Debt Consolidation Templates

Consolidate and Manage Your Debts - Debt Consolidation Services

Are you overwhelmed by mounting debts? Are you finding it difficult to keep track of multiple payments and interest rates? Our comprehensive debt consolidation services can provide you with the solution you need to regain control over your finances.

Also known as debt management or debt settlement, debt consolidation refers to the process of combining multiple debts into a single loan or payment plan. This approach simplifies your financial obligations, making it easier to manage your monthly payments and potentially save money in the long run.

At our company, we understand the challenges that come with a heavy debt burden. That's why we offer tailored debt consolidation services to individuals and businesses alike. Our knowledgeable professionals will work closely with you to create a customized debt settlement plan that aligns with your specific financial circumstances.

By consolidating your debts, you can benefit from a range of potential advantages. First and foremost, you'll only have to worry about a single monthly payment, reducing the risk of missed or late payments. Additionally, a well-structured debt consolidation plan can help lower your interest rates and possibly even negotiate with creditors for reduced balances.

Our team is well-versed in the intricacies of debt management laws and regulations across various jurisdictions. Whether you're in the USA, Canada, or any other country, we have the expertise to navigate the specific requirements and ensure compliance with all necessary documentation and reporting.

If you're ready to take control of your finances and alleviate the stress of overwhelming debt, contact us today. Our debt consolidation services can help you achieve financial stability and create a clear path towards a debt-free future.

Documents:

10

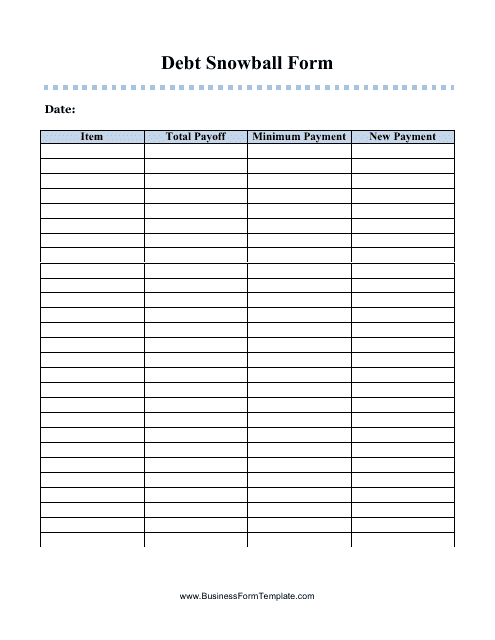

This form is used for organizing and managing your debt repayment strategy using the debt snowball method.

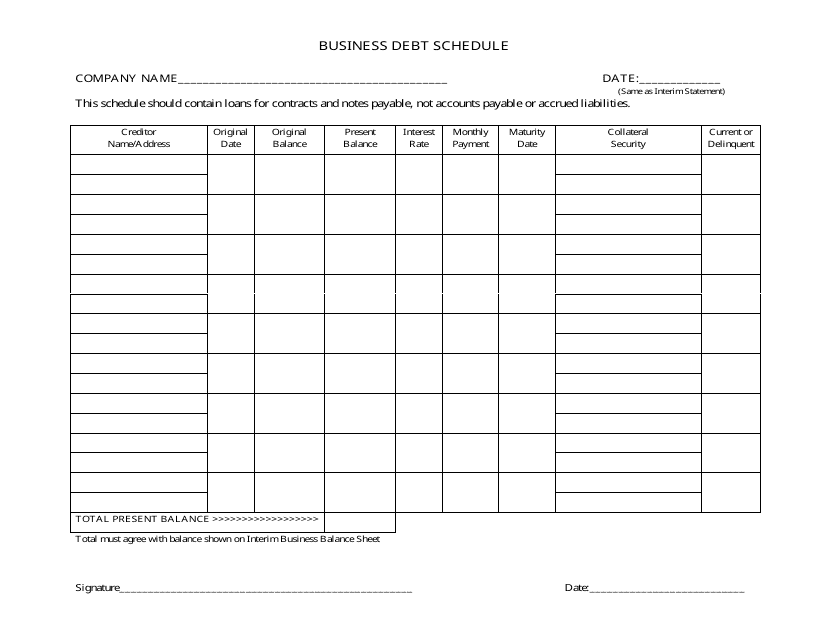

This document helps businesses organize and track their debts. It provides a template for listing the details of each debt, such as the amount owed, interest rate, and repayment terms. By using this template, businesses can better manage their debt obligations and make informed financial decisions.

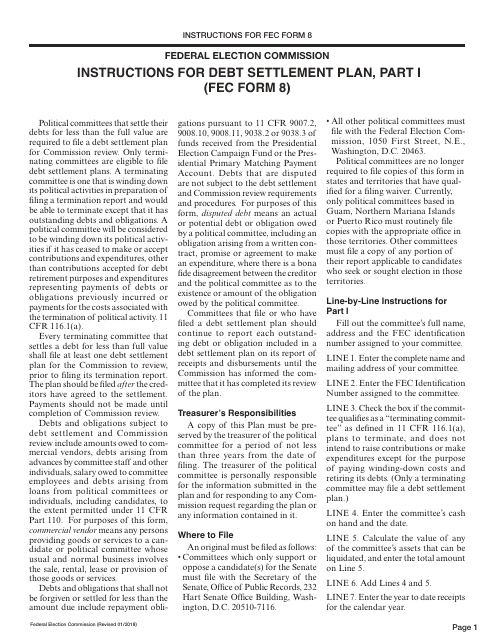

This document provides instructions for completing the FEC Form 8 Debt Settlement Plan.

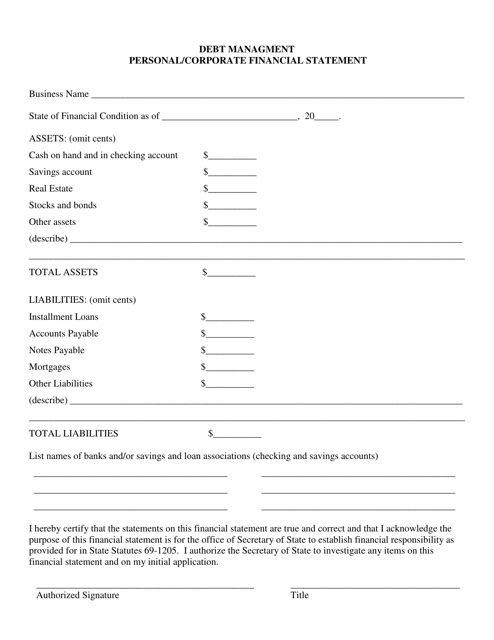

This document is used for managing personal or corporate debt by providing a financial statement in Nebraska. It helps individuals or businesses to track their income, expenses, and overall financial position.

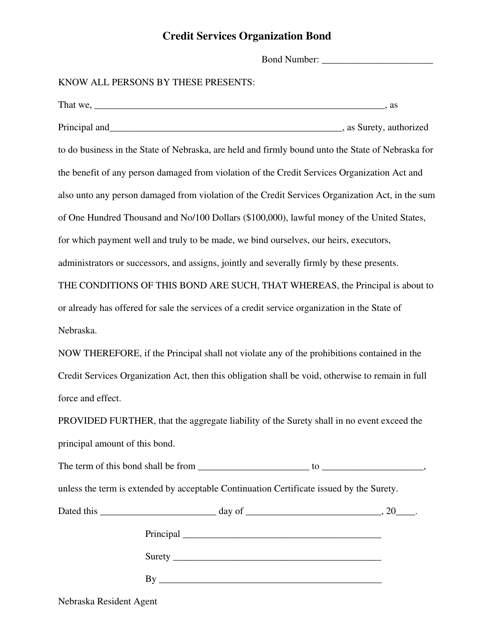

This document is a bond required for Credit Services Organizations operating in Nebraska.

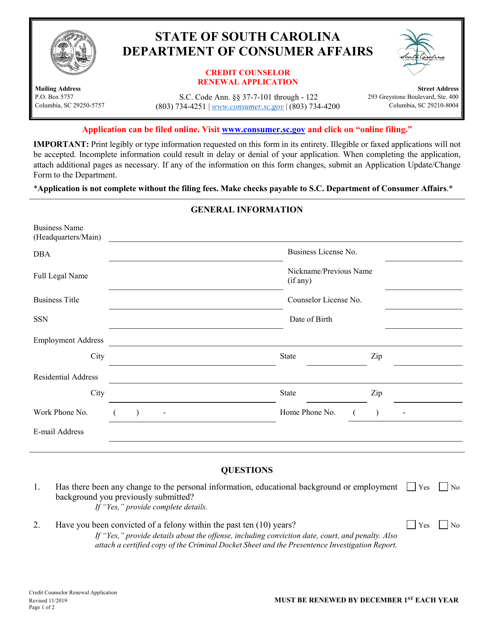

This document is used for renewing the license of a credit counselor in South Carolina.

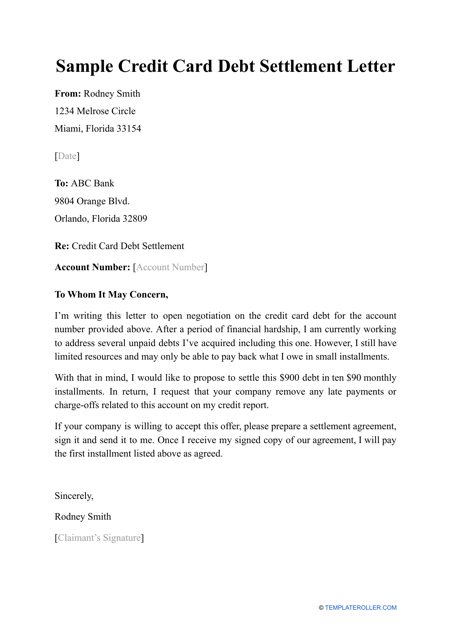

This type of debt settlement letter is used by filers who want to decrease the debt on their credit card.

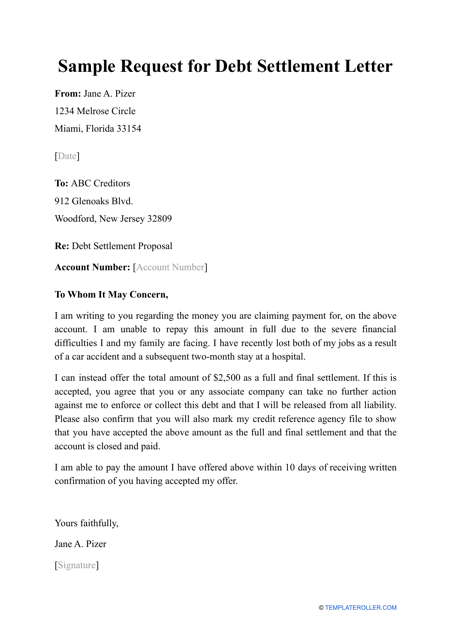

This document's purpose is to help a debtor decrease their debt or change the terms of paying it back in order to make it easier for them.

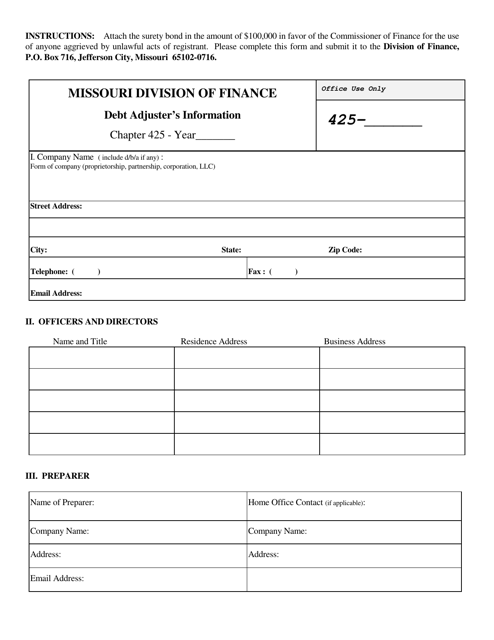

This document provides information about debt adjusters in the state of Missouri.

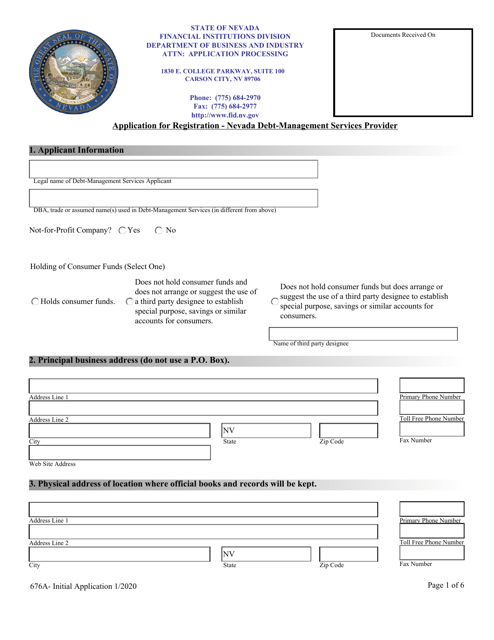

This document is the application for registration for a debt-management services provider in Nevada. It is used to apply for the necessary registration to operate as a debt-management services provider in the state of Nevada.