Operating Loss Templates

Operating loss, also known as operating losses, is a term used to describe the financial situation of a business or individual where the expenses exceed the revenue generated from their operations. This can occur due to various factors such as high costs, low sales, or unforeseen circumstances.

Operating losses can have a significant impact on the financial health of an entity as it reduces taxable income and may require additional funding to cover the shortfall. It is essential for businesses and individuals to understand and manage their operating losses effectively to minimize financial strain and ensure long-term sustainability.

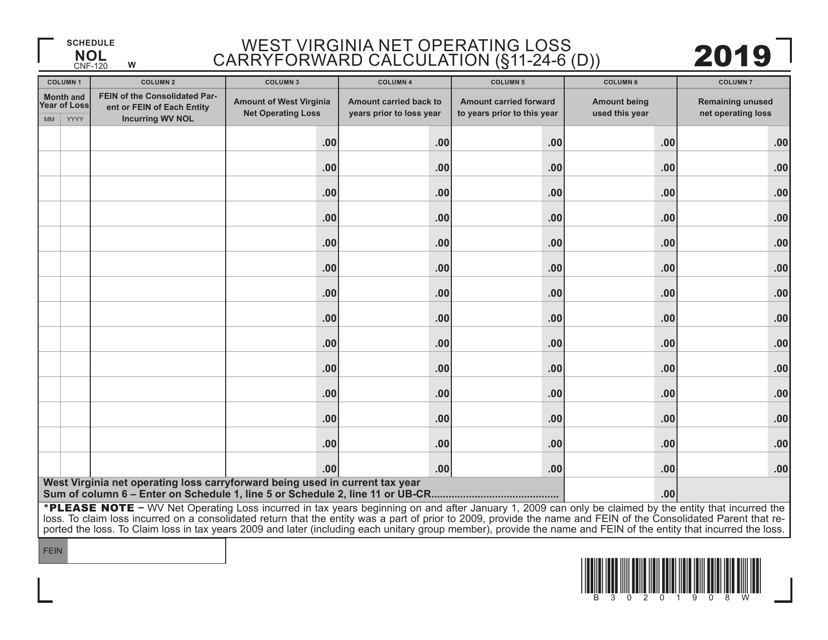

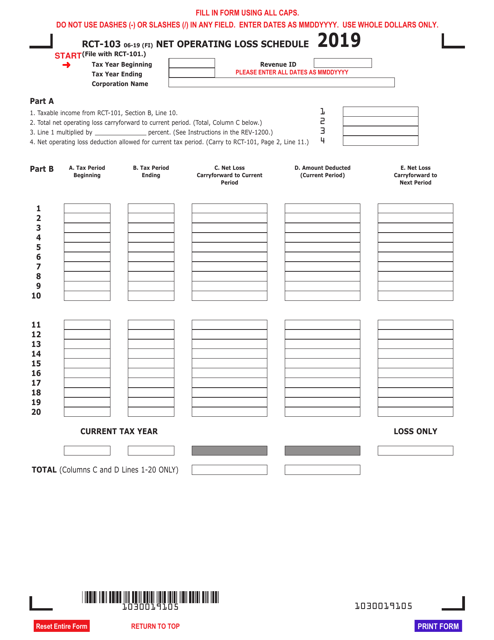

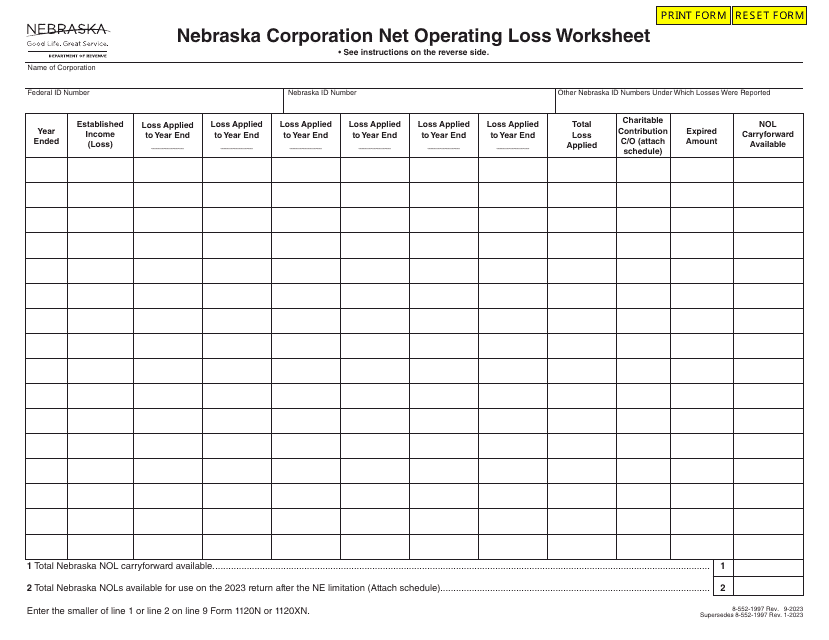

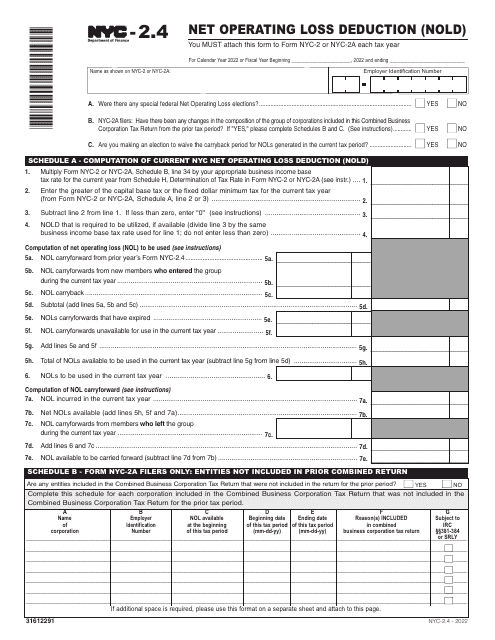

To calculate and manage operating losses, different jurisdictions have specific requirements and forms. For instance, in West Virginia, Form CNF-120 Schedule NOL is used to calculate the Net Operating Loss Carryforward. Similarly, in Pennsylvania, Schedule RCT-103 Net Operating Loss Schedule is required, while in New York City, businesses use Form NYC-2.4 for the Net Operating Loss Deduction.

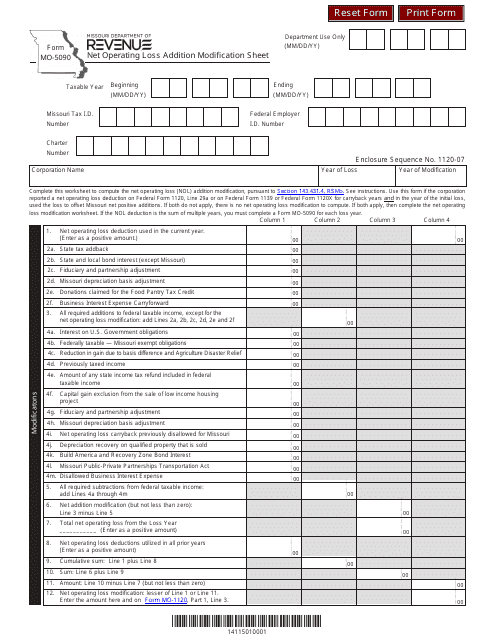

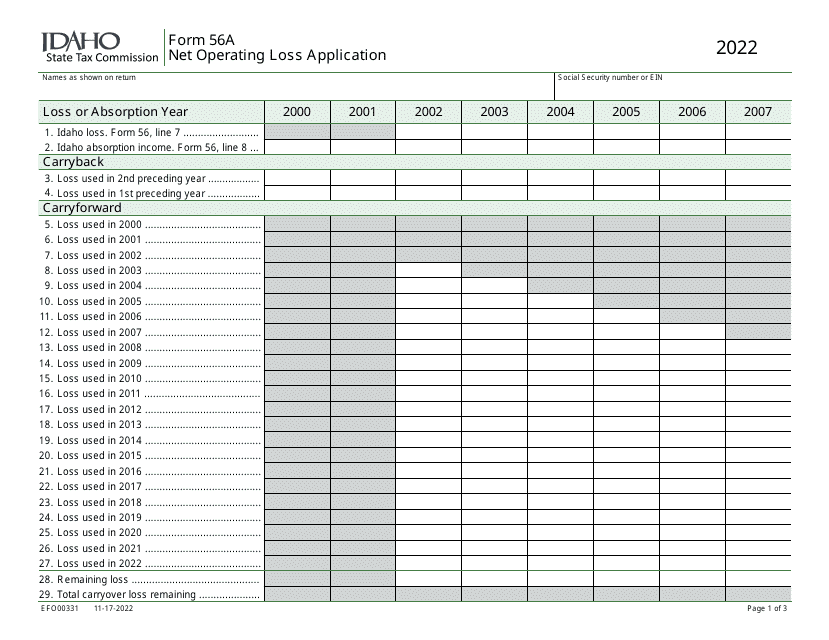

In Missouri, individuals and entities must complete Form MO-5090 Net Operating Loss Addition Modification Worksheet to accurately report operating losses. Meanwhile, in Idaho, Form 56A (EFO00331) Net Operating Loss Application is the official document for applying for a net operating loss.

Understanding and properly completing these operating loss forms is crucial for businesses and individuals to offset losses against future income and potentially receive tax benefits. Failure to accurately report and document operating losses can result in financial penalties or missed opportunities for tax deductions.

For businesses and individuals seeking guidance on managing operating losses and navigating the related forms, professional assistance from accountants or tax experts can be invaluable. These professionals have expertise in tax laws and regulations and can provide strategic advice tailored to specific circumstances, helping to minimize the impact of operating losses and maximize the potential benefits.

In conclusion, operating losses can pose significant challenges to businesses and individuals. To effectively manage and navigate operating losses, it is essential to understand the specific requirements and forms issued by different jurisdictions. Seeking professional guidance can be advantageous in optimizing tax benefits and ensuring financial stability in the face of operating losses.

Documents:

6

This form is used for calculating the net operating loss carryforward in West Virginia. It is specifically for taxpayers in West Virginia who are filing their state taxes.

This form is used for reporting net operating losses in the state of Pennsylvania.

This form is used for applying for a net operating loss in the state of Idaho. It helps individuals or businesses offset their income by deducting any previous losses.