Additional Child Tax Credit Templates

Are you looking to claim the Additional Child Tax Credit? This tax credit is designed to provide extra financial support for families with dependent children. However, navigating the complex world of tax forms and documents can be overwhelming. That's where our Additional Child Tax Credit resource comes in.

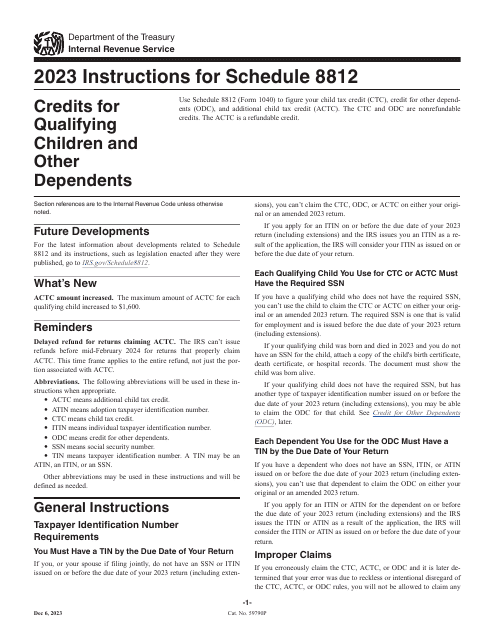

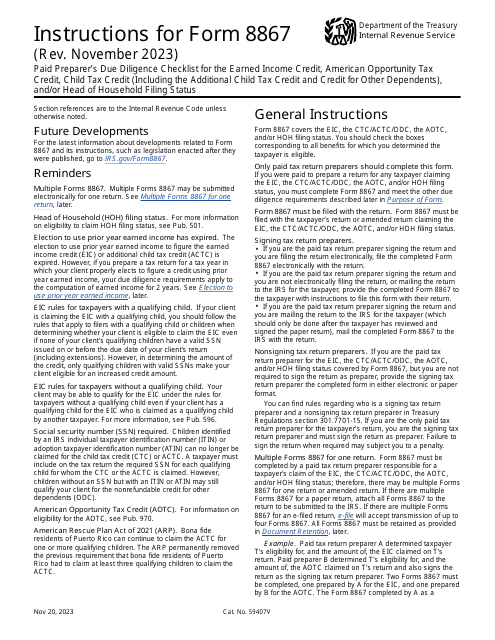

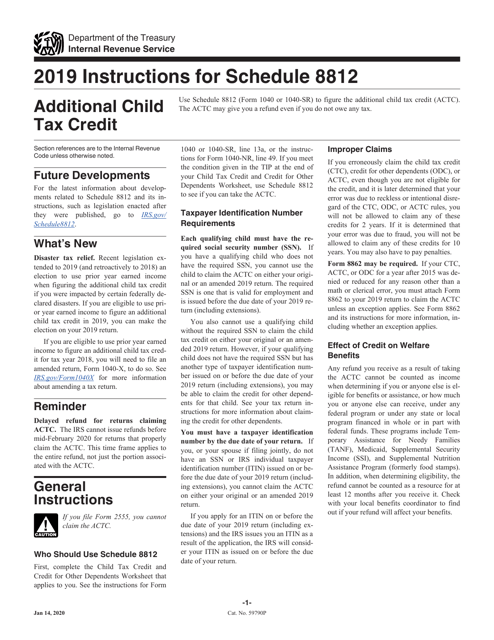

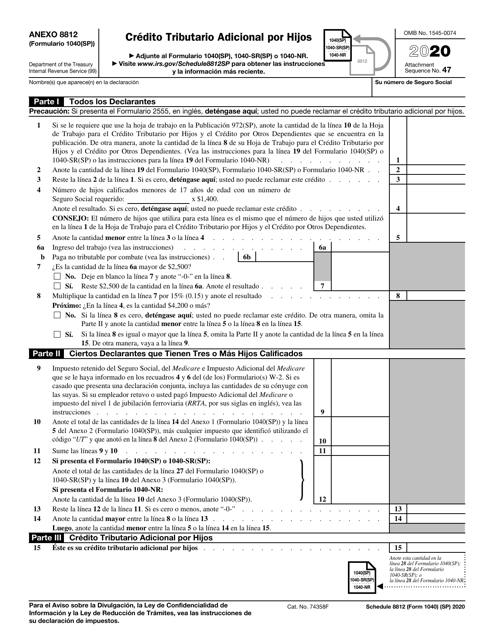

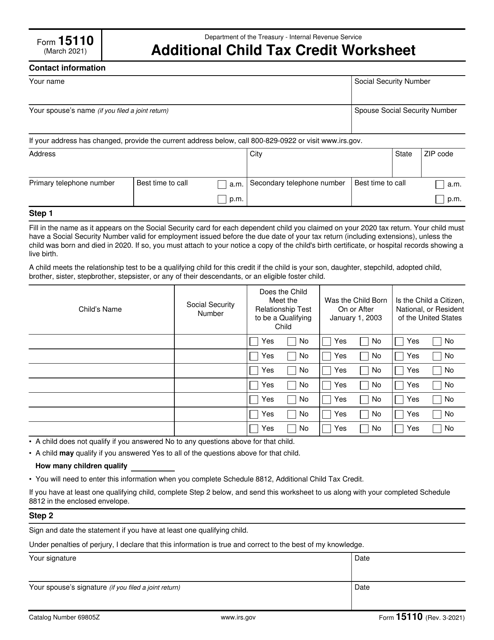

Our comprehensive collection of documents and resources will guide you through the process of claiming the Additional Child Tax Credit. From IRS forms such as Form 1040 Schedule 8812 and Form 15110, to step-by-step instructions like the IRS Form 8867 Paid Preparer's Due Diligence Checklist, we have everything you need to ensure you receive the maximum benefit.

Our Alternate Names collection provides additional flexibility, ensuring that you can find the information you need no matter how it's labeled. Whether you refer to it as the Additional Child Tax Credit or its various other names, our resource will help you understand the eligibility requirements, calculate the credit amount, and fill out the necessary forms accurately.

Don't let the paperwork and jargon stand in the way of claiming the Additional Child Tax Credit you deserve. Let our comprehensive document collection and expert guidance simplify the process for you. Navigate through the world of tax credits with ease and get the financial support you need for your family.

Documents:

21

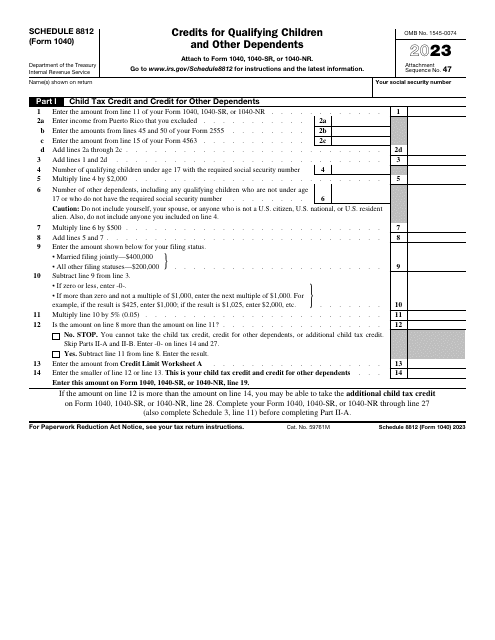

This is a fiscal statement created to let taxpayers with children make the most of the tax benefits they qualify for via extra tax credit.

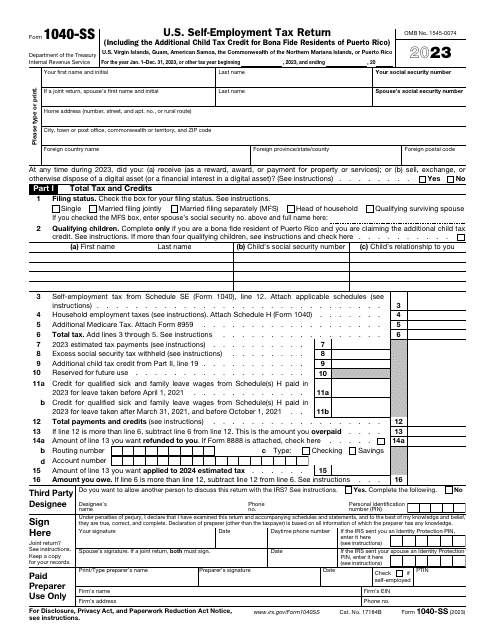

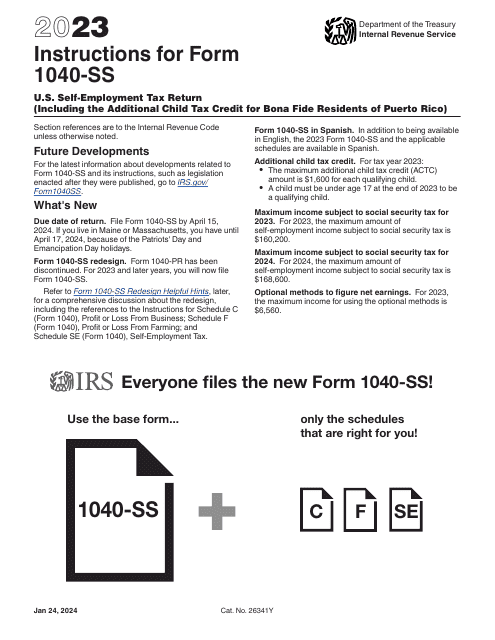

Use this document only if you are a resident of the United States Virgin Islands (USVI), Commonwealth of Puerto Rico, Commonwealth of the Northern Mariana Islands (CNMI), Guam, and American Samoa and wish to report your self-employment net earnings to the United States.

This form is used for claiming the Additional Child Tax Credit on your federal tax return. It provides instructions on how to fill out Form 1040 or Form 1040-SR if you qualify for this tax credit.

This Form is used for claiming the Additional Child Tax Credit on your tax return.

This form is used for calculating the additional child tax credit.