Research Credit Templates

Are you a business that invests in research and development? Are you looking to take advantage of research credits to help offset your tax liabilities? Look no further! Our comprehensive collection of documents, known as the research credit documents, is here to assist you in maximizing your tax benefits.

The research credit documents provide valuable information and instructions on how to claim research credits for increasing research activities. These credits can play a crucial role in reducing your overall tax burden and freeing up additional funds to invest back into your business.

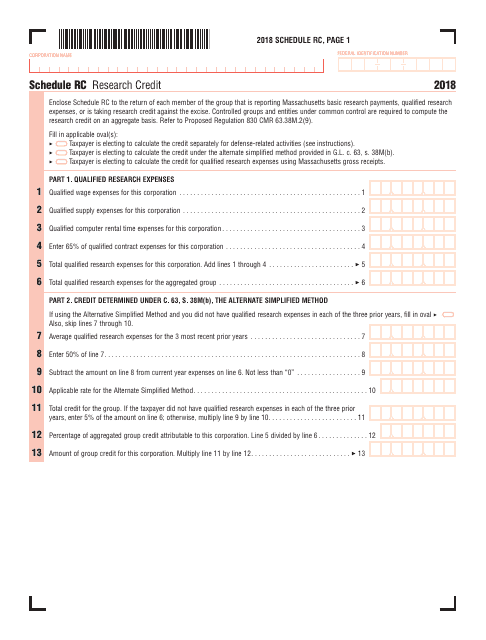

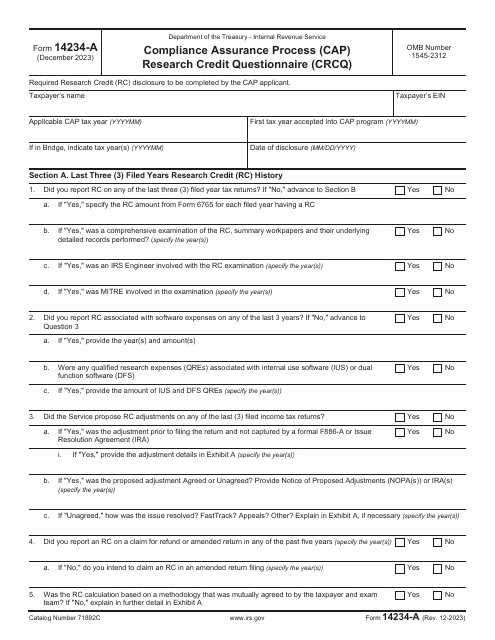

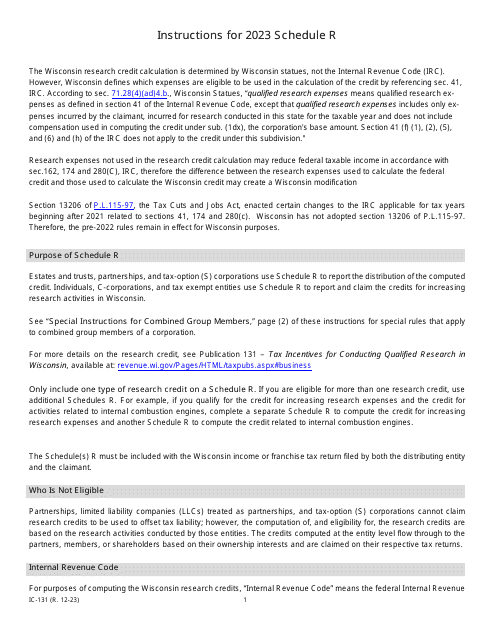

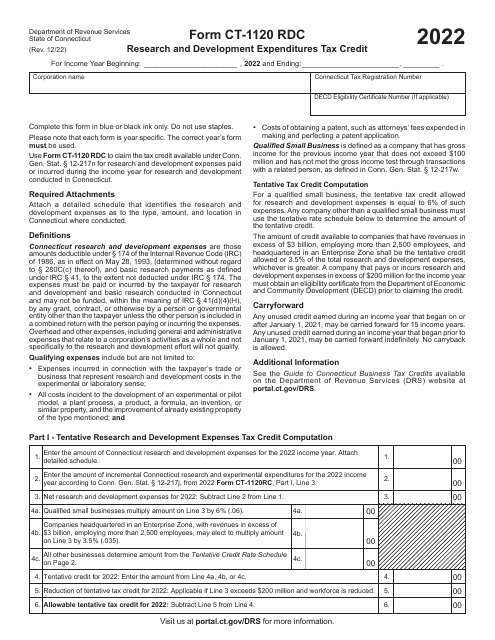

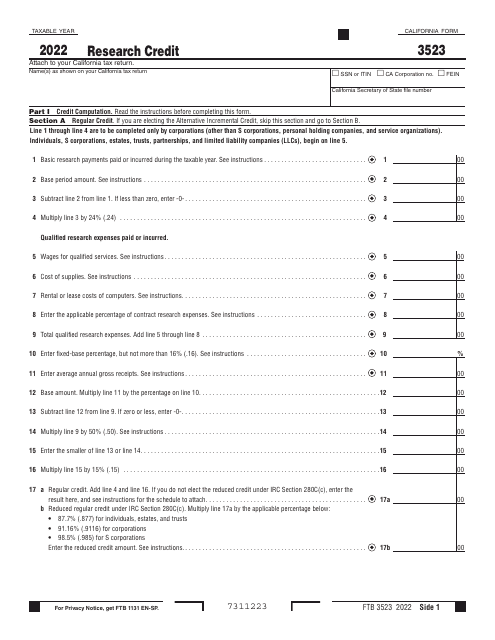

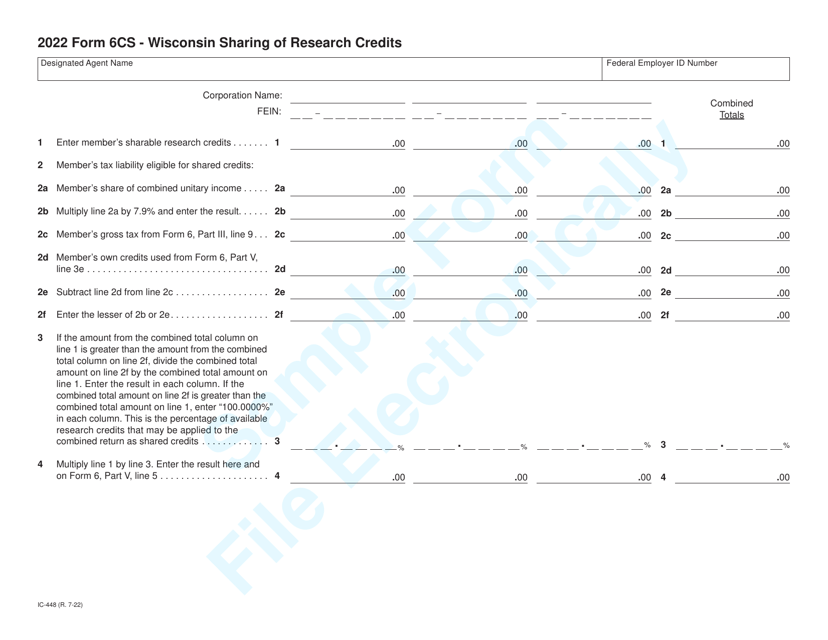

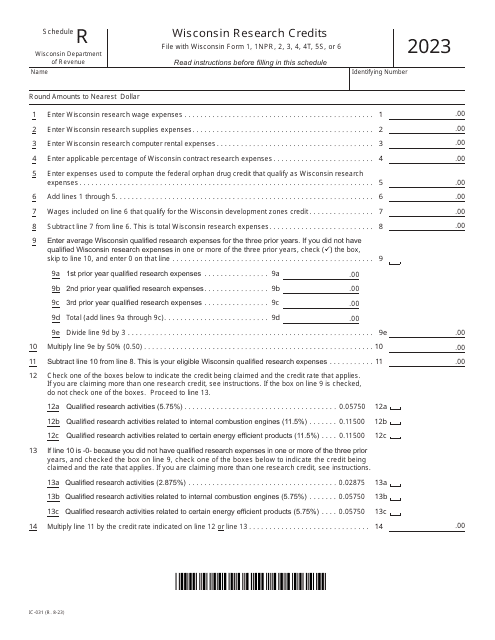

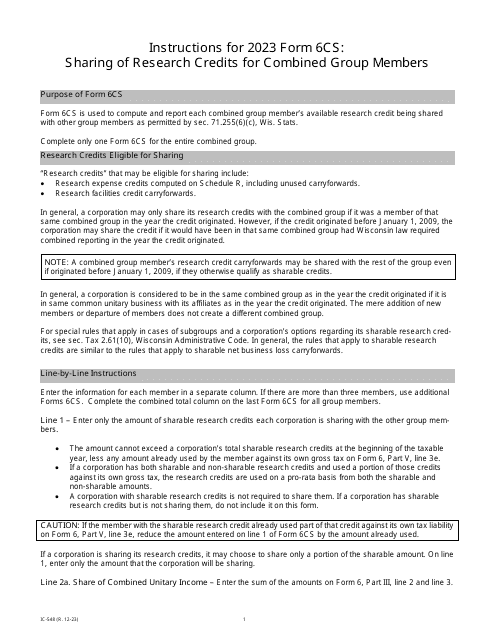

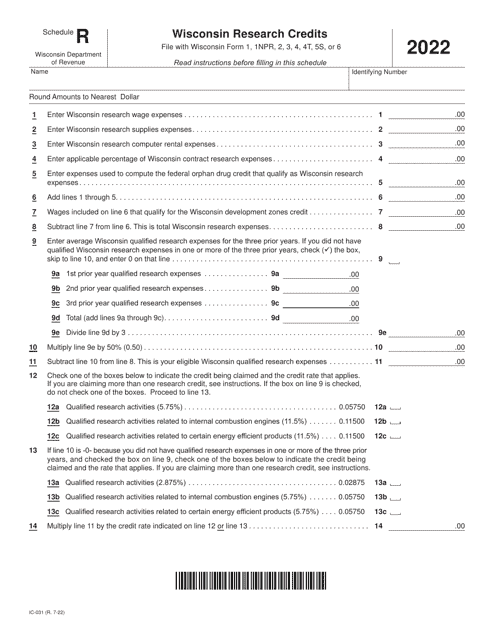

Whether you are located in Massachusetts, Wisconsin, or any other state, our collection includes specific schedules and forms tailored to meet the unique requirements of each jurisdiction. From Schedule RC Research Credit in Massachusetts to Form IC-031 Schedule R Wisconsin Research Credits, we have got you covered.

With our easy-to-follow instructions and guidelines, you can navigate the complex process of claiming research credits with confidence. Our documents will walk you through the eligibility criteria, qualifying research activities, and calculation methods required to take advantage of these credits.

Don't let the opportunity for research credits slip through your fingers. By leveraging the information and insights provided in the research credit documents, you can unlock substantial tax savings for your business. Maximize your research and development investments and propel your company forward.

Take the first step towards optimizing your tax planning strategy by exploring our research credit documents today. Empower your business and unlock the potential of research credits to drive innovation and growth. Your success starts here.

Documents:

16

This document is for claiming the Research Credit in Massachusetts. It provides a schedule for reporting and calculating the credit.

This is a document you may use to figure out how to properly complete IRS Form 6765

This form is used for claiming research credits in the state of Wisconsin.