Tax Installment Templates

Are you struggling to pay your taxes in full? Don't worry, there's a solution for you - tax installments. This method allows you to break down your tax payments into manageable chunks, making it easier to stay on top of your financial obligations. With tax installments, you can avoid being burdened by a large lump sum payment and instead pay your taxes in regular, affordable installments.

Whether you refer to it as tax installments, tax instalment, or tax instalments, the concept remains the same. It's a convenient way to fulfill your tax liabilities without overwhelming your budget. By utilizing tax installment plans, you take control of your finances and make tax payments more manageable.

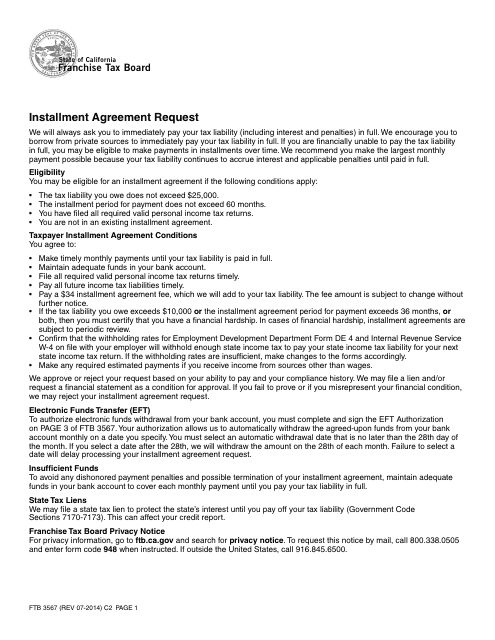

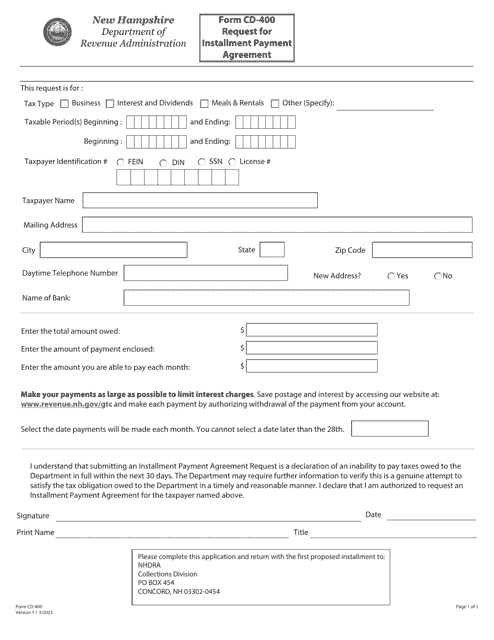

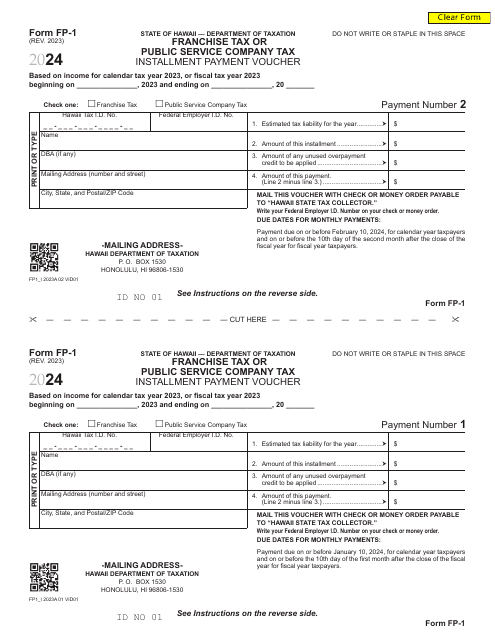

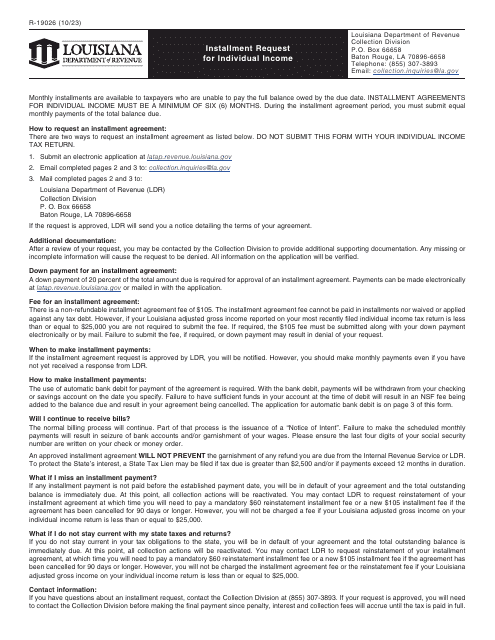

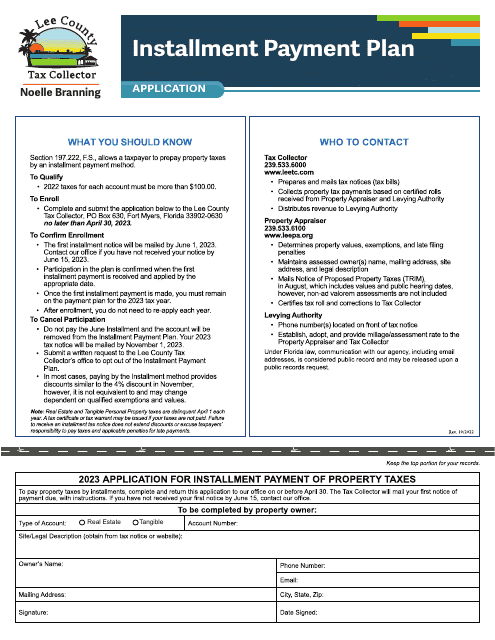

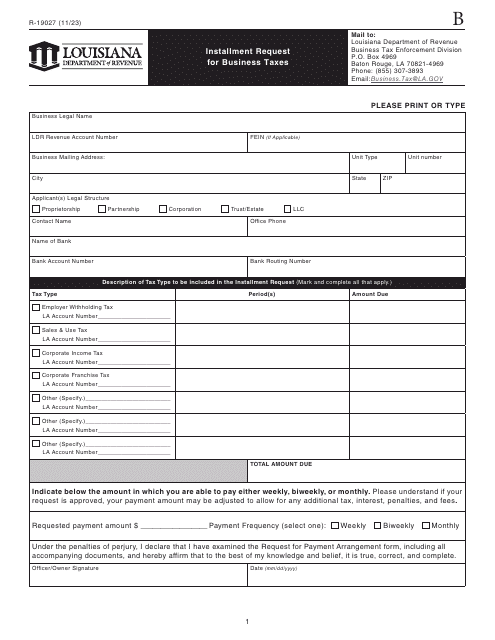

To assist you in navigating the tax installment process, various documents are available to guide you through each step. For instance, you might come across documents like Form FTB3567 Installment Agreement Request in California, Form R-19026 Installment Request forIndividual Income in Louisiana, or Application for Installment Payment of Property Taxes in Lee County, Florida. These documents cater to different regions and jurisdictions but ultimately serve the same purpose - to initiate the tax installment process.

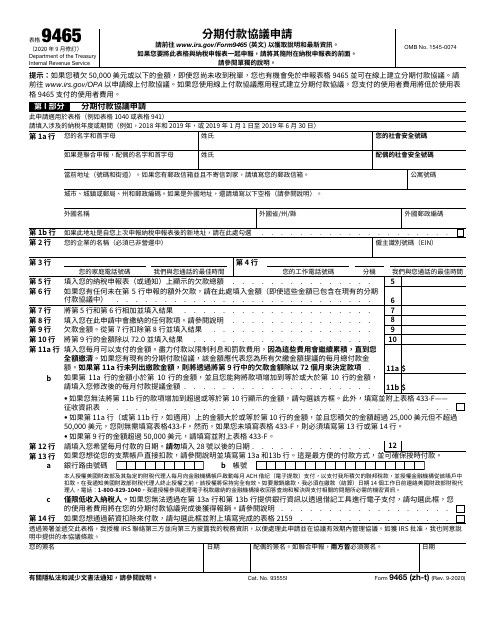

If you are more comfortable reading in Chinese, you can also find the IRS Form 9465 (ZH-T) Installment Agreement Request. It's crucial to have all the necessary documents in order to comply with the specific requirements set by your jurisdiction. This ensures a smooth and hassle-free application process for tax installments.

So, if you find yourself overwhelmed by a large tax bill, don't fret. Take advantage of tax installments, also known as tax instalment or tax instalments. Explore the available documents that suit your regional requirements, such as Form FTB3567 Installment Agreement Request, Form R-19026 Installment Request for Individual Income, Application for Installment Payment of Property Taxes, and IRS Form 9465 (ZH-T) Installment Agreement Request. With tax installments, you can make your tax payments more manageable and alleviate the stress of a hefty lump sum payment.

Documents:

10

This Form is used for requesting an installment agreement with the California Franchise Tax Board (FTB) to pay taxes owed over time.

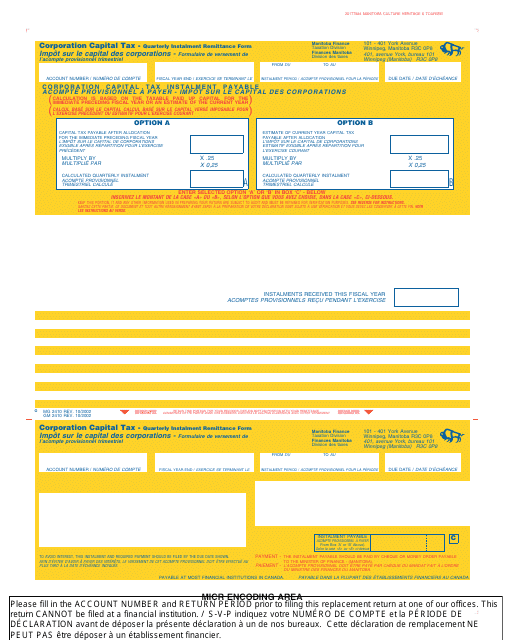

This document is used for remitting quarterly instalments of capital tax for corporations in Manitoba, Canada. The form is available in English and French.

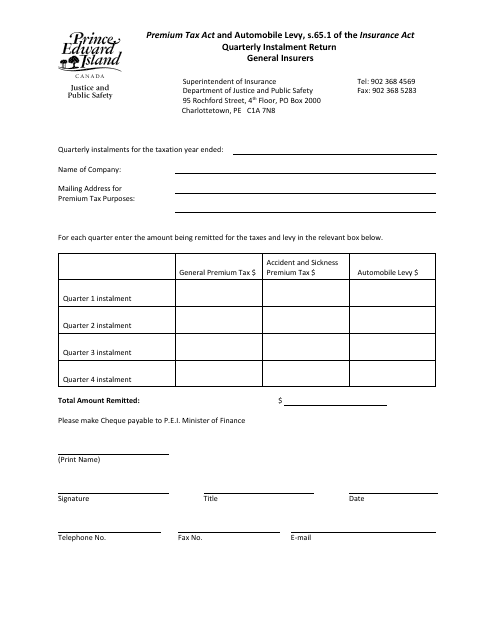

This document is used by businesses in Prince Edward Island, Canada to report their quarterly instalment payments to the government. It is a form that helps businesses calculate and remit the amount they owe for income tax or sales tax on a quarterly basis.

This document is for residents of Lee County, Florida who want to apply for an installment payment plan for their property taxes.