Small Business Loans Templates

Are you a small business owner looking for financial support to grow your business? Look no further! Our small business loans program is here to help you achieve your goals.

At Templateroller.com, we understand the unique challenges that small businesses face when it comes to accessing capital. That's why we offer a range of flexible loan options specifically designed with small businesses in mind.

Our small business loans program provides funding for a variety of purposes, such as purchasing new equipment, expanding your operations, or hiring additional staff. Whether you need a short-term loan to cover immediate expenses or a long-term loan to fuel your business's growth, we have the perfect solution for you.

With our small business loans program, the application process is simple and straightforward. Our team of experienced professionals will guide you through each step, ensuring that you have all the information and support you need to make an informed decision. We offer a range of loan products, including traditional term loans, lines of credit, and equipment financing, so you can choose the option that best fits your business's needs.

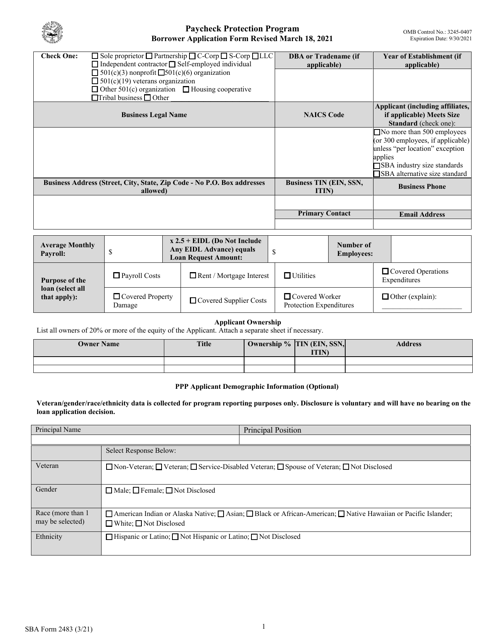

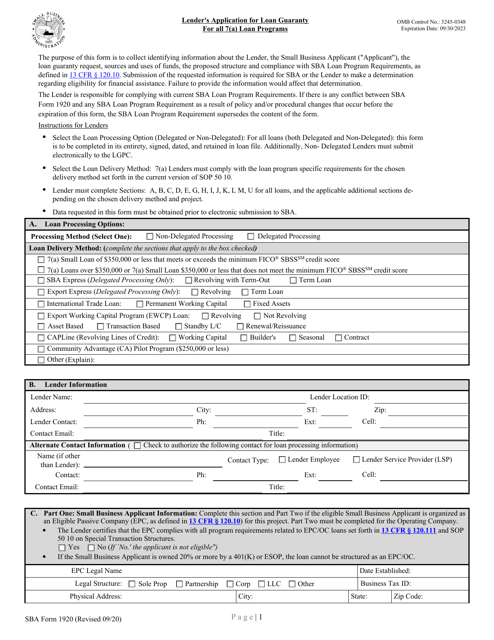

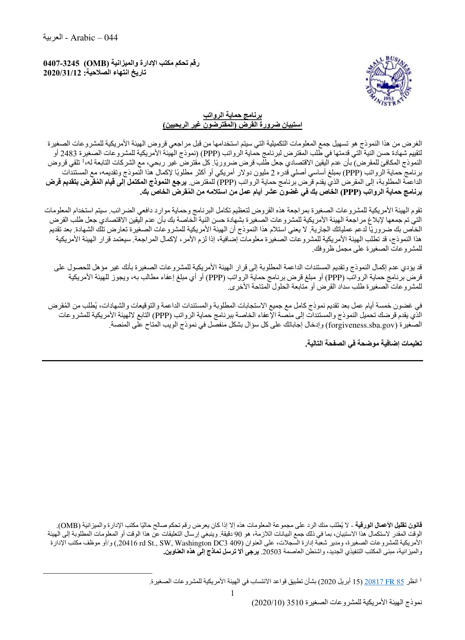

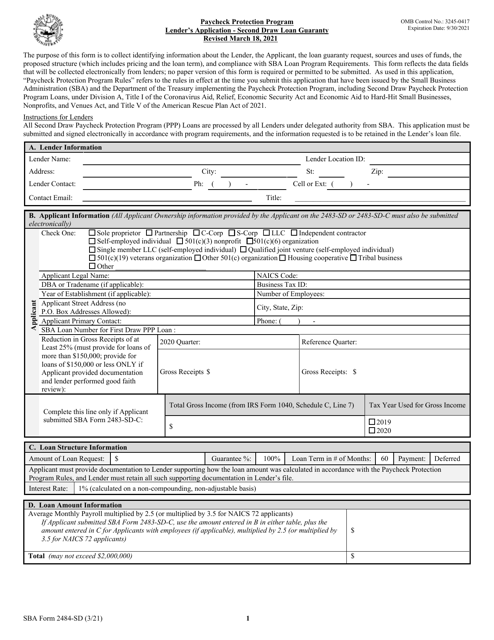

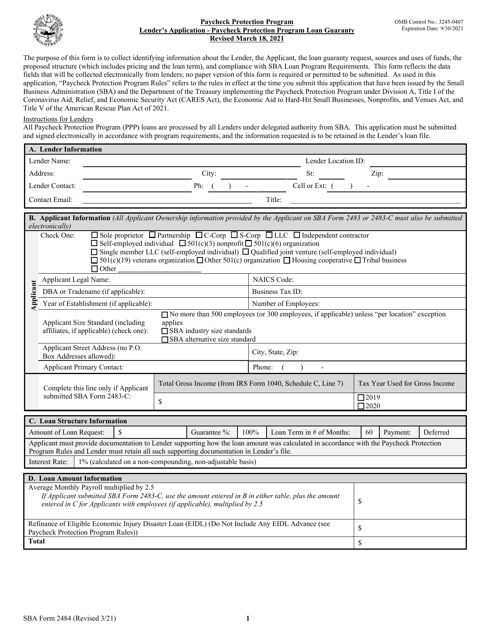

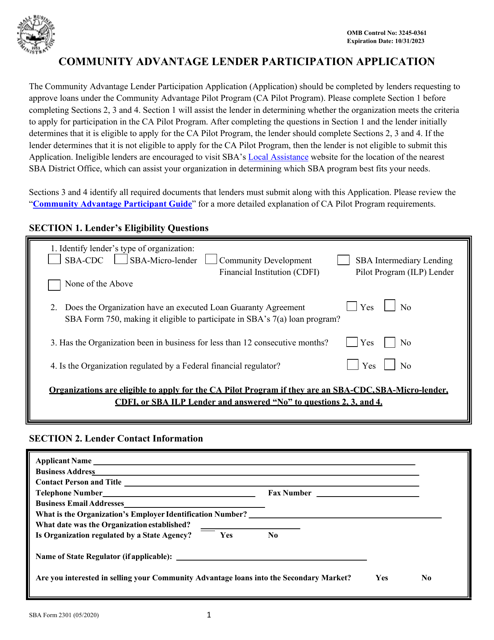

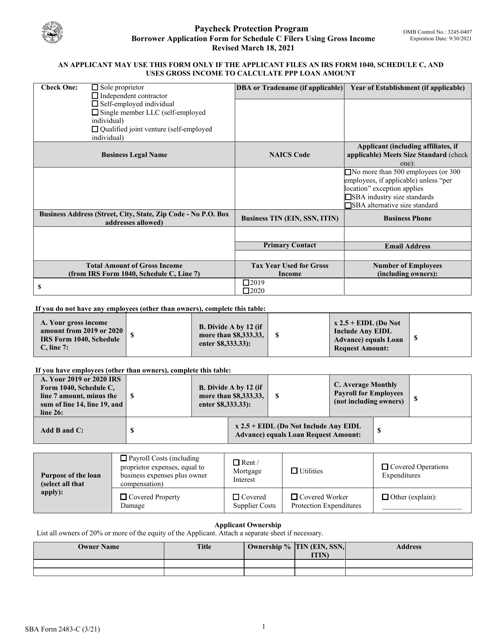

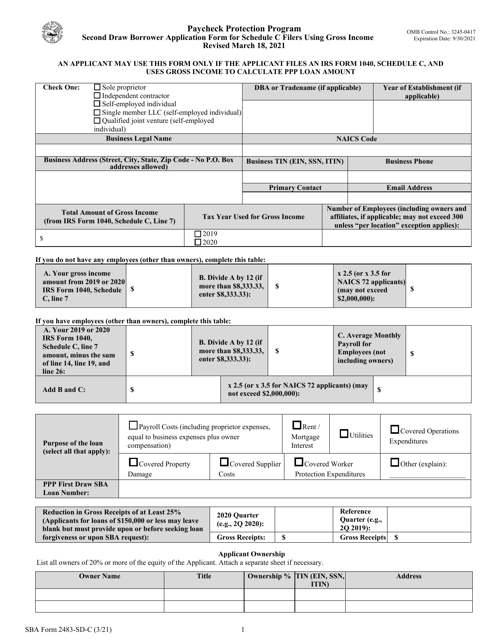

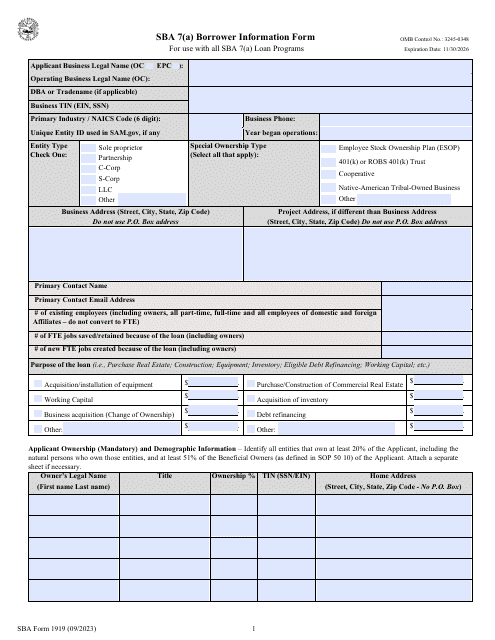

Our small business loans program is backed by the Small Business Administration (SBA), providing you with additional security and peace of mind. The SBA Form 601 Agreement of Compliance and SBA Form 1920 Lender's Application for Loan Guaranty for All 7(A) Loan Programs are just a couple of examples of the documentation required for our SBA-backed loans. These forms help ensure that your business is eligible for the loan and provide the necessary information to evaluate your loan application.

In addition to traditional loans, we also offer the Microloan Program, which provides smaller loan amounts to businesses in need of quick funding. If you're located in Virginia, you may be interested in our Microloan Program Application - Virginia, specifically tailored to the unique needs of businesses in your state.

Don't let financial constraints hold your business back. Our small business loans program is here to support you on your journey to success. Apply today and let us help you take your business to new heights.

Documents:

51

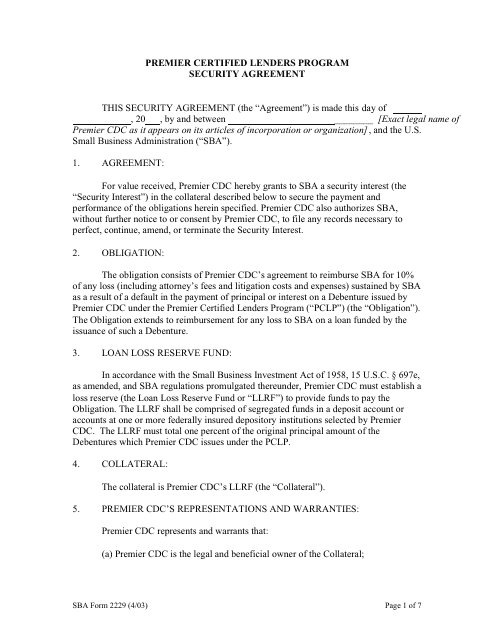

This type of document is a security agreement used in the Premier Certified Lenders Program of the Small Business Administration (SBA).

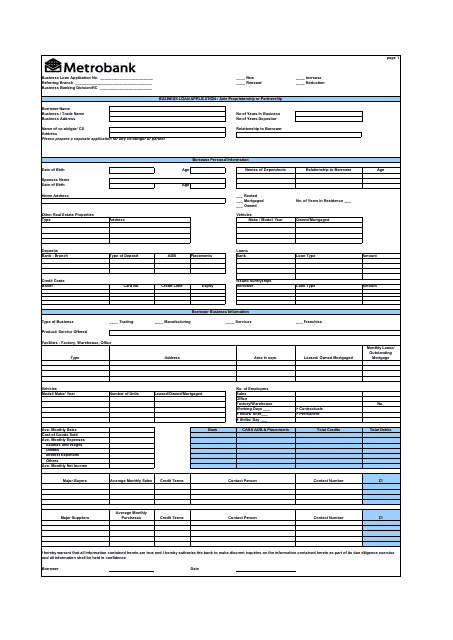

This document is used for applying for a business loan with Metrobank.

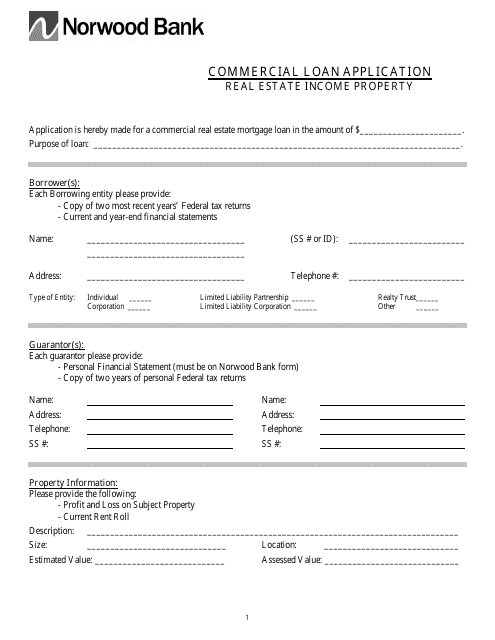

This Form is used for applying for a commercial loan at Norwood Bank in Massachusetts.

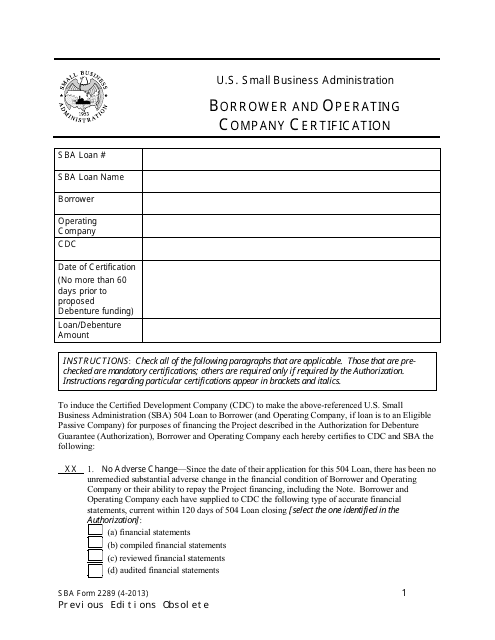

This form is used for the certification of borrowers and operating companies in the Small Business Administration (SBA) loan program.

This document is used as a promise by the borrower to pay a certain amount to the lender, as well as any interest and other amounts on the unpaid principal balance owing.

This Form is used for applying to become a Loan Pool Originator for the First Mortgage Loan Pool (FMLP) Program administered by the Small Business Administration (SBA).

This Form is used for businesses to agree to comply with certain regulations or requirements set by the Small Business Administration (SBA).

This form is used for creating a legally binding agreement between a borrower and a lender to secure a loan or credit with specified collateral.

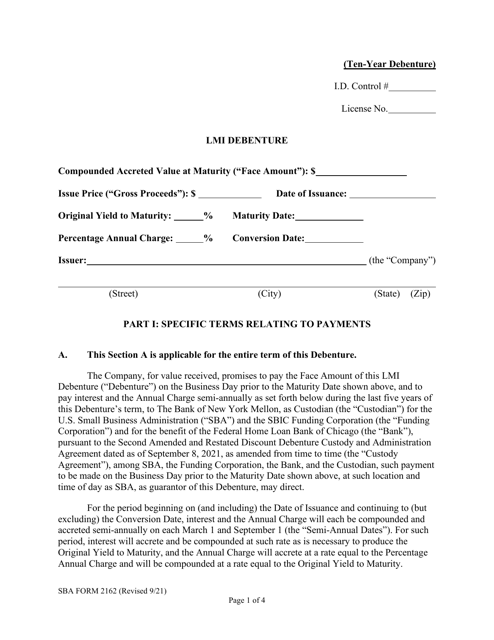

This form is required to be filled out by the Certified Development Company (CDC) to report the debenture payment schedule of development companies.

This form serves as evidence of a 504 Loan from the proceeds of a 504 Debenture. The Certified Development Company (CDC) signs this Note to assign it to the Small Business Administration (SBA).

This form used to be previously completed by Franchisors. It was previously attached to the SBA Form 2462 (Addendum to Franchise Agreement).

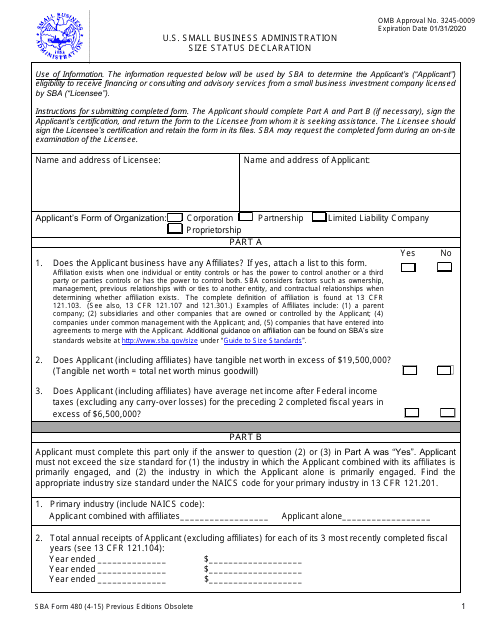

This form is used for small businesses to declare their size status for contracting opportunities.

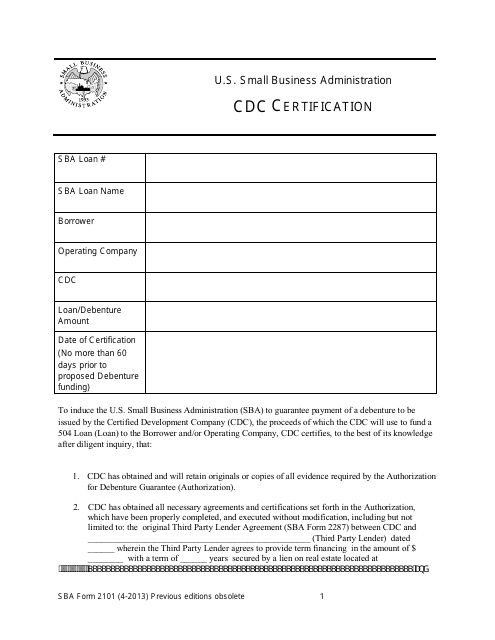

This form is used for the Small Business Administration (SBA) CDC (Certified Development Company) certification process. It verifies the qualifications of CDCs under the SBA's 504 loan program.

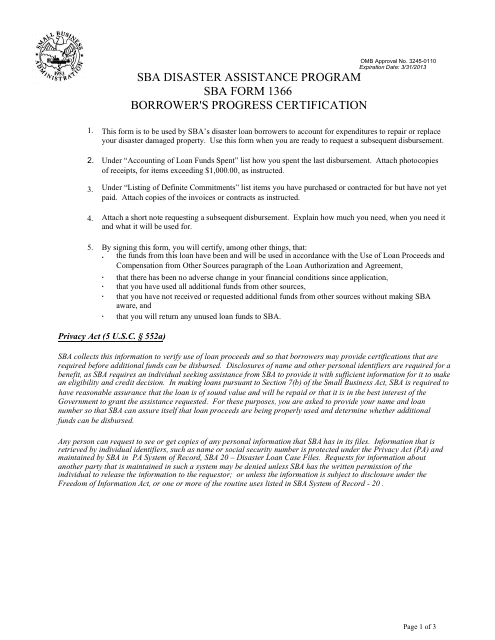

This form is used for borrowers to certify their progress in the SBA Disaster Assistance Program. It helps track and verify the borrower's use of funds and the progress made towards recovery.

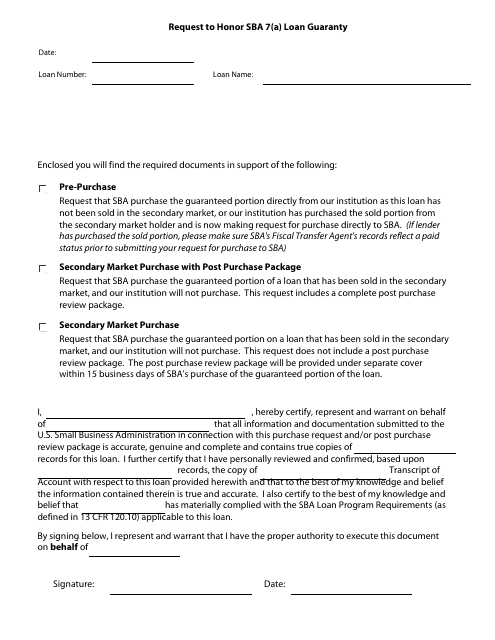

This Form is used for requesting SBA 7(A) Loan Guaranty to honor the loan agreement.

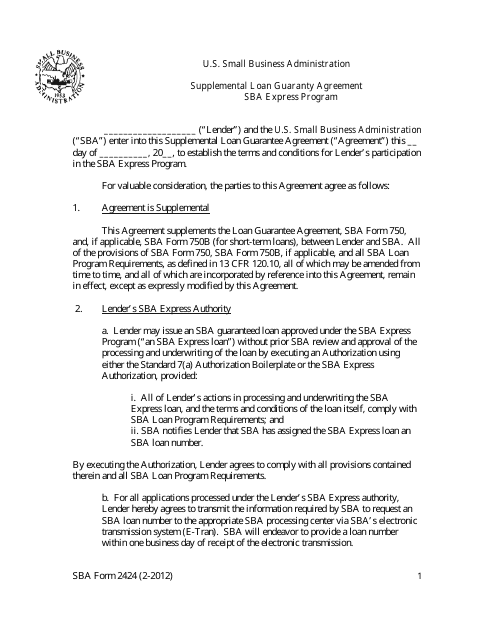

This form is used for a supplemental loan guaranty agreement in the SBA Express Program.

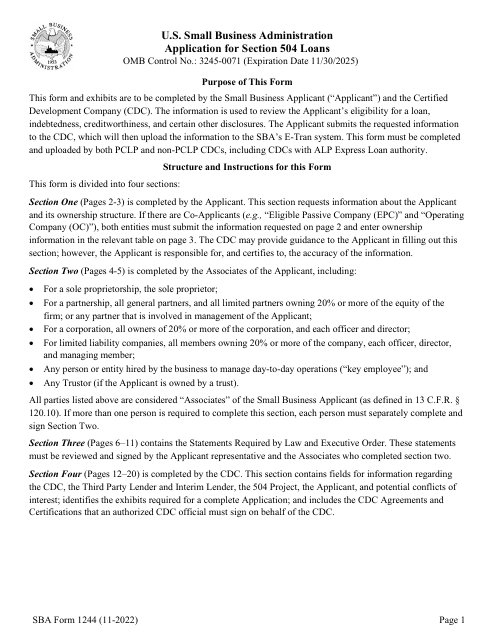

This form is used by the Small Business Administration (SBA) to determine a loan applicant's creditworthiness, indebtedness, and overall eligibility for the SBA Section 504 loan.

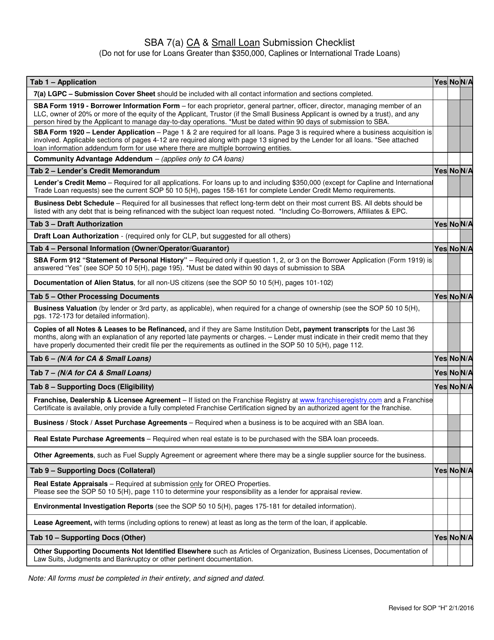

This document provides a checklist for submitting a CA and small loan application under the Small Business Administration's 7(A) loan program.

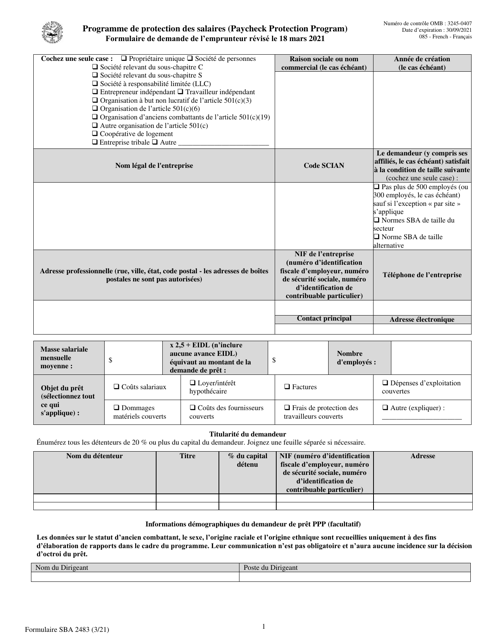

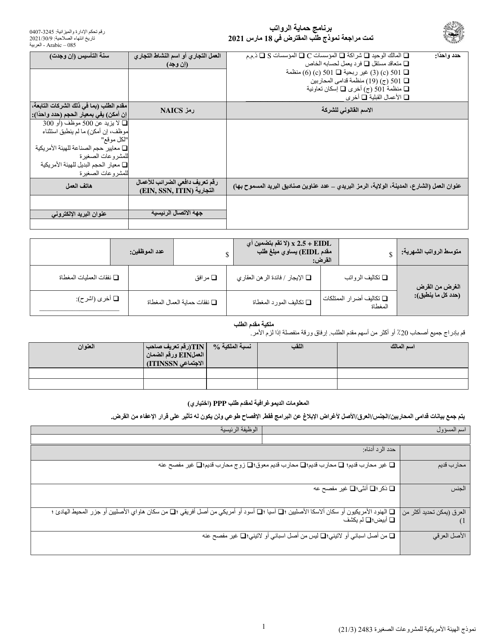

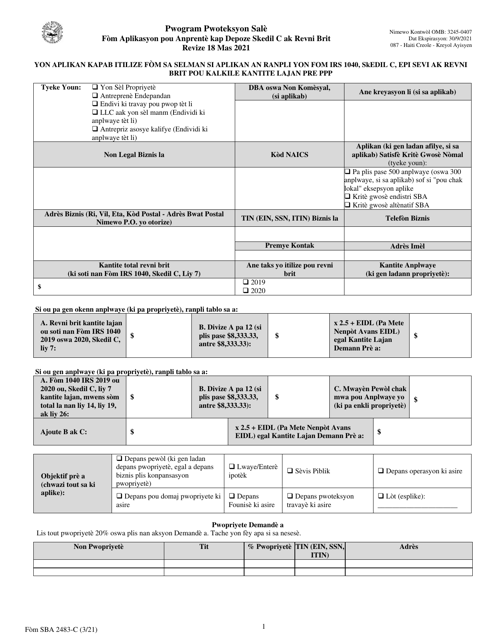

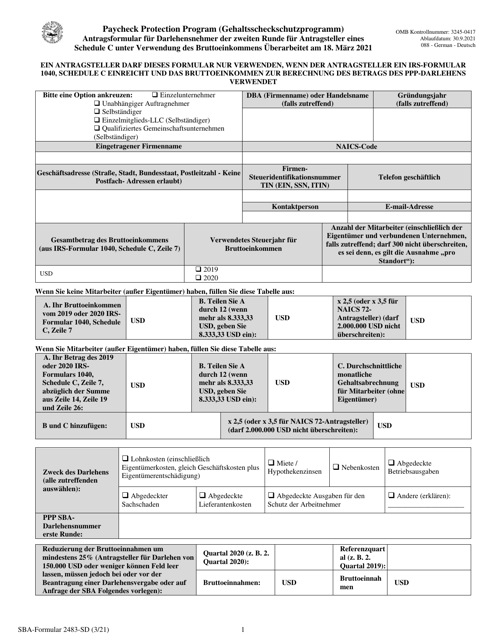

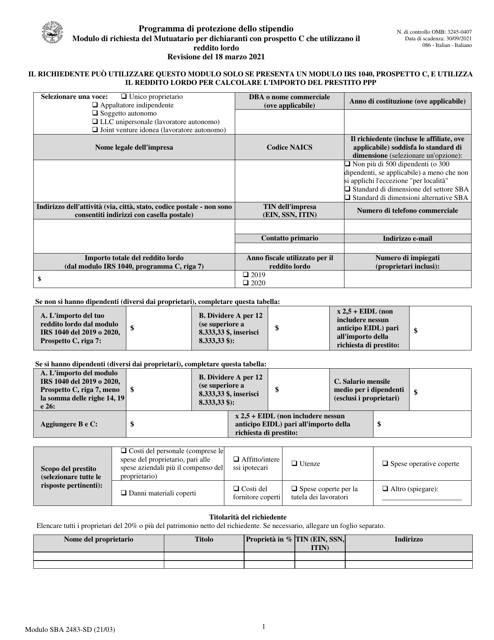

This Form is used for Schedule C filers who are applying for a loan with the Small Business Administration (SBA) and are using gross income as their method of calculation.

This form is used for small business owners who file their taxes with a Schedule C form and are applying for a second draw loan through the Small Business Administration. The form specifically caters to those who calculate eligibility based on gross income.

This form is used for second draw borrowers who are self-employed using gross income and need assistance from the SBA.

This Form is used for Italian Schedule C filers applying for the First Draw Borrower Application under the SBA program.

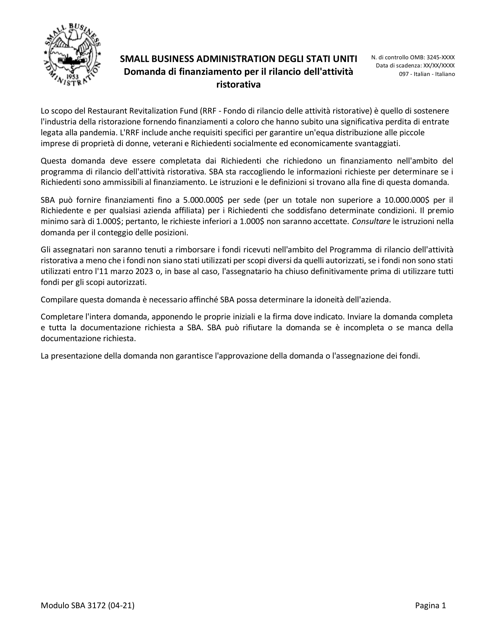

This document is a sample application form for the Restaurant Revitalization Funding Program offered by the Small Business Administration (SBA). It specifically caters to Italian restaurants.

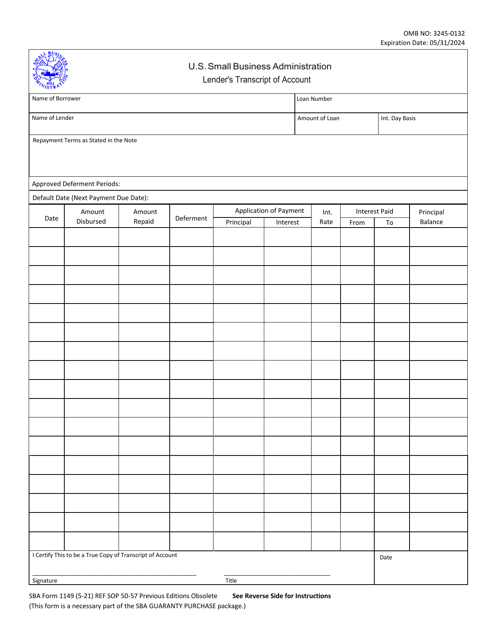

This document keeps track of the disbursement of 7(a) Loan proceeds and the applications of payments. It allows to determine the date the loan went into default and to assess how much interest the lender is receiving.

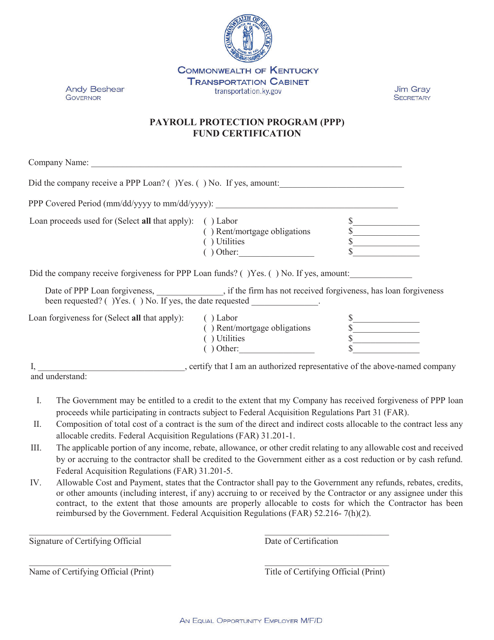

This document is the Payroll Protection Program (PPP) Fund Certification specifically for businesses located in Kentucky. It verifies that a business has received funds from the PPP program, which is designed to provide financial support to businesses during the COVID-19 pandemic.

This form is issued by the Small Business Administration (SBA) and used by small businesses applying for a 7(a) loan and submitted to the SBA participating lender.