Annualized Income Installment Method Templates

The Annualized Income Installment Method, also known as the AIIM, is a tax calculation method used by individuals, estates, and trusts to determine their estimated tax payments. This method allows taxpayers to avoid penalties for underpayment of taxes by calculating their payments based on their income and deductions throughout the year.

With the AIIM, taxpayers can calculate their estimated tax payments on a more accurate and timely basis, rather than making equal payments throughout the year. This method takes into account fluctuations in income and deductions, providing a more realistic representation of the taxpayer's tax liability.

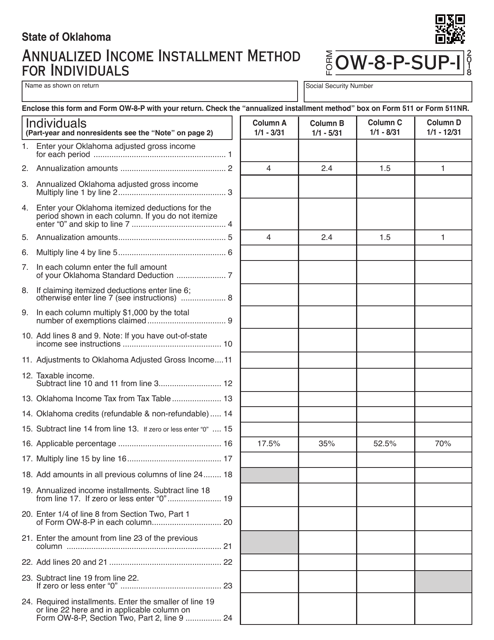

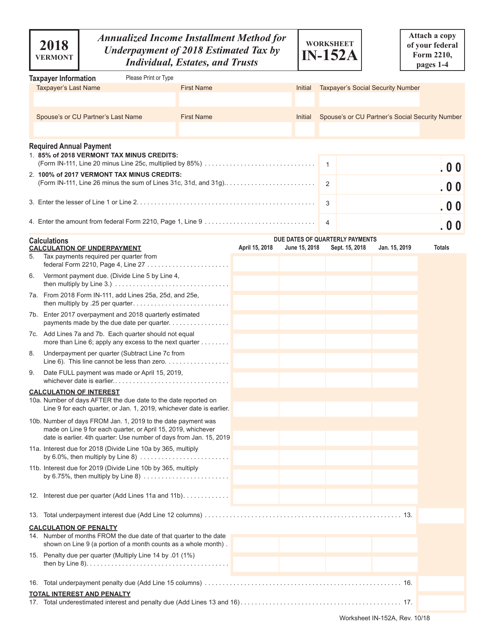

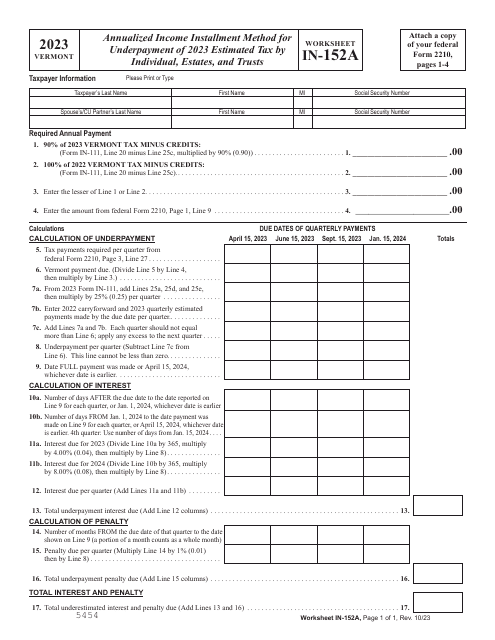

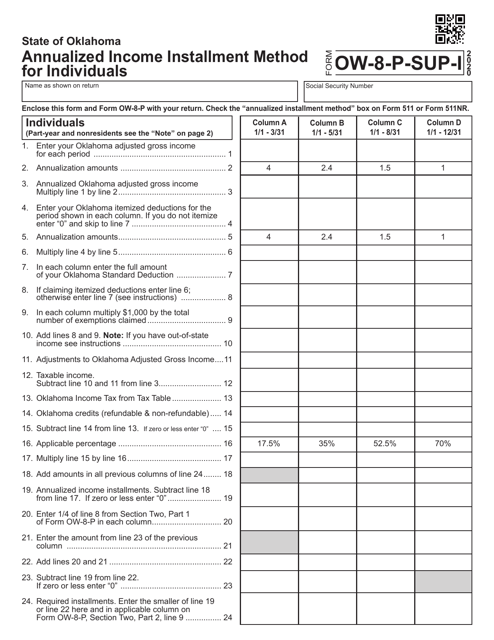

The AIIM is used by various states, including Oklahoma and Vermont, as indicated by the OTC Form OW-8-P-SUP-I and Worksheet IN-152A. These forms provide detailed instructions and calculations for individuals, estates, and trusts to determine their annualized income installment method.

By utilizing the AIIM, taxpayers can ensure they are meeting their tax obligations in a timely and accurate manner, avoiding any penalties or interest charges for underpayment. This method provides flexibility and accuracy, helping taxpayers better manage their tax payments throughout the year.

If you are an individual, estate, or trust looking to optimize your estimated tax payments, the Annualized Income Installment Method is a valuable tool to consider. Take advantage of this method to calculate your tax liability more effectively and stay compliant with your tax obligations.

Documents:

8

This document is a worksheet that individuals, estates, and trusts in Vermont can use to calculate their annualized income installment for the underpayment of estimated tax for the year 2018. It helps determine if any additional tax needs to be paid to avoid penalties.

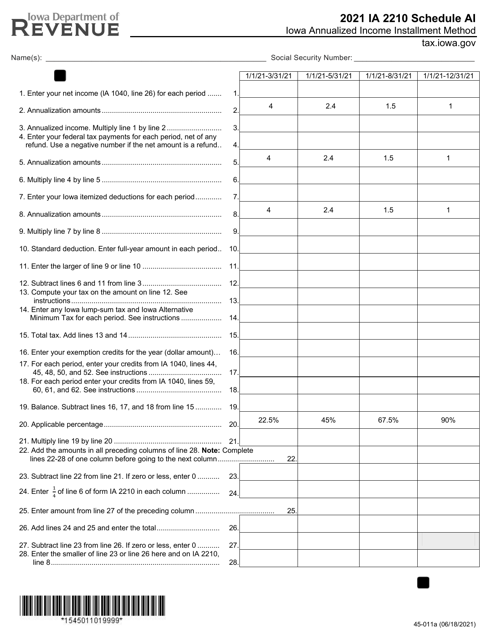

This Form is used for calculating and reporting Iowa state income tax using the Annualized Income Installment Method in Iowa.