Farm Tax Credits Templates

Are you a farmer looking to save on your taxes? Look no further than our farm tax credits! These valuable incentives are designed to support agricultural producers like you and can help you reduce your tax liability while supporting sustainable farming practices.

Our farm tax credits program offers a variety of opportunities for farmers to save on their taxes. Whether you're involved in organic foods production, farmland preservation, or making charitable donations to food pantries, there's a tax credit available to you. We understand the importance of supporting the farming community and want to ensure that you receive the benefits you deserve.

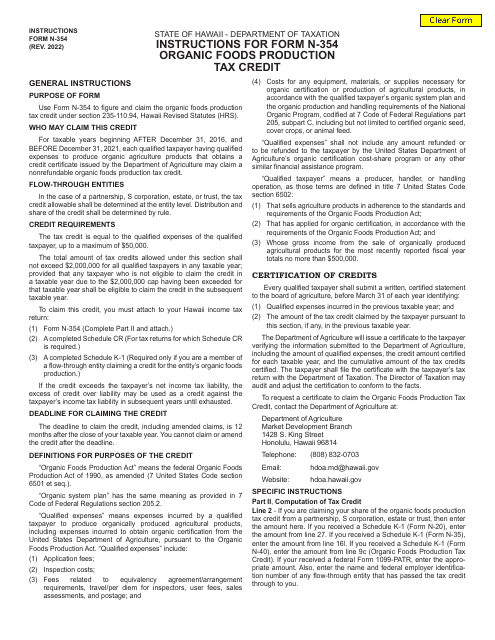

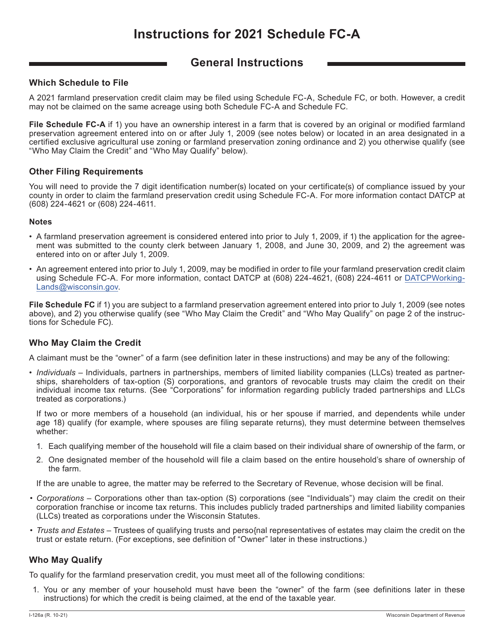

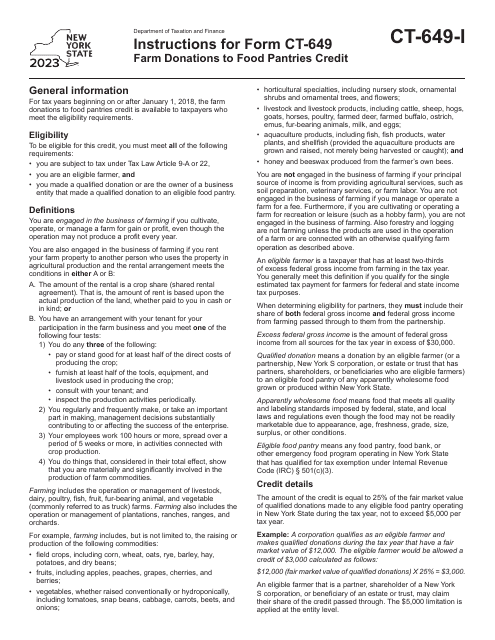

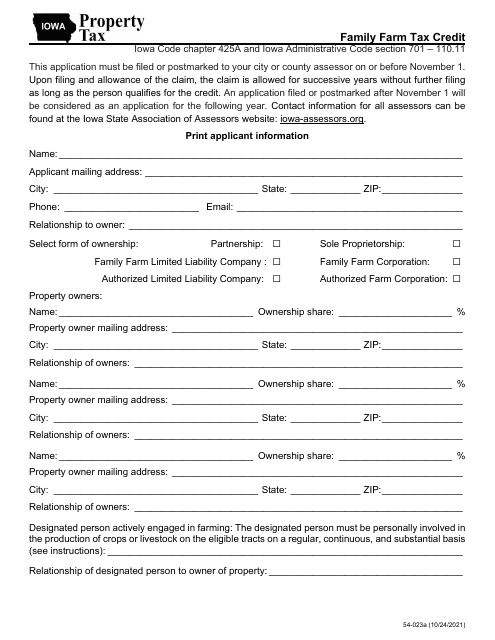

Take advantage of our easy-to-use, step-by-step instructions for each specific tax credit form. We provide clear guidance on how to complete each form accurately, maximizing your chances of qualifying for the tax credit. We offer detailed instructions for forms such as Form N-354 Organic Foods Production Tax Credit in Hawaii, Form IC-025AI Schedule FC-A Farmland Preservation Credit in Wisconsin, Form CT-649 Farm Donations to Food Pantries Credit in New York, and Form 54-023 Family Farm Tax Credit in Iowa.

Don't miss out on these valuable opportunities to save on your taxes and support sustainable farming. Start exploring our farm tax credits program today and see how much you can save. It's time to reap the benefits of your hard work while enjoying the financial advantages of these tax credits. Check out our farm tax credits program now and see how you can maximize your savings!

Documents:

5

This Form is used for claiming the Farmland Preservation Credit in Wisconsin. It provides instructions on how to complete and file Form IC-025AI Schedule FC-A.