Corporate Minimum Tax Templates

Corporate Minimum Tax

Ensure your corporation is in compliance with the requirements of the Corporate Minimum Tax

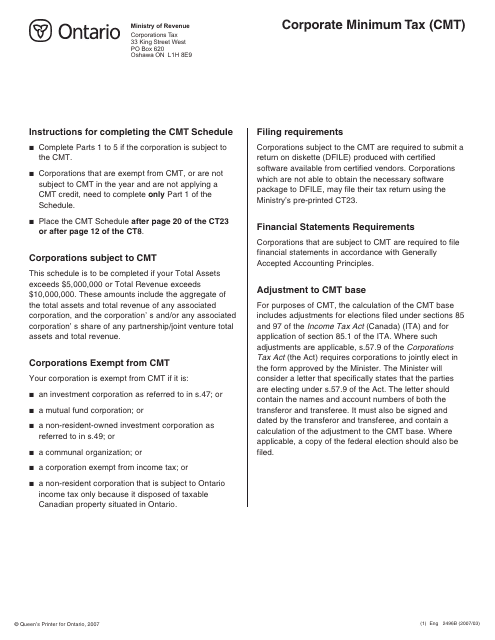

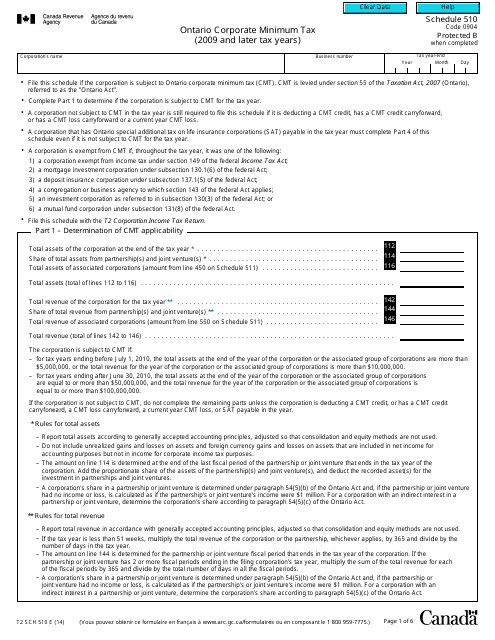

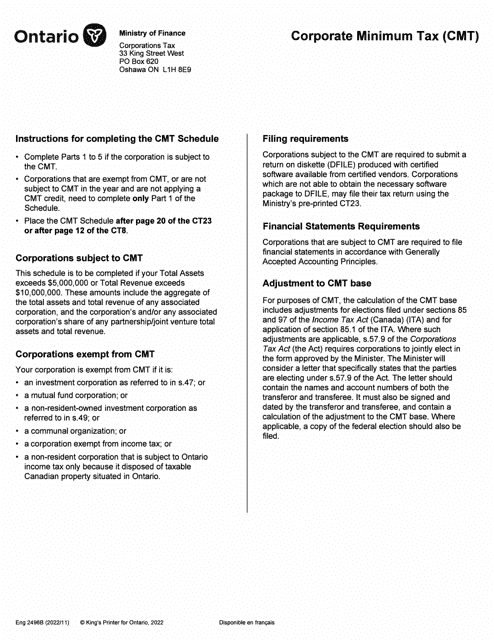

. This tax is imposed on corporations to ensure that they contribute a minimum amount to the government's revenue, regardless of their profitability. Also known as Corporation Minimum Tax, this tax is applicable in various jurisdictions, such as Canada.To determine your corporation's liability, you may need to fill out specific forms and schedules, depending on your jurisdiction. For instance, in Canada, you may have to complete Form T2 Schedule 510 Ontario Corporate Minimum Tax

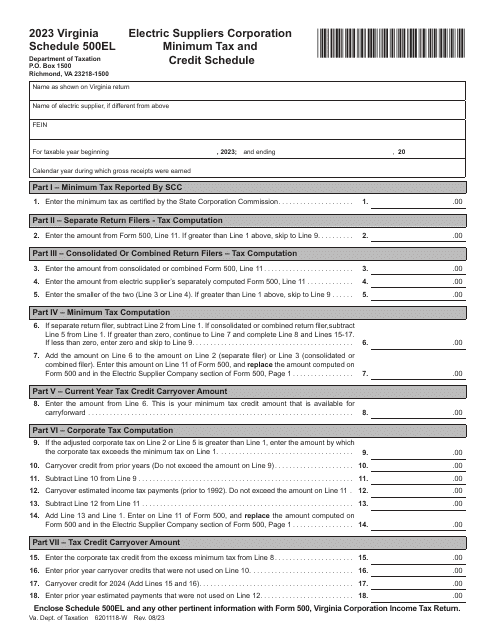

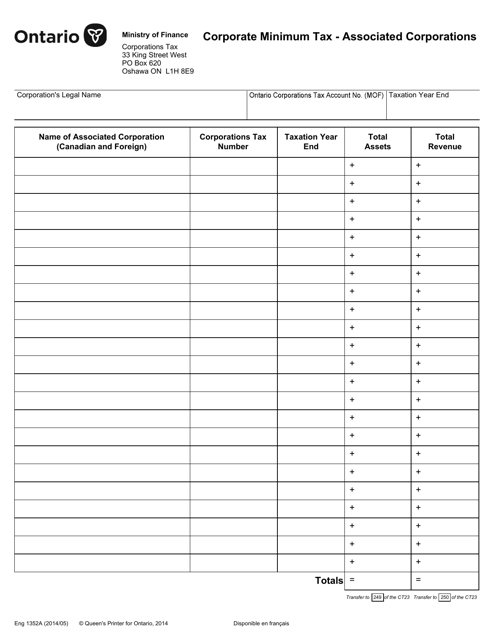

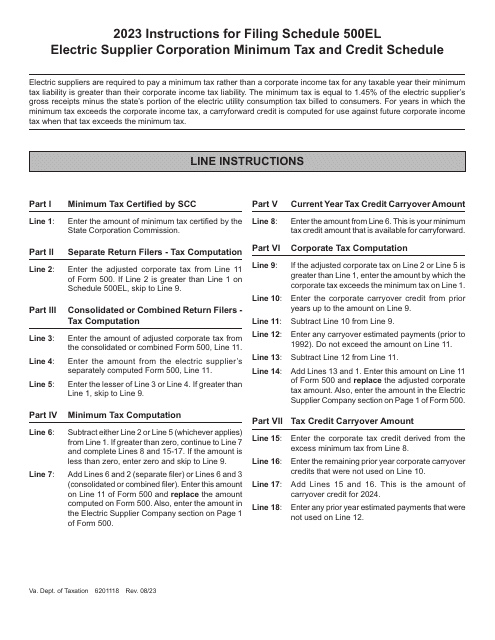

, Schedule 511 Ontario Corporate Minimum Tax, and Form 2496B Schedule 101 Corporate Minimum Tax (Cmt).Similarly, in some US states like Virginia, electric suppliers are required to fill out Schedule 500EL Electric Suppliers Corporation Minimum Tax and Credit Schedule. Additionally, there may be specific forms, such as Form 1352A Corporate Minimum Tax

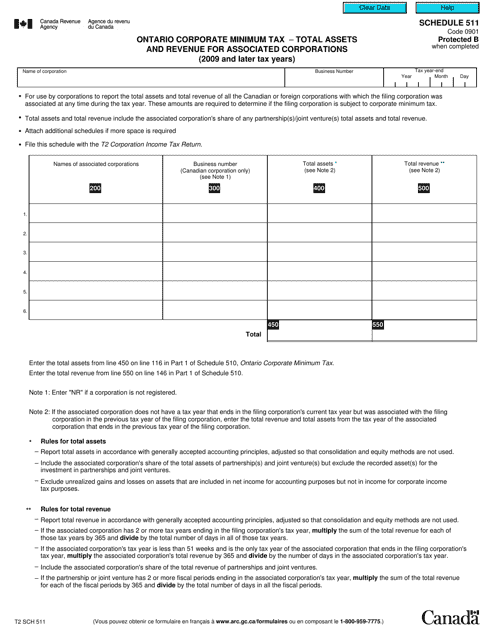

-Associated Corporations, which are meant to report the total assets and revenue for associated corporations in Ontario, Canada.Understanding and managing your corporation's minimum tax obligations can be complex, but it is crucial for regulatory compliance. Our services provide you with the necessary information and tools to accurately calculate your minimum tax liability and ensure that you meet all filing requirements for your jurisdiction.

At Templateroller.com, we are committed to assisting corporations in navigating the complexities of corporate minimum tax regulations. Our team of experts has in-depth knowledge and experience in this area and can provide you with the support and guidance you need to ensure compliance.

Contact us today to learn more about how we can help you with your corporate minimum tax obligations. Don't let this important aspect of your corporation's financial health go unaddressed - trust the experts at Templateroller.com to assist you every step of the way.

Documents:

7

This Form is used for reporting and calculating the Corporate Minimum Tax (Cmt) in the province of Ontario, Canada.

This form is used for reporting and calculating the Ontario Corporate Minimum Tax for Canadian corporations for the tax years 2009 and later.

This form is used for calculating and reporting the corporate minimum tax for associated corporations in the province of Ontario, Canada.

This form is used in Canada for reporting the total assets and revenue of associated corporations when calculating the Ontario Corporate Minimum Tax for tax years 2009 and later.

This form is used for calculating and reporting the Corporate Minimum Tax (CMT) in Ontario, Canada. It is required for certain corporations to determine the minimum tax they owe based on their Ontario taxable income.