Fuel Sales Templates

Are you looking for accurate and up-to-date information about fuel sales? Look no further! Our comprehensive collection of documents includes everything you need to know about fuel sales, also known as the fuel sales database or fuel sales records.

Whether you're a business owner, a tax professional, or simply interested in understanding the regulations and processes surrounding fuel sales, our extensive collection of forms and instructions is here to help.

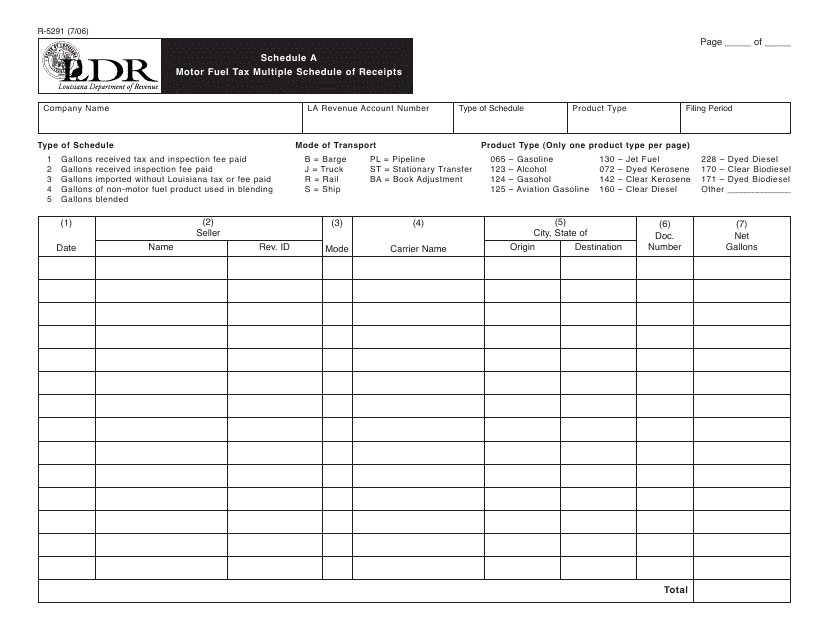

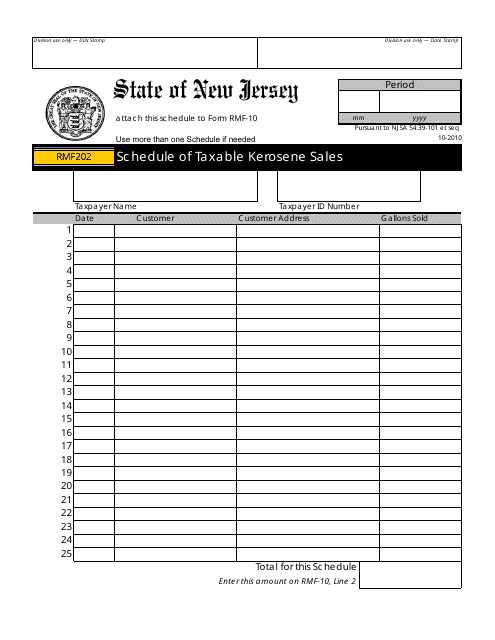

For instance, if you're operating in Louisiana, you can access the Form R-5291 Schedule A Motor Fuel Tax Multiple Schedule of Receipts, which provides a detailed breakdown of your fuel sales and tax liabilities. Similarly, the Form RMF202 Schedule of Taxable Kerosene Sales in New Jersey highlights the specific requirements for reporting kerosene sales in the state.

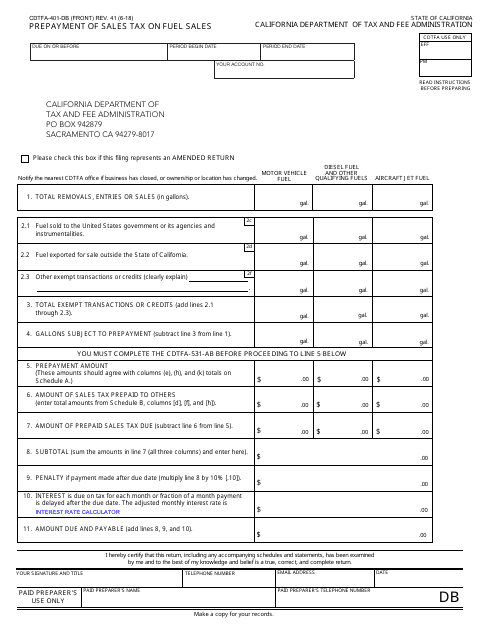

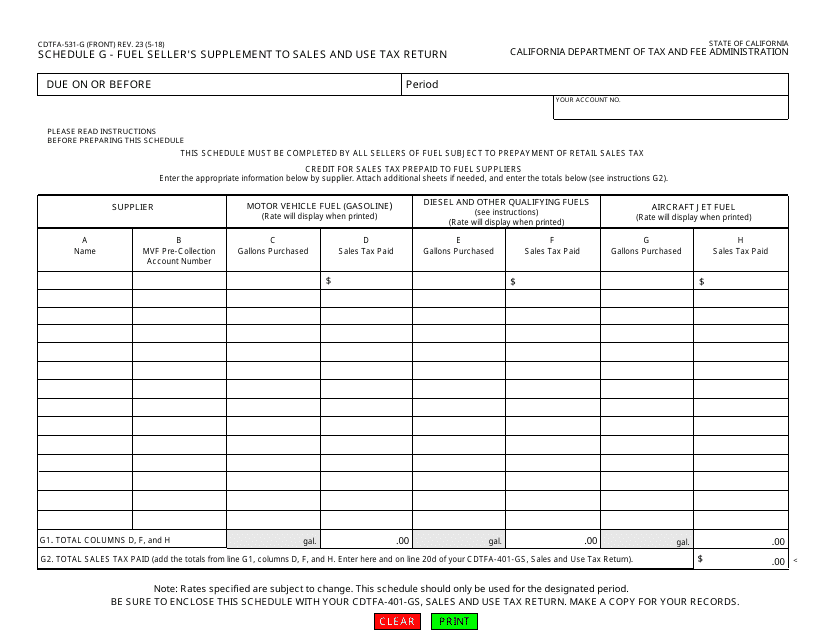

If you're a fuel supplier in California, you might need to refer to the Form CDTFA-401-DB Prepayment of Sales Tax on Fuel Sales, which provides instructions on how to prepay your sales tax obligations. On the other hand, the Instructions for Form GAS-1288 Kerosene Supplier Return in North Carolina outline the proper procedure for submitting your kerosene supplier return.

In addition to these specific forms, we offer detailed instructions on how to complete various fuel sales-related documents, such as the Instructions for Form EIA-863 Petroleum Product Sales Identification Survey.

With our comprehensive collection of fuel sales documents, you can easily navigate the complex world of fuel sales regulations and confidently fulfill your reporting and payment obligations. Stay informed and compliant with our valuable resources. Explore our fuel sales documents today!

Documents:

17

This form is used for reporting multiple motor fuel tax receipts in Louisiana.

This Form is used for reporting and documenting the sales of taxable kerosene in the state of New Jersey. It is used by businesses to comply with tax regulations and provide accurate information to the government.

This document is for prepaying sales tax on fuel sales in California. It is used by businesses to submit their prepayment to the California Department of Tax and Fee Administration (CDTFA).

This form is used for fuel sellers in California to provide additional information for their sales and use tax return. It is a supplement form that helps sellers report their fuel sales accurately.

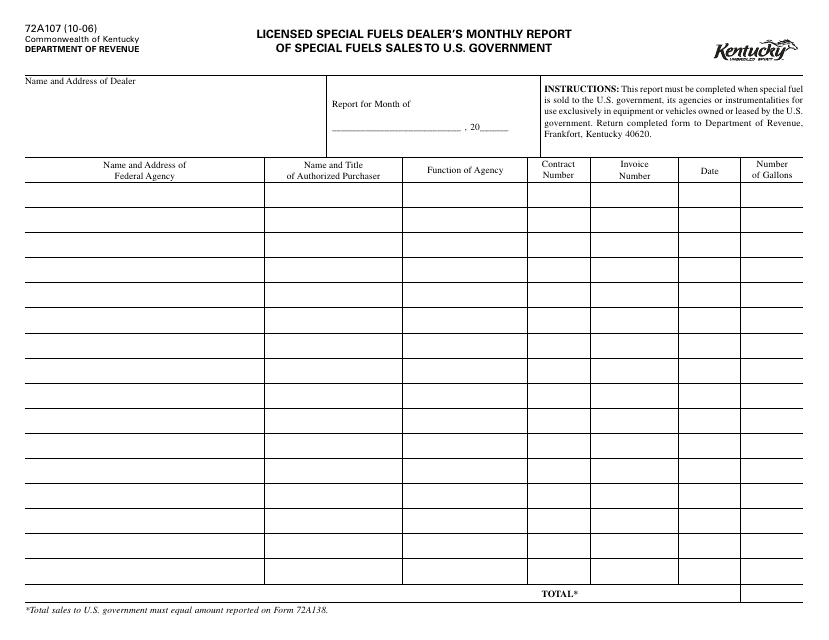

This form is used for licensed special fuel dealers in Kentucky to report their monthly sales of special fuels to the U.S. Government. It helps track and regulate the sales of special fuels to the government in Kentucky.

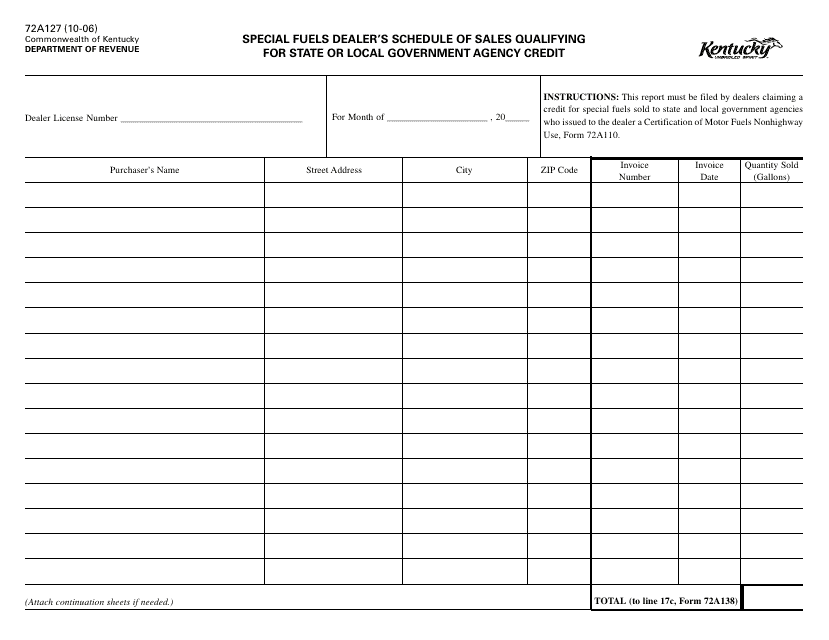

This form is used for reporting sales of special fuels eligible for state or local government agency credits in Kentucky.

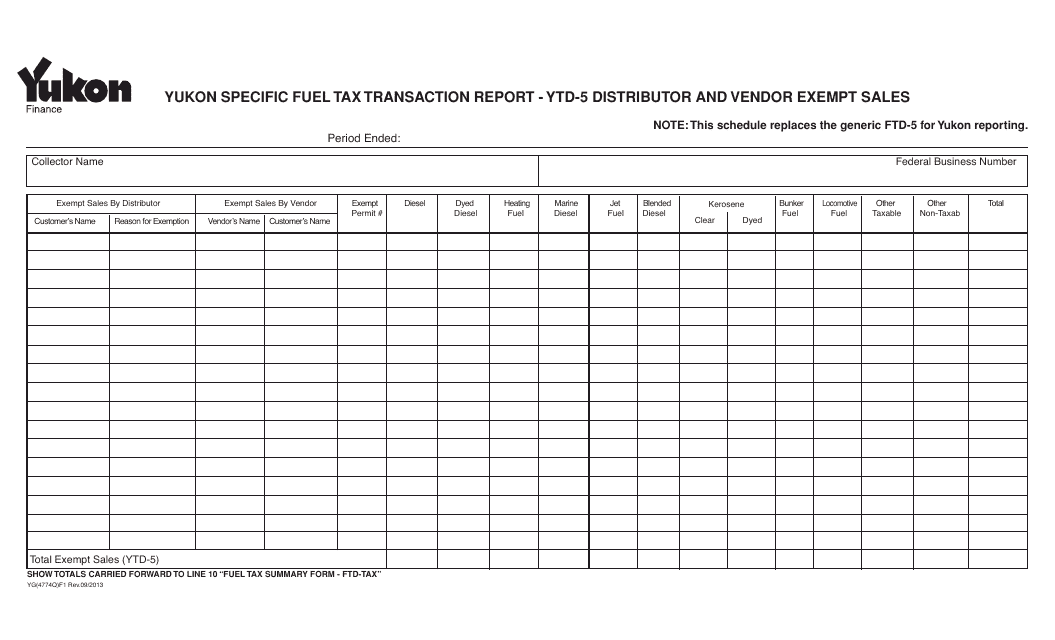

This Form is used for reporting Yukon specific fuel tax transactions related to distributor and vendor exempt sales. It is specific to the Yukon territory in Canada.

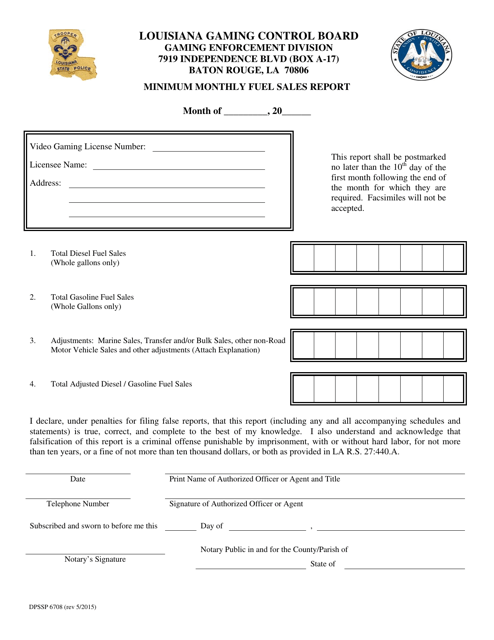

This form is used for reporting the minimum monthly fuel sales in the state of Louisiana.

This document is used for reporting the minimum monthly fuel sales meter reading in the state of Louisiana.

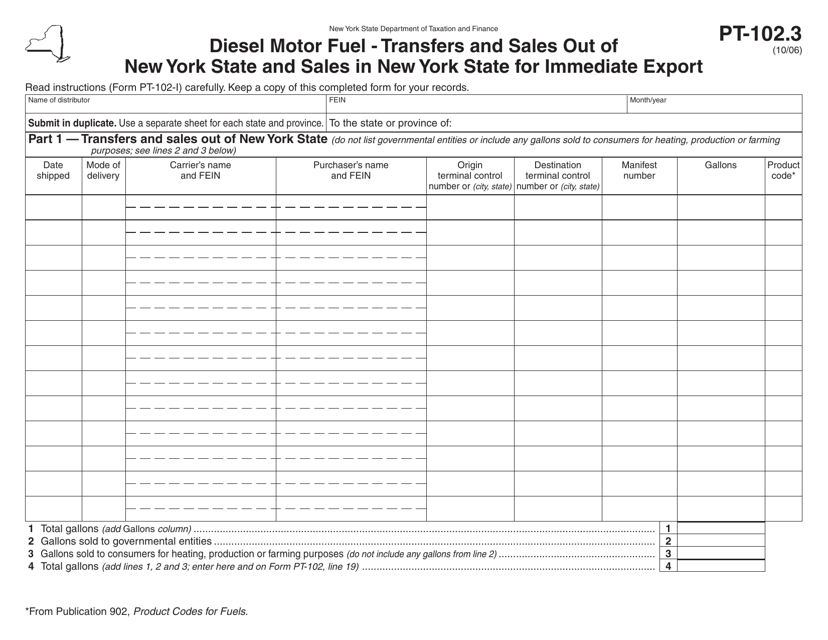

This form is used for reporting the transfers and sales of diesel motor fuel in and out of New York State, specifically for immediate export.

This Form is used for collecting information on petroleum product sales. It provides instructions on how to complete the survey accurately.