Vt Taxes Templates

Are you looking for information on Vermont taxes? Look no further! We have all the resources you need to understand and navigate the tax system in the Green Mountain State.

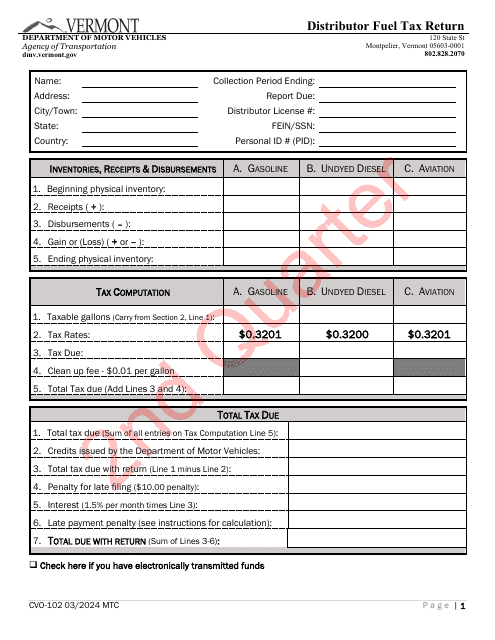

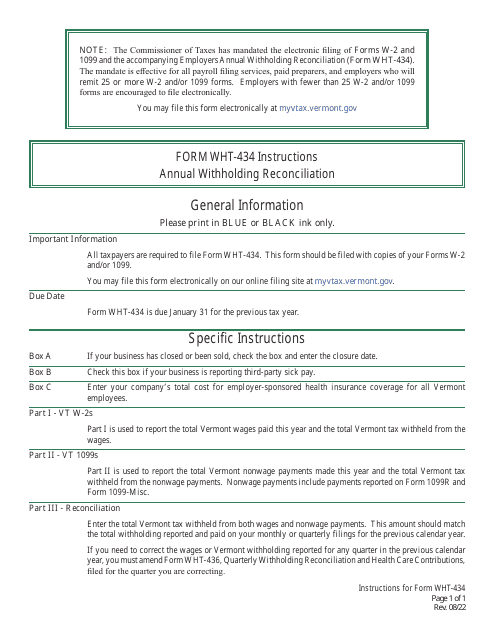

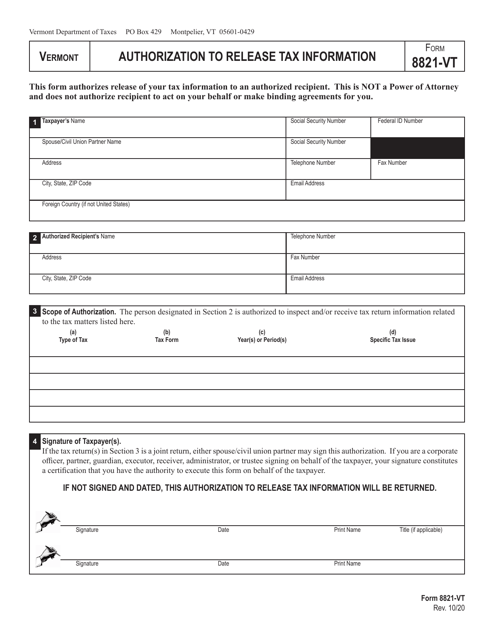

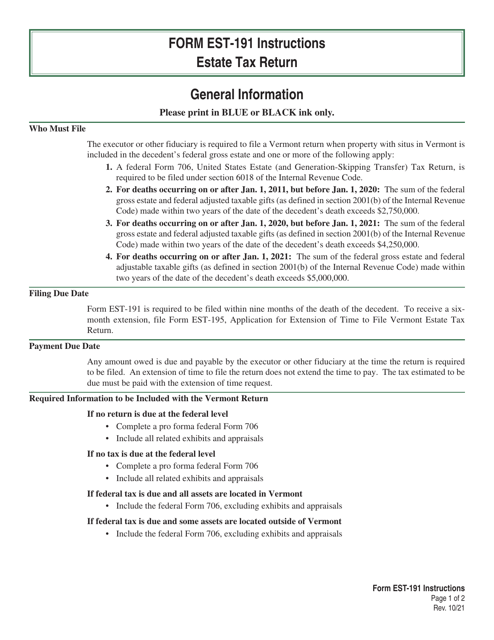

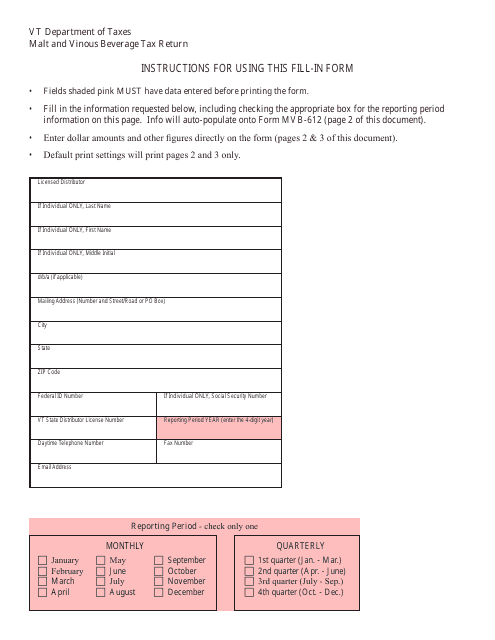

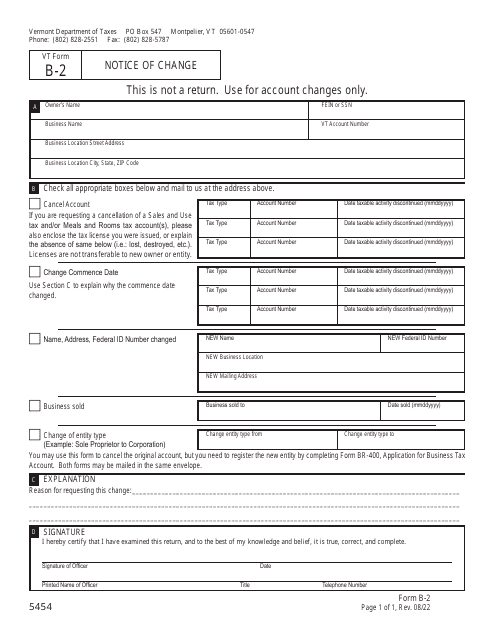

Our collection of documents, also referred to as VT taxes or Vermont tax forms, is designed to help individuals and businesses fulfill their tax obligations accurately and efficiently. Whether you need to file income tax returns, report meals and rooms tax, reconcile withholding taxes, or submit an estate tax return, our comprehensive collection of forms and instructions has you covered.

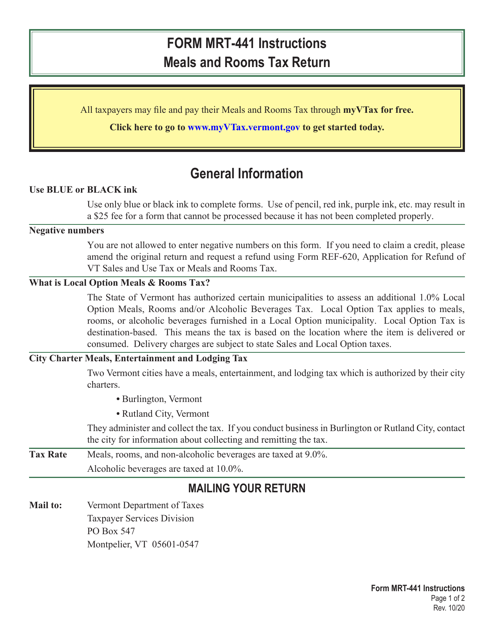

Our resources include detailed instructions for various tax forms such as FIT-166, MRT-441, WHT-434, 8821-VT, and EST-191. These forms cover a wide range of tax scenarios, including income adjustments and tax computations for fiduciaries, meals and rooms tax returns, annual withholding reconciliations, authorization to release tax information, and estate tax returns.

We understand that taxes can be complex and confusing, but our user-friendly documents and clear instructions make the process much more manageable. With our VT tax form templates, you can easily fill out the necessary information and ensure accuracy when submitting your tax returns.

Whether you're an individual taxpayer or a business owner, our collection of VT tax documents will provide you with the guidance and resources you need to navigate the tax system in Vermont. Don't let taxes overwhelm you - let us help you stay compliant and make the tax filing process as smooth as possible.

Please note that the names of the example documents mentioned above are for illustrative purposes only and may not reflect the specific forms or instructions you need. However, our collection covers a wide range of tax-related topics to meet your needs. Happy filing!

Documents:

17

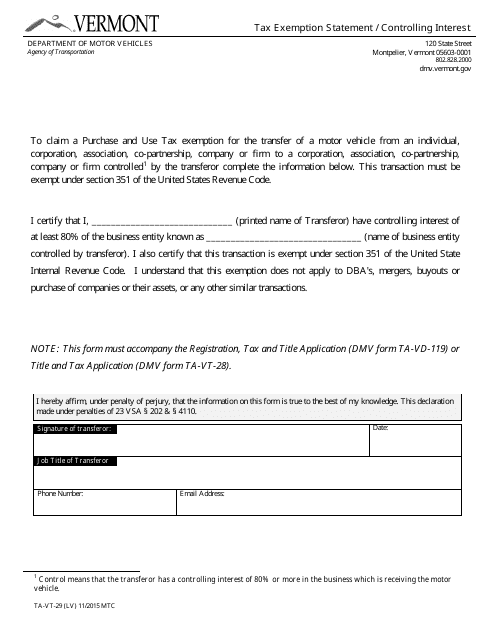

This form is used for submitting a tax exemption statement for controlling interest in Vermont.

This Form is used for applying for a refund of miscellaneous taxes paid in the state of Vermont.

This Form is used for reporting income adjustments and tax computations for fiduciaries in Vermont. It provides instructions on how to accurately complete the VT Form FIT-166.

This document is used for filing the Vermont Land Gains Tax Return in the state of Vermont. It provides instructions on how to complete the form and report any taxable gains from the sale of land or real estate in Vermont.