Income Tax Act Templates

The Income Tax Act, also known as the income tax regulations, is a vital collection of legislation that governs the taxation of individuals and entities in countries such as the USA, Canada, and others. This comprehensive set of laws outlines the rules, regulations, and procedures related to the assessment, calculation, and payment of income tax.

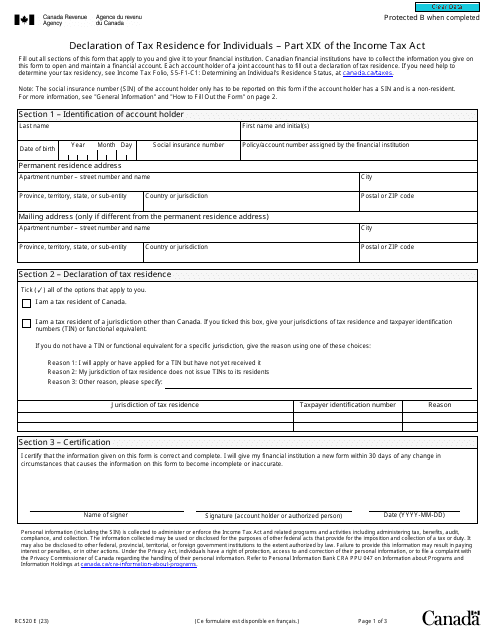

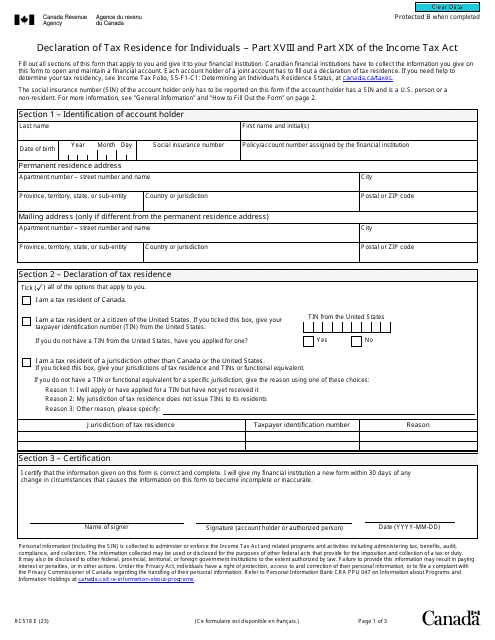

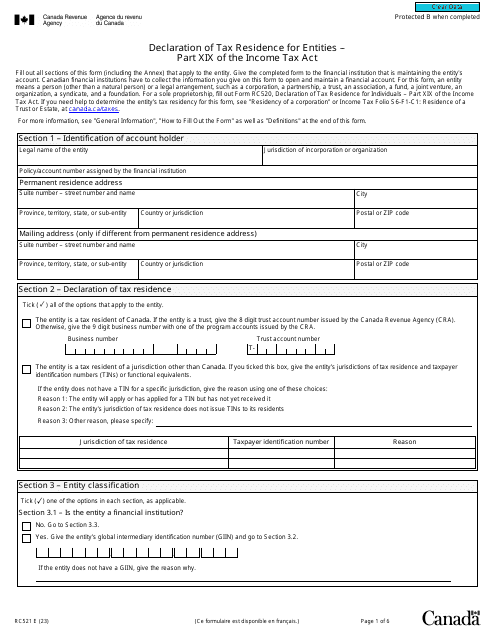

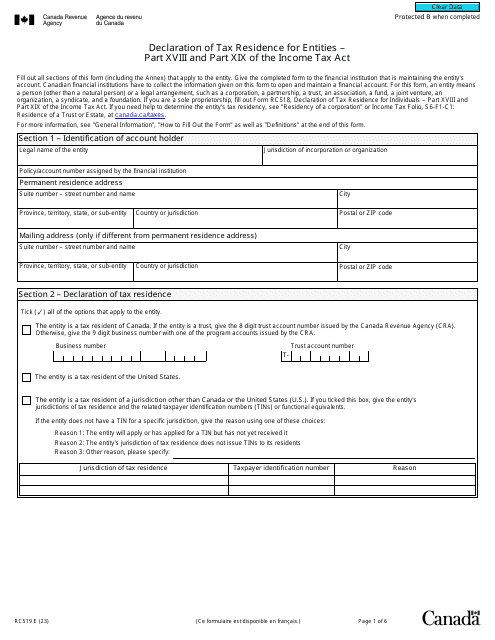

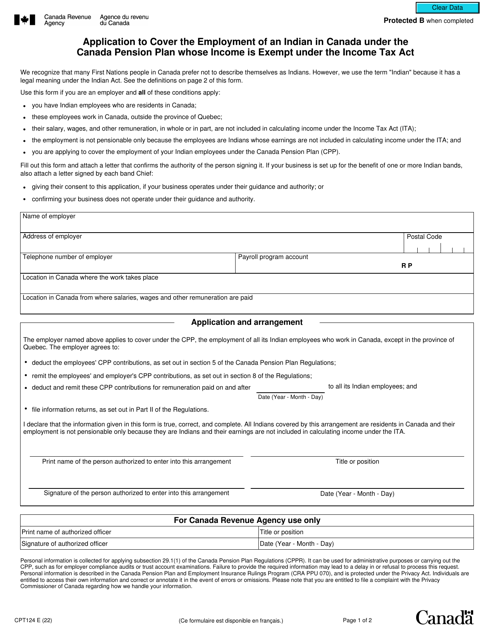

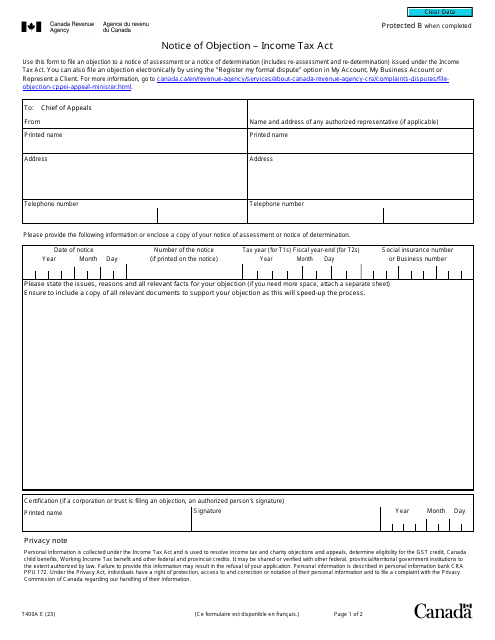

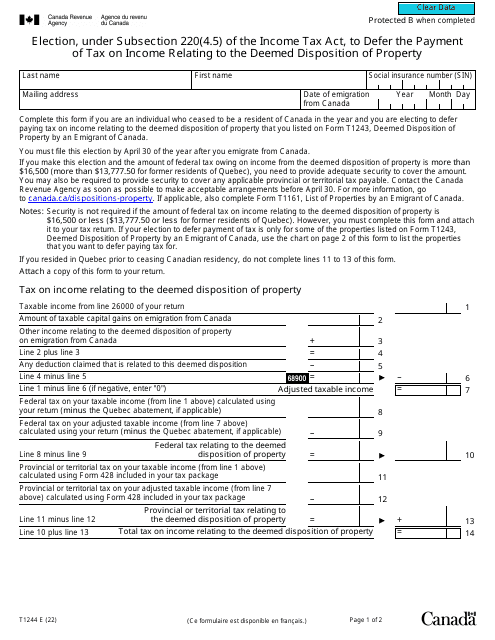

Under the Income Tax Act, taxpayers are required to comply with various provisions and submit documentation to ensure accurate reporting of their income and tax liabilities. This includes forms such as the Declaration of Tax Residence for Individuals and Entities, the Notice of Objection, and the Application to Cover the Employment of an Indian in Canada Under the Canada Pension Plan Whose Income Is Exempt.

By adhering to the guidelines outlined in the Income Tax Act, individuals and entities can navigate the complexities of the tax system and fulfill their obligations with ease. It is essential for taxpayers to stay informed about any amendments or updates to the income tax regulations to ensure compliance and avoid any penalties or legal issues.

With the Income Tax Act as your guide, understanding and managing your tax responsibilities becomes more manageable. Seek advice from tax professionals or refer to the relevant government websites for further information and assistance.

Documents:

36

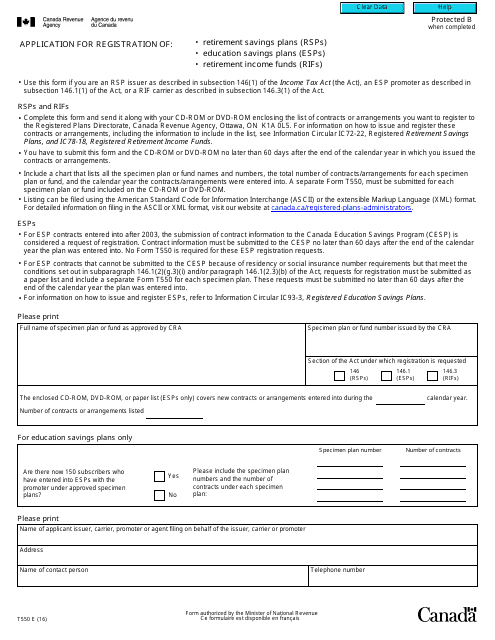

This form is used for applying to register RSPs, ESPs, or RIFs under specific sections of the Canadian Income Tax Act.

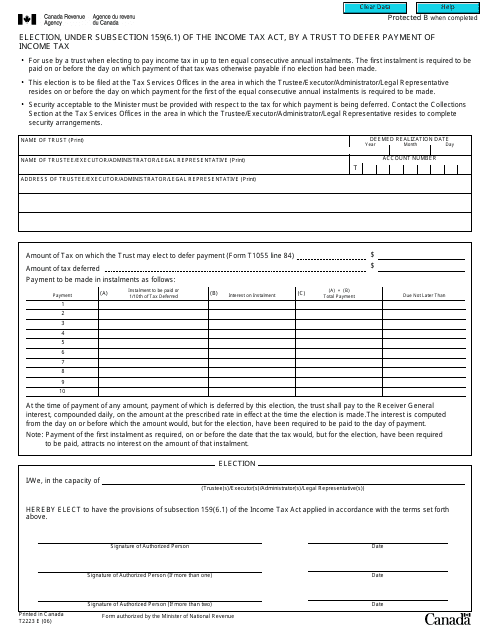

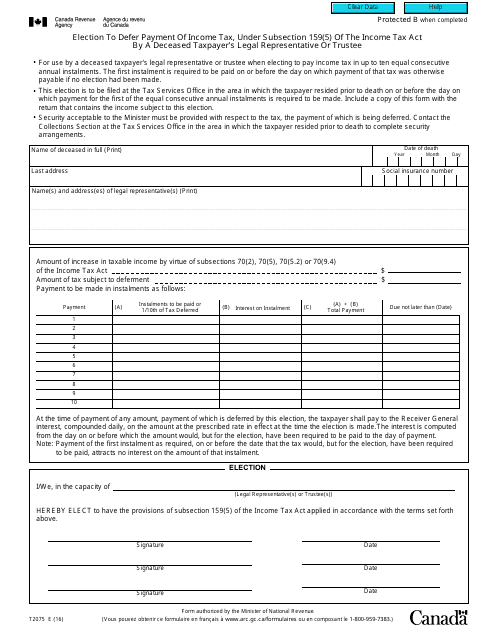

This form is used by a trust in Canada to make an election under subsection 159(6.1) of the Income Tax Act. It allows the trust to defer the payment of income tax.

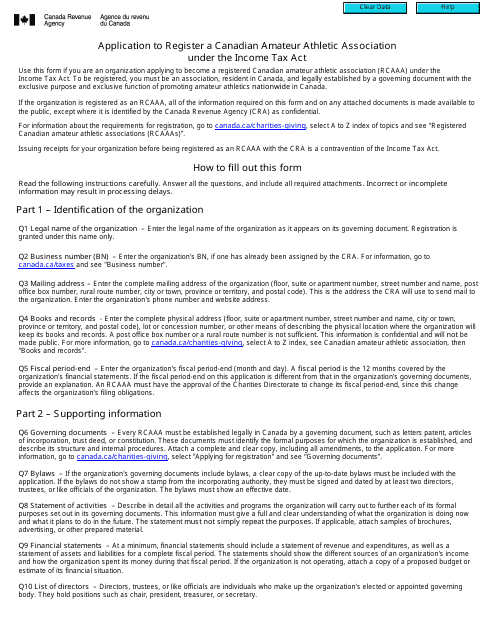

This form is used to apply for the registration of a Canadian Amateur Athletic Association (CAAA) under the Income Tax Act in Canada. The CAAA will be eligible for certain tax benefits as a registered charity.

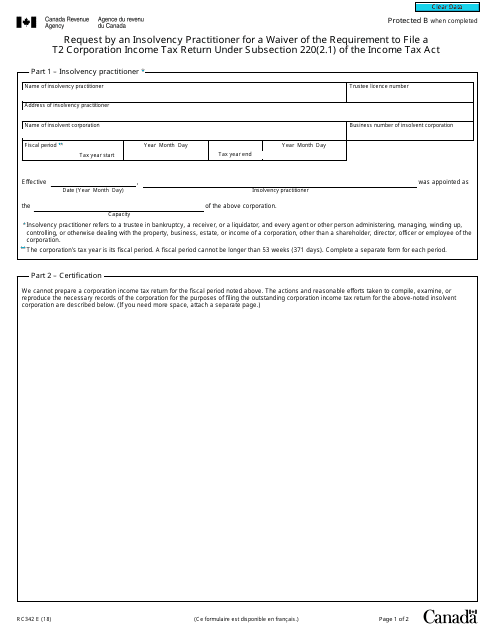

This form is used by an Insolvency Practitioner in Canada to request a waiver for the requirement to file a T2 Corporation Income Tax Return under Subsection 220(2.1) of the Income Tax Act.

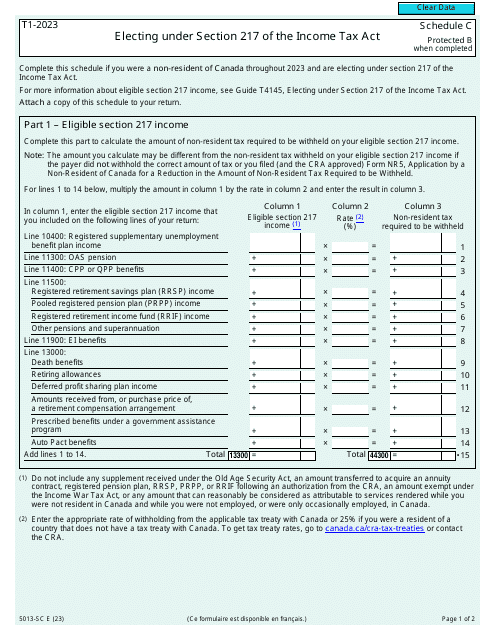

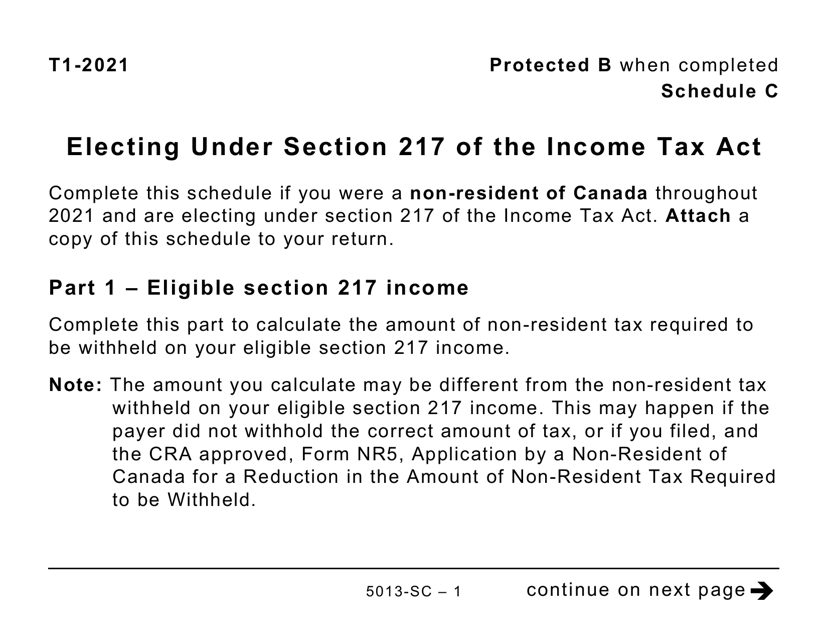

This form is used for electing under Section 217 of the Income Tax Act in Canada. It is a large print version of Form 5013-SC Schedule C.

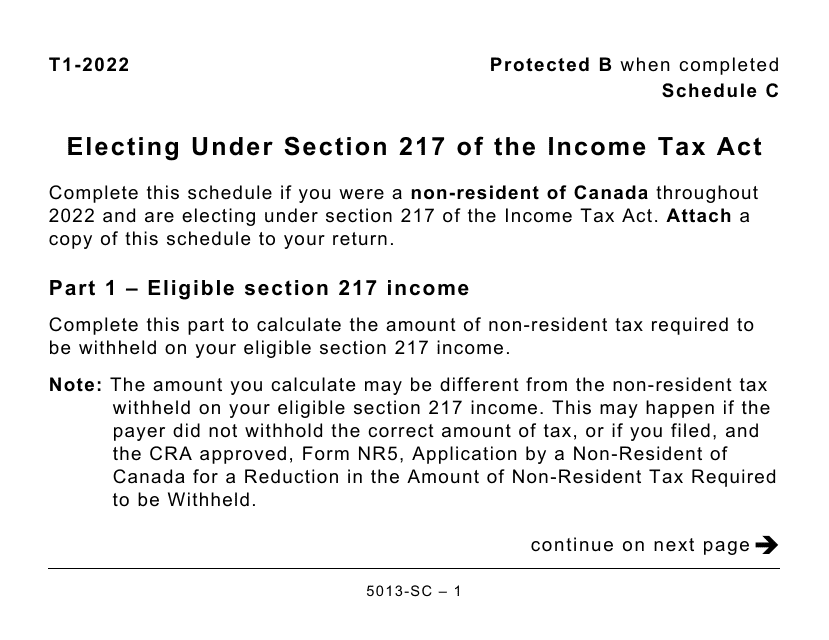

This Form is used for electing under Section 217 of the Income Tax Act in Canada. It is in large print for easy readability.