School Tax Credit Templates

Looking for ways to save on your school expenses? Look no further than the school taxcredit program. This program, also known as school tax credits or school tax credits, is designed to provide financial relief to individuals and families who incur school-related expenses.

With the school tax credit program, you may be eligible to claim tax credits for various educational expenses, such as school repair and maintenance costs, farmers' school expenses, or even expenses incurred in New York City. These credits can help offset the financial burden of school-related costs and put more money back in your pocket.

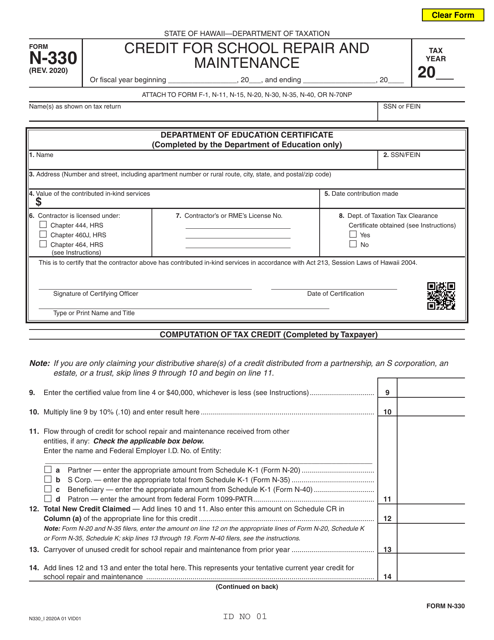

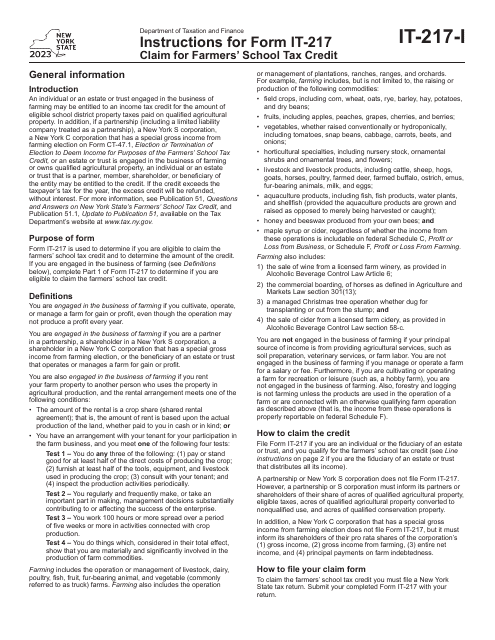

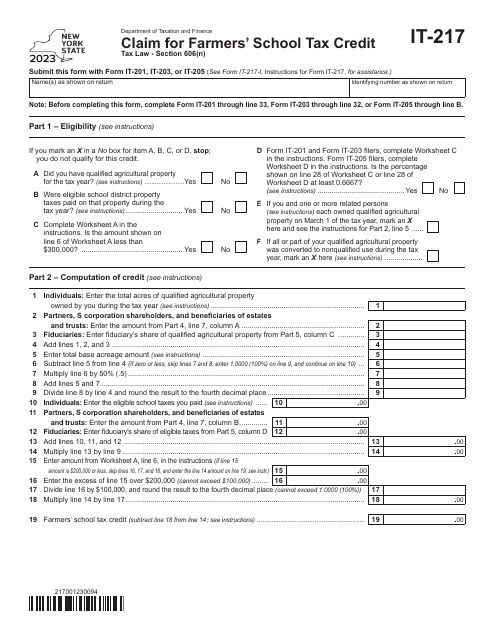

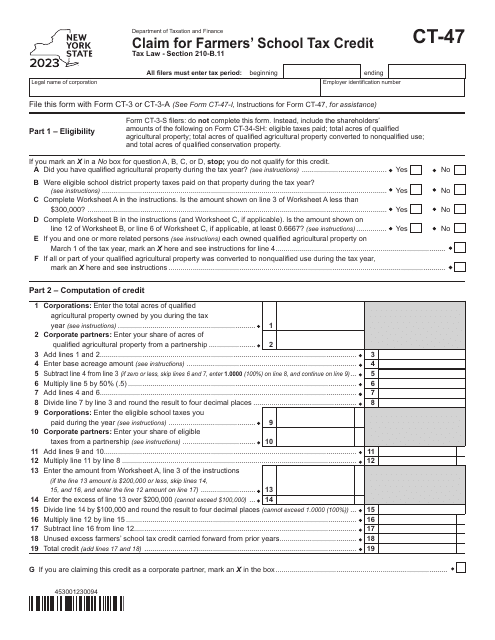

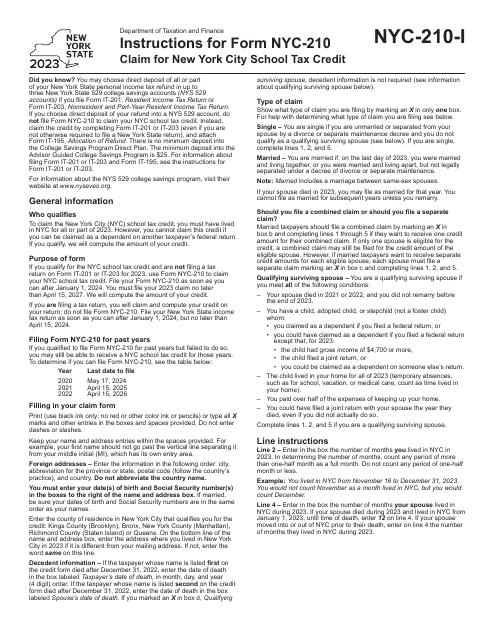

Whether you're a parent looking for assistance with school repairs or a farmer seeking tax relief for education expenses, the school tax credit program has you covered. By utilizing the various forms and instructions, such as Form N-330 School Repair and Maintenance Tax Credit in Hawaii, Form IT-217 Claim for Farmers' School Tax Credit in New York, or Form NYC-210 Claim for New York City School Tax Credit, you can take advantage of the credits available to you.

Don't let the cost of education weigh you down. Explore the school tax credit program and see if you qualify for tax relief today. It's time to make your education expenses more affordable and accessible. Start saving with school tax credits.

Documents:

8