Agricultural Cooperatives Templates

Are you looking to start or join an agricultural cooperative? Agricultural cooperatives, also known as agricultural cooperative or cooperative agriculture, are organizations formed by farmers and agricultural producers to collectively promote their interests and enhance their businesses.

At our website, we provide a wide range of resources and documents specifically tailored for agricultural cooperatives. Whether you are looking to incorporate your cooperative, file required tax reports, or submit necessary statements of information, we have the information and forms you need.

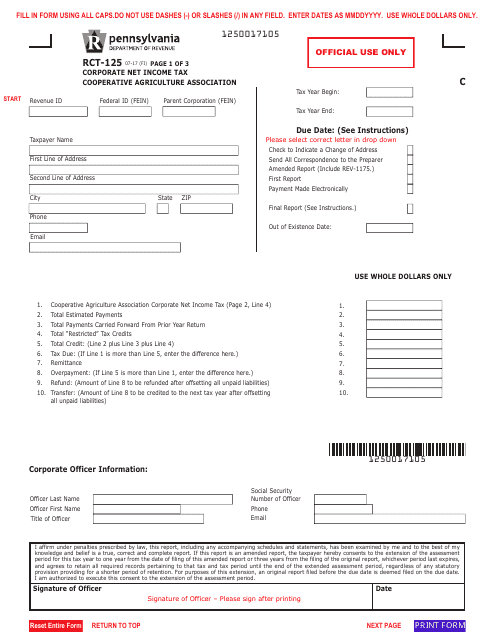

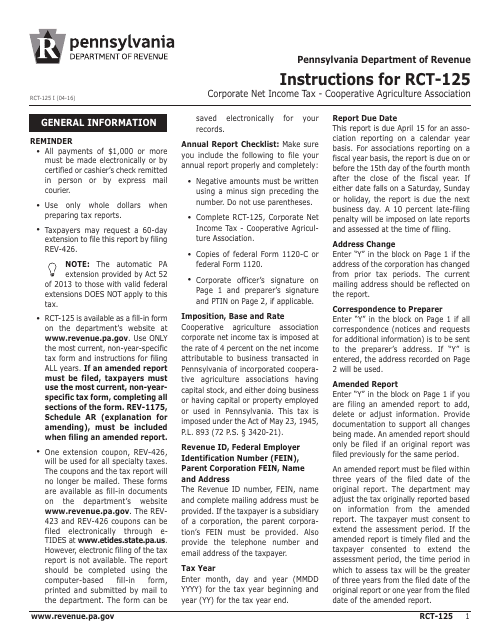

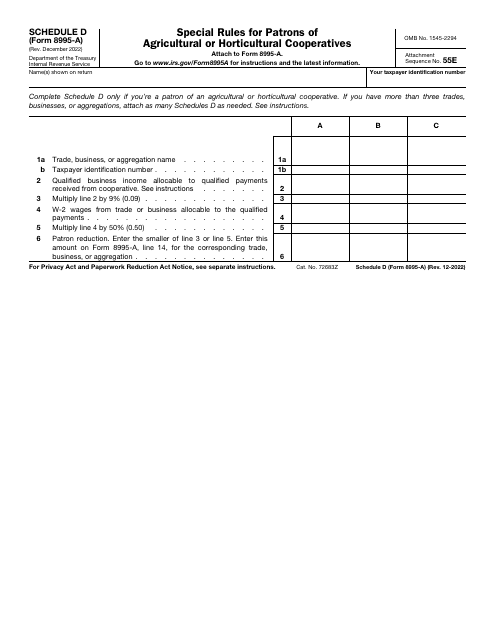

For instance, we offer documents such as the Form RCT-125 Corporate Net IncomeTax Report - Cooperative Agriculture Association - Pennsylvania, which enables you to accurately report your cooperative's net income for tax purposes. Alongside this, we also provide Instructions for Form RCT-125 Corporate Net Income Tax, ensuring you have clear guidance on how to complete the form correctly.

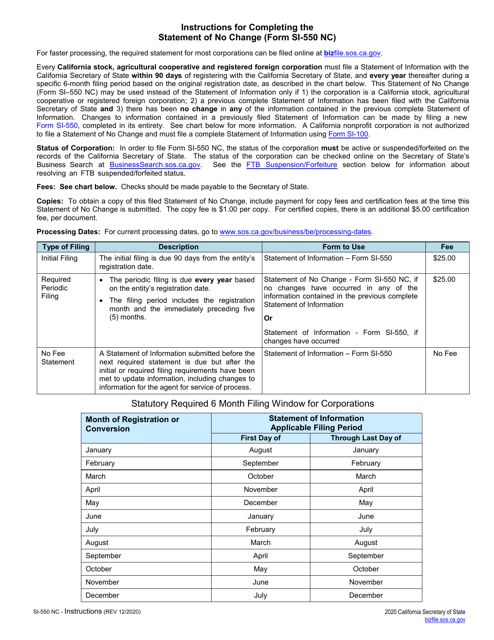

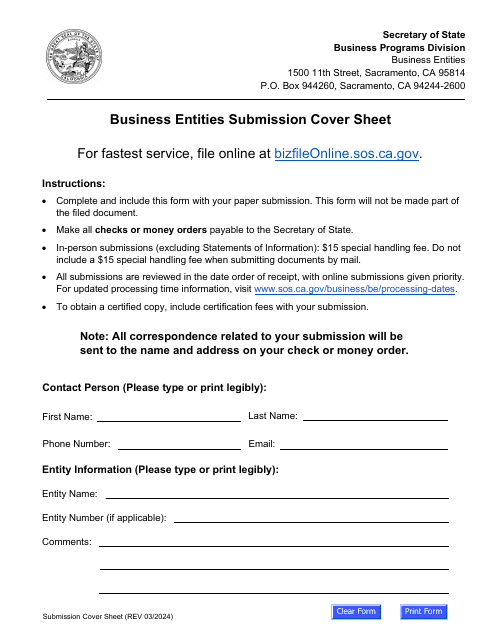

Additionally, if you are in California, we have the Form SI-550 Statement of Information for California Stock, Agricultural Cooperative, and Foreign Corporations. This form is crucial for maintaining accurate and up-to-date information about your agricultural cooperative, and our website provides both the form and detailed instructions on how to fill it out.

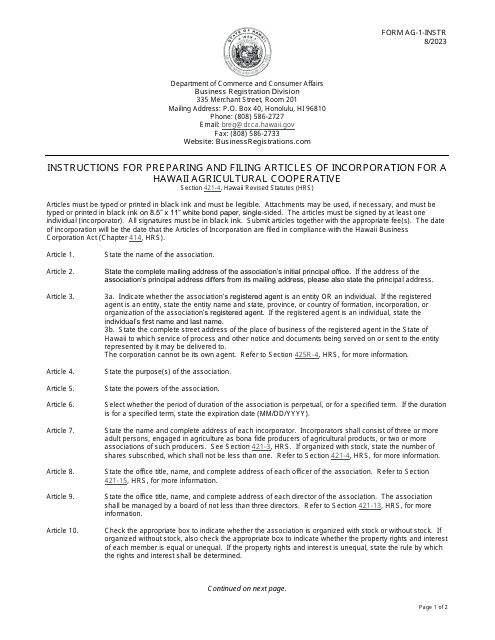

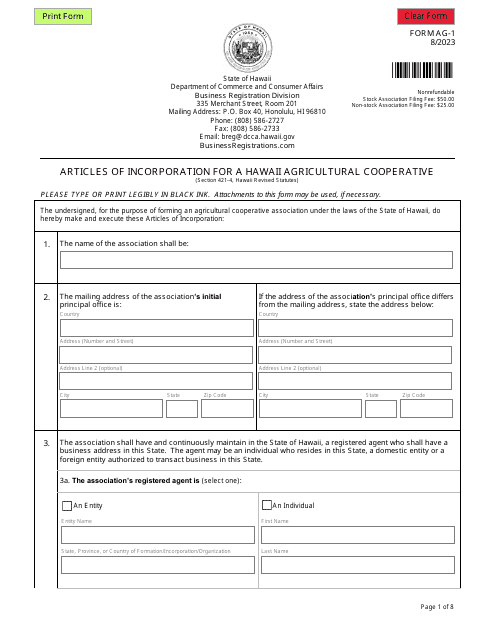

If you are based in Hawaii, we also have resources such as the Instructions for Form AG-1 Articles of Incorporation for a Hawaii Agricultural Cooperative. This document will guide you through the process of incorporating your cooperative in the state of Hawaii, ensuring you meet all the necessary requirements.

Our website is a comprehensive resource for agricultural cooperatives, providing a wide range of documents and information to support your cooperative's success. Whether you need to file tax reports, submit statements of information, or incorporate your cooperative, we have the resources you need.

Do you want to learn more about agricultural cooperatives or access the necessary documents to meet your cooperative's requirements? Visit our website today and explore our collection of resources and forms tailored specifically for agricultural cooperatives.

Documents:

10

This form is used for reporting the corporate net income tax of Cooperative Agriculture Associations in Pennsylvania.

This Form is used for filing corporate net income tax for Cooperative Agriculture Associations in Pennsylvania. It provides instructions on how to accurately complete the form and submit it to the appropriate authorities.

This is a document which must be filed by every California stock, agricultural cooperative and registered foreign corporation in order to provide the California Secretary of State with information about the business's officers, directors, registered agents, and address.