Pass Through Entity Templates

Are you looking to understand more about pass-through entities? Look no further! Our website is your go-to source for all information related to pass-through entities, also known as pass-through entity, pass-through entities and pass-through structures.

Pass-through entities are a popular choice for businesses due to their unique tax treatment. These entities do not pay federal income tax at the entity level, instead, the income "passes through" to the owners, who report it on their individual tax returns. This often results in a lower overall tax liability for the owners.

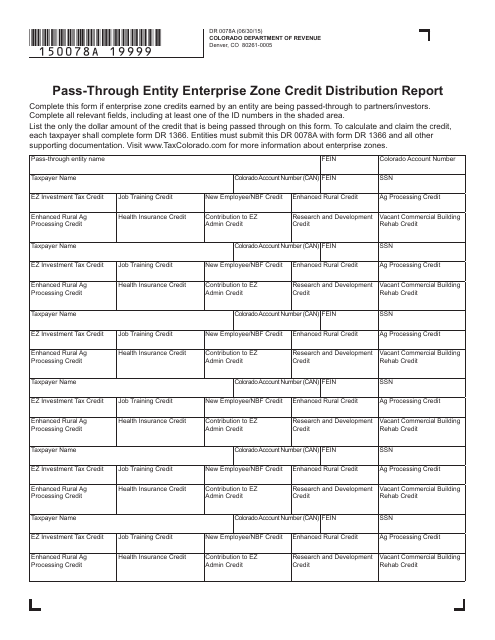

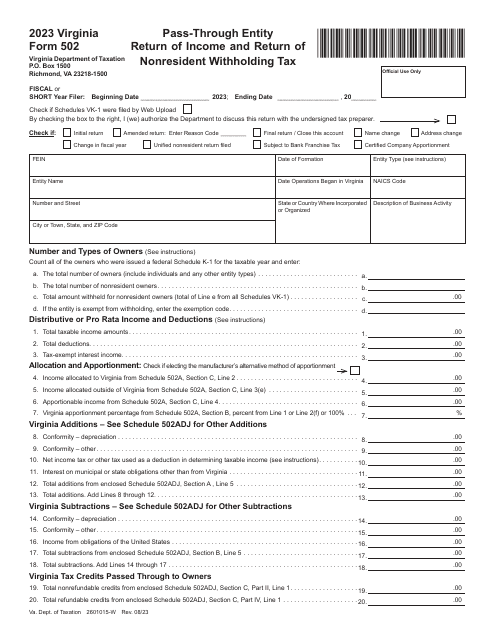

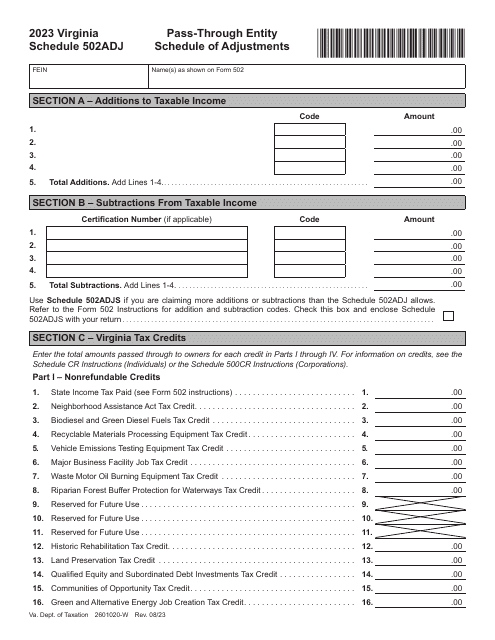

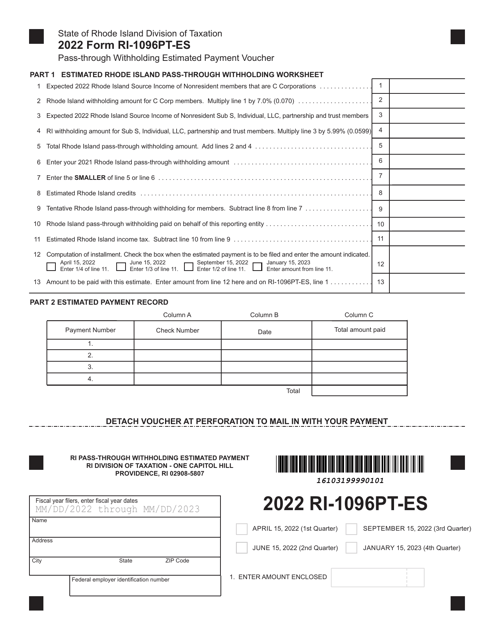

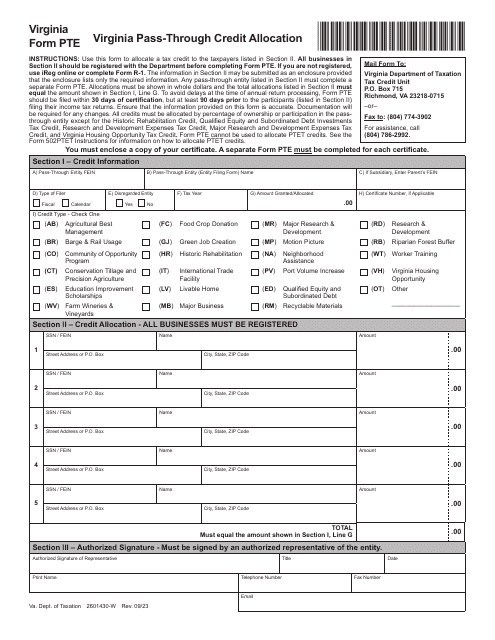

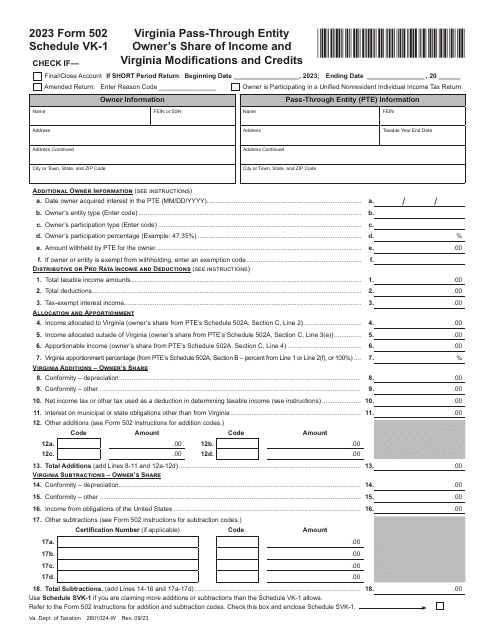

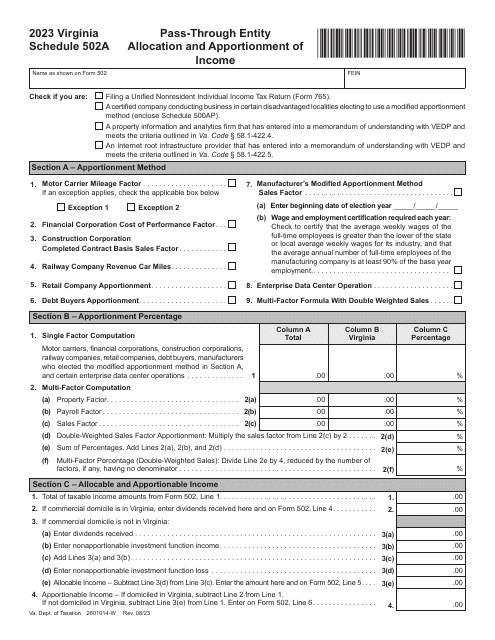

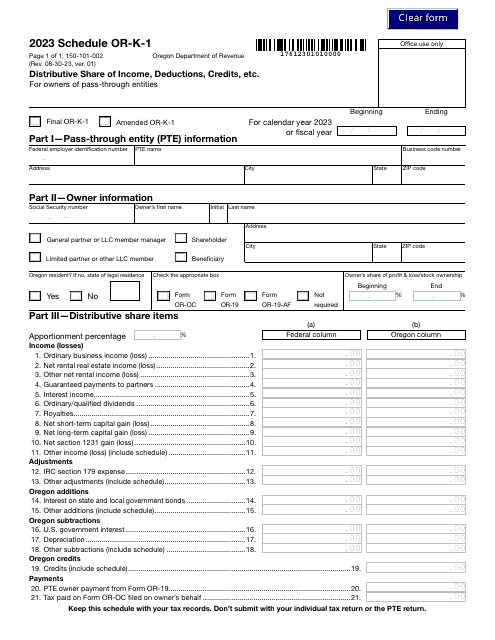

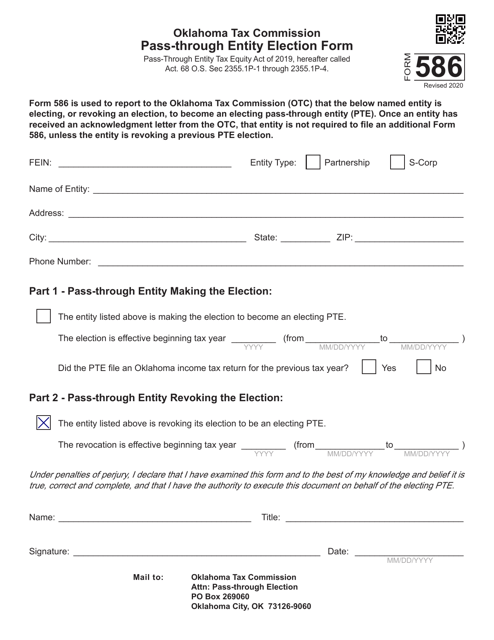

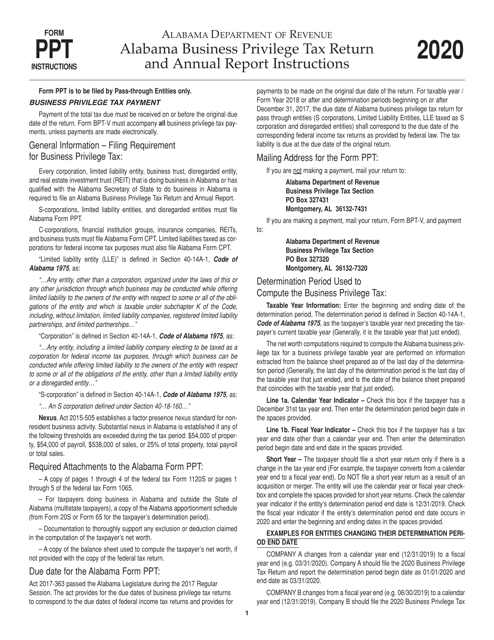

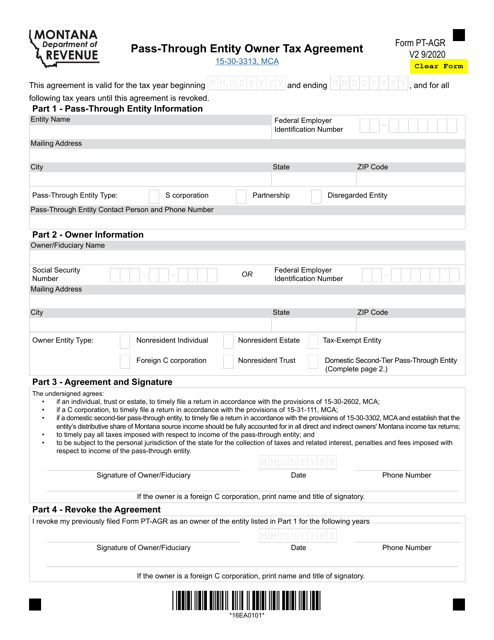

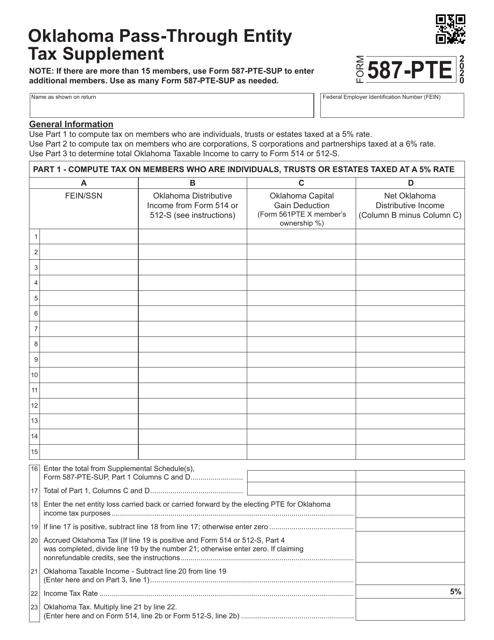

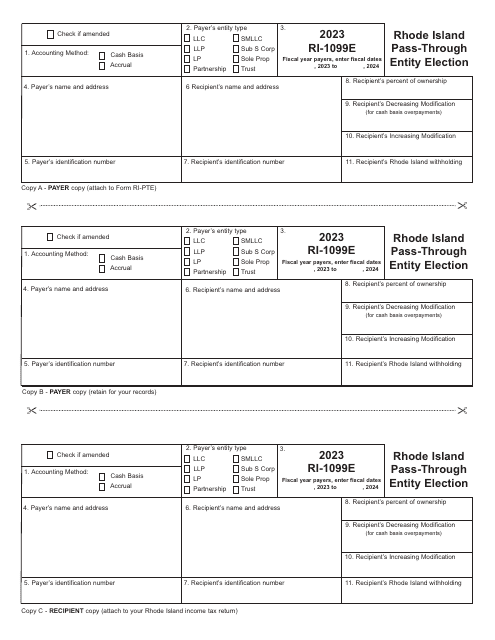

Our website provides a comprehensive collection of documents and forms related to pass-through entities. We have everything from Form 586 Pass-Through Entity Election Form in Oklahoma to Form IT-653 Pass-Through Entity Tax Credit in New York. These documents cover a wide range of topics, such as the allocation and apportionment of income (Schedule 502A in Virginia), distributive share of proceeds and credits for members (Schedule OR-21-K-1 in Oregon), and even pass-through entity elections (Form RI-1099E in Rhode Island).

Whether you are a business owner looking to understand the tax implications of forming a pass-through entity, or an individual needing to report pass-through income on your tax return, our documents will provide you with all the information you need. Don't wait any longer, explore our extensive collection of pass-through entity documents today!

Documents:

158

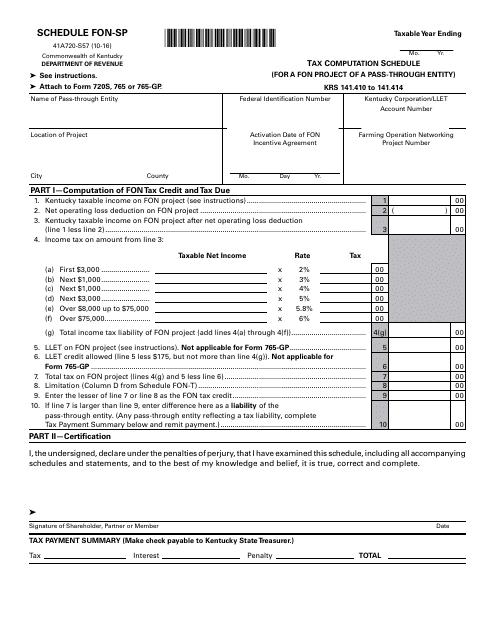

This Form is used for calculating tax for a Fon project of a pass-through entity in Kentucky.

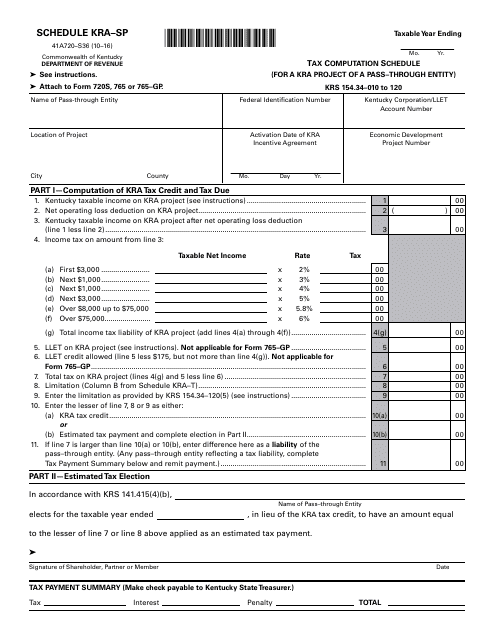

This Form is used for tax computation for a Kra project of a pass-through entity in Kentucky.

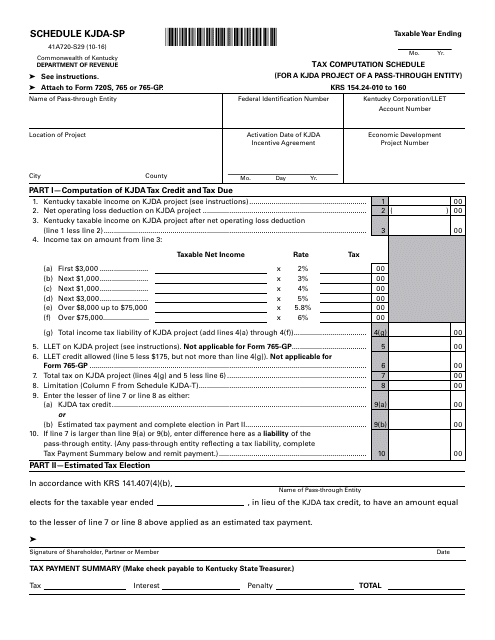

This Form is used for calculating the tax for a specific type of project in Kentucky that is owned by a pass-through entity.

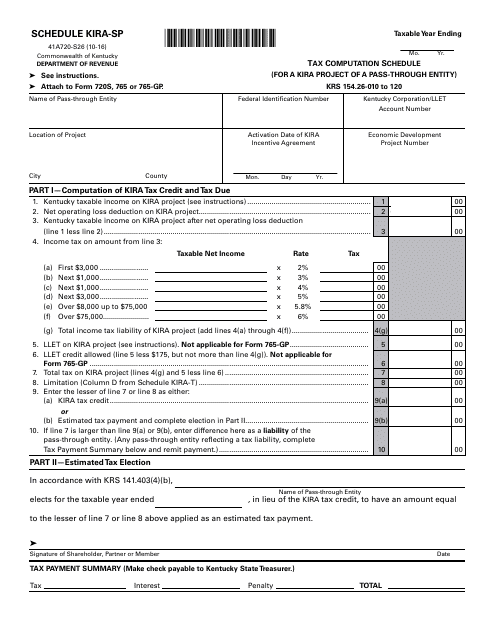

This form is used for calculating and reporting taxes for a Kira Project of a pass-through entity in Kentucky.

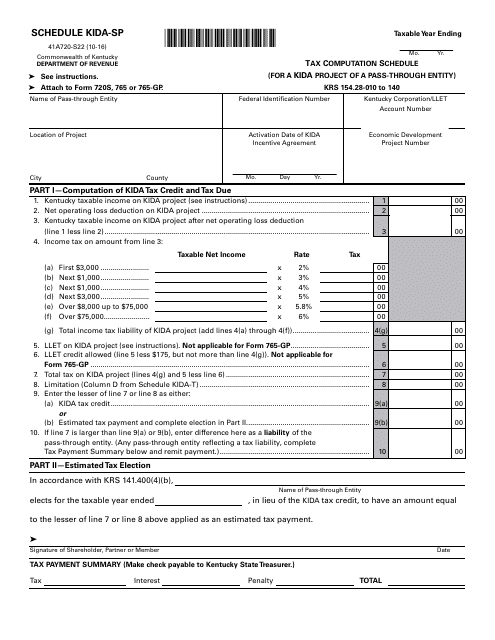

This Form is used for calculating tax for a Kida project of a pass-through entity in Kentucky.

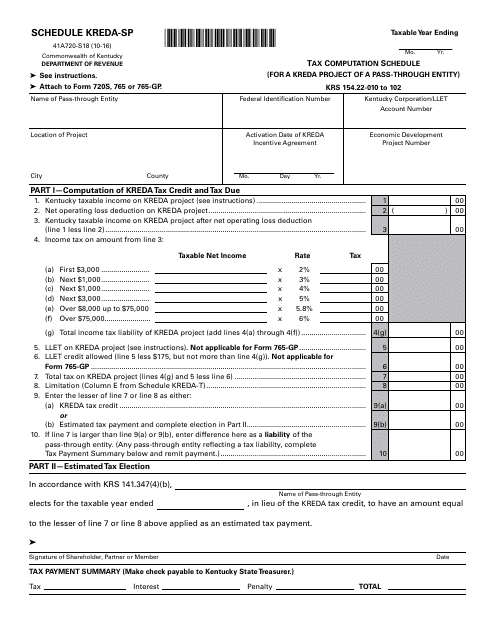

This form is used for calculating tax for a Kreda project of a pass-through entity in Kentucky.

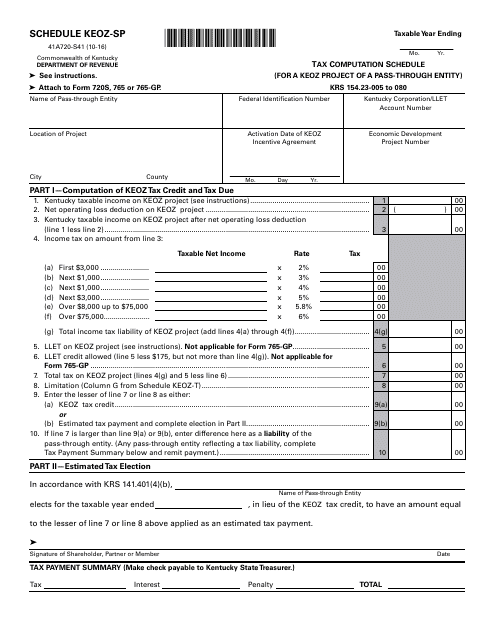

This document is used for calculating the tax for a Keoz project of a pass-through entity in the state of Kentucky.

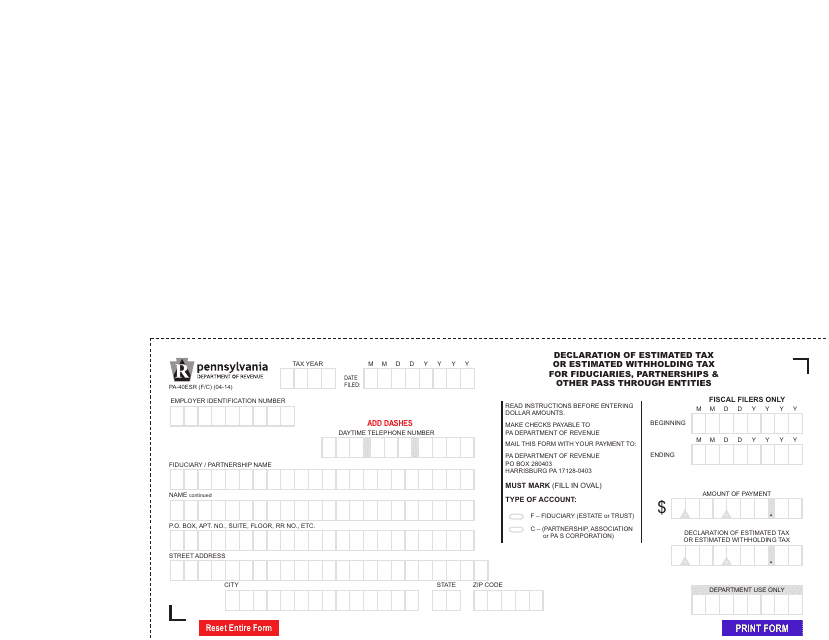

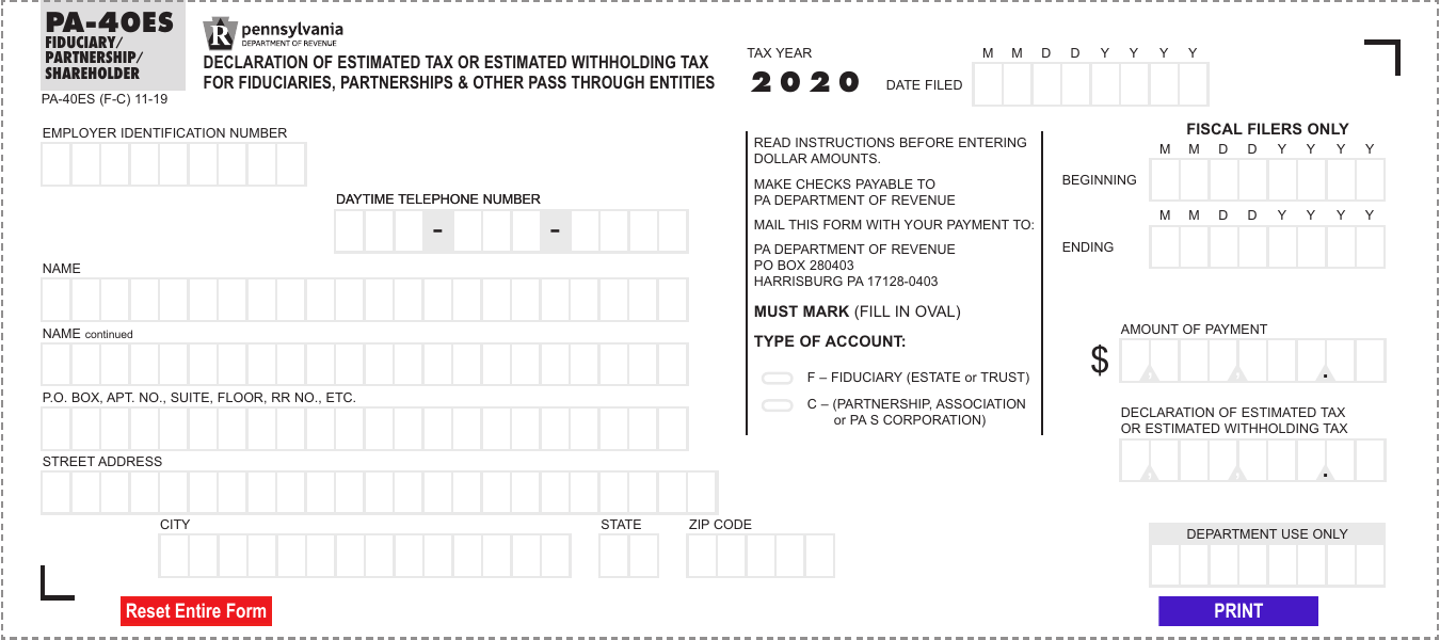

This form is used for fiduciaries, partnerships, and other pass-through entities in Pennsylvania to declare their estimated tax or estimated withholding tax.

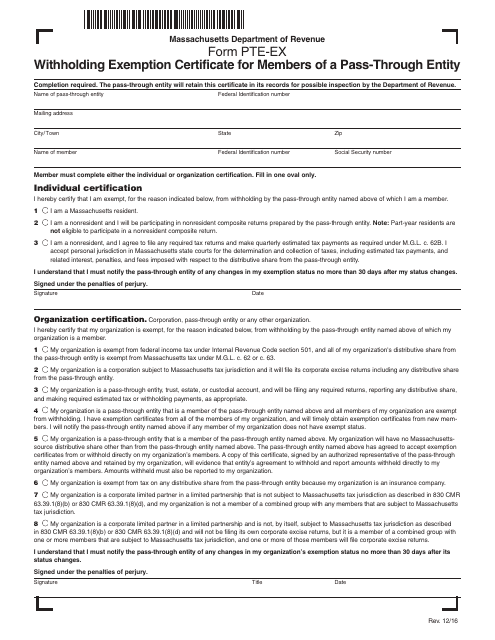

This Form is used for members of a pass-through entity in Massachusetts to claim withholding exemption.

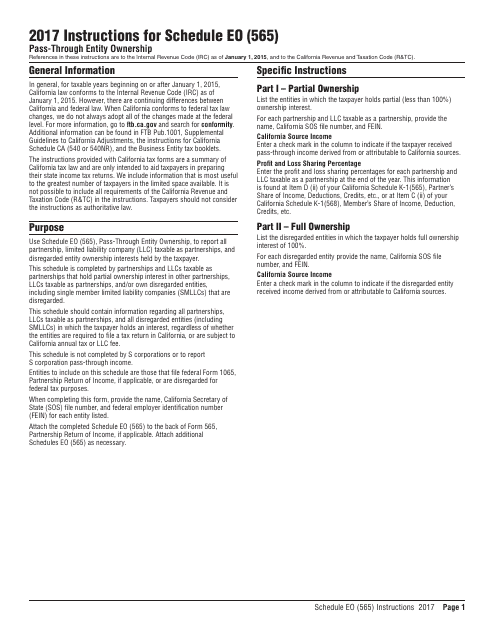

This Form is used for reporting ownership information of pass-through entities in California.

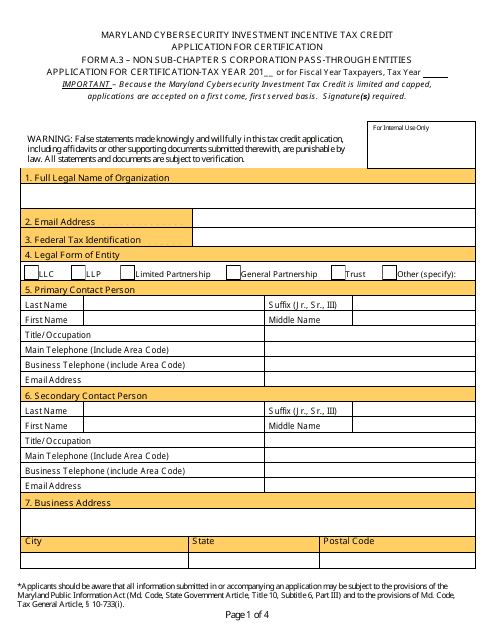

This Form is used for applying for certification as a non Sub-chapter S corporation pass-through entity for the Maryland Cybersecurity Investment Incentive Tax Credit.

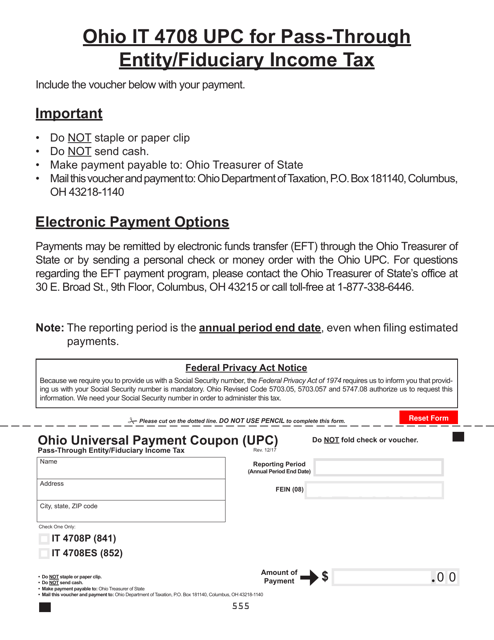

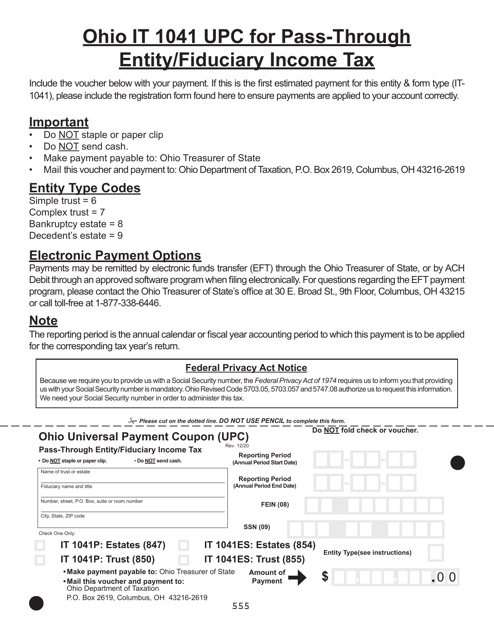

This form is used for paying pass-through entity/fiduciary income tax in Ohio.

This Form is used to submit the Universal Payment Coupon (UPC) for Pass-Through Entities and Fiduciary Income Tax in Ohio.

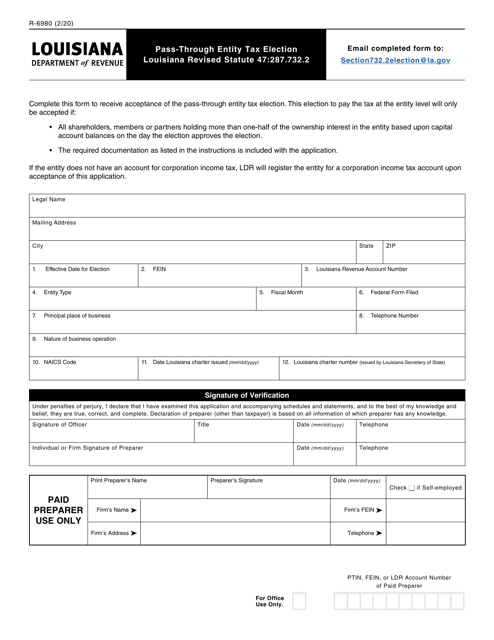

This form is used for electing pass-through entity tax in the state of Louisiana.

This Form is used for declaring estimated tax or estimated withholding tax for fiduciaries, partnerships, and other pass-through entities in Pennsylvania.