Bond Agreement Templates

A bond agreement is an essential legal document that outlines the terms and conditions of a bond between parties. It serves as a binding agreement, protecting the interests of both the issuer of the bond and the bondholder. This agreement ensures that all parties involved understand their rights and obligations related to the bond.

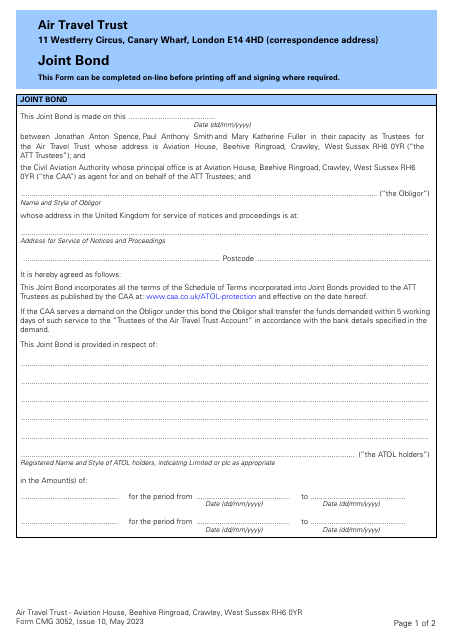

Whether you are in the United States, Canada, or other countries, a bond agreement is a crucial document that provides security and clarity in financial transactions. It acts as a guarantee for performance, payment, or compliance, depending on the type of bond.

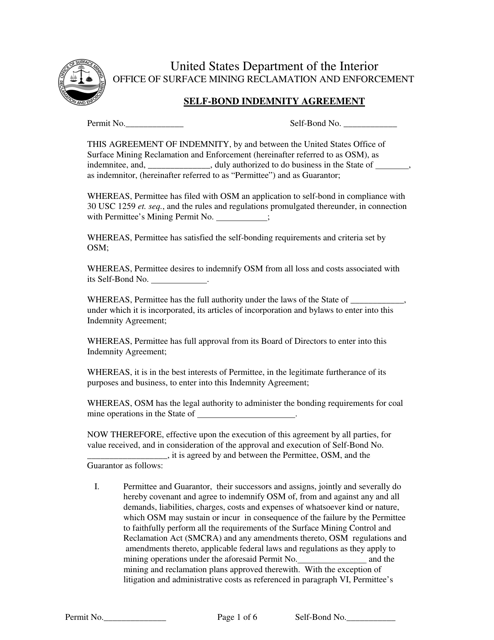

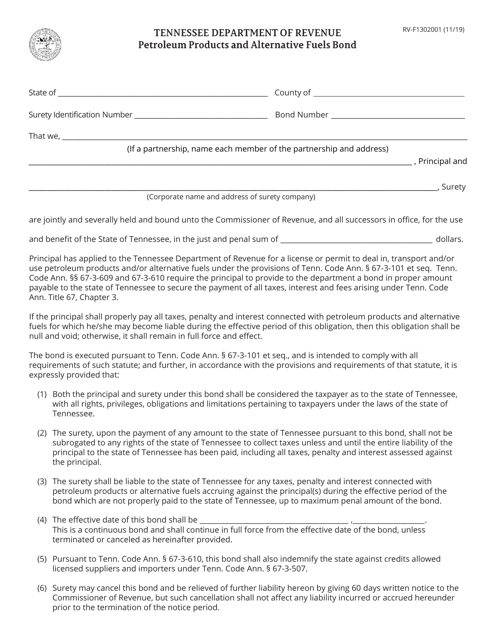

Also known as a bond agreement template, bonding agreement, agreement bond, or bond agreement form, this document comes in various forms depending on the specific requirements and regulations of different jurisdictions. It can be a Performance Contract Bond, Cash Bond Agreement, Promoter Bond, or even a Subdivision Improvement Bond Agreement, among others.

These bond agreements provide a structured framework for parties to enter into financial agreements with confidence. By clearly defining the conditions, responsibilities, and potential penalties, a bond agreement ensures that all parties involved are protected and that the bond operates smoothly.

If you are looking to enter into a bond agreement, it is essential to consult with legal professionals who specialize in this area. They can help you navigate the intricate details and ensure all necessary provisions are included in the agreement.

For individuals, businesses, or governments seeking financial stability and assurance, a bond agreement is an indispensable tool. It helps establish trust, minimize risks, and offer peace of mind in various financial transactions.

Documents:

68

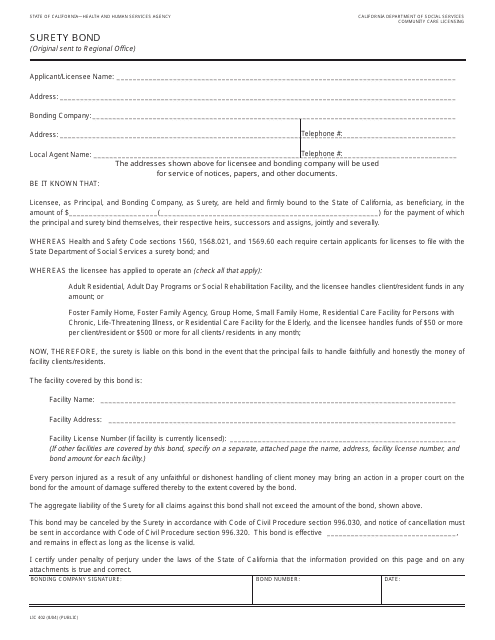

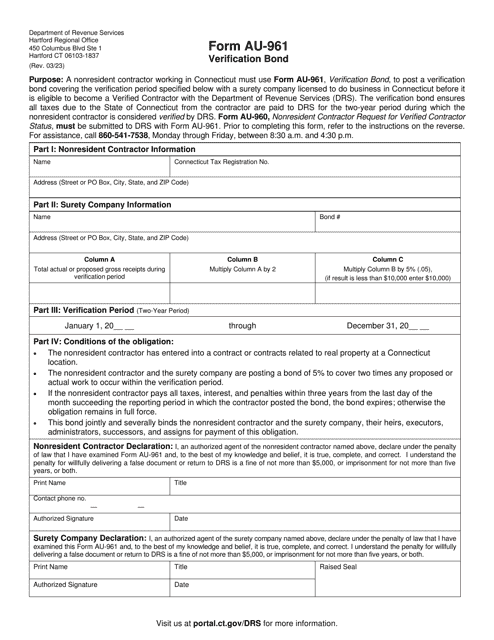

This Form is used for obtaining a surety bond in California. Surety bonds are a type of insurance that provides financial protection in case the party being bonded fails to fulfill their obligations. This document is required for various business activities in California.

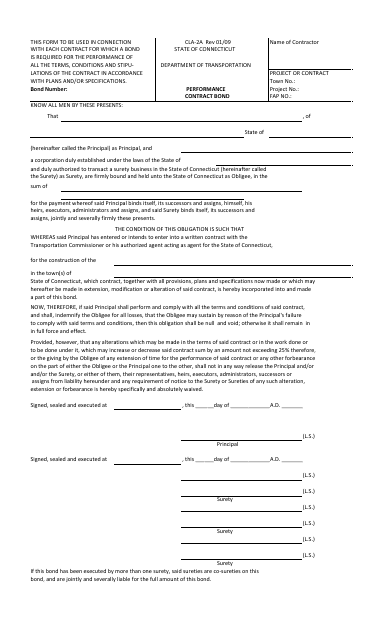

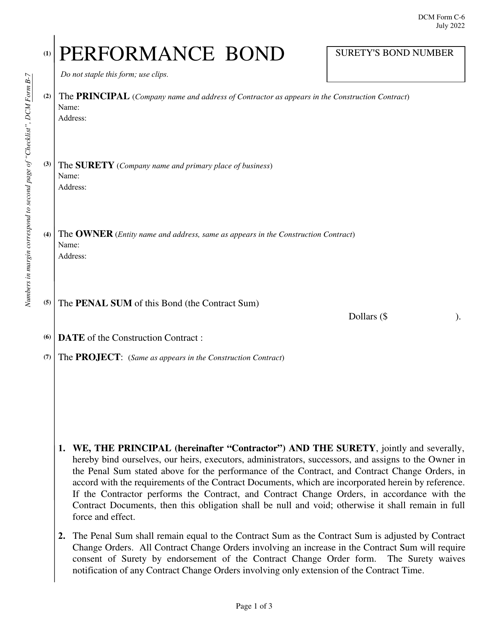

This Form is used for obtaining a performance contract bond in the state of Connecticut.

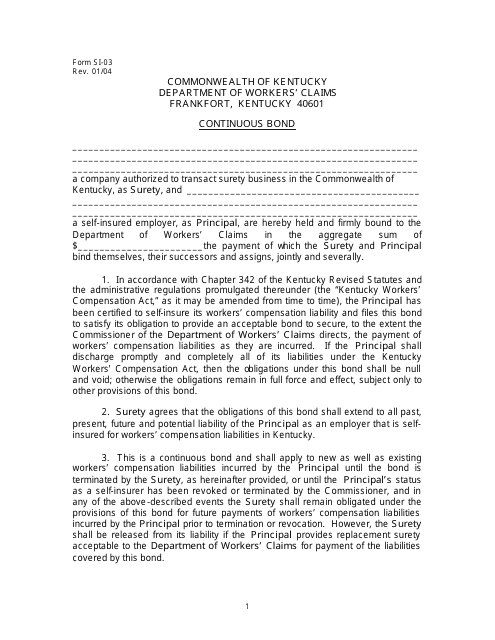

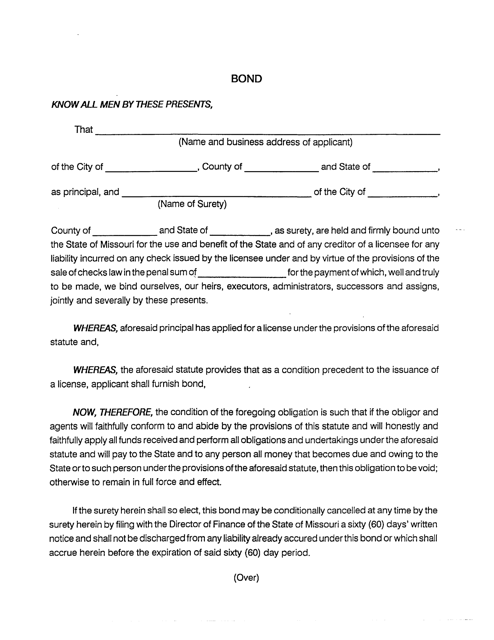

This Form is used for applying for a continuous bond in the state of Kentucky. It is required for businesses that engage in certain activities like importing or exporting goods. The bond acts as a guarantee for compliance with relevant laws and regulations.

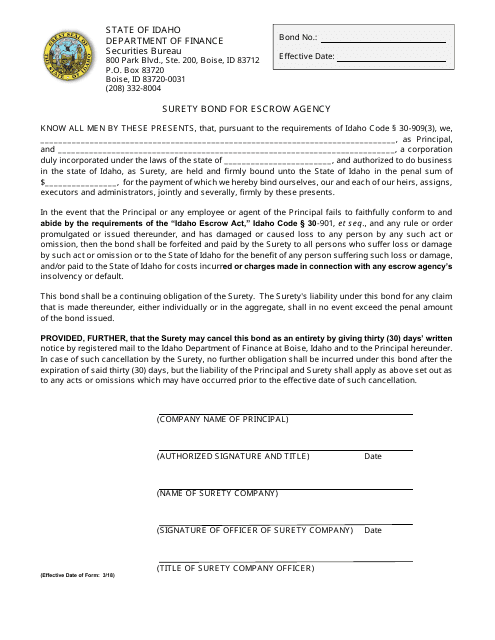

This document is used for obtaining a surety bond for an escrow agency located in Idaho. It is a type of insurance that protects clients in the event of financial loss or misconduct by the escrow agency.

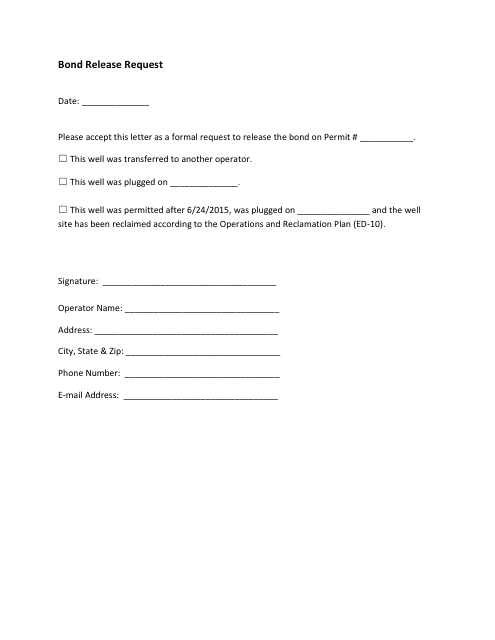

This form is used for requesting the release of a bond in the state of Kentucky. It allows individuals to formally request the return of their bond funds that were previously submitted as a guarantee for certain legal obligations.

This document is a type of bond used in Manitoba, Canada for penal purposes. It is a financial agreement between the accused individual and the court, ensuring that they will comply with certain conditions or pay a specified amount of money if they fail to do so.

This document is a Bond specific to the state of New Jersey. It is a form used for official financial agreements and obligations issued by the state.

This document is a Salt Water Disposal Damage Bond specific to the state of New Mexico. It is used to ensure that funds are available to cover any potential damage caused by the disposal of salt water in oil and gas operations in the state.

This form is used for requesting the release of a bond in the state of Oklahoma.

This document is used to add additional terms and conditions to a surety bond. It is a rider that allows for customization of the bond based on specific needs or requirements.

This document is used for assigning a Certificate of Deposit as collateral for a partnership bond.

This document is used for a corporation to provide collateral and indemnify the bond issuer.

This type of document is used for individuals who want to promise to be personally responsible for a financial obligation, without the need for a third-party surety.

This Form is used for individuals to agree to indemnify and hold harmless a party by pledging their own assets as security.

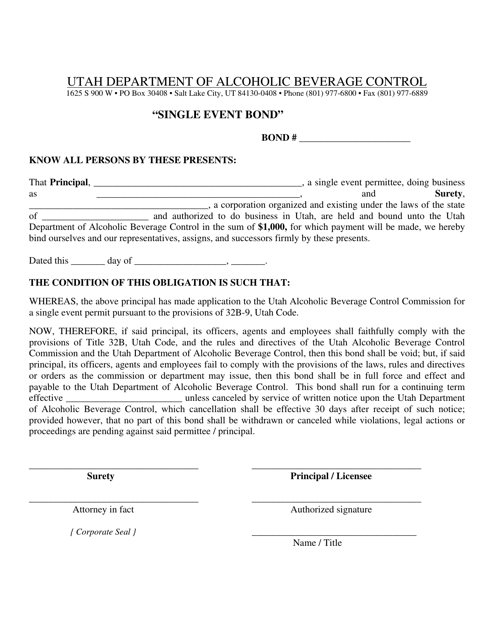

This document is for obtaining a bond for a single event in the state of Utah. It provides a guarantee for the event organizer to cover any financial losses or damages that may occur during the event.

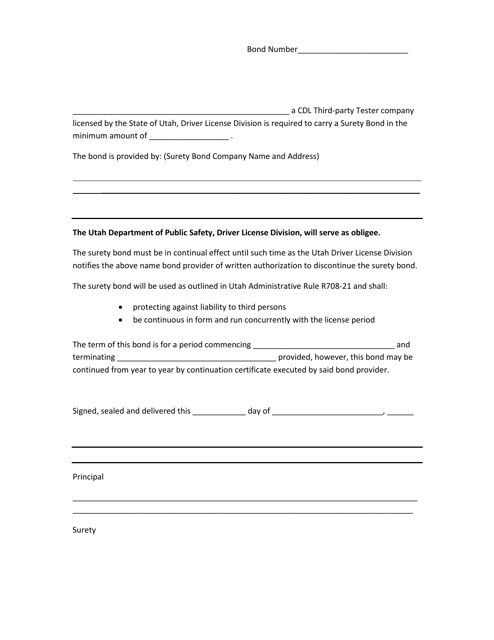

This Form is used for obtaining a surety bond in the state of Utah.

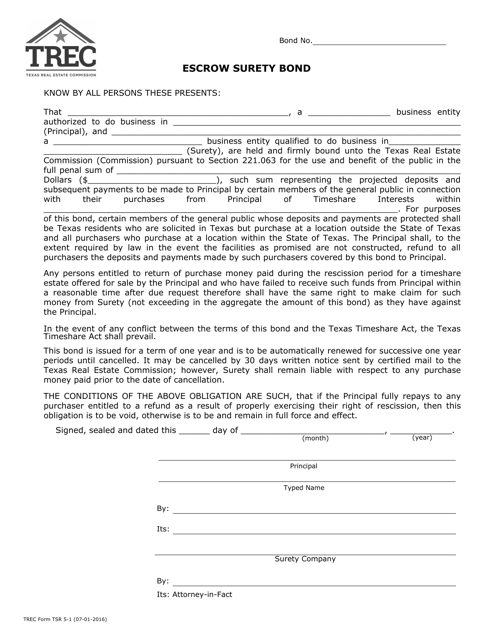

This document is used for obtaining an escrow surety bond in Texas.

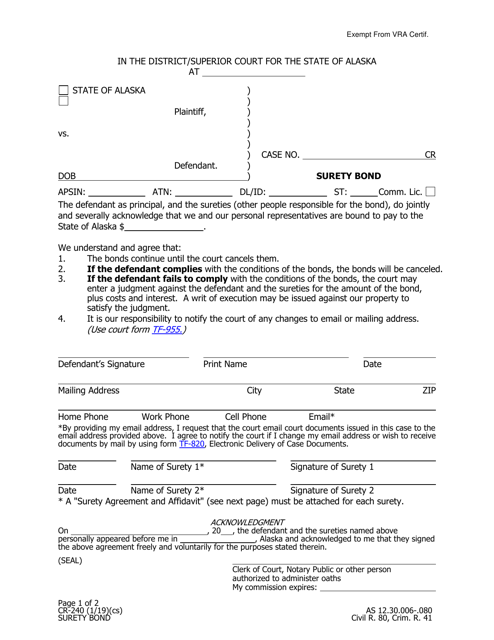

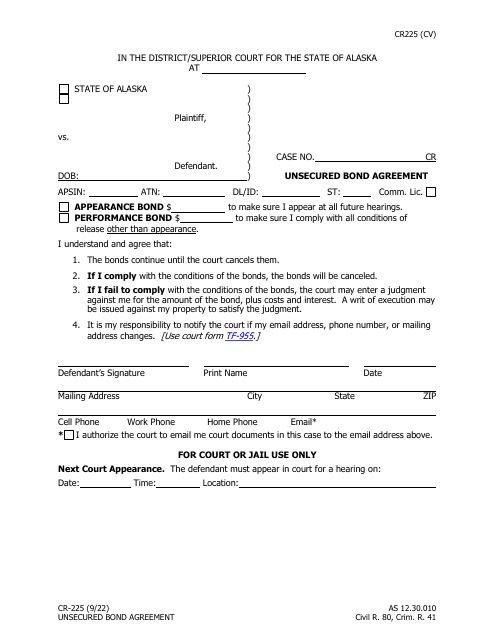

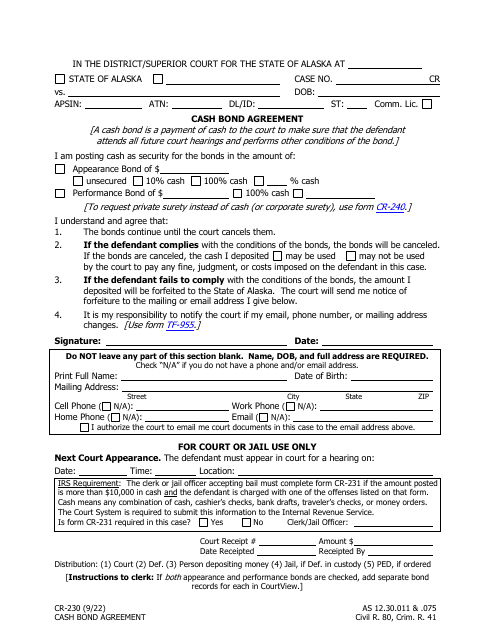

This form is used for obtaining a surety bond in Alaska. A surety bond is a form of insurance that provides financial security to guarantee the performance of a contract or certain obligations.

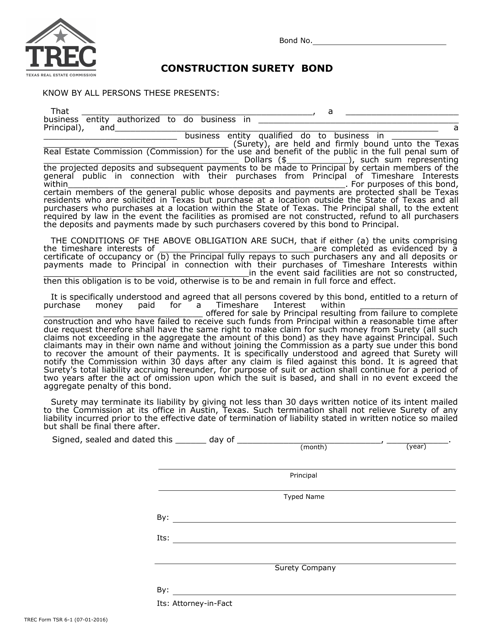

This Form is used for acquiring a Construction Surety Bond in the state of Texas. The bond is a form of insurance that guarantees the completion of a construction project.

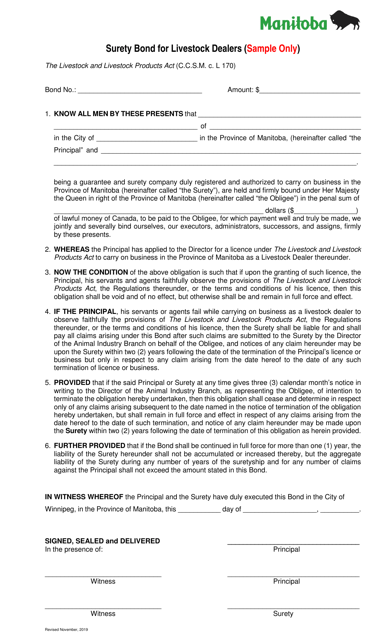

This document is a sample surety bond that is used by livestock dealers in Manitoba, Canada. A surety bond is a type of financial guarantee that ensures the livestock dealer will fulfill their obligations to the sellers and buyers of livestock. This bond helps to protect the interests of all parties involved in the livestock trade.

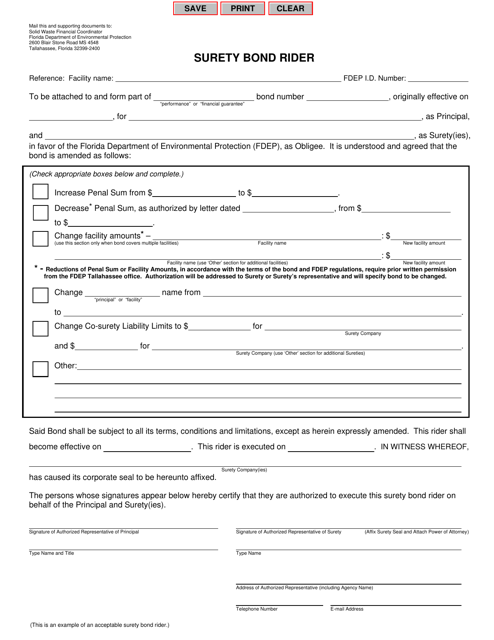

This document is a type of surety bond rider specific to the state of Florida. It is used to modify or add additional terms to an existing surety bond agreement.

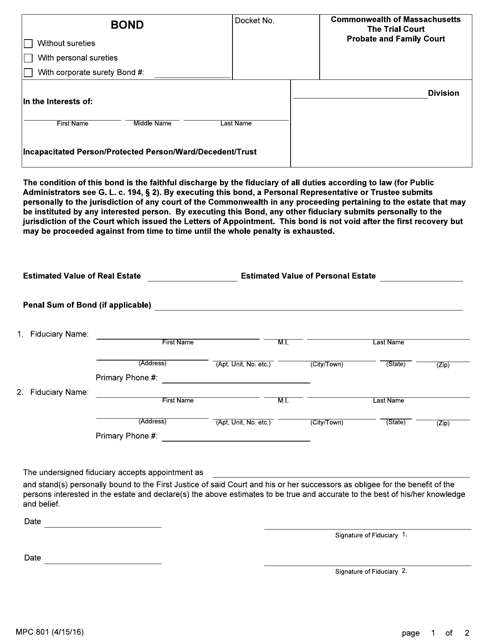

This form is used for obtaining a bond in Massachusetts. It is typically required for certain legal or financial transactions.

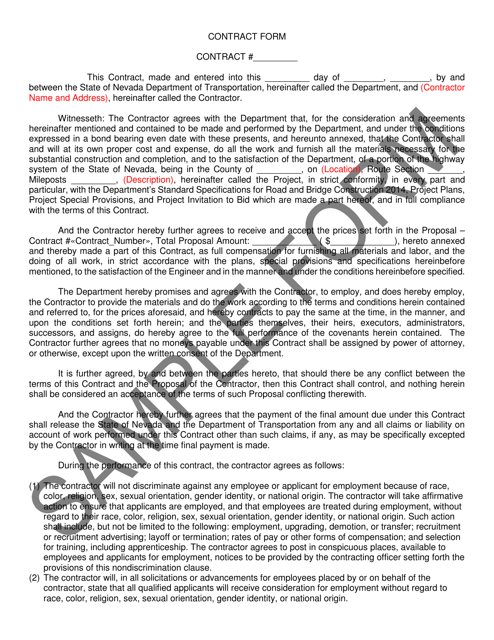

This Form is used for creating a contract and bond agreement at the federal level in Nevada.

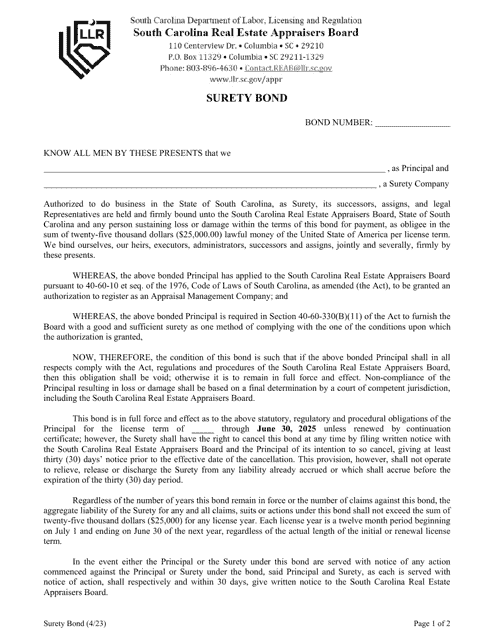

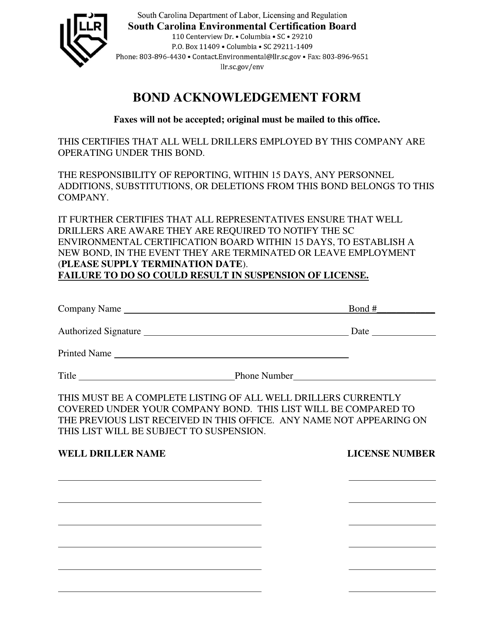

This form is used for acknowledging the receipt of a bond in the state of South Carolina.

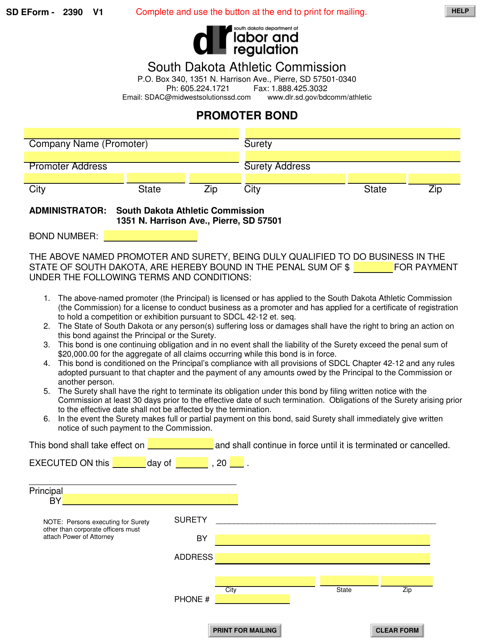

This Form is used for obtaining a promoter bond in South Dakota.

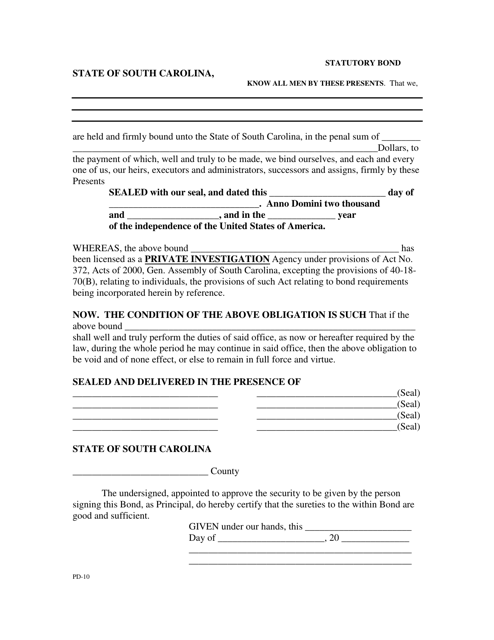

This form is used for obtaining a statutory bond in South Carolina. It is necessary for certain legal matters and ensures financial security for the involved parties.

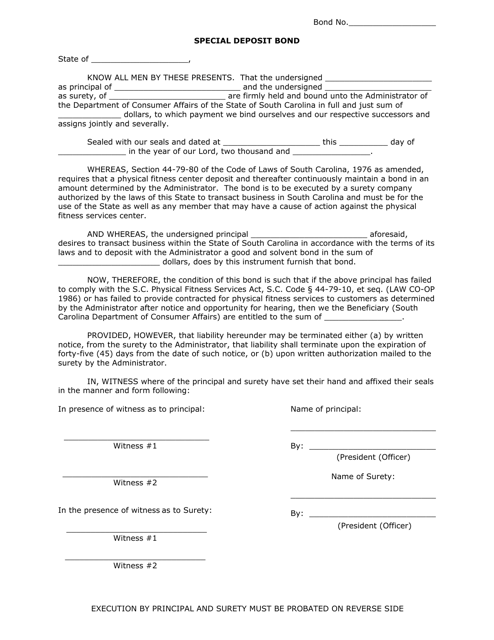

This document is used for requesting a special deposit bond in South Carolina.

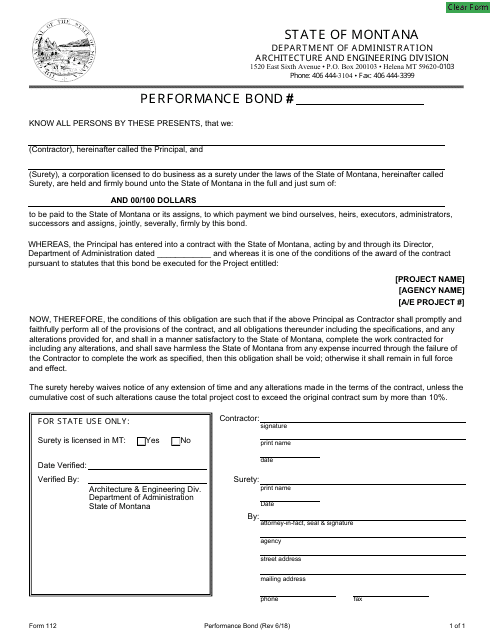

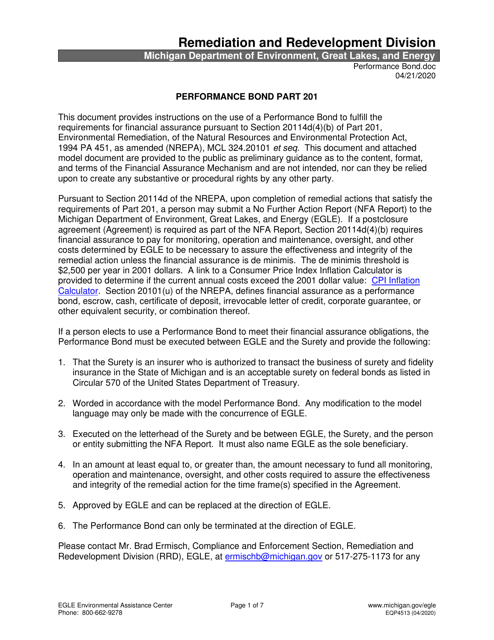

This form is used for submitting a performance bond as part of a construction project in the state of Michigan.