Assessment Notice Templates

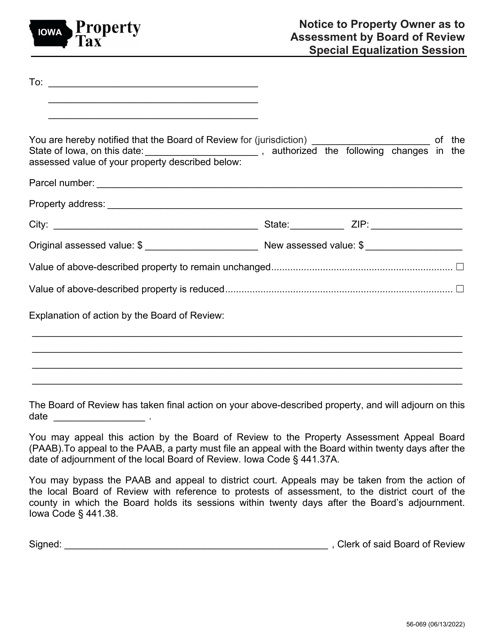

An assessment notice, also known as a property tax assessment notice or a notice of assessment, is an important document that provides individuals with information about the assessed value, taxable valuation, and property classification of their real estate or personal property.

This document is typically issued by the local government or tax authority and serves as a notification of the property's assessed value for tax purposes. It outlines the amount of taxes owed based on the property's valuation and classification.

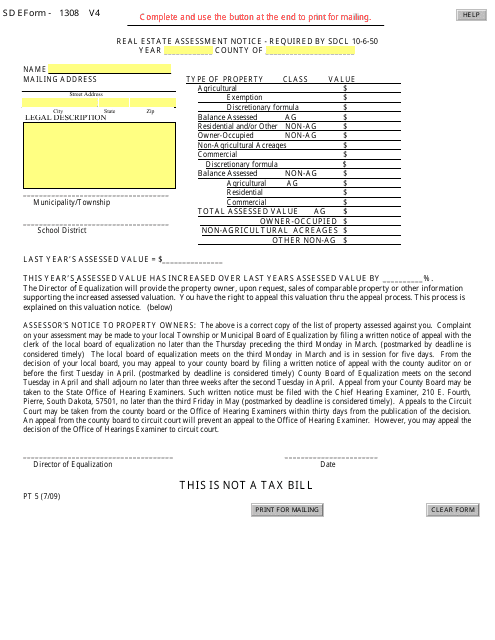

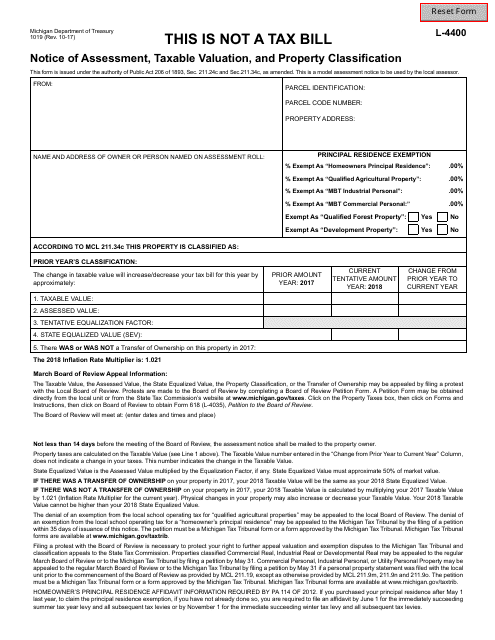

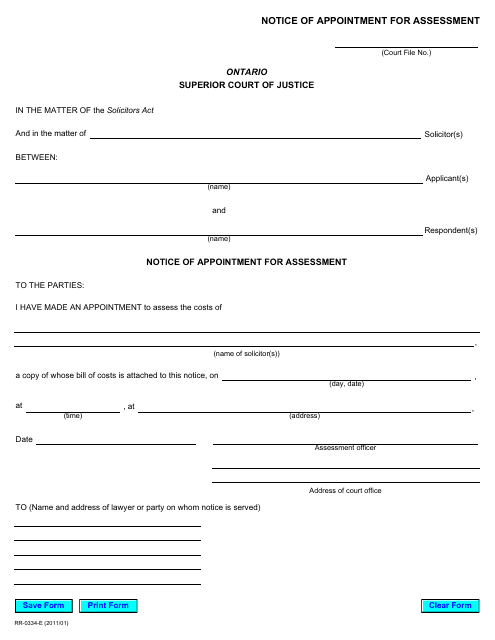

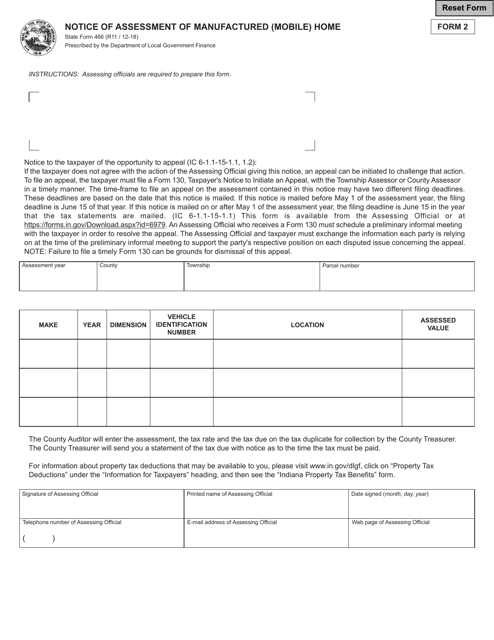

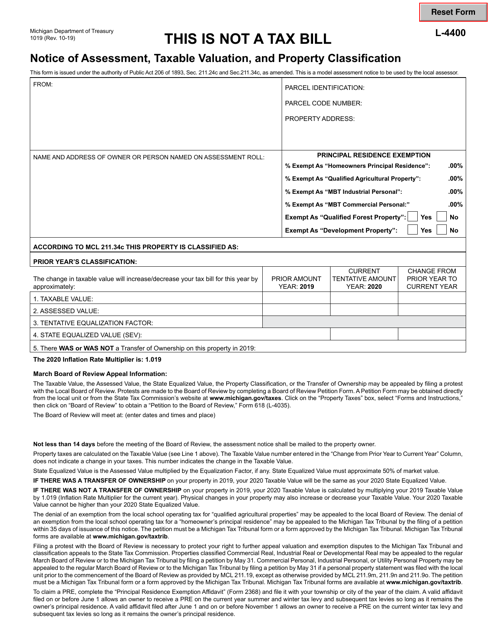

Assessment notices vary from one jurisdiction to another and may come in different forms, such as Form 1019 Notice of Assessment, Taxable Valuation, and Property Classification in Michigan, or Form RR0334 Notice of Appointment for Assessment in Ontario, Canada. These notices are designed to inform property owners about the details of their assessments, helping them understand the basis on which their taxes are calculated.

Understanding your assessment notice is crucial, as it allows you to verify the accuracy of the assessment and ensure that you are being taxed fairly. It also provides an opportunity to review any exemptions or deductions that may apply to your property.

If you receive an assessment notice, it's important to carefully review it and seek clarification from the relevant tax authority if you have any questions or concerns. Keeping track of your assessment notices can also be helpful for future reference, such as when applying for mortgage financing or appealing an assessment.

In summary, an assessment notice is a formal document that informs property owners about the assessed value, taxable valuation, and property classification of their real estate or personal property. It is essential for understanding and managing your property taxes effectively.

Documents:

15

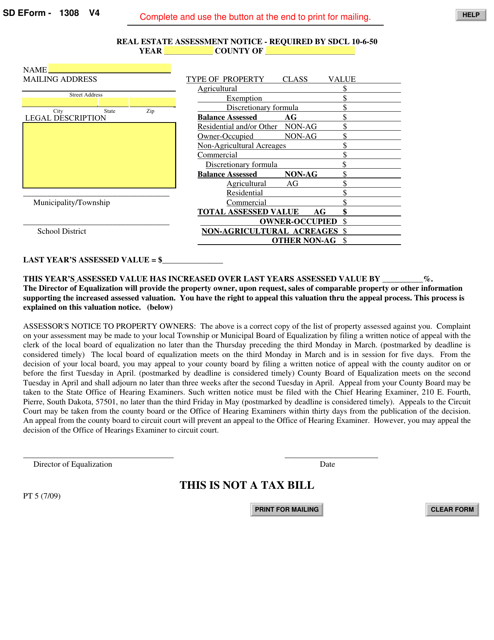

This Form is used for receiving a Real Estate Assessment Notice in South Dakota.

This form is used for notifying taxpayers in Michigan about the assessment, taxable valuation, and classification of their property for tax purposes. It provides information about the tax amount owed based on the property's value and classification.

This Form is used for notifying individuals of their appointment for assessment in Ontario, Canada.

This Form is used for notifying the assessment of a manufactured (mobile) home in Indiana.

This document is a real estate assessment notice specific to South Dakota. It is used to inform property owners about the assessed value of their property for tax purposes.

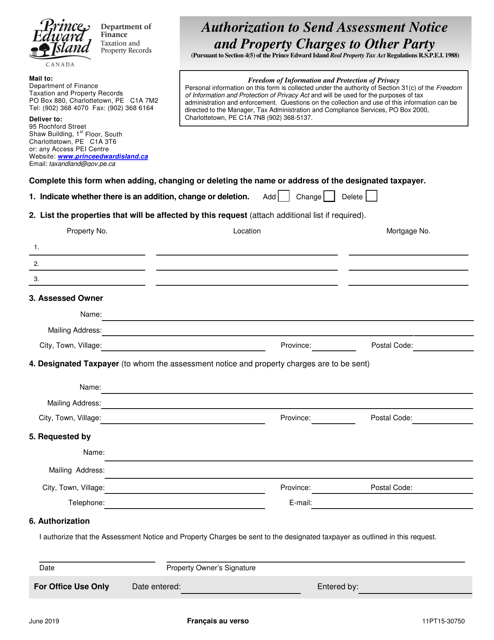

This document authorizes the sending of assessment notices and property charges to another party in Prince Edward Island, Canada.

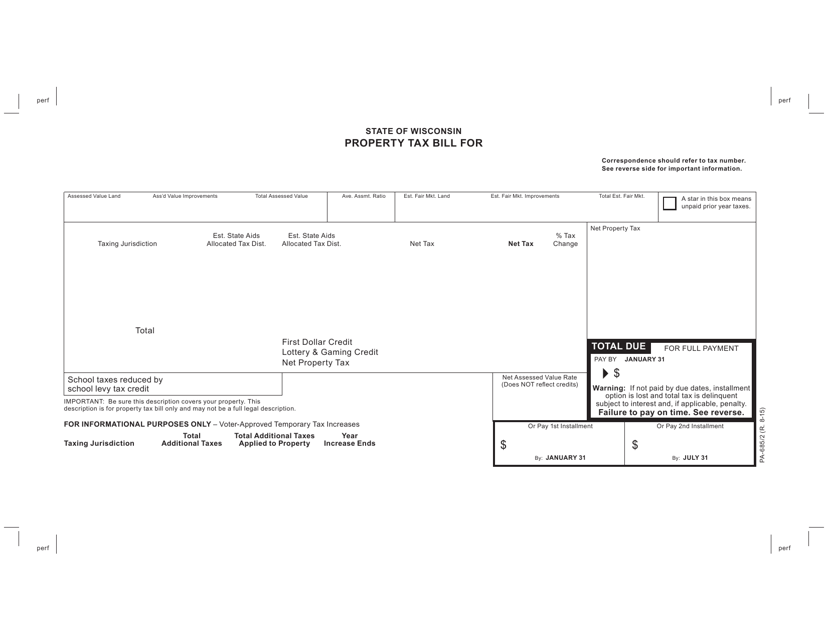

This document is used for paying property taxes in the state of Wisconsin. It provides a detailed bill of the amount owed for the property tax and instructions for payment.

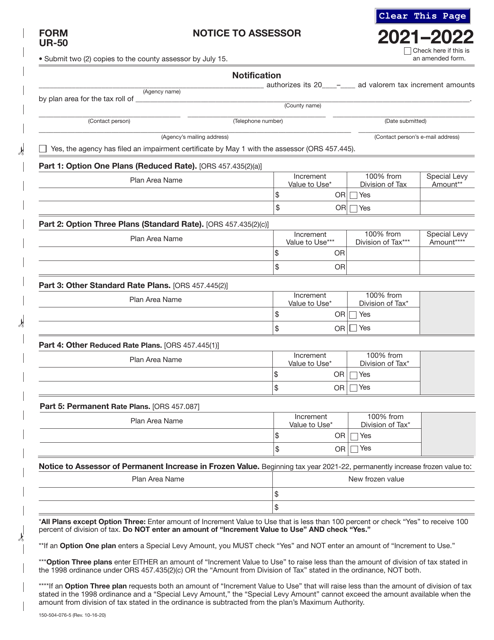

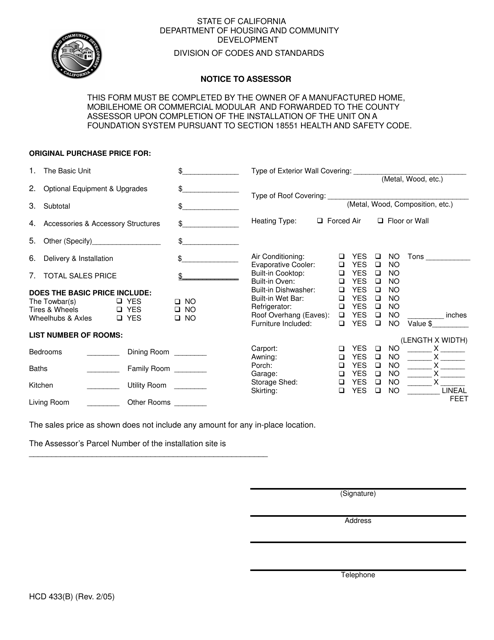

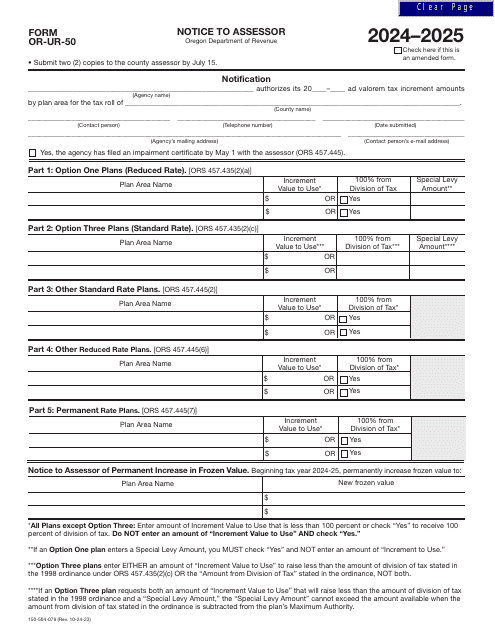

This form is used for notifying the assessor in California about certain changes or updates related to property assessment.

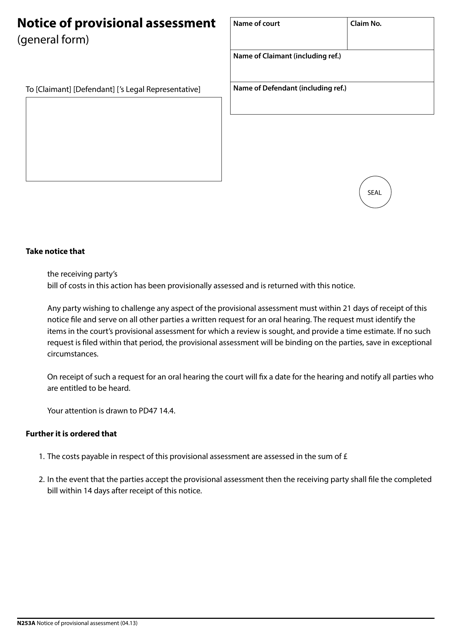

This Form is used for providing a provisional assessment of a situation or event in the United Kingdom.

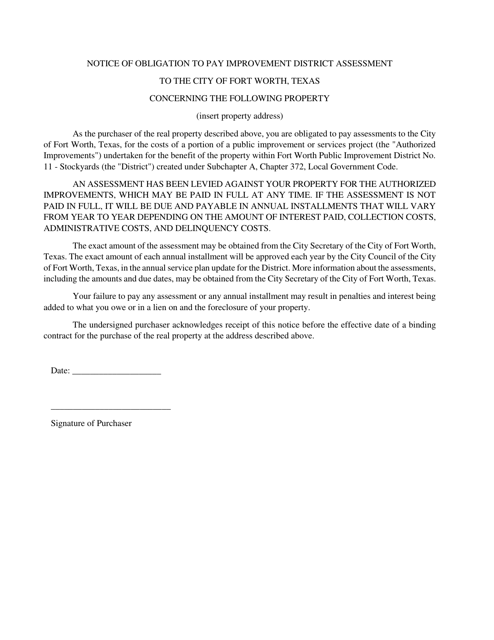

This document notifies property owners in the Stockyards Improvement District in Fort Worth, Texas of their obligation to pay an assessment for district improvements.