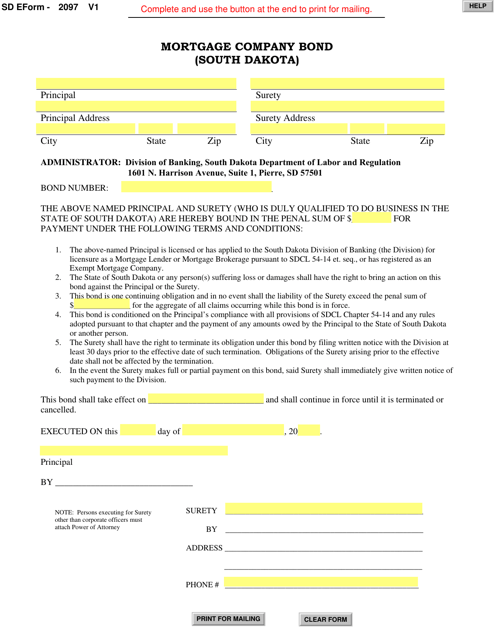

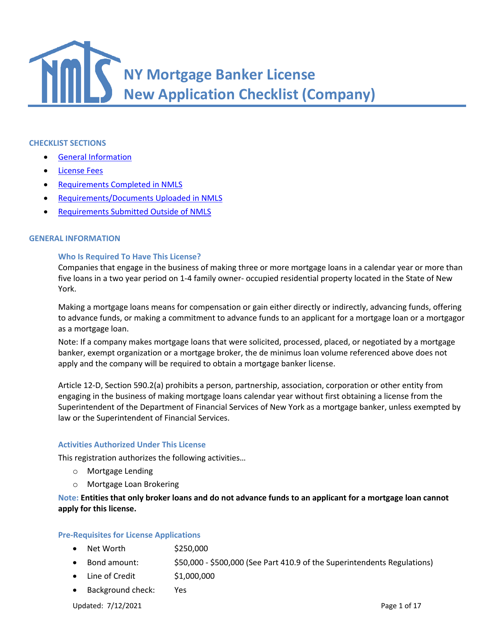

Whether you're facing financial difficulties and need assistance drafting a hardship letter for mortgage modification, renewing your mortgage company's license or bond, or ensuring compliance with regulatory requirements, our team of professionals is here to guide you through every step of the process.

With years of experience and a commitment to providing exceptional customer service, we have established ourselves as a trusted resource in the mortgage industry. We pride ourselves on our ability to listen to our clients' needs and tailor our services accordingly, ensuring that we find the best possible solution for each unique situation.

Our extensive suite of services includes mortgage refinancing, loan origination, mortgage loan modifications, and various compliance services. We take the time to assess your financial situation, understand your long-term goals, and present you with personalized options that align with your needs and preferences.

Whether you're based in Montana, South Dakota, New York, Texas, or any other state across the United States and beyond, our team of experts is well-versed in the regional regulations and requirements to ensure a seamless and efficient process.

When it comes to navigating the complex world of mortgages, trust the expertise and professionalism of a reputable mortgage company like Templateroller.com. Contact us today to learn more about how we can assist you in achieving your homeownership goals.

Documents:

7

Use this sample as a reference when drafting your own Hardship Letter for Mortgage.

This form is used for obtaining a mortgage company bond in South Dakota.

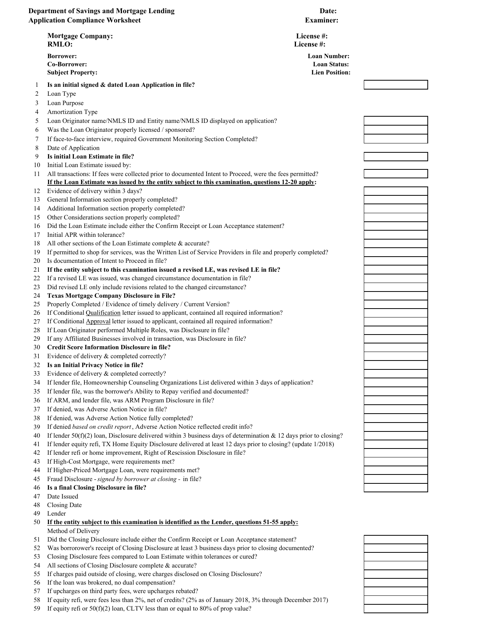

This document is used by a mortgage company in Texas to ensure compliance with the application requirements for mortgage applications.

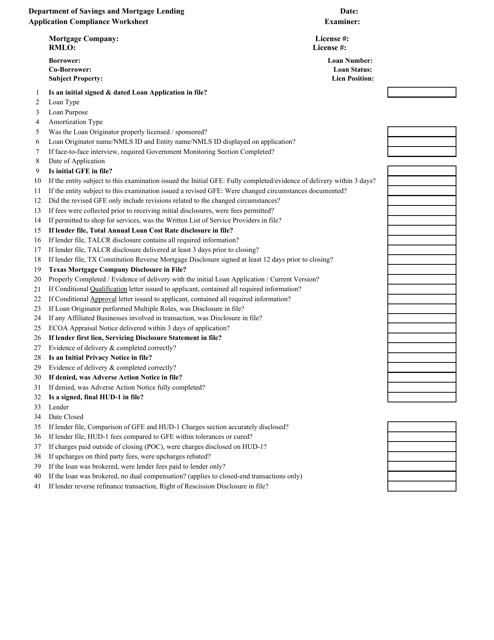

This document is used by a mortgage company in Texas to assess compliance with regulations for reverse mortgages. It helps ensure that all necessary documents and information are in order for the application process.

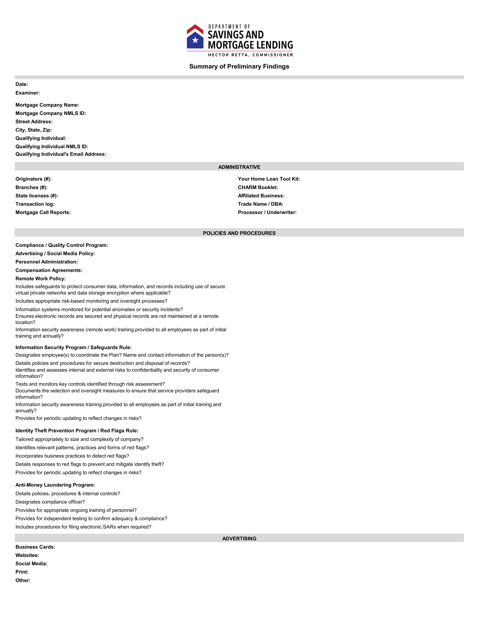

This document provides an overview of the initial findings made by a mortgage company in Texas. It gives a summary of the observations and conclusions made during the preliminary evaluation.