School Tax Templates

Are you a resident of New York and seeking information about school taxes and related forms? Look no further! Our website provides a comprehensive guide to school tax resources that can help you understand and manage your tax obligations in New York State.

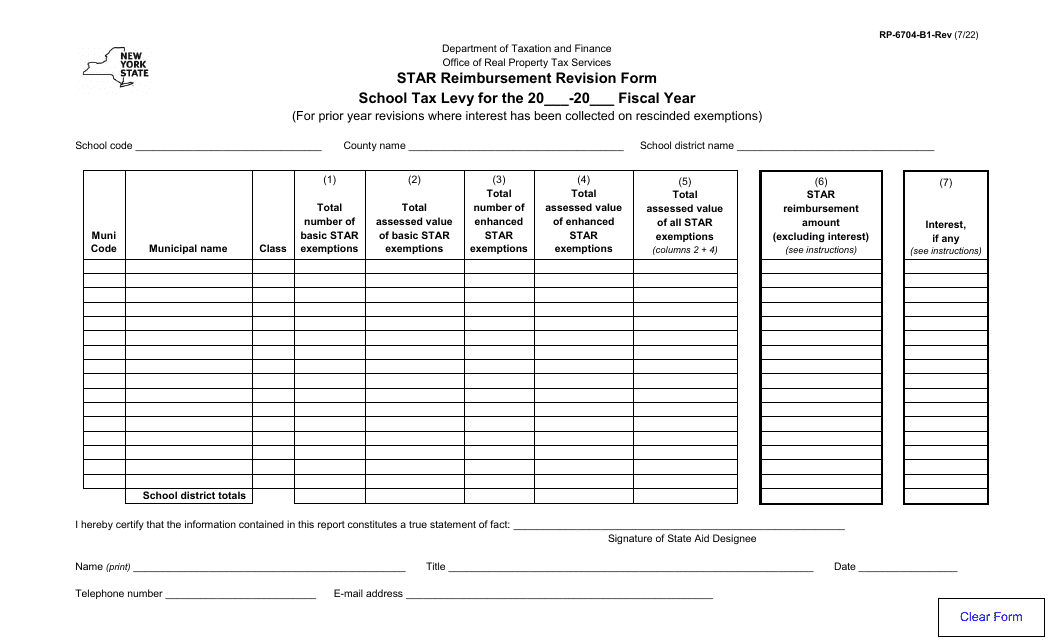

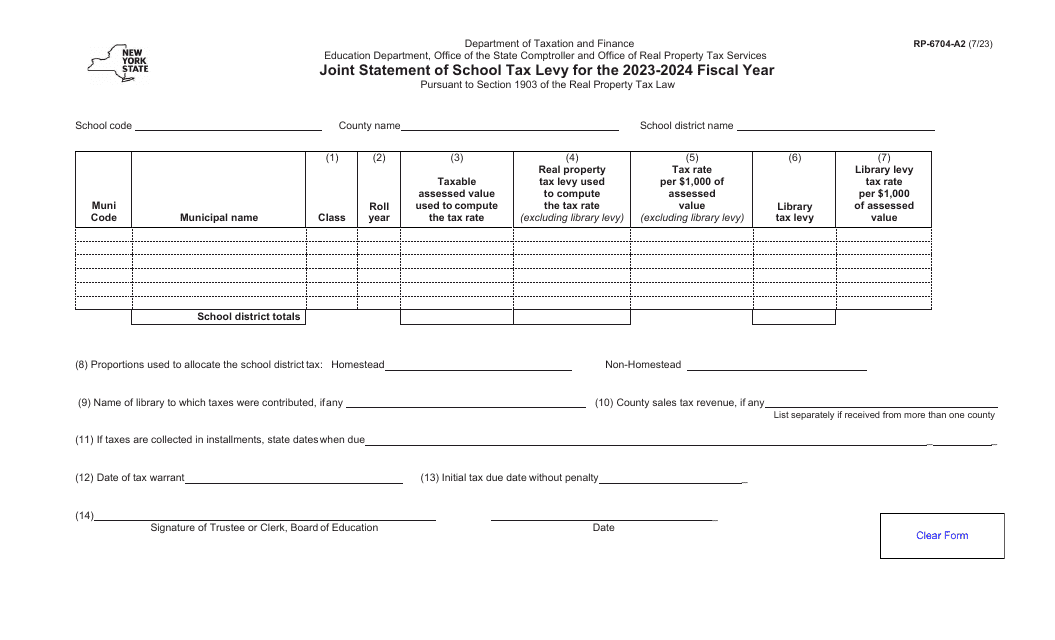

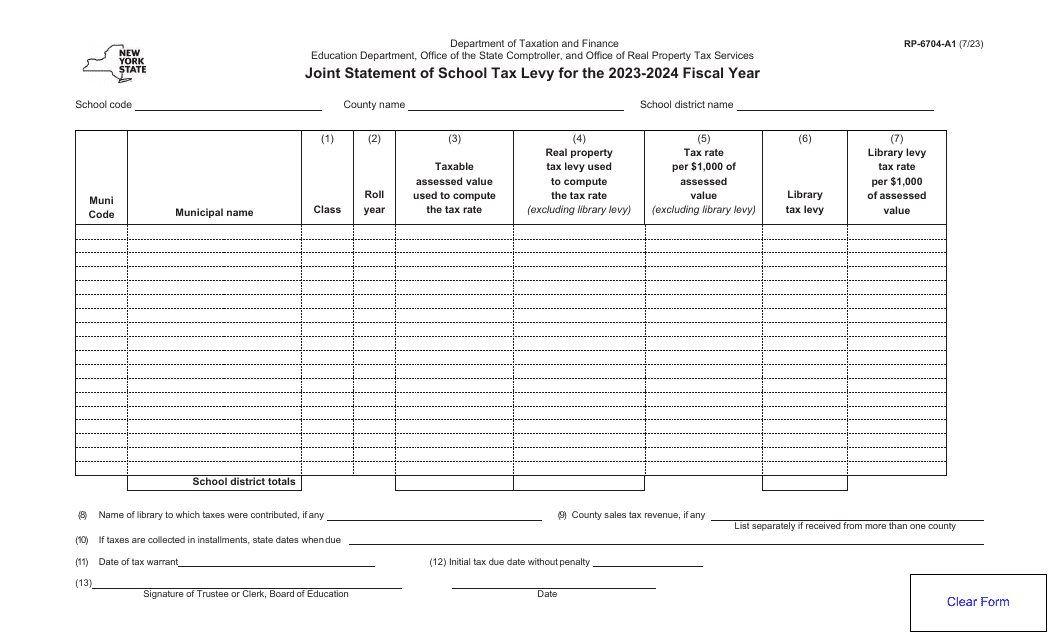

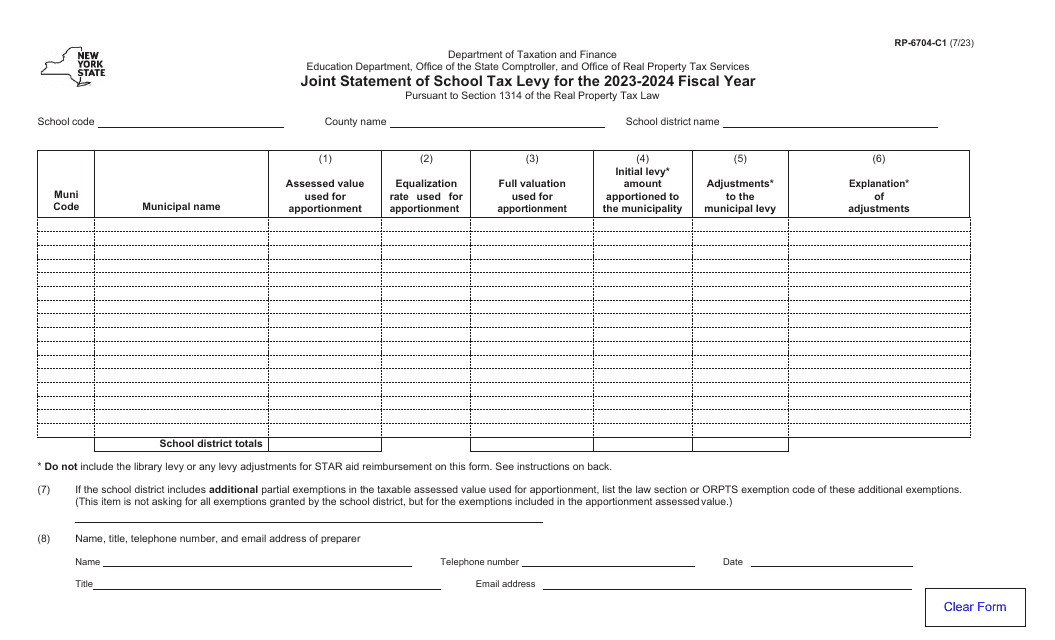

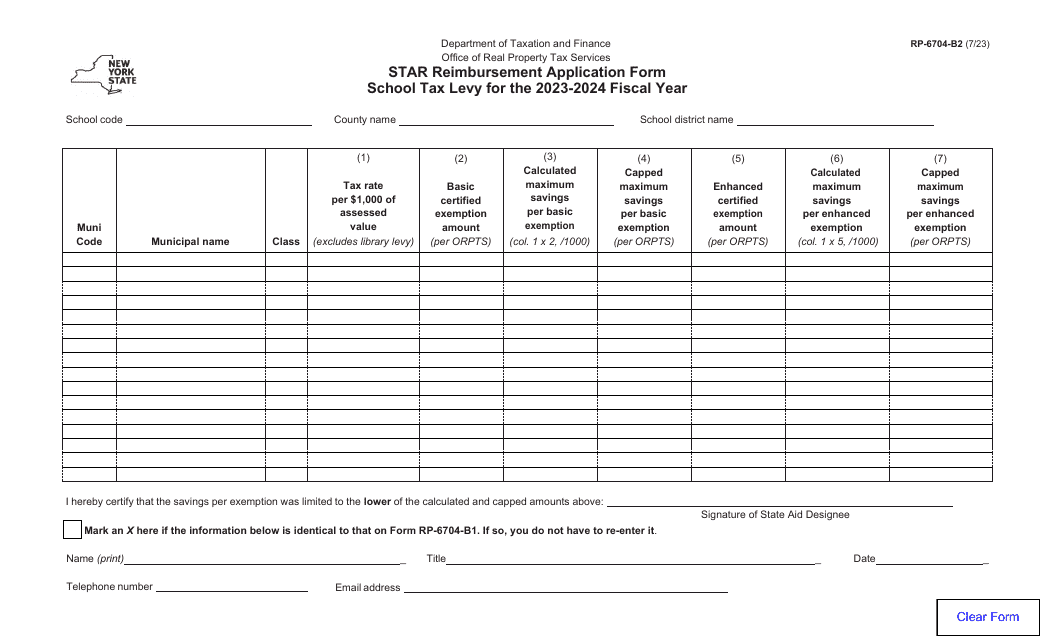

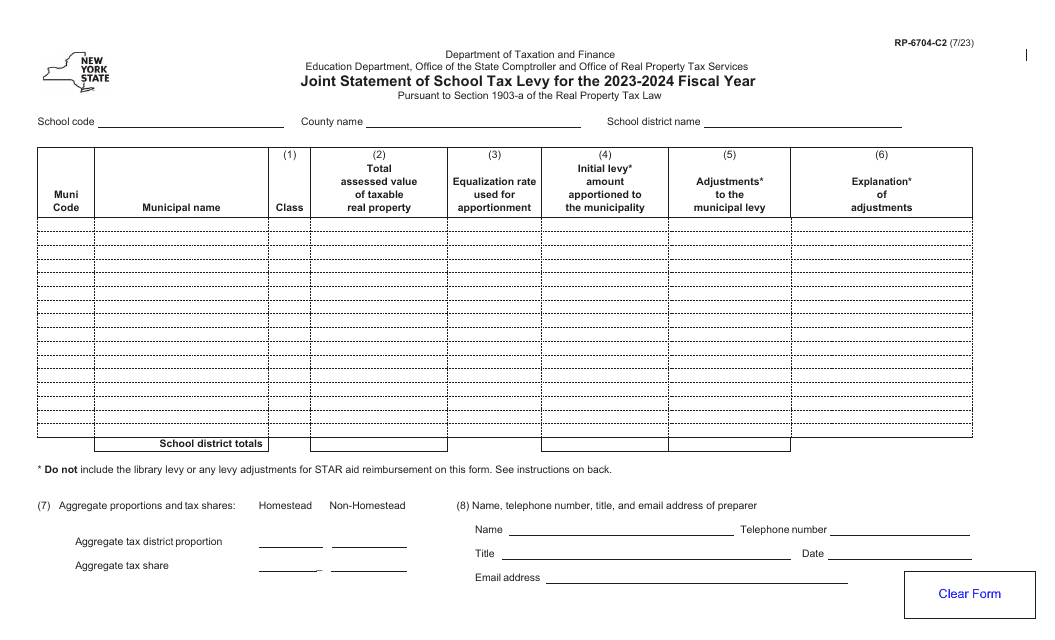

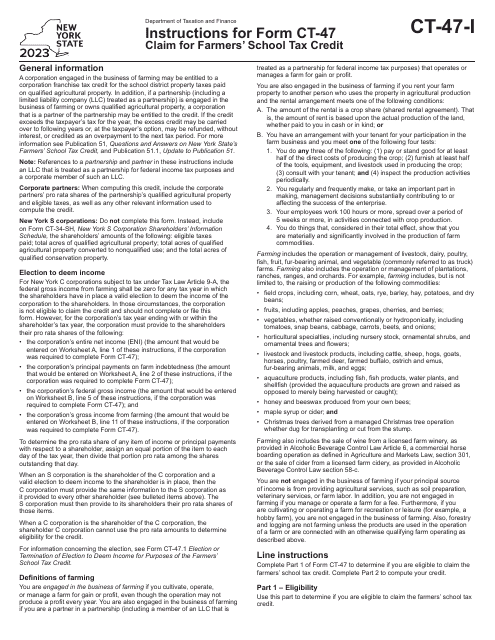

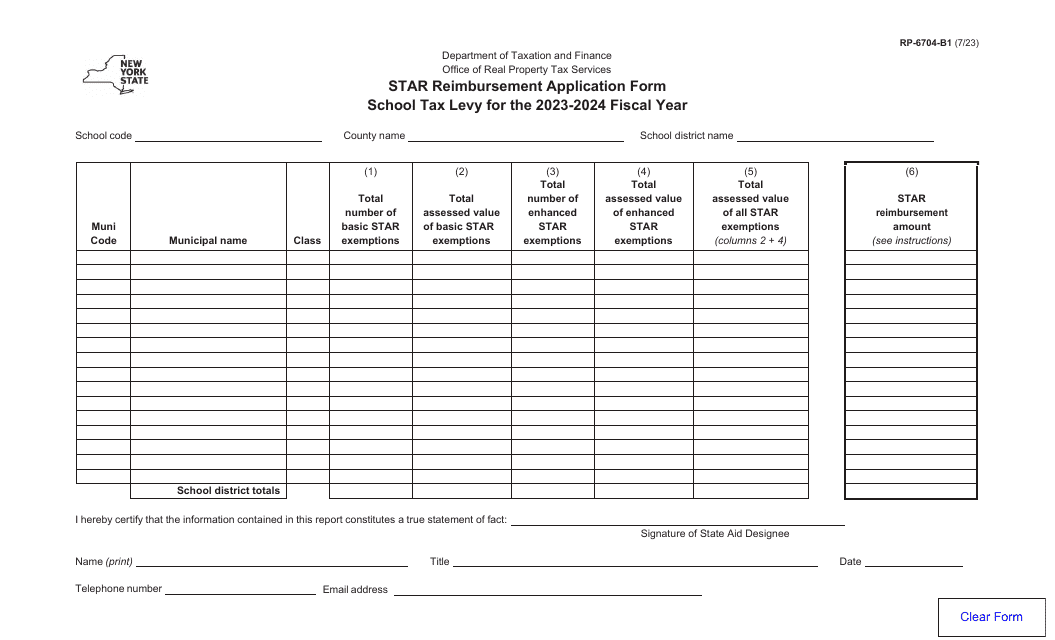

Sometimes referred to as "Form RP-6704-B2 Star Reimbursement Application Form - School Tax Levy" or "Form RP-6704-A2 Joint Statement of School Tax Levy," these documents are essential for homeowners who want to apply for the Star Reimbursement program or disclose their joint statement of school tax levy. Another critical resource is the "Form CT-47 Claim for Farmers' School Tax Credit - New York," which benefits farmers who are eligible for this tax credit.

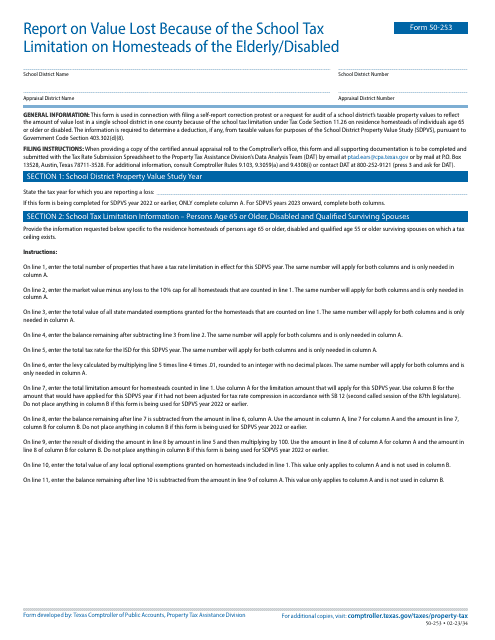

Our website has all the details and instructions you need to complete these forms correctly. Whether you are a homeowner, farmer, or a concerned citizen, we strive to make the process as simple and straightforward as possible. Our step-by-step guidelines will walk you through each form, ensuring that you have a clear understanding of the requirements.

Our user-friendly interface allows you to easily access the relevant forms and instructions, along with helpful tips and FAQs. You can find all the information you need in one place, saving you time and effort. We understand that dealing with taxes can be overwhelming, but our goal is to provide you with the knowledge and resources to navigate the school tax system confidently.

So, whether you're a first-time homeowner or a seasoned farmer looking for tax credits, our website is your one-stop destination for all your school tax needs. Explore our resources today and take control of your tax obligations with ease!

Documents:

17

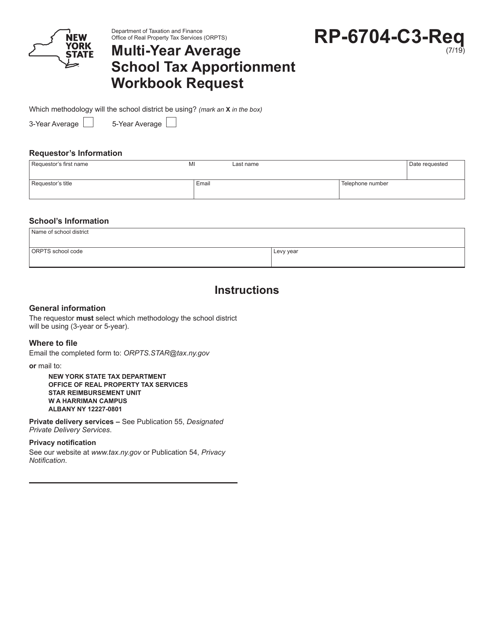

This form is used to request the Multi-Year Average School Tax Apportionment Workbook in New York. It is used to determine the average amount of school tax that should be apportioned over multiple years.