General Excise Tax Templates

The General Excise Tax, also known as the General Excise Taxes, is a mandatory levy imposed by various states and countries. This tax applies to a wide range of business activities and transactions.

If you are a business owner or operator, it is crucial to be familiar with the requirements and regulations surrounding the General Excise Tax. Failure to comply with these guidelines can result in penalties and legal consequences.

Our website provides a comprehensive resource on the General Excise Tax, featuring a wide range of information and documents to help you navigate this complex system. Whether you are seeking specific forms, instructions, or exemptions, our platform has it all.

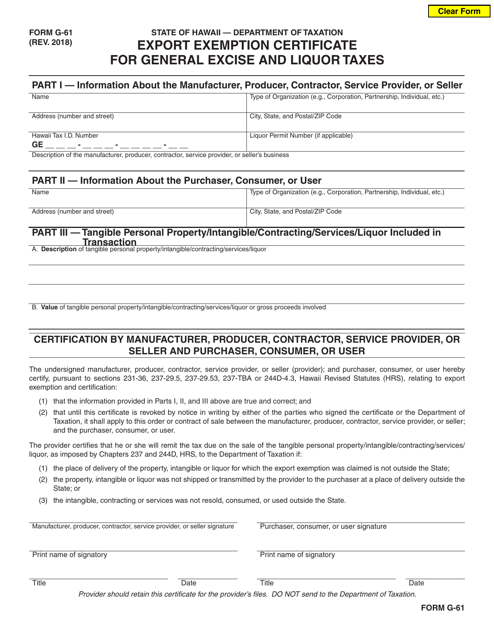

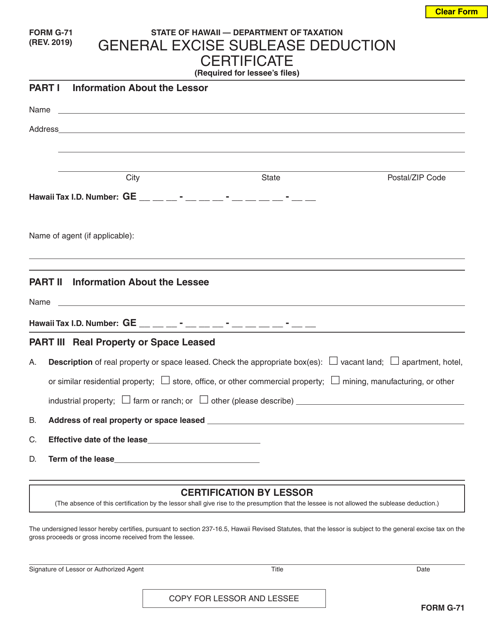

For instance, you can find documents such as the Form G-71 General Excise Sublease Deduction Certificate, which allows you to claim deductions for leasing and subleasing transactions. Additionally, the Form G-61 Export Exemptiion Certificate for General Excise and Liquor Taxes is another valuable document that can assist businesses involved in export activities.

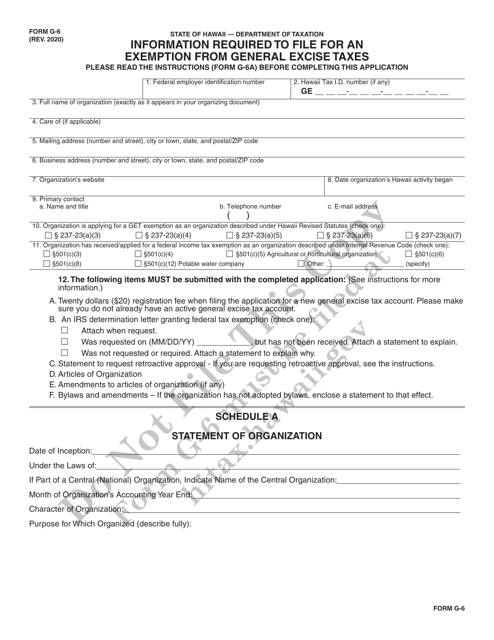

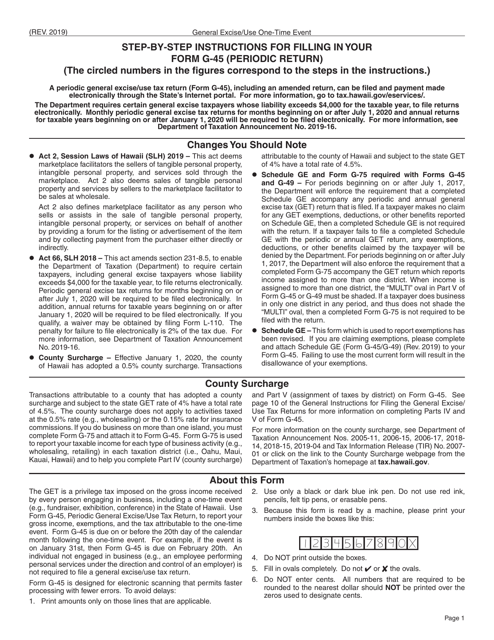

If you need assistance in filing your tax returns, you can refer to the Instructions for Form G-45 General Excise/Use Tax Return. This detailed guide will walk you through the process step by step, ensuring accuracy and compliance.

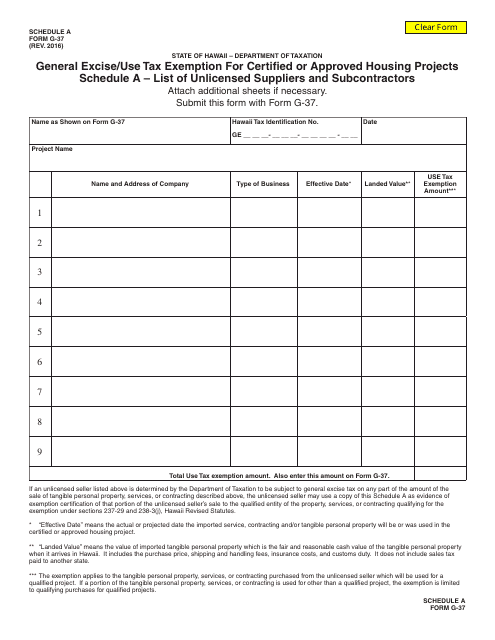

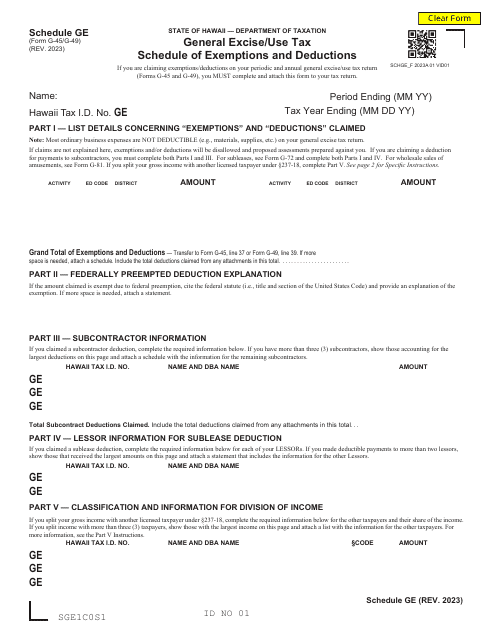

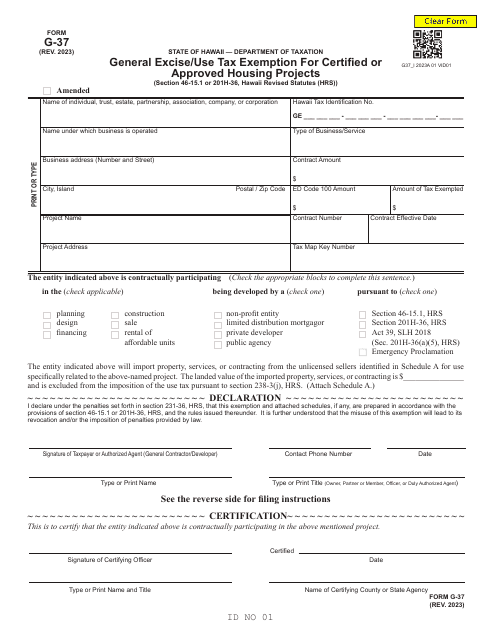

Moreover, we offer resources like the Form G-37 General Excise/Use Tax Exemption for Certified or Approved Housing Projects, which provides exemptions for housing initiatives approved by the authorities. Lastly, for businesses looking to understand the exemptions and deductions available, the Form G-45 (G-49) Schedule GE General Excise/Use Tax Schedule of Exemptions and Deductions is an indispensable tool.

Our website aims to simplify the General Excise Tax process for businesses and individuals, bringing clarity and ease to this often-challenging area. With our extensive range of documents and resources, you can stay informed and confidently navigate your tax obligations. Explore our site today and discover the wealth of information available to you.

Documents:

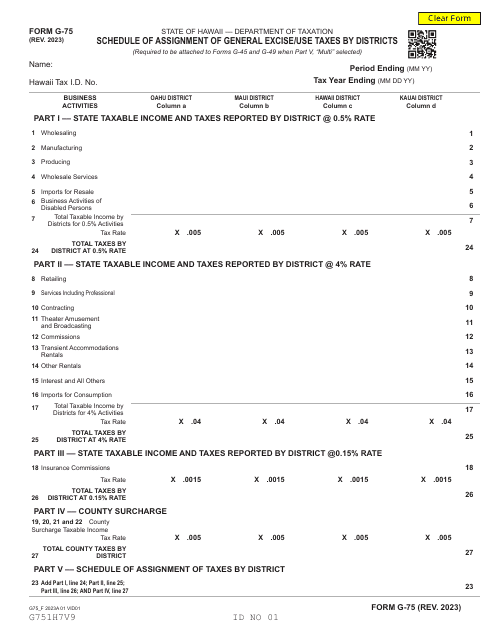

23

This form is used for listing unlicensed suppliers and subcontractors for claiming a general excise/use tax exemption for certified or approved housing projects in Hawaii.

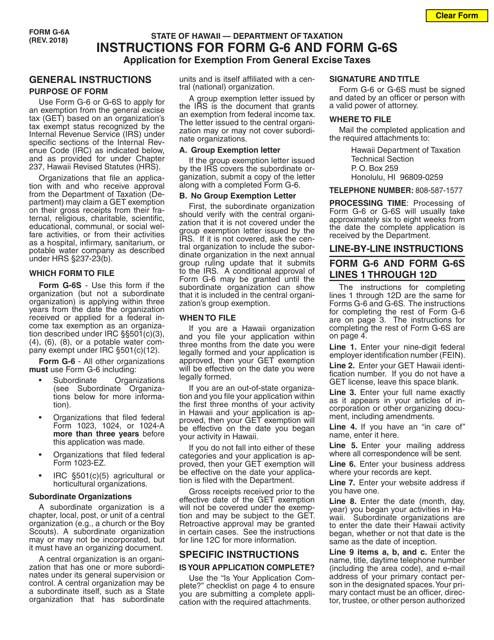

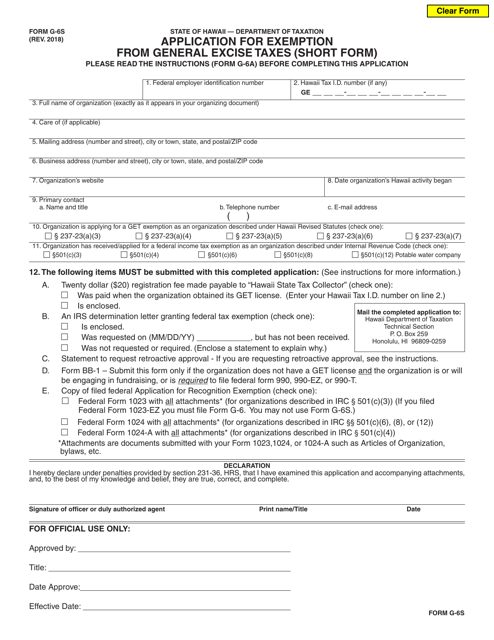

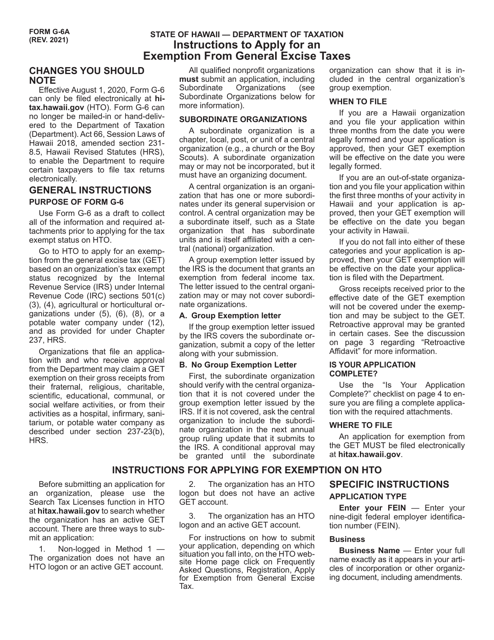

This Form is used for applying for exemption from general excise taxes in Hawaii using the short form version.

This Form is used for filing General Excise/Use Tax Returns in Hawaii. It provides instructions on how to properly fill out and submit the form.

This Form is used for filing the One Time Use General Excise/Use Tax Return in the state of Hawaii. It provides instructions on how to report and pay the general excise tax and use tax for a one-time transaction.

This document provides instructions for filing a one-time use General Excise/Use Tax Return in the state of Hawaii. It explains how to complete Form G-45 OT and fulfill tax reporting requirements.