IRS Collections Templates

Are you facing difficulties with IRS collections? Don't worry, we are here to help you. Our team is well-versed in dealing with IRS collections and can guide you through the process, ensuring that your rights are protected.

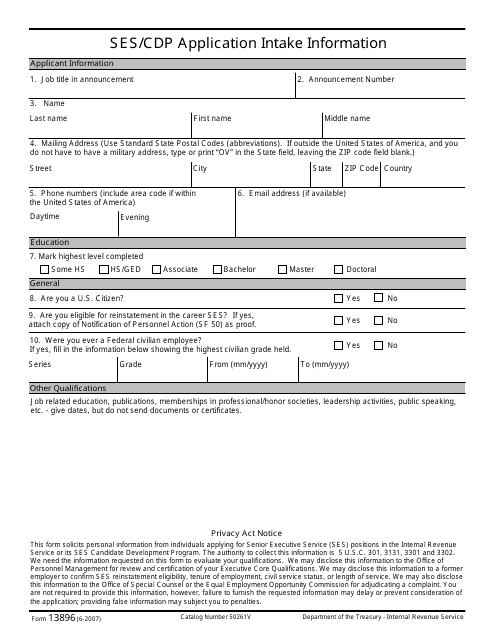

At Templateroller.com, we understand that dealing with the IRS can be a daunting task. That's why we offer a range of services to assist you with your IRS collection issues. Whether you need help filling out IRS Form 13896 or understanding the complexities of IRS Notice CP3219N, our experts have the knowledge and expertise to provide you with the assistance you need.

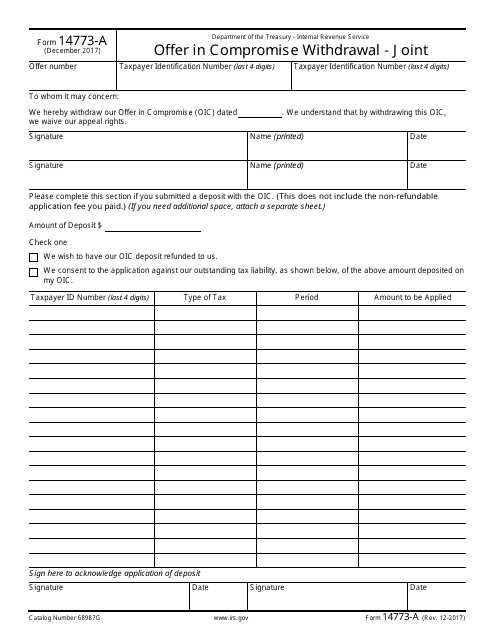

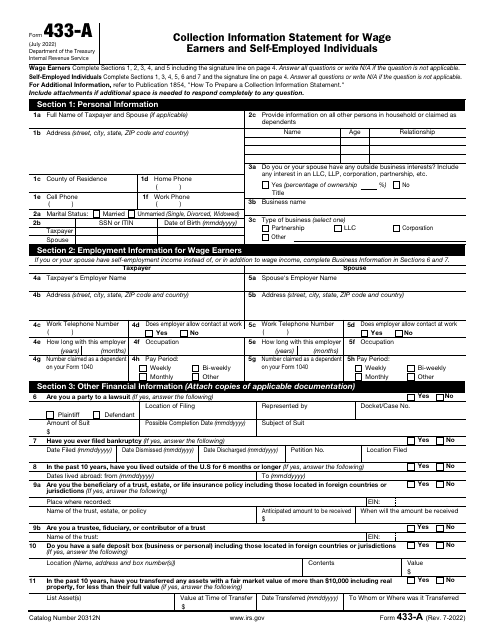

Our dedicated team can also help you with IRS Form 14773-A, which is used for Offer in Compromise withdrawal, or IRS Form 433-A, the Collection Information Statement for Wage Earners and Self-employed Individuals. We will ensure that you have all the necessary documentation and information to submit a strong case to the IRS.

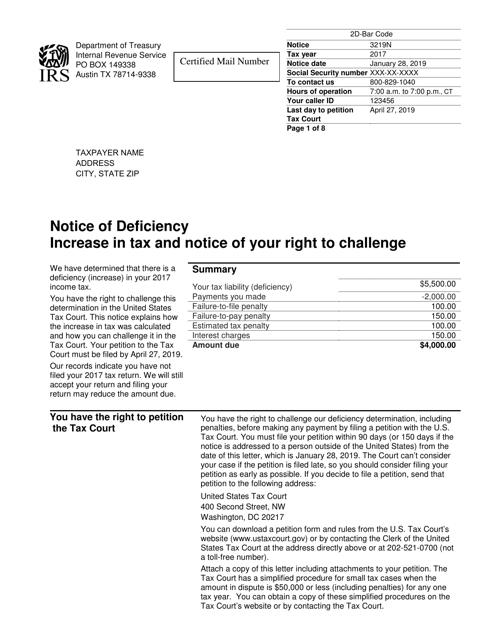

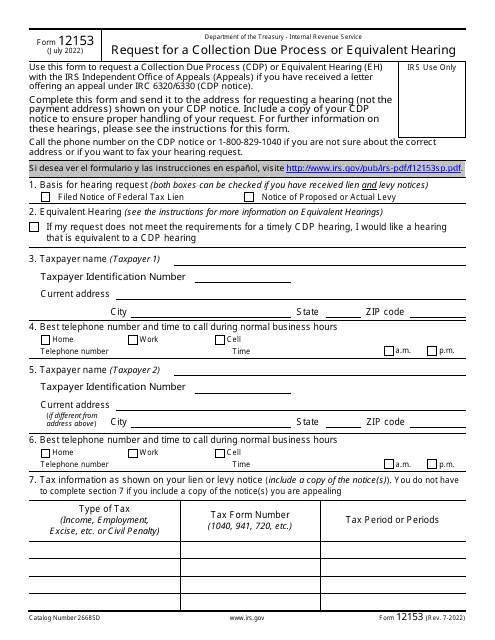

If you have received IRS Notice CP3219N or any other notices of deficiency, it is crucial to take action promptly. Ignoring these notices can lead to serious consequences, including wage garnishment or asset seizure. Our team can assess your situation and guide you through the appropriate steps, such as filing IRS Form 12153 for a Collection Due Process or Equivalent Hearing.

Don't let the complexity of IRS collections overwhelm you. Our experienced professionals are here to assist you every step of the way. Contact us today to schedule a consultation and let us help you navigate the IRS collections process with confidence.

Documents:

6

This form is used for applying for a Ses/Cdp Application Intake with the IRS.

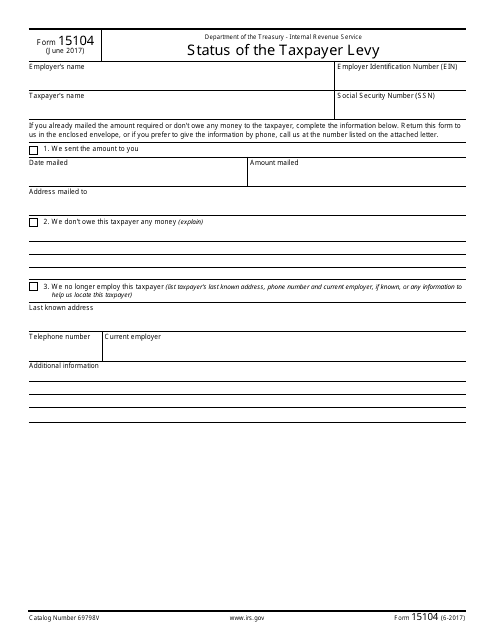

This form is used to check the status of a taxpayer levy with the IRS.

This form is used for withdrawing a joint offer in compromise submission to the IRS.

This document is a Notice of Deficiency from the Internal Revenue Service (IRS). It is sent to taxpayers who have underreported their income or have other tax liabilities. The notice provides information about the proposed changes to the tax return and the options available to the taxpayer to respond.

This is a fiscal form filled out by a taxpayer to appeal an upcoming tax levy or lien.