Brownfield Cleanup Program Templates

Are you looking to clean up and redevelop a contaminated property? Look no further than our Brownfield Cleanup Program. Also known as the brownfield redevelopmenttax credit program, this initiative provides a pathway for qualified sites to undergo environmental remediation and receive incentives for revitalization.

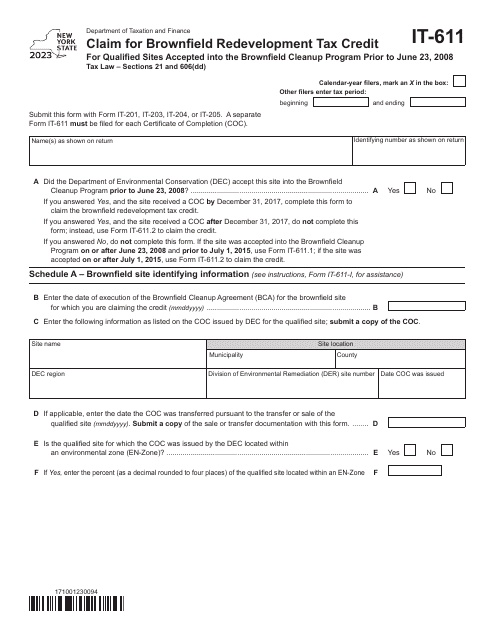

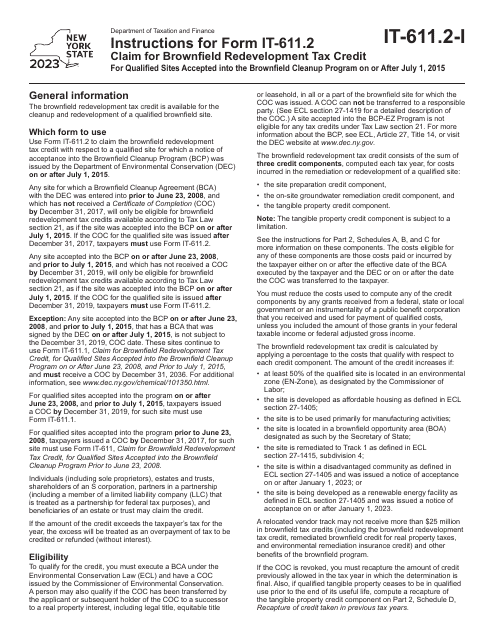

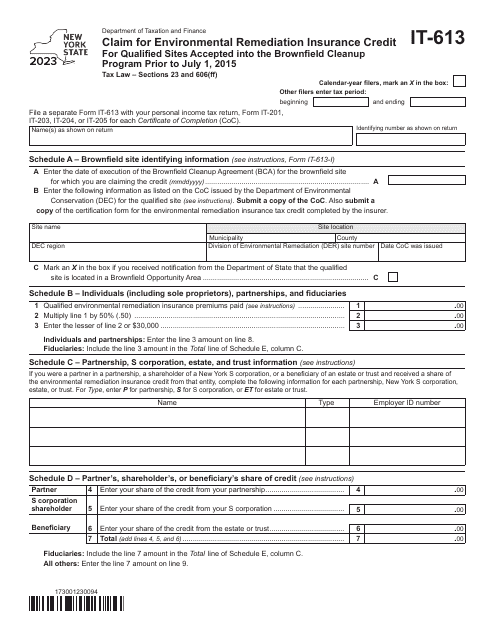

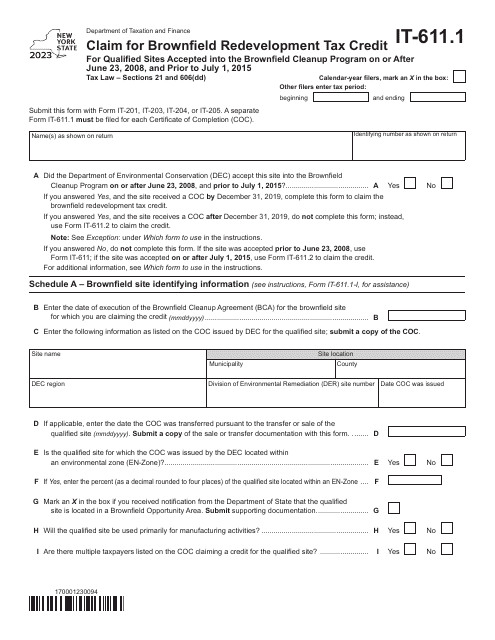

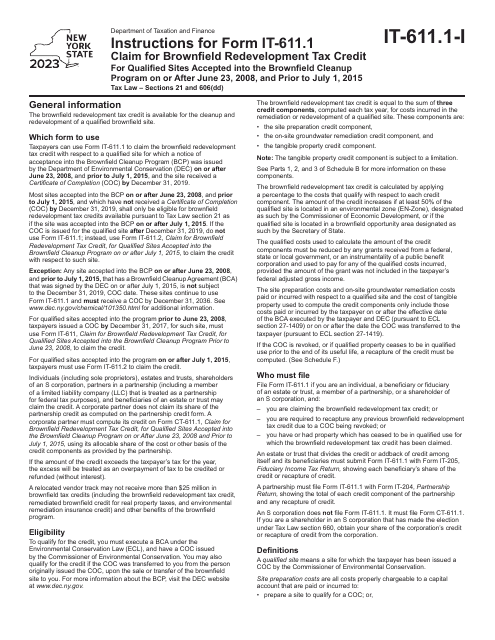

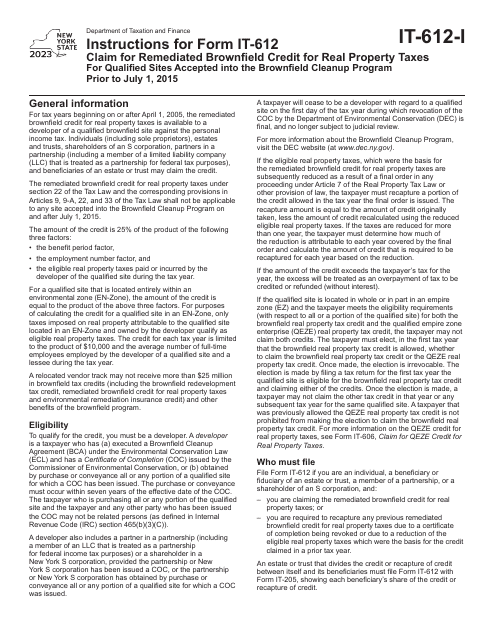

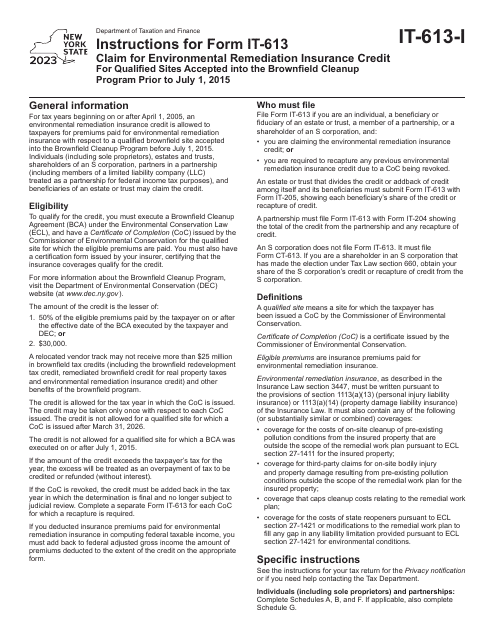

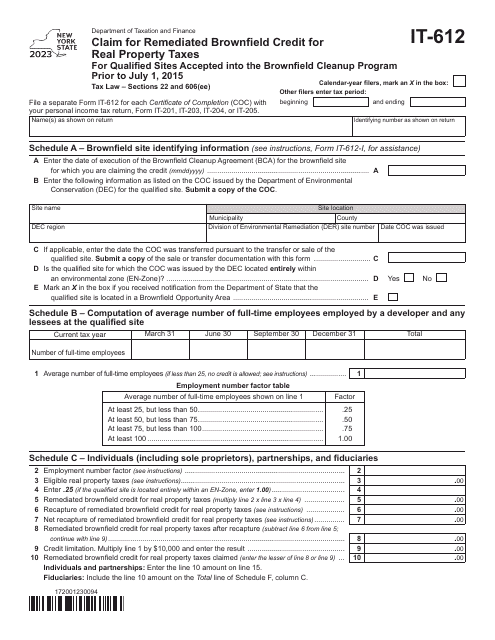

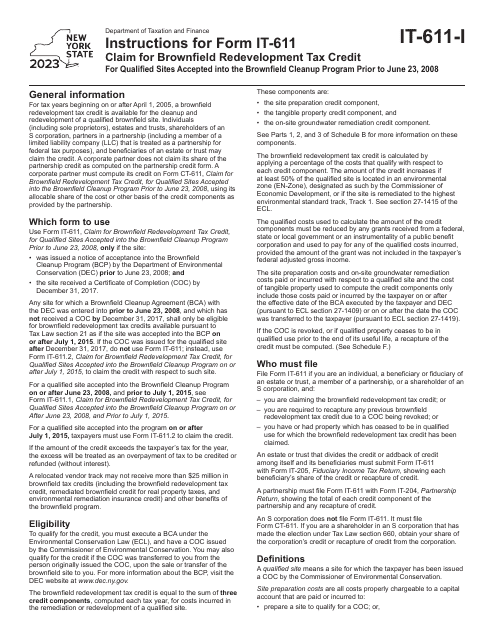

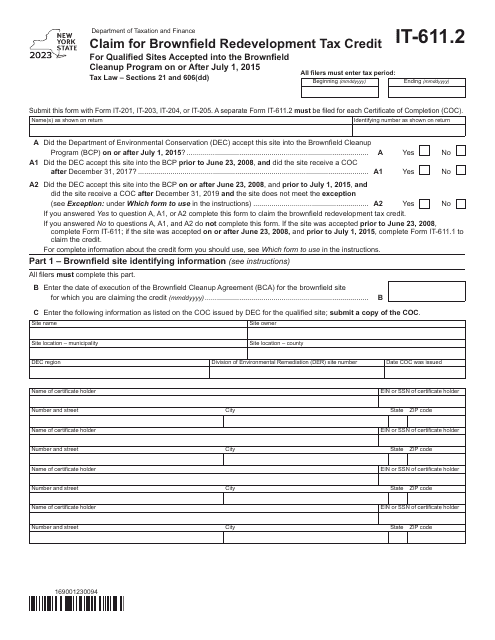

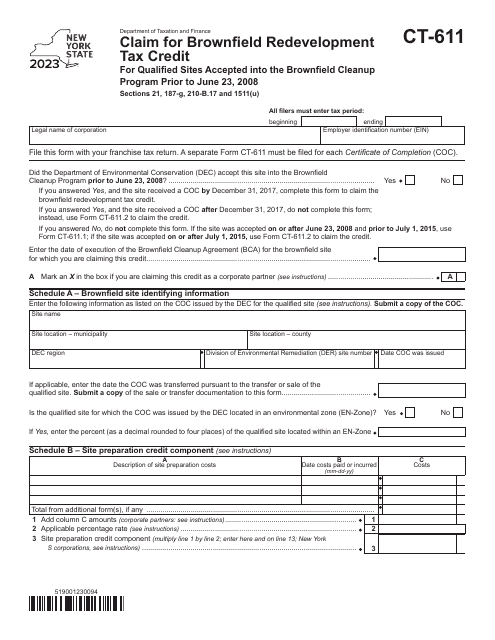

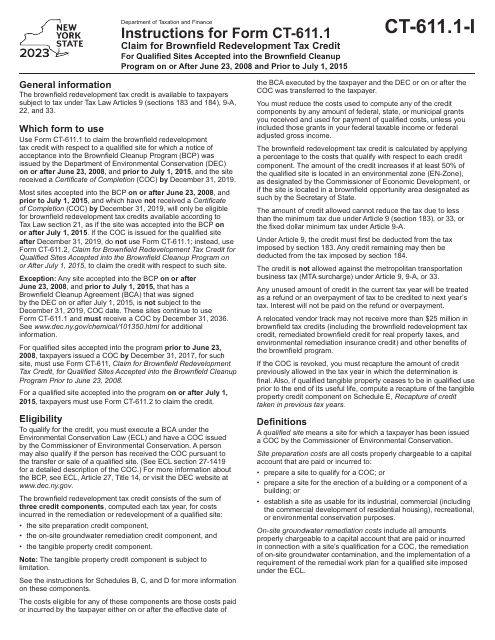

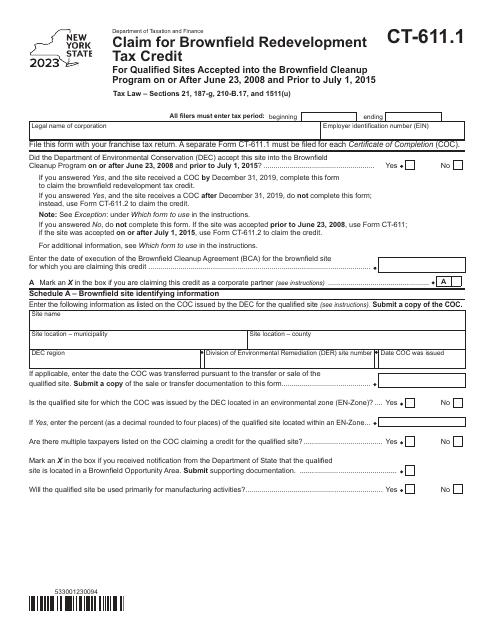

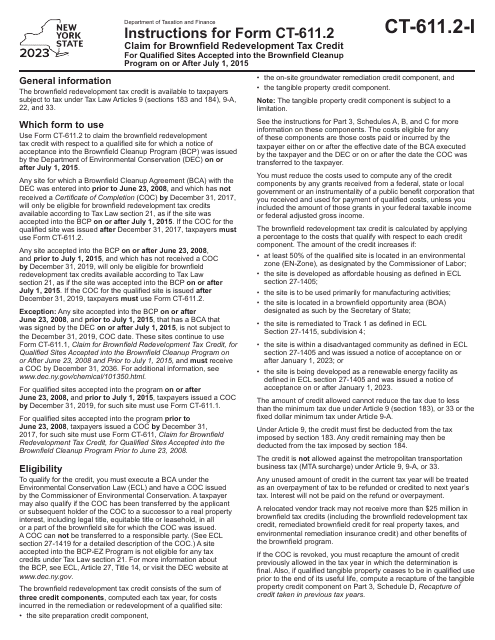

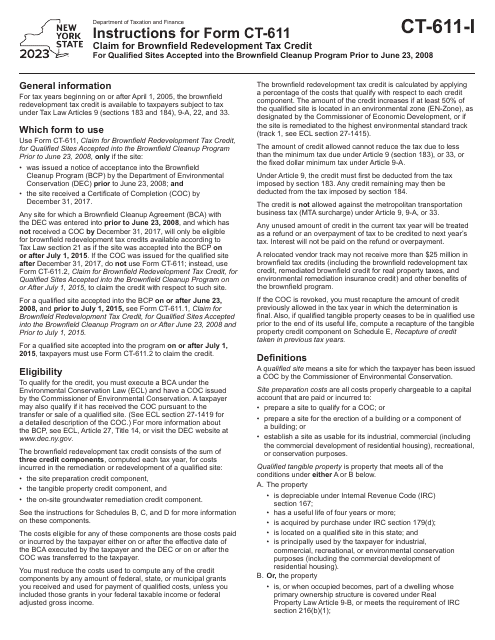

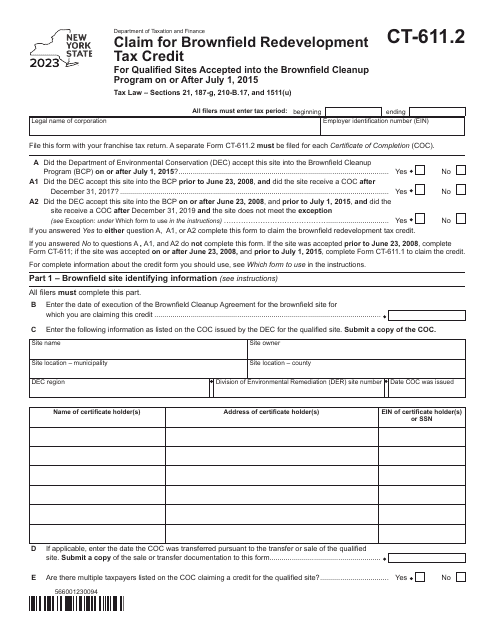

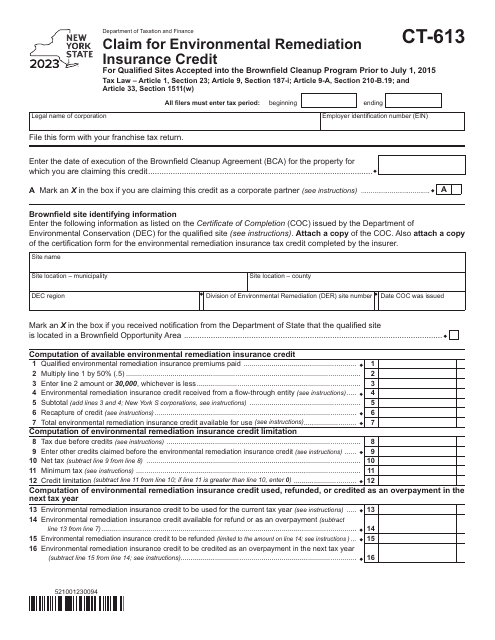

Our program offers various forms and instructions to help you navigate the brownfield cleanup process. For example, you may need to fill out Form IT-613 or Form CT-611.2, depending on the date your site was accepted into the program. These forms allow you to claim environmental remediation insurance credits or brownfield redevelopment tax credits.

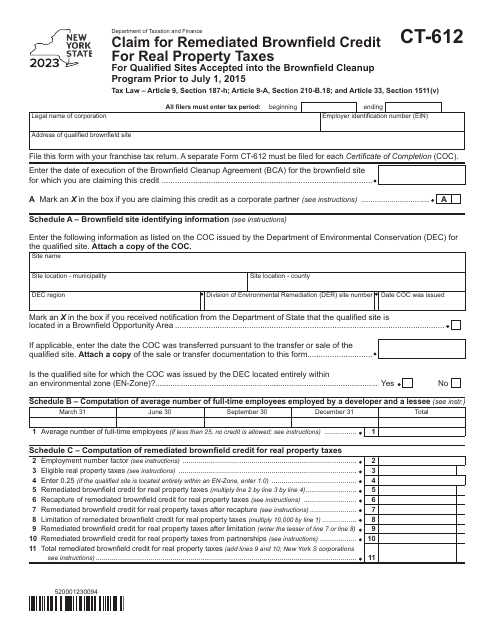

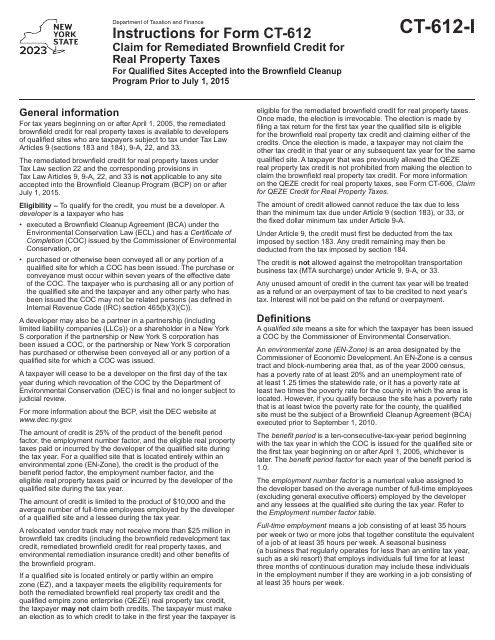

If your site was accepted into the Brownfield Cleanup Program prior to June 23, 2008, you may need to use Form CT-611 or Form CT-612 to claim the appropriate credits. Our detailed instructions for each form will guide you through the necessary steps to complete your claim accurately.

By participating in the Brownfield Cleanup Program, you can not only clean up contaminated sites but also unlock opportunities for future development. Whether you're looking to redevelop a commercial property, industrial site, or even vacant land, our program can provide the support you need.

Take advantage of the Brownfield Cleanup Program today and transform blighted properties into thriving assets for your community. Discover how you can benefit from our brownfield cleanup incentives and make a positive impact on the environment and the local economy.

Note: This text is an example of how your document group can be described. Feel free to modify, expand, or customize it to meet your specific requirements.

Documents:

65