Dependent Care Templates

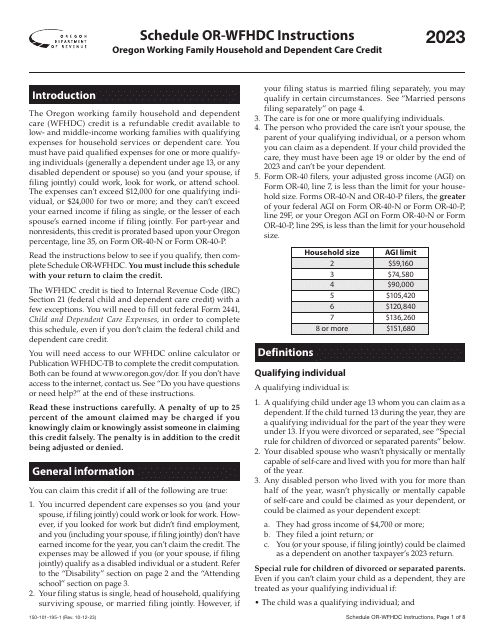

Are you looking for information on dependent care or information related to caring for dependents? Look no further! We have compiled a comprehensive collection of documents that cover various aspects of dependent care. Whether you are looking for tax deductions for child and dependent care expenses, verification forms, or working family household and dependent care credits, we have you covered.

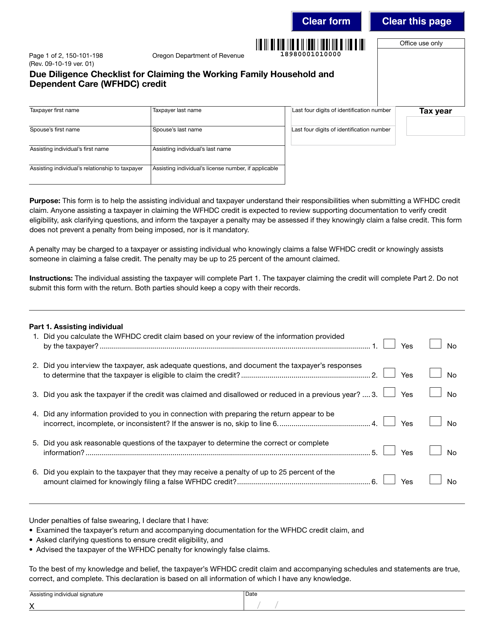

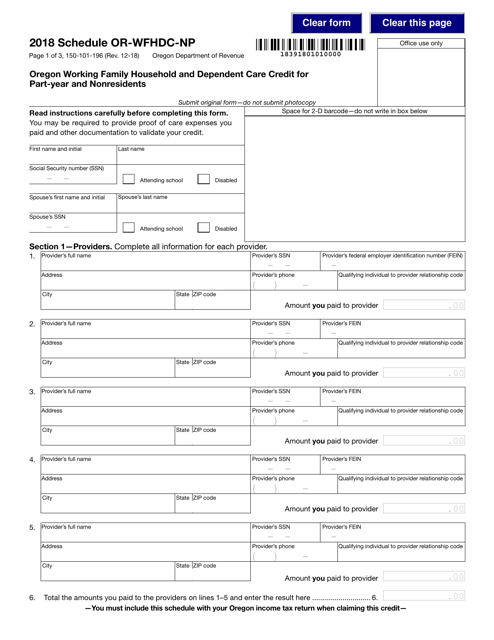

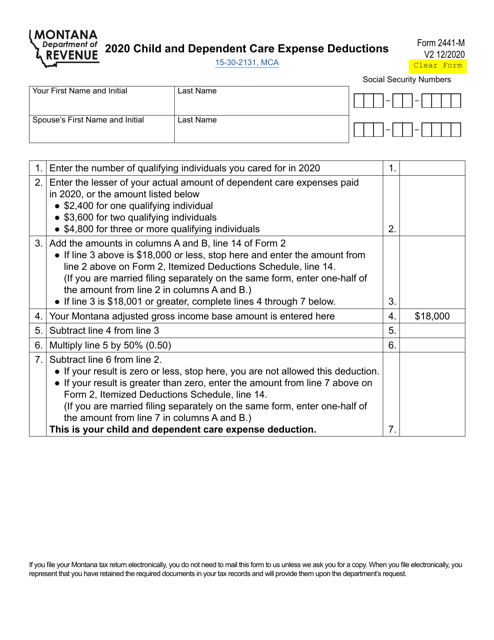

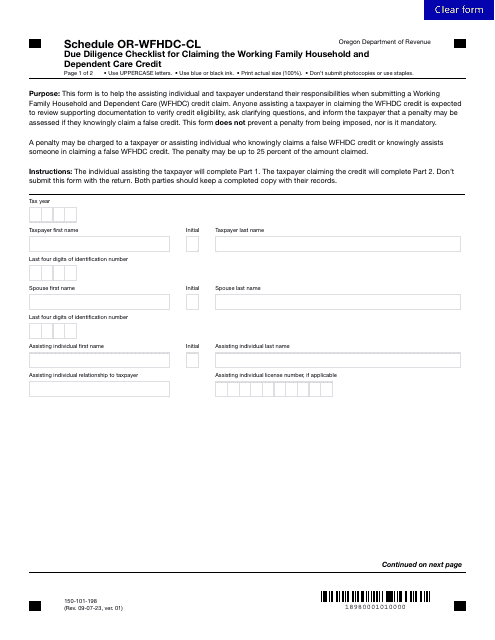

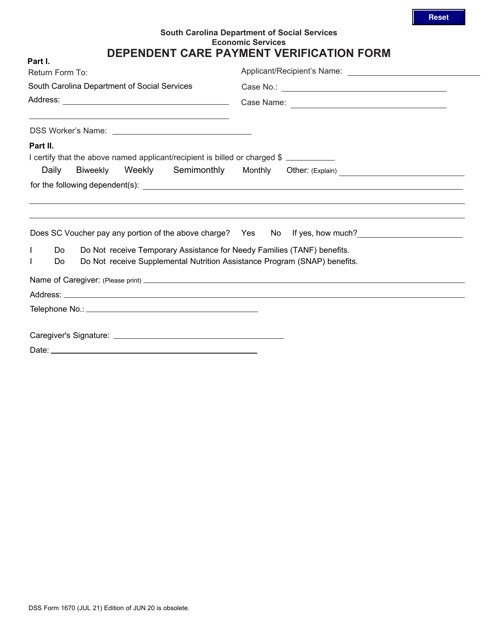

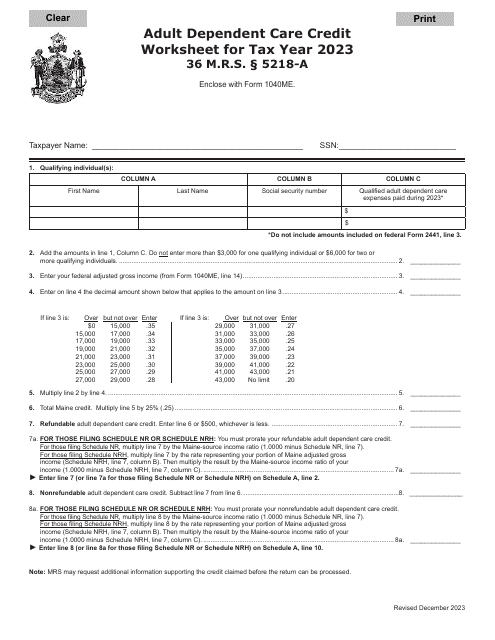

Our documents include resources such as the Form 150-101-198 Due Diligence Checklist for Claiming the Working Family Household and Dependent Care (WFHDC) Credit in Oregon, Form 2441-M Child and Dependent Care Expense Deduction in Montana, and the DSS Form 1670 Dependent Care Payment Verification Form in South Carolina.

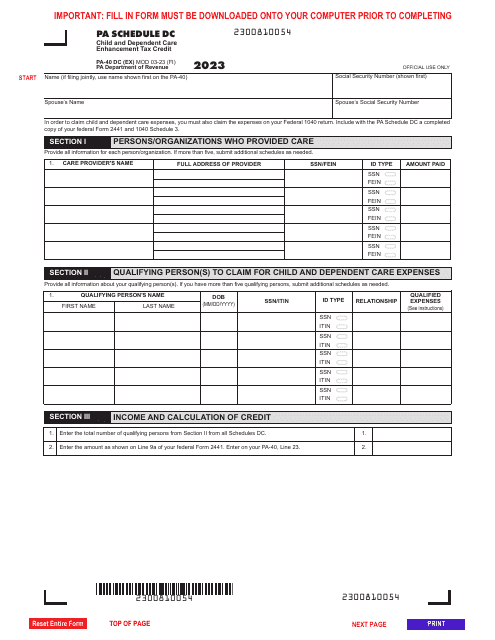

These documents provide valuable information and guidelines to help you navigate through the process of claiming deductions, verifying payments, and understanding the eligibility criteria for various dependent care programs. Whether you are an individual or a business, our collection of dependent care documents is designed to assist you in making informed decisions and maximizing your benefits.

At Templateroller.com, we understand the importance of providing the necessary resources to assist you in caring for your dependents. Our collection of dependent care documents is regularly updated to ensure that you have access to the most up-to-date information and forms. We strive to make the process of managing dependent care expenses as smooth and straightforward as possible.

Browse through our extensive collection of dependent care documents today to find the resources you need. From tax forms to verification documents, our collection is a valuable asset for individuals, businesses, and organizations alike. Trust Templateroller.com to provide you with the essential information and resources to make informed decisions regarding dependent care.

Documents:

38

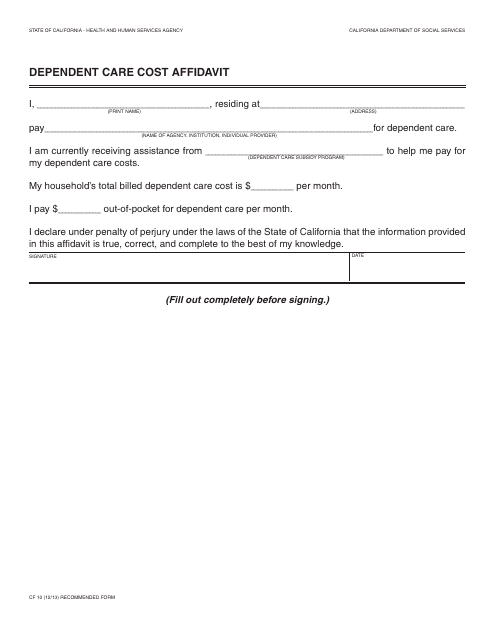

This Form is used for California residents to provide an affidavit of dependent care costs.

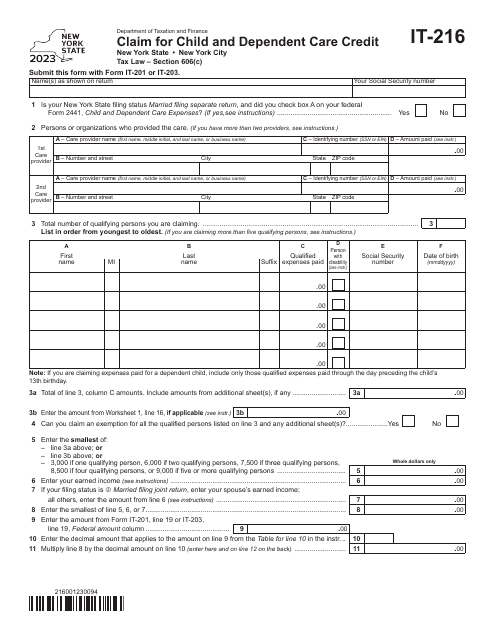

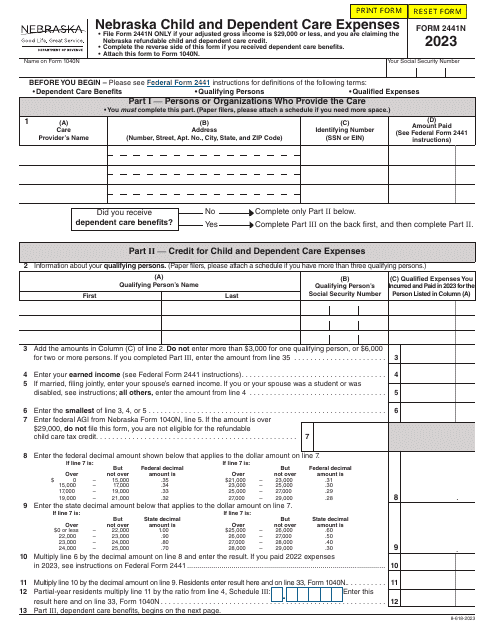

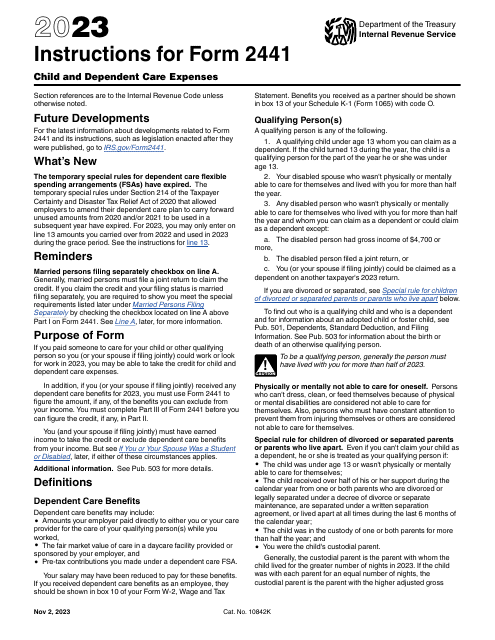

This form was developed for taxpayers who have paid someone to care for their child or another qualifying person so they could work or look for work.

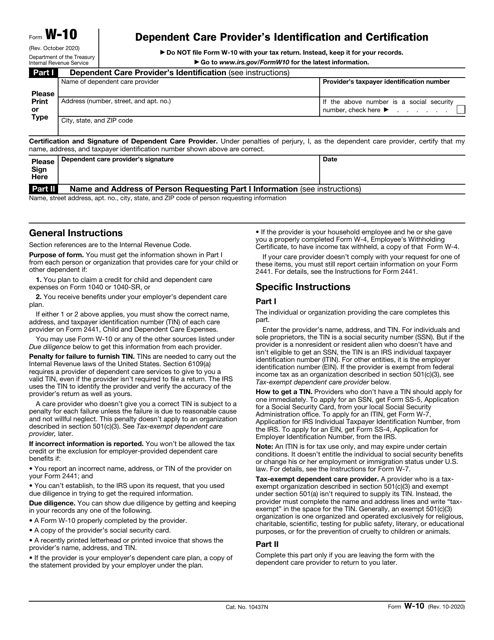

A W-10 Form's purpose is to get the correct information from each entity or individual that provides care for a taxpayer's child or another dependent.

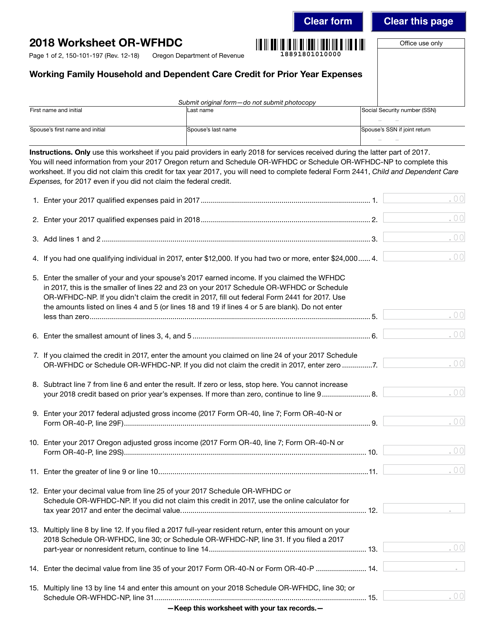

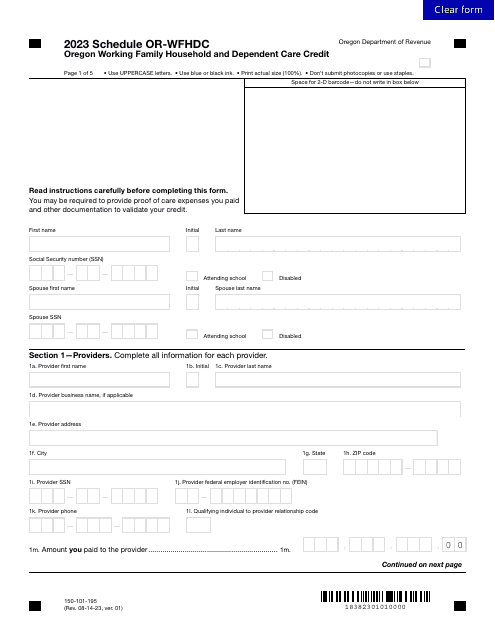

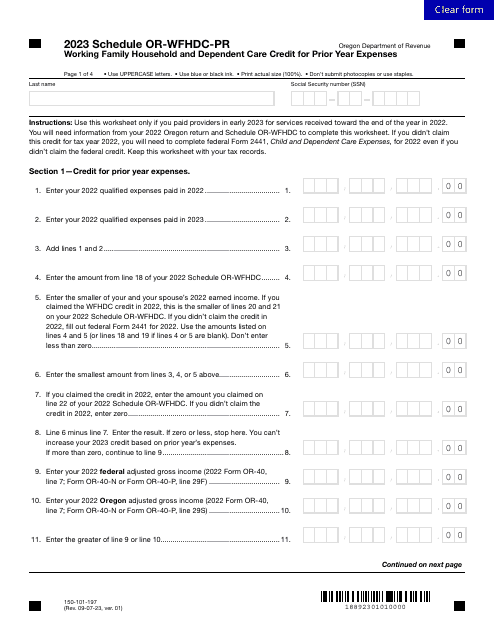

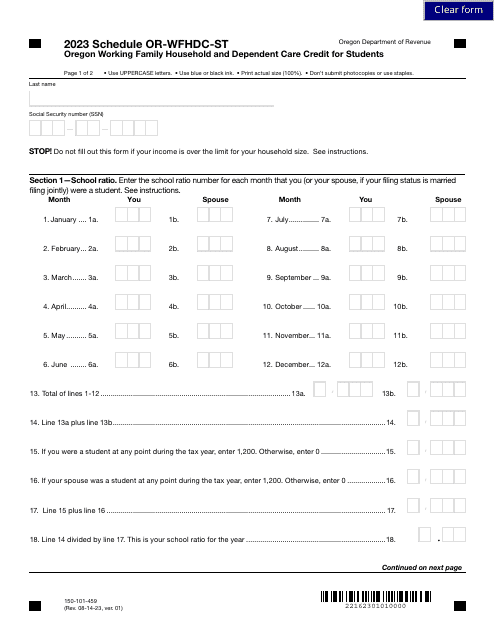

This form is used for claiming the Working Family Household and Dependent Care Credit for prior year expenses in the state of Oregon.

This Form is used for claiming the Working Family Household and Dependent Care Credit in Oregon for part-year residents and nonresidents.

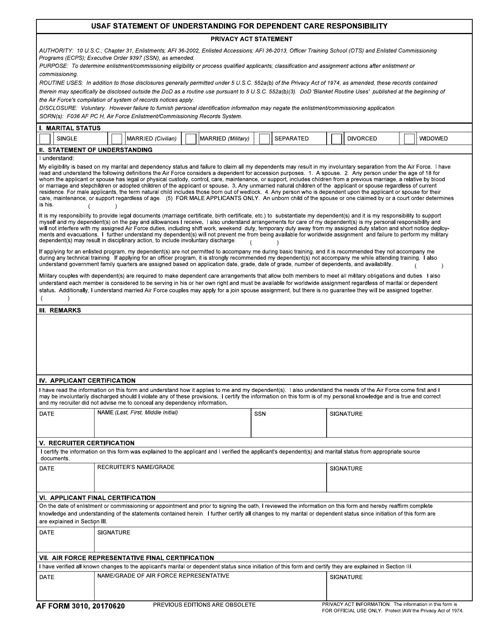

This Form is used for the United States Air Force (USAF) to document the understanding of dependent care responsibilities by an individual. It outlines the responsibilities and expectations for caring for dependents while serving in the USAF.

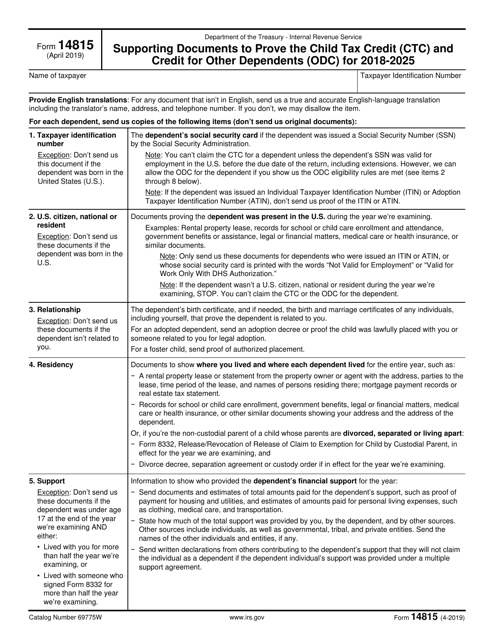

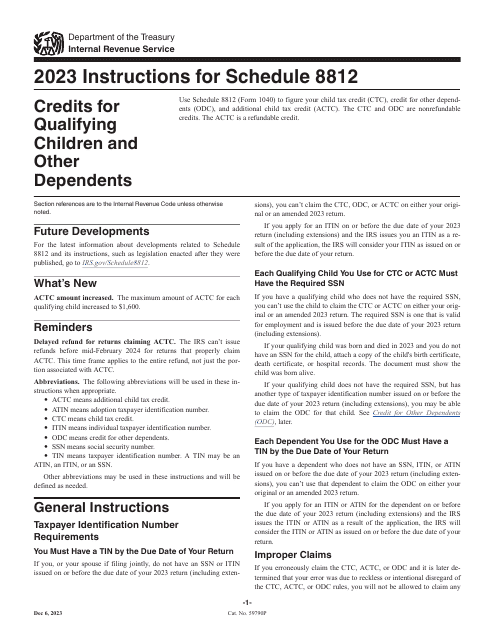

This Form is used for submitting supporting documents to prove eligibility for the Child Tax Credit (CTC) and Credit for Other Dependents (ODC) to the IRS.

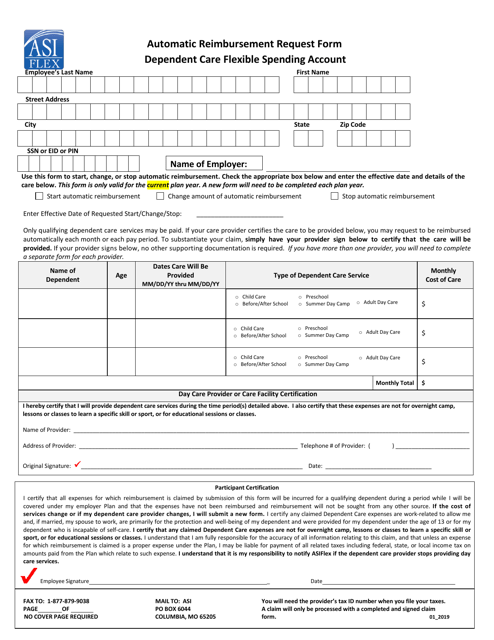

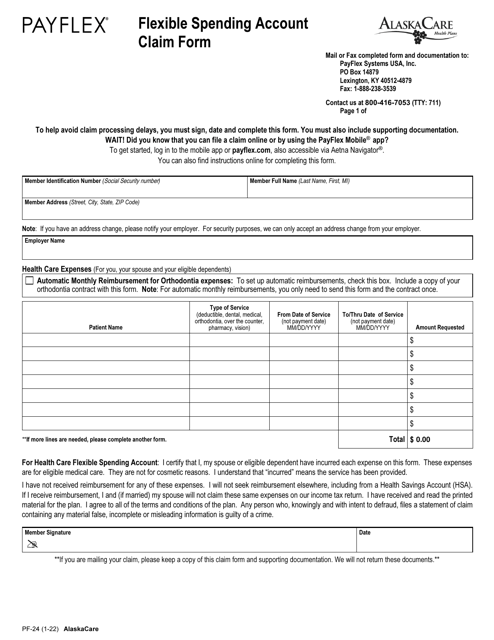

This Form is used for submitting reimbursement requests for dependent care expenses through the Flexible Spending Account in Montana.

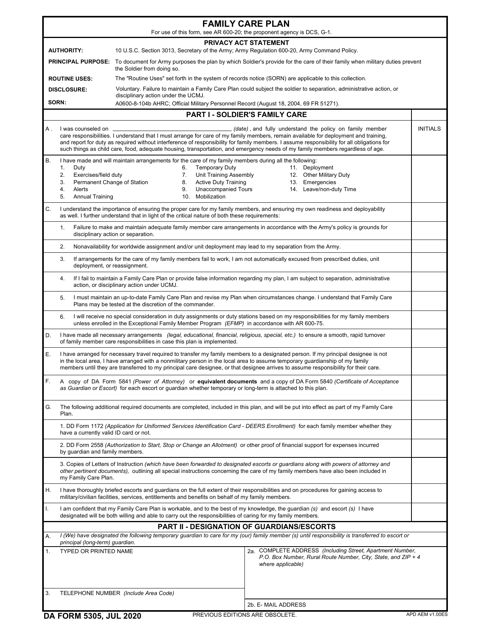

This is a form used by service members unable to provide care for their families and seeking assistance and substitution while they are on active duty.

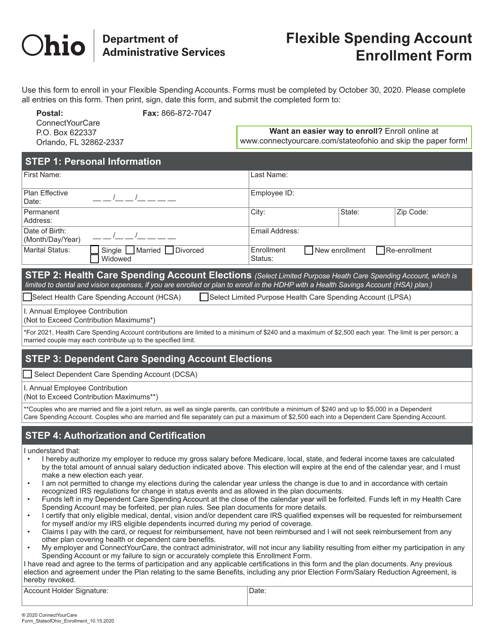

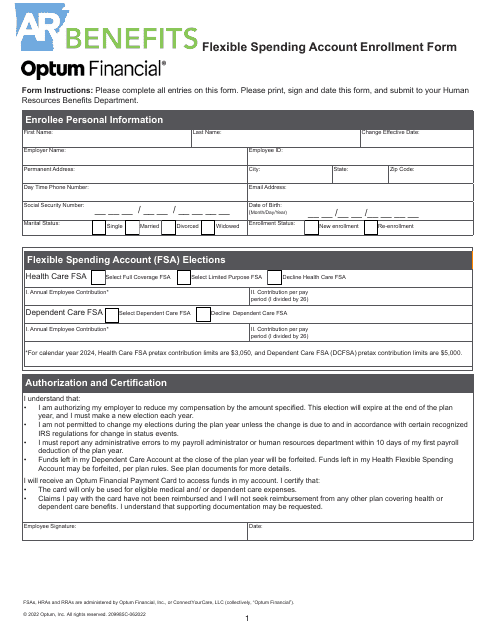

This document is for enrolling in a Flexible Spending Account (FSA) in Ohio. FSAs allow you to set aside pre-tax money for certain healthcare or dependent care expenses.

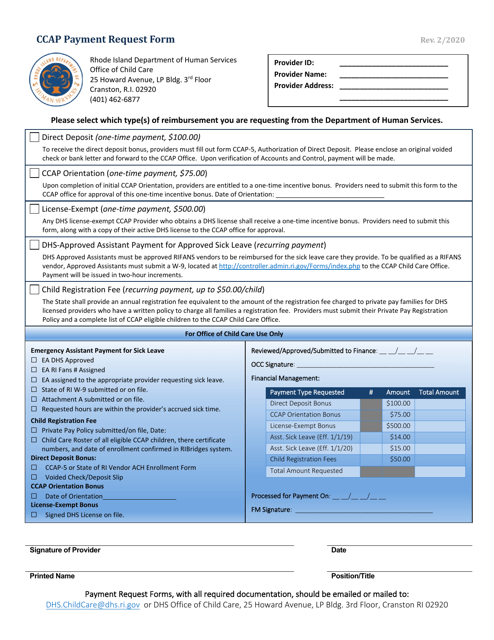

This Form is used for requesting payments through the CCAP program in Rhode Island.

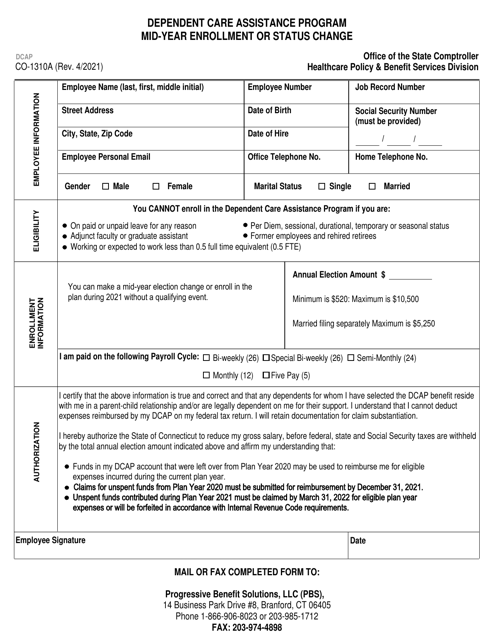

Form CO-1310A Mid-year Enrollment or Status Change - Dependent Care Assistance Program - Connecticut

This form is used for making mid-year enrollment or status changes in the Dependent Care Assistance Program in Connecticut.

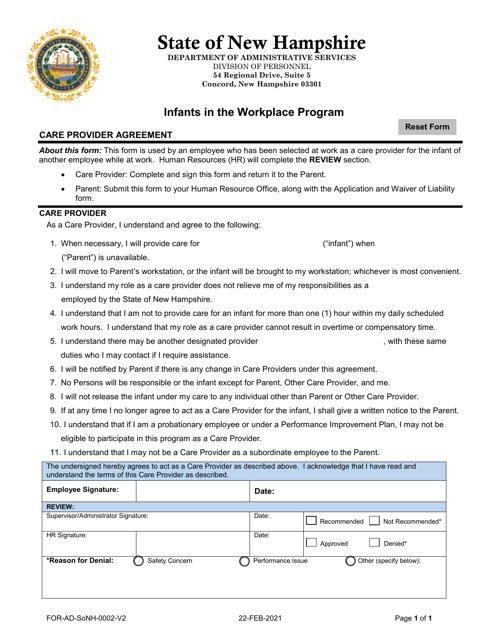

This document is a Care Provider Agreement specifically designed for the Infants in the Workplace Program in New Hampshire. It outlines the terms and conditions between the employer and the care provider for the care of infants in the workplace.

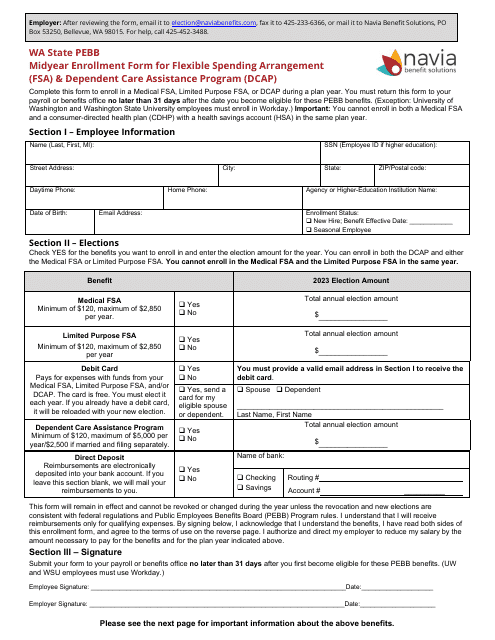

This form is used for midyear enrollment in the Flexible Spending Arrangement (FSA) and Dependent Care Assistance Program (DCAP) in Washington.

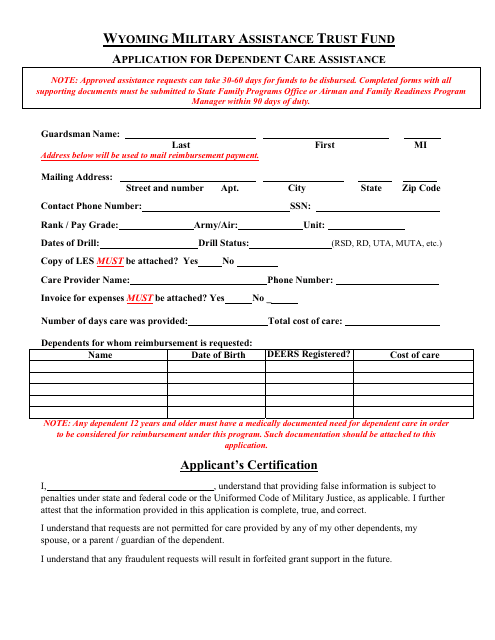

This document is an application for individuals in Wyoming who are seeking dependent care assistance through the Wyoming Military Assistance Trust Fund.

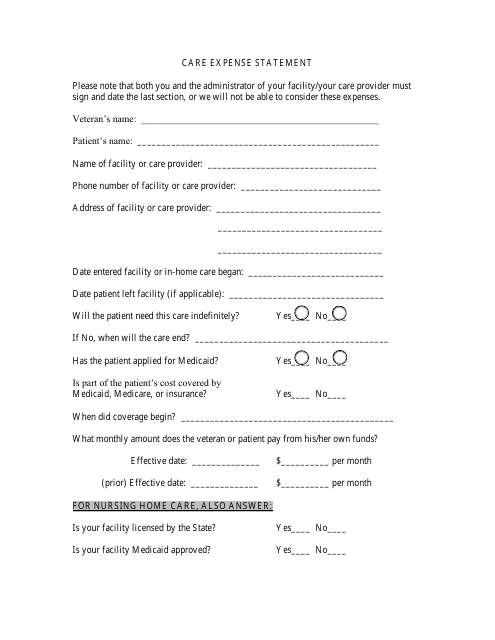

This document is used for reporting care expenses in South Dakota. It helps individuals or families claim tax deductions or credits related to their care expenses.