Liability Bond Templates

Protect Your Business with a Liability Bond

Ensure the financial stability and security of your business with a liability bond, also known as a bond liability. Liability bonds provide a guarantee to third parties that your business will fulfill its obligations and responsibilities, providing them with the confidence and peace of mind they need when engaging in business with you.

Liability bonds serve as a form of insurance that protects your business from potential financial losses that may arise from legal claims or damages. By obtaining a liability bond, you demonstrate your commitment to fulfilling your legal and financial obligations, which can enhance your reputation and credibility in the marketplace.

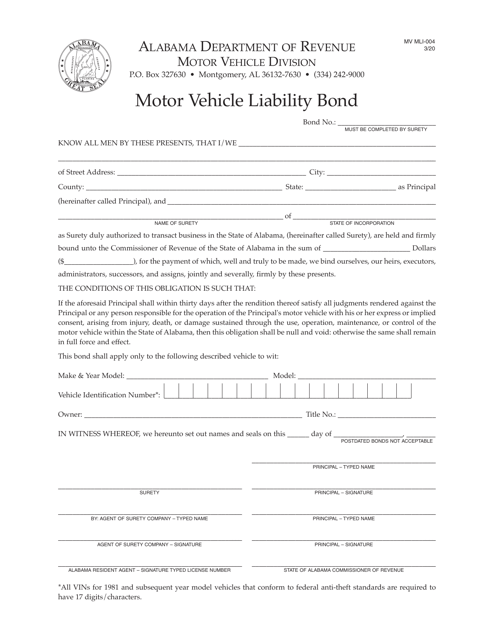

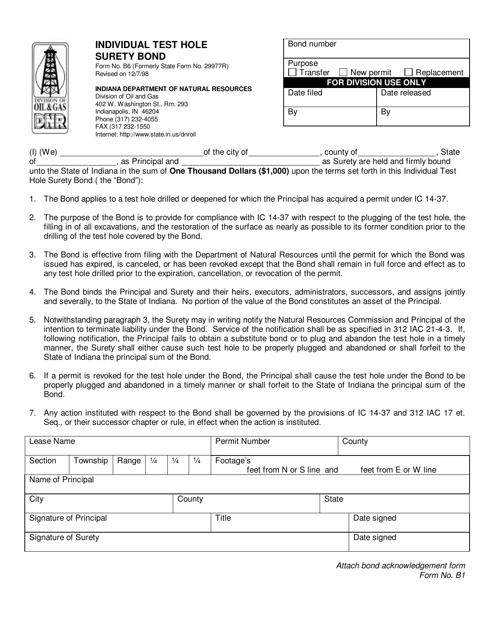

Our comprehensive collection of liability bond documents includes everything you need to meet your business's unique requirements. Whether you need a Change of Name Liability Bond Rider, a Surety Bond for Assumed Certified Self-insurance Liabilities, a Bond Information Statement, a Motor Vehicle Liability Bond, or an Individual Test Hole Surety Bond, we have you covered.

With our user-friendly forms and expert guidance, you can easily navigate the process of obtaining a liability bond. Our documents are tailored to meet the specific regulations and requirements of various states, including North Carolina, Texas, South Dakota, Alabama, Indiana, and more.

Don't let potential liabilities weigh you down. Protect your business and gain the trust of your clients and partners with a liability bond from our extensive collection. Contact us today to explore our range of liability bond documents and find the perfect solution for your business's needs.

Documents:

9

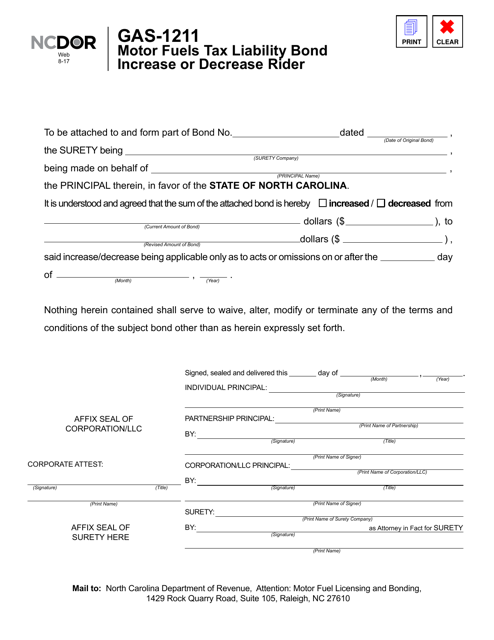

This form is used for applying for an increase or decrease of the motor fuels tax liability bond in North Carolina.

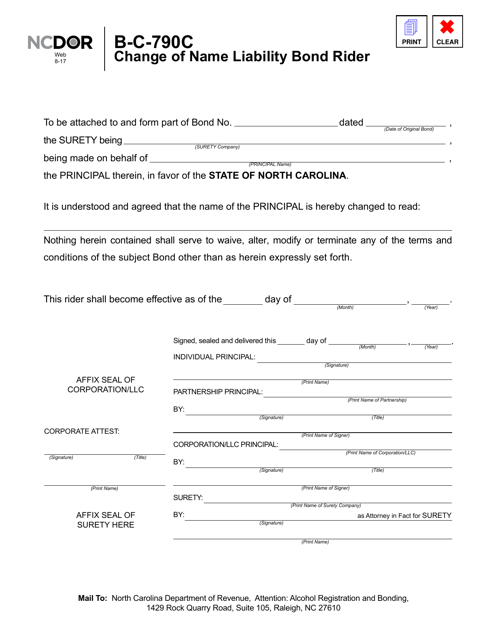

This form is used for adding or changing a liability bond rider for a name change in the state of North Carolina.

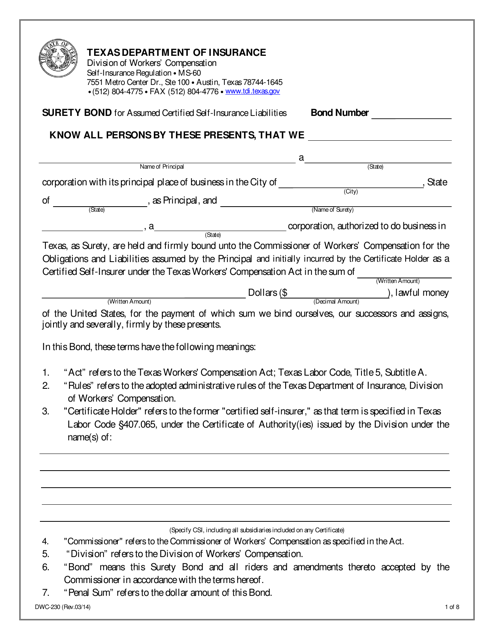

This form is used for obtaining a surety bond to cover assumed certified self-insurance liabilities in the state of Texas.

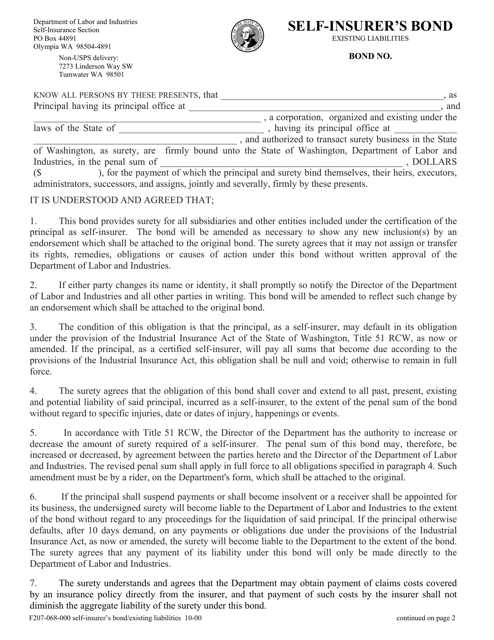

This form is used for self-insurers in Washington to secure existing liabilities through a bond.

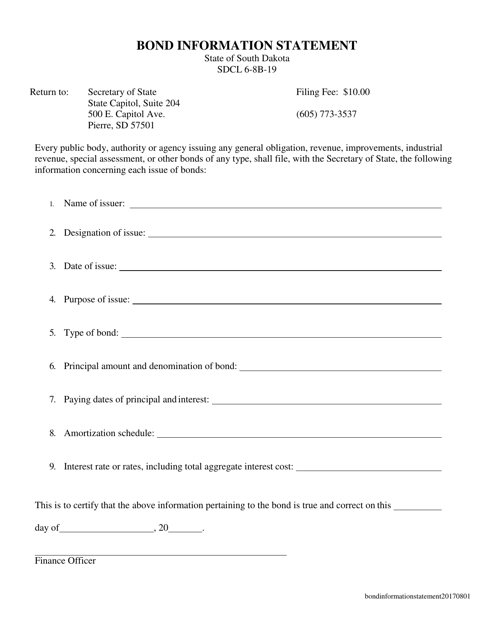

This document provides information about bonds in South Dakota. It includes details such as the bond issuer, interest rates, and repayment terms.

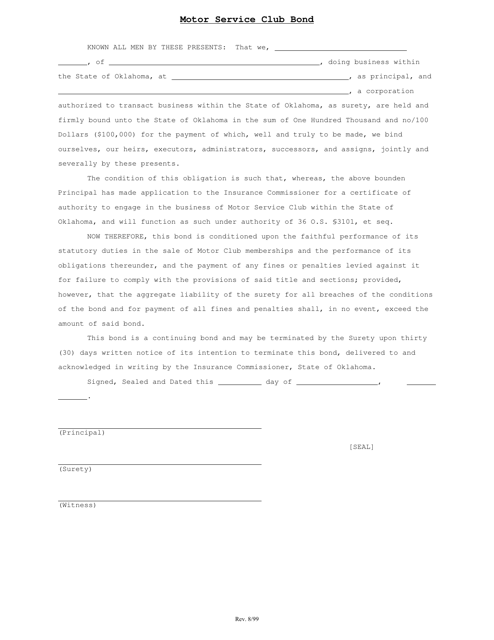

This document is a bond specifically for motor service clubs in the state of Oklahoma. It ensures that these clubs comply with relevant regulations and provide the services they offer to their members.

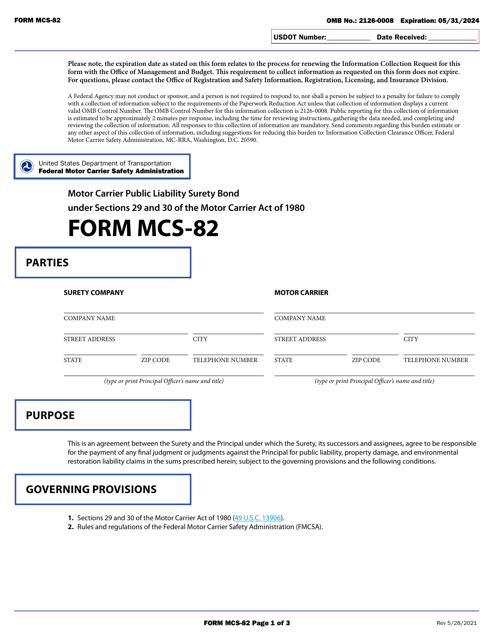

This Form is used for obtaining a Motor Carrier Public Liability Surety Bond, as required by Sections 29 and 30 of the Motor Carrier Act of 1980.

This Form is used for obtaining a surety bond for individual test holes in Indiana.