Transfer Pricing Templates

Are you looking for information on transfer pricing or transfer prices? Look no further. Our comprehensive collection of documents related to transfer pricing can provide you with all the information you need.

Transfer pricing, also known as transfer price, refers to the pricing of goods, services, and intangible assets transferred between related parties, such as different branches or subsidiaries of a multinational corporation. It is an important concept in international taxation and is subject to specific rules and regulations.

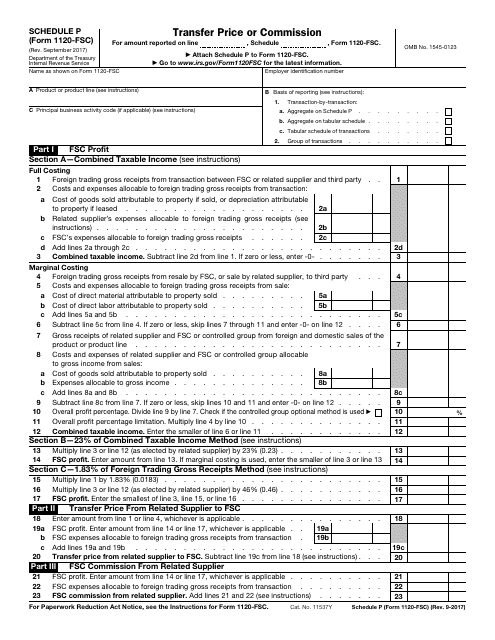

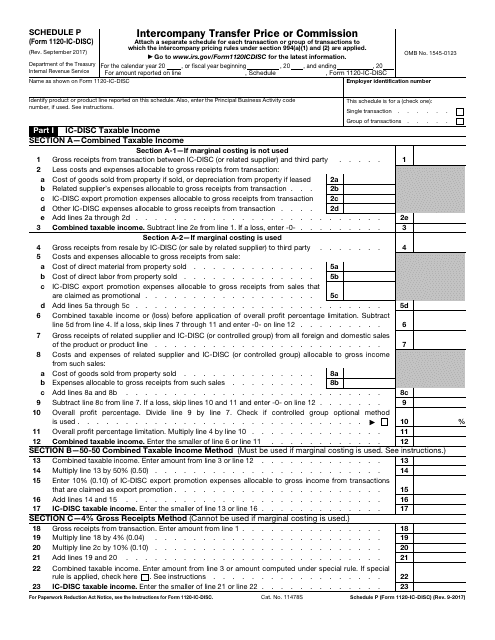

Our collection of transfer pricing documents includes forms, instructions, and information returns for both the United States and Canada. One such document is the IRS Form 1120-FSC Schedule P Transfer Price or Commission, which is used to report transfer prices or commissions related to transactions involving foreign sales corporations. Similarly, the IRS Form 1120-IC-DISC Schedule P Intercompany Transfer Price or Commission is used to report transfer prices or commissions for transactions involving interest charge domestic international sales corporations.

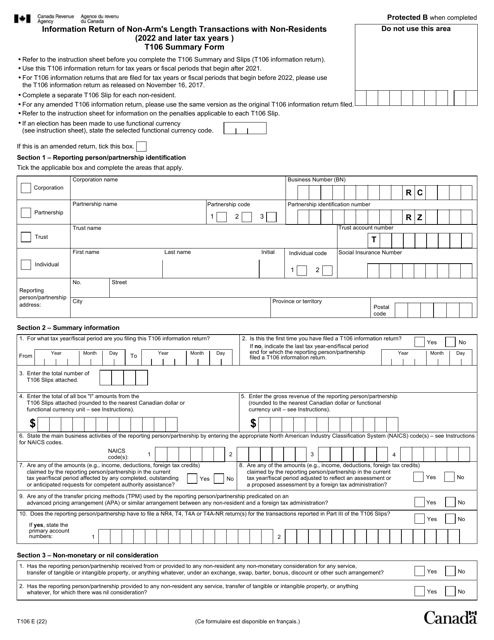

If you are conducting business in Canada, the Form T106 Information Return of Non-arm's Length Transactions With Non-residents is an essential document. It provides information on non-arm's length transactions with non-residents and helps ensure compliance with transfer pricing rules.

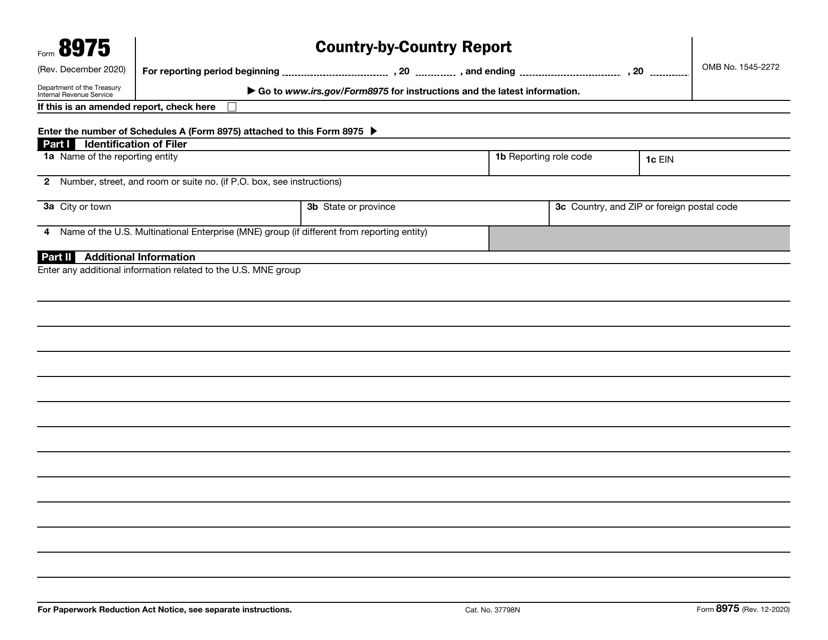

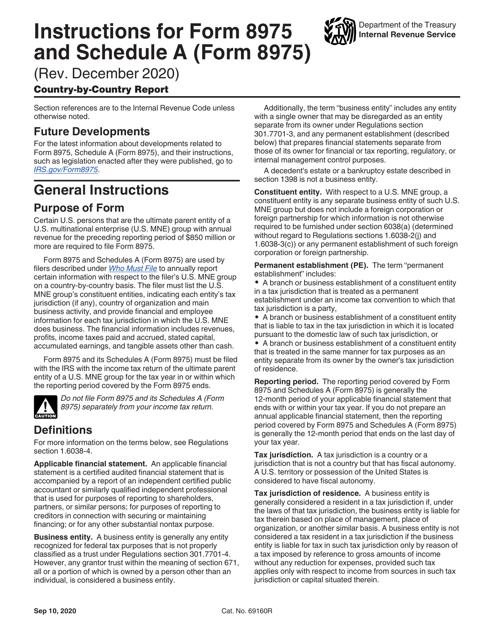

We also provide instructions for IRS Form 8975 Schedule A, which is used to report country-by-country information for multinational enterprises with operations in the United States. This form is crucial for transfer pricing documentation and compliance purposes.

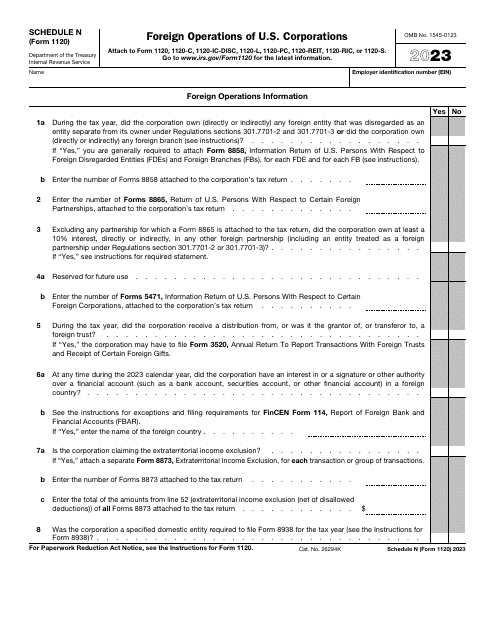

Lastly, we have the IRS Form 1120 Schedule N, which is used to report foreign operations of U.S. corporations. This form may include information on transfer pricing if the corporation has transactions with related parties abroad.

With our diverse collection of transfer pricing documents, you can stay informed and ensure compliance with transfer pricing regulations. Don't wait. Start exploring our comprehensive collection today.

Documents:

9

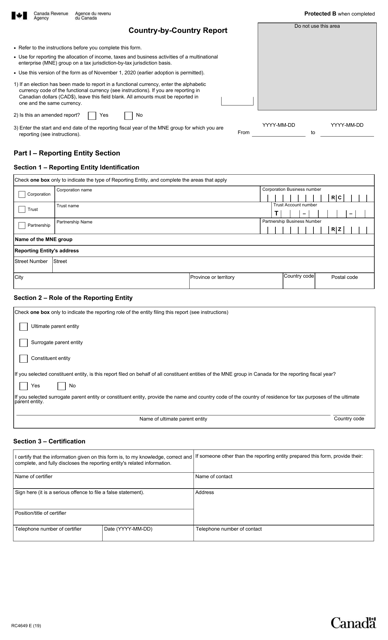

This Form is used for reporting country-by-country information in Canada. It helps multinational corporations provide details on their global operations, including revenue, taxes paid, and employees.