Passive Loss Templates

Passive Loss is a comprehensive collection of documents that guide taxpayers on how to navigate the complex realm of passive activity loss limitations. These resources aim to help individuals and businesses accurately report and calculate their passive losses, ensuring compliance with IRS regulations.

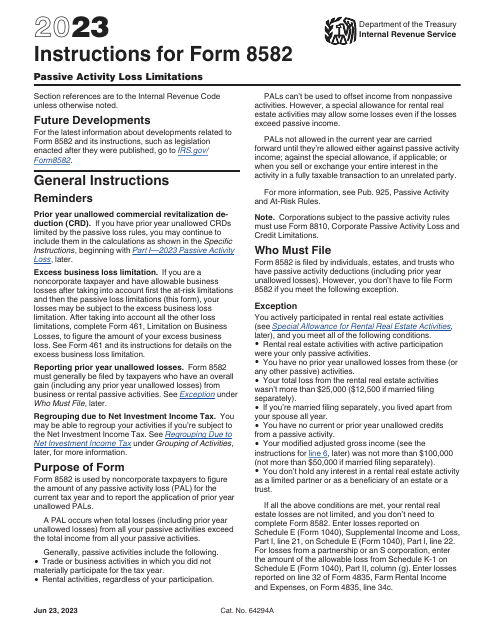

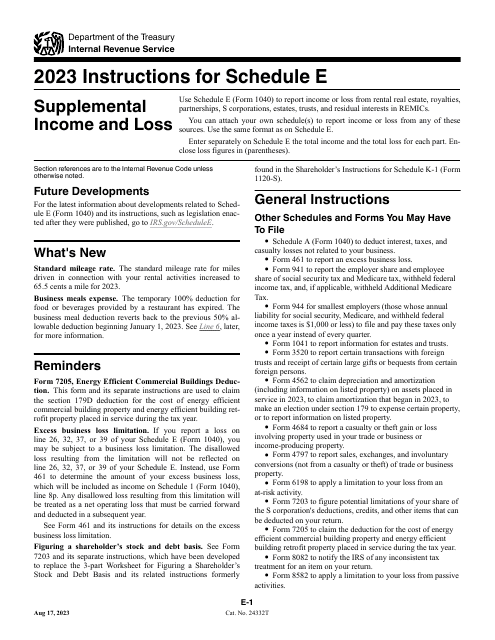

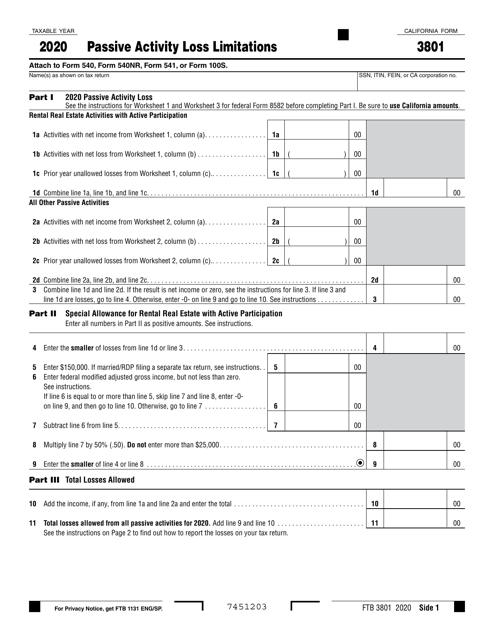

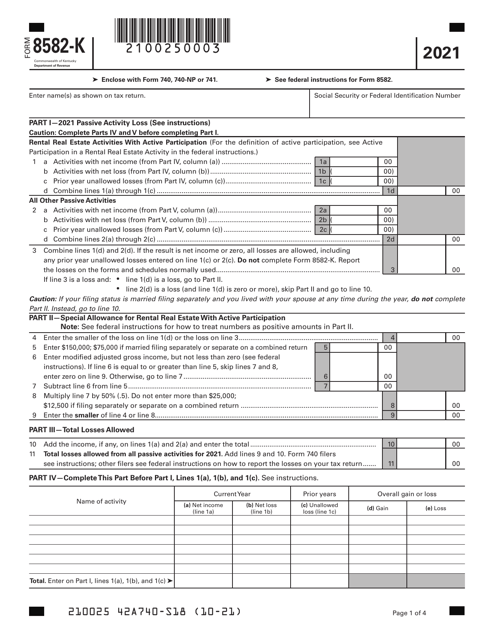

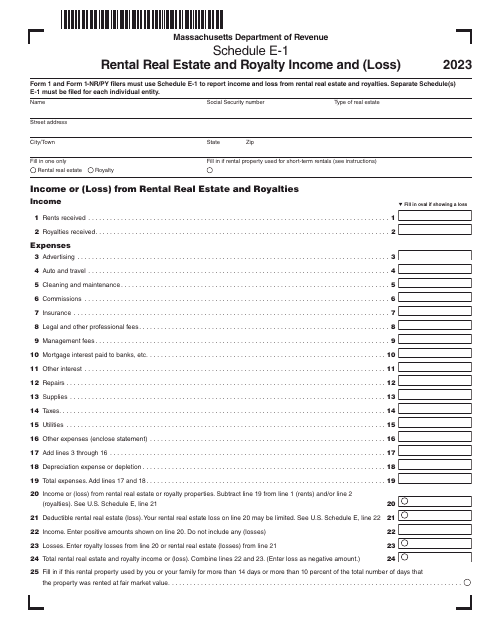

These documents provide clear instructions on how to complete the necessary forms and schedules, such as the IRS Form 8582 and Form 1040 Schedule E Supplemental Income and Loss. Additionally, specific state requirements are addressed, with resources like the California Form FTB3801 Passive Activity Loss Limitations and the Kentucky Form 8582-K Kentucky Passive ActivityLoss Limitations.

Passive losses can arise from rental real estate activities, limited partnerships, and other investment ventures in which individuals or businesses do not actively participate. Calculating and reporting these losses correctly is crucial to ensure accurate tax liability calculations and avoid potential penalties or audits.

With the Passive Loss documents provided, taxpayers can easily understand the rules and regulations surrounding passive losses. By following these guidelines, individuals and businesses can ensure compliance, minimize risks, and optimize their tax planning strategies.

Find the right information and guidance you need to navigate the complexities of passive losses with our comprehensive collection of Passive Loss documents. Stay informed, stay compliant, and make the most out of your investment ventures.

Documents:

6

This form is used for reporting passive activity loss limitations in California.